Analysis Of NNPC Petrol Prices In Light Of The Dangote Refinery's Operation

Table of Contents

NNPC's Current Petrol Pricing Mechanism

The Nigerian National Petroleum Company (NNPC) employs a multifaceted system to determine petrol prices, a system heavily influenced by global and local economic factors. Currently, the pricing mechanism considers several key elements: import costs (including crude oil prices and freight charges), exchange rates (the Naira's value against the US dollar), and the level of government subsidies. This complexity often leads to price volatility and public scrutiny.

- Import dependency and its impact on pricing volatility: Nigeria's heavy reliance on imported refined petroleum products leaves its fuel prices vulnerable to fluctuations in international markets and exchange rates. Any global price increase directly impacts the cost of petrol for consumers.

- Role of government subsidies and their financial implications: Government subsidies, designed to cushion consumers from price shocks, place a significant strain on public finances. These subsidies can be unsustainable in the long run and create inefficiencies in the market.

- Transparency and public perception of NNPC's pricing methodology: A lack of transparency surrounding the NNPC's pricing decisions has fueled public distrust and skepticism. Greater clarity and openness regarding the process are crucial for building confidence.

Dangote Refinery's Potential Impact on Supply and Demand

The Dangote Refinery, with its projected capacity to refine 650,000 barrels of crude oil per day, represents a potential game-changer for Nigeria's fuel market. Its operational success could significantly alter the dynamics of supply and demand, impacting NNPC petrol prices.

- Impact on import costs and foreign exchange pressure: By significantly reducing Nigeria's dependence on imported petrol, the refinery promises to alleviate pressure on the nation's foreign exchange reserves and reduce the vulnerability of fuel prices to global market fluctuations. This could stabilize the Naira and reduce the costs associated with importing refined petroleum products.

- Potential for increased competition and price stabilization: The introduction of a major new player into the market – the Dangote Refinery – has the potential to foster competition, potentially leading to more stable and potentially lower petrol prices for consumers. This increased competition could challenge NNPC's pricing power.

- Challenges in seamlessly integrating the refinery's output into the existing distribution network: Successfully integrating the refinery's substantial output into Nigeria's existing distribution network will be crucial. Logistical challenges and potential bottlenecks could delay the full impact on NNPC petrol prices.

Economic Factors Beyond Refinery Operation

While the Dangote Refinery's operation is a significant development, numerous other economic factors continue to influence NNPC petrol prices.

- Fluctuations in global crude oil markets: Global crude oil prices remain a dominant factor. Increases in global crude oil prices inevitably translate into higher costs for refined petroleum products, irrespective of domestic refining capacity.

- Impact of international trade policies and sanctions: International trade policies and sanctions can disrupt the global energy market, affecting the availability and price of crude oil and refined products.

- Influence of inflation and currency devaluation on fuel costs: Inflation and currency devaluation within Nigeria itself also play a significant role, impacting the overall cost of fuel, even with increased domestic refining.

Potential Scenarios and Predictions for NNPC Petrol Prices

Predicting the precise impact of the Dangote Refinery on NNPC petrol prices requires considering various scenarios:

- Optimistic scenario: A significant price reduction could result from increased domestic supply, reduced reliance on imports, and increased competition, leading to a more efficient and competitive market.

- Pessimistic scenario: Minimal impact on prices could occur due to persistent economic challenges, such as high inflation, currency instability, and unforeseen operational issues at the refinery. Global crude oil price hikes could also negate the positive impact of increased domestic supply.

- Realistic scenario: A gradual price reduction with continued volatility is the most likely outcome. The benefits of increased domestic refining capacity may be offset by other economic factors, resulting in a more moderate decrease in petrol prices and some level of continued price fluctuations.

Conclusion

The Dangote Refinery's impact on NNPC petrol prices is multifaceted, depending on various economic and operational factors. While increased domestic refining capacity holds significant promise for price stability and reduced reliance on imports, numerous external factors will continue to influence fuel costs. The interplay between global crude oil prices, exchange rates, government policies, and the efficiency of the refinery’s integration into the existing distribution network will determine the ultimate effect on NNPC petrol prices.

Call to Action: Stay informed about the ongoing developments in Nigeria's fuel market and the impact of the Dangote Refinery on NNPC petrol prices. Continue to follow our analysis for updates on NNPC petrol prices and their relationship to the Dangote Refinery's operation. Understanding these dynamics is crucial for navigating the evolving Nigerian fuel landscape.

