Analysis: Trump Tariffs And The $174 Billion Hit To Top Billionaires' Wealth

Table of Contents

Industries Most Affected by Trump Tariffs

The Trump administration's tariffs, primarily targeting China, significantly impacted various sectors of the US economy. This trade war created ripple effects, diminishing the value of investments held by numerous billionaires. The increased costs and decreased consumer confidence directly translated into losses for many of the nation's wealthiest individuals.

-

Retail: Increased import costs on consumer goods, ranging from clothing and electronics to furniture, led to decreased consumer spending and reduced profits for major retailers. Billionaires with substantial investments in this sector, such as those holding shares in large retail chains, experienced significant losses. The impact was felt across the entire retail supply chain, from manufacturers to distributors and ultimately consumers.

-

Technology: The tech sector, heavily reliant on global supply chains for components and manufactured goods, faced disruptions and increased costs. This negatively affected billionaire shareholders and investors in companies producing smartphones, computers, and other electronics. The increased tariffs on imported parts led to higher production costs and ultimately higher prices for consumers, dampening demand.

-

Manufacturing: While intended as beneficiaries of the tariffs, American manufacturers also experienced negative consequences due to retaliatory tariffs from trading partners. This led to reduced exports and decreased profitability for billionaire investors in the sector. The decreased demand for US-made goods abroad significantly hurt certain manufacturing sectors.

-

Agriculture: The agricultural sector, a significant exporter, suffered immensely from retaliatory tariffs imposed by China. This resulted in decreased farm income and substantial losses for billionaires involved in agriculture and related industries. The impact was particularly severe on soybean exports and other agricultural products that were heavily targeted by Chinese tariffs.

Mechanisms of Wealth Erosion

The decline in billionaire wealth wasn't a direct result of the tariffs themselves, but rather a consequence of their far-reaching economic effects. The mechanisms through which these losses occurred are complex and intertwined.

-

Decreased Stock Prices: The uncertainty and disruptions caused by the tariffs led to lower stock valuations for companies heavily reliant on international trade, directly impacting the net worth of billionaires holding significant shares in these businesses. This uncertainty made investors wary, leading to a sell-off in many affected sectors.

-

Reduced Corporate Profits: Increased input costs due to tariffs and decreased demand resulting from higher prices led to reduced corporate profits. This shrinkage directly impacted the value of billionaire holdings in affected companies. Profit margins were squeezed, leading to reduced overall profitability.

-

Supply Chain Disruptions: The trade war created substantial supply chain disruptions, leading to production delays, increased costs, and diminished profitability across numerous industries. These disruptions cascaded throughout the global economy, impacting businesses beyond those directly targeted by tariffs.

-

Investor Sentiment: Negative investor sentiment towards the overall economic climate, fueled by trade uncertainty, contributed to a general decline in asset values, impacting billionaire portfolios broadly. This general apprehension led to a flight from risk, further depressing asset prices.

