Analysis: Uber Stock And The Promise (and Peril) Of Robotaxi

Table of Contents

The Potential Upside: Robotaxi's Impact on Uber's Future Earnings

The promise of robotaxis holds immense potential to reshape Uber's financial landscape. Successfully integrating autonomous vehicles could unlock significant cost savings and drive revenue growth, ultimately boosting Uber's stock price.

Reduced Operational Costs

Autonomous vehicles promise to dramatically reduce Uber's operational expenses. This translates directly into increased profitability and a more attractive investment opportunity.

- Lower driver wages: Eliminating the need for human drivers represents a massive cost reduction.

- Reduced insurance premiums: Insurers may offer lower premiums for autonomous vehicles due to their potential for improved safety and accident reduction. However, this remains a dynamic area, with liability issues still being debated.

- Increased vehicle utilization: Robotaxis can operate 24/7, maximizing vehicle utilization and generating more revenue per vehicle.

Industry analysts project that these cost reductions could reach billions of dollars annually for companies like Uber, significantly impacting their bottom line and potentially driving up their stock price.

Increased Efficiency and Scalability

Robotaxis offer unparalleled efficiency and scalability compared to human-driven vehicles.

- 24/7 operation: Unlike human drivers who require breaks and rest, robotaxis can operate continuously, increasing ride availability and maximizing revenue streams.

- Optimized routing: Sophisticated algorithms can optimize routes, reducing travel times and fuel consumption, further enhancing efficiency.

- Expansion into underserved markets: Robotaxis can potentially provide reliable transportation in areas where human drivers are scarce or unwilling to operate, opening up new revenue opportunities.

This increased efficiency and scalability could lead to exponential growth in ride volume, driving up Uber's revenue and attracting further investment, ultimately impacting the Uber stock and robotaxi connection favorably.

Enhanced Customer Experience

Autonomous vehicles offer the potential for a significantly enhanced rider experience.

- Increased comfort: Robotaxis could feature more comfortable interiors and quieter rides, potentially attracting a premium customer base.

- Safety features: Advanced safety technologies built into autonomous vehicles may lead to fewer accidents and increased rider confidence.

- Potential for in-car entertainment: Passengers could enjoy in-car entertainment options during their journeys.

The potential for a premium robotaxi service, commanding higher fares, adds another layer of revenue potential, strengthening the link between Uber stock and robotaxi success.

The Perilous Path: Challenges and Risks in the Robotaxi Deployment

Despite the immense potential, the path to widespread robotaxi adoption is fraught with challenges and risks that could negatively impact Uber's stock price.

Technological Hurdles

Developing fully autonomous driving technology remains a significant technological challenge.

- Software glitches: Unexpected software errors can lead to accidents or operational disruptions.

- Unpredictable weather conditions: Autonomous vehicles still struggle to navigate challenging weather conditions such as heavy rain, snow, or fog.

- Ethical considerations surrounding accidents: Determining liability in the event of an accident involving an autonomous vehicle remains a complex and unresolved legal issue.

Several high-profile incidents involving autonomous vehicles have highlighted the ongoing challenges and the potential for negative publicity, which could negatively influence Uber stock and robotaxi investor confidence.

Regulatory Uncertainty

The regulatory landscape surrounding autonomous vehicles is constantly evolving and varies significantly across different jurisdictions.

- Licensing requirements: Obtaining necessary permits and licenses for operating robotaxis can be a complex and time-consuming process.

- Safety testing protocols: Rigorous safety testing is required before autonomous vehicles can be deployed on public roads, adding to development costs and timelines.

- Liability issues in case of accidents: Determining liability in case of accidents involving autonomous vehicles remains a major legal hurdle.

Regulatory uncertainty introduces significant risk, potentially delaying the widespread adoption of robotaxis and impacting the trajectory of Uber stock and robotaxi performance.

Public Perception and Adoption

Public acceptance of autonomous vehicles is crucial for their successful deployment. However, several factors could hinder widespread adoption.

- Safety concerns: Many people remain hesitant about the safety of autonomous vehicles, particularly given the potential for software glitches or unexpected malfunctions.

- Job displacement anxieties: Concerns about job displacement for human drivers could lead to public opposition and regulatory hurdles.

- Concerns about data privacy: The collection and use of data by autonomous vehicles raise concerns about privacy and data security.

Addressing these concerns through robust public education campaigns and proactive engagement with stakeholders is essential for the successful integration of robotaxis and the positive influence on Uber Stock and Robotaxi.

Competition and Market Saturation

The autonomous vehicle market is becoming increasingly competitive, with numerous tech giants, established automakers, and startups vying for market share.

- Competition from other tech giants: Companies like Google's Waymo and Tesla pose significant competition in the autonomous vehicle market.

- Established automakers: Traditional automakers are also investing heavily in autonomous driving technology, adding further pressure to the competitive landscape.

- Startups: Numerous startups are developing innovative autonomous driving technologies, creating a dynamic and competitive market environment.

Intense competition could lead to price wars, squeezing profit margins and impacting the overall profitability of Uber's robotaxi initiative, therefore affecting the relationship between Uber stock and robotaxi positively or negatively.

Analyzing Uber Stock Performance in Relation to Robotaxi Developments

Analyzing the correlation between Uber's stock performance and its robotaxi developments is crucial for understanding the impact of this technology on investor sentiment.