Featured Posts

-

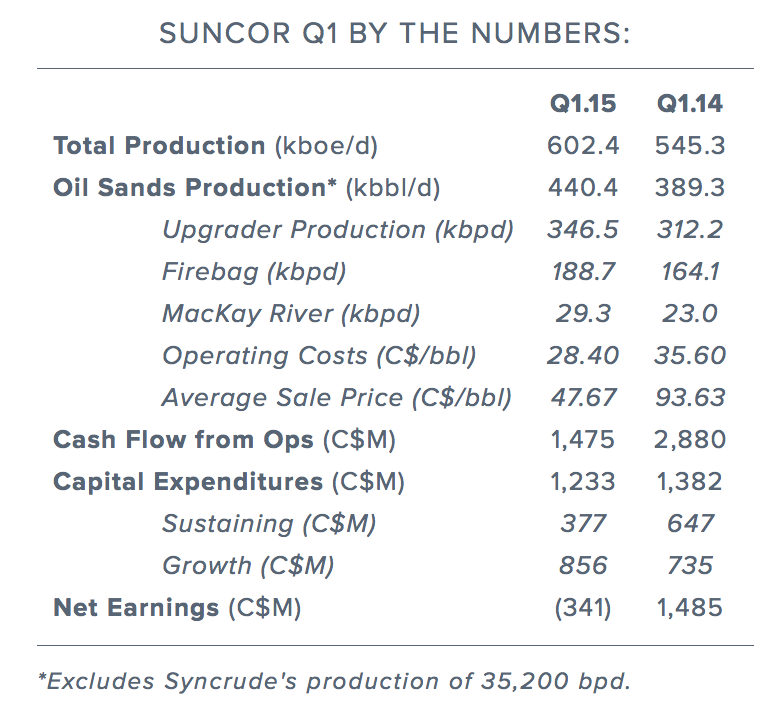

Suncor Hits Record Production Inventory Levels Rise Sales Dip

May 09, 2025

Suncor Hits Record Production Inventory Levels Rise Sales Dip

May 09, 2025 -

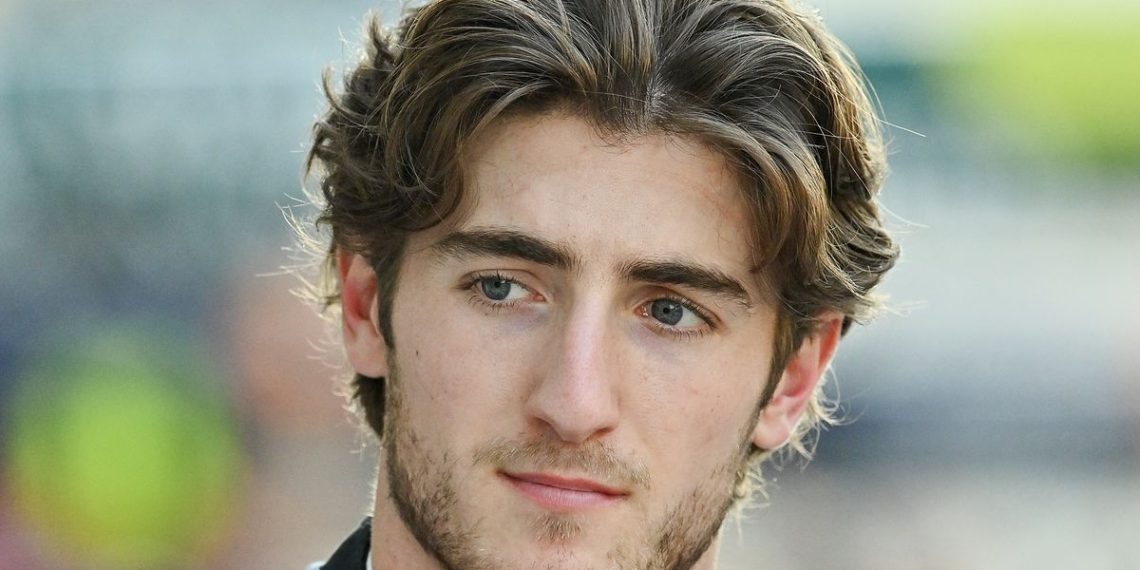

Tributes Pour In For F1 Figure Colapinto And Perez Lead The Way

May 09, 2025

Tributes Pour In For F1 Figure Colapinto And Perez Lead The Way

May 09, 2025 -

Nyt Strands Today April 1 2025 Clues Hints And Solutions

May 09, 2025

Nyt Strands Today April 1 2025 Clues Hints And Solutions

May 09, 2025 -

Jeanine Pirro Insights Into Her Background And Net Worth

May 09, 2025

Jeanine Pirro Insights Into Her Background And Net Worth

May 09, 2025 -

Stiven King Novaya Ataka Na Trampa I Maska

May 09, 2025

Stiven King Novaya Ataka Na Trampa I Maska

May 09, 2025