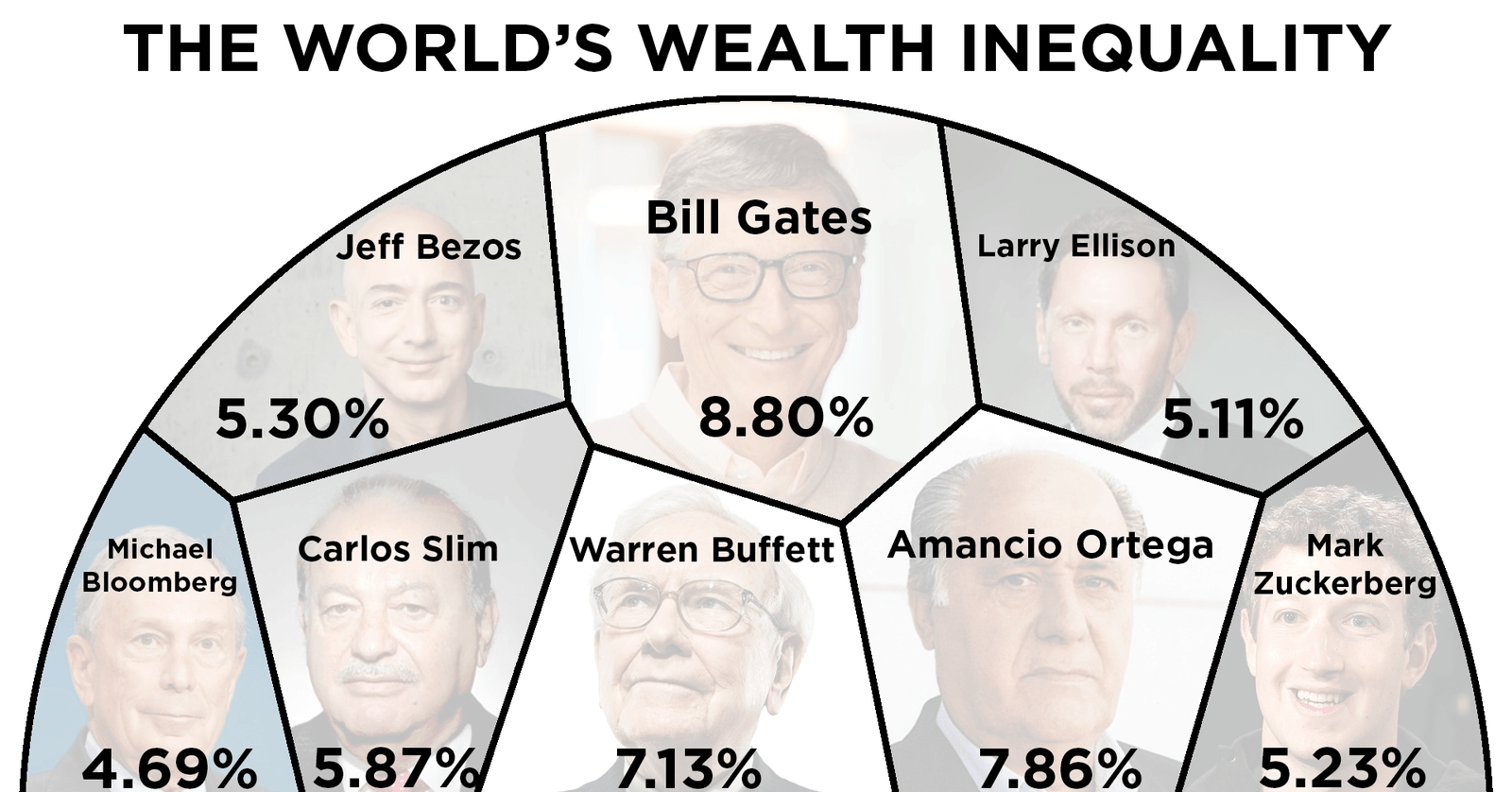

Long-Term Implications for Wealth Inequality

The $174 billion loss represents a significant blow to the already concentrated wealth distribution in the United States. The long-term implications are substantial and require further in-depth analysis.

-

Exacerbated Inequality: The impact of the tariffs disproportionately affected certain sectors and populations, potentially exacerbating existing economic inequalities. The losses were not evenly distributed, impacting some groups more significantly than others.

-

Economic Uncertainty: The trade war created a period of prolonged economic uncertainty, negatively affecting investment and economic growth. This uncertainty continued long after the tariffs were implemented, hindering long-term economic planning and investment.

-

Shifting Global Dynamics: The tariffs altered global trade relationships, leading to a reevaluation of supply chains and international business strategies. Companies scrambled to adapt, leading to significant restructuring and shifts in global trade patterns. The effects of these shifts are ongoing.

Conclusion

The analysis of the Trump tariffs' impact clearly demonstrates a substantial $174 billion loss in wealth among top billionaires. This significant reduction highlights the far-reaching economic consequences of protectionist policies. The ripple effect impacted key sectors, causing decreased stock prices, reduced corporate profits, supply chain disruptions, and negatively impacting investor sentiment. These consequences serve as a stark reminder of the interconnectedness of the global economy and the potential ramifications of protectionist trade policies. Further research is crucial to fully understand the long-term effects on wealth inequality and the overall economic landscape. Understanding the consequences of Trump tariffs and their impact on billionaire wealth is essential for informed policy discussions and future economic planning. We need to analyze the lasting effects of these tariffs to prevent similar economic disruptions in the future.

Featured Posts

-

Investing In Palantir Technologies Is It The Right Time To Buy

May 09, 2025

Investing In Palantir Technologies Is It The Right Time To Buy

May 09, 2025 -

Vegas Golden Knights Win Game 4 In Ot Barbashevs Goal Evens Series

May 09, 2025

Vegas Golden Knights Win Game 4 In Ot Barbashevs Goal Evens Series

May 09, 2025 -

Jessica Tarlov Criticizes Jeanine Pirros Support For Canada Trade War

May 09, 2025

Jessica Tarlov Criticizes Jeanine Pirros Support For Canada Trade War

May 09, 2025 -

How To Watch Celebrity Antiques Road Trip Streaming Episodes And More

May 09, 2025

How To Watch Celebrity Antiques Road Trip Streaming Episodes And More

May 09, 2025 -

Alleged Microsoft And Asus Xbox Handheld Appears In Leaked Images

May 09, 2025

Alleged Microsoft And Asus Xbox Handheld Appears In Leaked Images

May 09, 2025