Correlation Analysis

Examining past stock performance following announcements or milestones related to Uber's autonomous driving program can reveal potential correlations. For instance, positive news regarding successful testing or partnerships could lead to a temporary stock price increase. Conversely, setbacks or delays could trigger a decline.

Charts and graphs illustrating the relationship between Uber's stock price and robotaxi-related news would provide a visual representation of this correlation.

Investor Sentiment

Investor sentiment regarding Uber's robotaxi strategy significantly influences its stock price. Positive investor sentiment, driven by successful progress and promising projections, can propel stock prices upwards. Negative sentiment, fueled by setbacks, regulatory hurdles, or increased competition, can lead to a decline.

Future Projections

Predicting the long-term impact of robotaxis on Uber's stock price is inherently challenging. While the potential for significant growth exists, so do the risks of technological setbacks, regulatory hurdles, and intense competition. Any future projections must acknowledge this inherent uncertainty.

Conclusion: Navigating the Future of Uber Stock with Robotaxi in Mind

Uber's investment in robotaxi technology presents both immense opportunities and significant risks. While the potential for reduced costs, increased efficiency, and enhanced customer experience is considerable, the challenges of technological development, regulatory hurdles, public perception, and intense competition cannot be ignored. The relationship between Uber stock and robotaxi is intrinsically linked, with the success of the latter directly influencing the former.

Therefore, before making any investment decisions regarding Uber stock and robotaxi technology, conduct thorough research and carefully consider the information presented here. Further reading on autonomous vehicle regulations, the competitive landscape of the ride-sharing industry, and financial analyses focusing on Uber's autonomous vehicle program is strongly recommended. Understanding the complex interplay between innovation, regulation, and market dynamics is paramount for navigating the future of Uber stock and robotaxi investments wisely.

Featured Posts

-

Cleveland Browns Land Chicago Bears Free Agent Wideout De Andre Carter

May 08, 2025

Cleveland Browns Land Chicago Bears Free Agent Wideout De Andre Carter

May 08, 2025 -

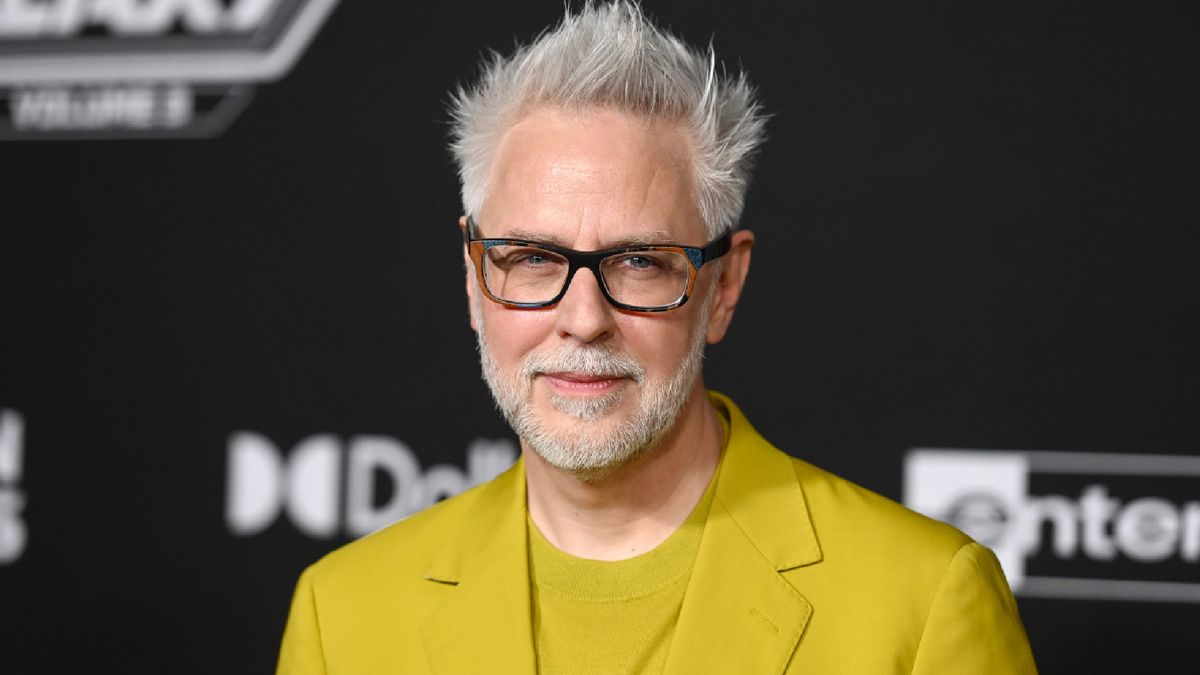

James Gunn Celebrates Jimmy Olsens 85th Anniversary With A Cryptic Daily Planet Set Photo

May 08, 2025

James Gunn Celebrates Jimmy Olsens 85th Anniversary With A Cryptic Daily Planet Set Photo

May 08, 2025 -

Dwp Home Visit Increase Concerns For Benefit Claimants

May 08, 2025

Dwp Home Visit Increase Concerns For Benefit Claimants

May 08, 2025 -

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025 -

Nathan Fillions Brief But Powerful Performance In Saving Private Ryan

May 08, 2025

Nathan Fillions Brief But Powerful Performance In Saving Private Ryan

May 08, 2025