Analysis: The Ripple Effect Of Trump Tariffs On India's Solar Energy Exports To Southeast Asia

Table of Contents

India's Position in the Global Solar Market Before and After the Tariffs

Before the imposition of Trump tariffs, India was emerging as a significant player in the global solar market, actively aiming to increase its share in the burgeoning Southeast Asian solar energy sector. Indian manufacturers leveraged their cost advantages and established trade relationships to secure contracts. However, the tariffs, primarily targeting Chinese solar panel imports into the US, had unintended consequences. The increased cost of solar panels globally, impacted Indian manufacturers who faced higher input costs, reducing their competitiveness. This resulted in:

- Changes in production volume: Many Indian solar panel manufacturers experienced a decline in production due to reduced demand and increased costs.

- Price adjustments in response to tariffs: Indian companies were forced to raise prices, making their products less attractive compared to competitors who benefited from either lower input costs or existing supply chains unaffected by the tariffs.

- Loss of market share to competitors: Chinese manufacturers, despite facing the tariffs themselves, retained a significant advantage in scale and established global supply chains, allowing them to aggressively compete in the Southeast Asian market, eating away at India's share.

The Southeast Asian Solar Market Dynamics

The Southeast Asian solar market, characterized by rapid economic growth and increasing energy demands, was a prime target for Indian solar exports. Before the tariffs, this region experienced consistent growth in solar energy adoption, driven by ambitious government targets and falling solar panel prices. However, the tariffs introduced uncertainty and volatility:

- Key Southeast Asian countries and their solar energy initiatives: Countries like Vietnam, Thailand, and the Philippines have all actively pursued large-scale solar energy projects, providing ample opportunities for solar panel suppliers.

- Demand fluctuations due to tariff-related price changes: Increased prices for solar panels, directly or indirectly caused by the tariffs, impacted demand in Southeast Asia, causing some projects to be delayed or scaled back.

- Shift in sourcing countries for solar panels: Many Southeast Asian countries, faced with higher prices from Indian suppliers, shifted their sourcing to China, which often offered more competitive pricing despite the tariffs indirectly affecting their production costs.

Alternative Sourcing and Trade Routes

The disruption caused by the Trump tariffs forced Southeast Asian countries to re-evaluate their sourcing strategies. The impact on trade relations between India and Southeast Asian nations was substantial:

- Specific examples of countries shifting sources: Vietnam, for instance, saw a considerable increase in solar panel imports from China following the tariff implementation.

- Analysis of trade agreements and their influence: Existing trade agreements and regional economic partnerships played a significant role in shaping sourcing decisions, with some countries prioritizing regional suppliers.

- The role of logistics and transportation costs: The shift in sourcing also involved evaluating transportation costs, which varied depending on the origin and destination, further impacting the overall cost-competitiveness of solar panel imports.

Long-term Impacts and Policy Implications

The long-term consequences of the Trump tariffs are still unfolding, but their impact on India's solar industry's competitiveness is undeniable:

- Government subsidies and incentives: Both India and Southeast Asian governments responded with various policy initiatives, including subsidies and incentives to support their domestic solar industries and attract investment.

- Investment in domestic solar manufacturing capacity: The tariffs spurred investments in domestic solar manufacturing capacity in several Southeast Asian countries, reducing their reliance on imports.

- Opportunities for India to regain market share: While the tariffs initially hampered India's presence, there are opportunities for it to regain lost market share through strategic partnerships, technological advancements, and focused government support.

Conclusion: Understanding the Lasting Effects of Trump Tariffs on India's Solar Energy Exports to Southeast Asia

The Trump tariffs had a far-reaching ripple effect on India's solar energy exports to Southeast Asia. The increased costs, reduced competitiveness, and shift in sourcing dynamics significantly altered the landscape of the renewable energy sector in the region. Understanding these indirect consequences is crucial for both India and Southeast Asian nations as they navigate the complexities of global trade and sustainable energy development. Further research on the impact of Trump tariffs on India's solar energy exports is crucial to inform future trade policies and ensure the continued growth of the renewable energy sector. Understanding the ripple effect of trade policies on India's solar industry is paramount to mitigating the negative impacts of future trade disputes and achieving both India's and Southeast Asia's renewable energy goals.

Featured Posts

-

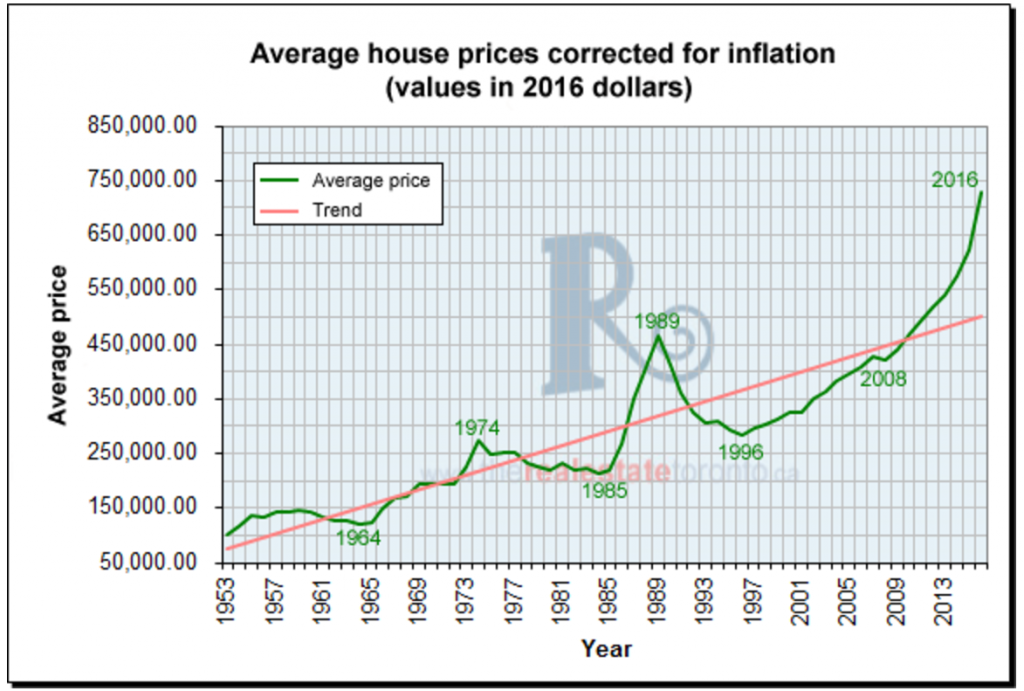

Real Estate Market Crash Home Sales Plummet To Crisis Levels

May 30, 2025

Real Estate Market Crash Home Sales Plummet To Crisis Levels

May 30, 2025 -

Agassi Dezvaluie Stresul Inainte De Meciuri Era Coplesitor

May 30, 2025

Agassi Dezvaluie Stresul Inainte De Meciuri Era Coplesitor

May 30, 2025 -

Emma Raducanu A Commanding Performance In Miami

May 30, 2025

Emma Raducanu A Commanding Performance In Miami

May 30, 2025 -

Odigos Tiletheasis Gia To M Savvato 19 Aprilioy

May 30, 2025

Odigos Tiletheasis Gia To M Savvato 19 Aprilioy

May 30, 2025 -

Kansas Sees Six Additional Measles Cases Public Health Concerns Rise

May 30, 2025

Kansas Sees Six Additional Measles Cases Public Health Concerns Rise

May 30, 2025