Toronto Housing Market Update: Significant Sales Drop And Price Correction

Table of Contents

Significant Drop in Sales Volume

The Toronto real estate market has witnessed a considerable decrease in sales volume compared to previous periods. This slowdown reflects a confluence of factors impacting buyer demand and market activity.

Lower Buyer Demand

The number of properties sold in Toronto has declined significantly year-over-year and month-over-month. This reduced buyer activity can be attributed to several key factors:

- Rising Interest Rates: The Bank of Canada's interest rate hikes have substantially increased borrowing costs, making mortgages more expensive and reducing affordability for many potential homebuyers. This directly impacts purchasing power and reduces the number of qualified buyers in the Toronto housing market.

- Increased Borrowing Costs: Higher interest rates translate to significantly higher monthly mortgage payments. Even a small increase in interest rates can dramatically affect a buyer's budget and ability to secure a mortgage in the competitive Toronto market.

- Economic Uncertainty: Concerns about inflation, potential recession, and general economic instability have created uncertainty among consumers, leading many to postpone major purchases like buying a home. This cautious approach has dampened demand in the Toronto real estate sector.

- Affordability Concerns: The combination of rising interest rates and persistently high home prices has created significant affordability challenges for many prospective buyers in Toronto. This is particularly true for first-time homebuyers.

Data from the Toronto Regional Real Estate Board (TREB) shows a [insert percentage]% decrease in sales compared to [previous period - e.g., the same period last year]. [Insert chart or graph showing sales volume decline]. This decline illustrates a clear softening of the Toronto housing market.

Inventory Levels

Increased inventory levels are another significant contributor to the drop in sales volume. As new listings outpace sales, the market is becoming more balanced, shifting from a seller's market to a more buyer-friendly environment.

- Supply and Demand Imbalance: The relationship between supply and demand is fundamental to pricing. Increased supply, coupled with reduced demand, leads to a slowdown in sales and puts downward pressure on prices within the Toronto housing market.

- Active Listings Surge: The number of active listings in Toronto has increased [insert percentage]% compared to [previous period], indicating a shift in market dynamics. [Insert chart or graph showing the increase in active listings]. This higher inventory provides buyers with more choices and reduces the urgency to make quick offers.

Price Correction in the Toronto Real Estate Market

Alongside the sales drop, the Toronto real estate market is experiencing a price correction, meaning that average home prices are declining.

Average Price Decreases

Average home prices across various property types in Toronto have decreased. This price correction reflects reduced buyer competition and increased supply.

- Neighborhood-Specific Declines: Price declines are not uniform across Toronto. Certain neighbourhoods, particularly those that experienced the most significant price appreciation in recent years, are seeing sharper price drops. For example, [mention specific neighbourhoods and percentage decreases].

- Benchmark Price Adjustments: TREB's benchmark prices, which provide a more stable measure of average home prices, also reflect a [insert percentage]% decrease compared to [previous period]. This illustrates a broader market adjustment.

The factors contributing to these price adjustments include reduced buyer competition, increased supply, and a market readjustment following a period of rapid price escalation.

Market Segmentation

The price correction is not impacting all segments of the Toronto real estate market equally.

- Differentiated Impacts: The extent of price decreases varies considerably depending on the property type (condos, townhouses, detached houses) and location within Toronto. For instance, the condo market might be experiencing a more moderate correction compared to the detached house market.

- Luxury Market Sensitivity: The luxury segment of the Toronto housing market often demonstrates greater sensitivity to economic shifts and interest rate changes, potentially experiencing sharper price declines than more affordable housing segments.

Analyzing data from different market segments is crucial to understand the nuances of the current price correction.

Factors Contributing to the Market Shift

Several interconnected factors have contributed to the significant shift in the Toronto housing market.

Interest Rate Hikes

The Bank of Canada's aggressive interest rate hikes are the primary driver of the current market correction.

- Mortgage Affordability: Higher interest rates significantly reduce mortgage affordability, impacting the purchasing power of potential buyers and leading to decreased demand.

- Monthly Payment Increase: A [insert interest rate]% increase can add hundreds or even thousands of dollars to monthly mortgage payments, making homeownership less attainable for many. [Provide example calculations to illustrate the point].

The impact of rising rates on buyer affordability is the most significant factor shaping the current Toronto housing market.

Economic Uncertainty

Broader economic factors, including inflation and recessionary fears, have further dampened buyer confidence and purchasing decisions.

- Consumer Sentiment: Economic uncertainty leads to decreased consumer confidence, making individuals less likely to commit to large purchases like real estate.

- Impact on Spending: Concerns about job security and potential economic downturn influence spending habits, reducing the number of buyers actively searching for properties in the Toronto market.

Government Regulations

While not as immediate an impact as interest rates, government regulations and policies can also influence the Toronto housing market.

- Policy Changes: Any recent changes to tax policies, building codes, or other regulations related to real estate could indirectly affect market activity. [Mention specific policies and their potential impact, if applicable]. For example, changes to land transfer taxes or foreign buyer taxes could influence market dynamics.

The interplay of these factors has resulted in the current conditions of the Toronto housing market.

Conclusion

The Toronto housing market is undeniably experiencing a period of significant change, characterized by a substantial sales drop and a noticeable price correction. Factors such as increased interest rates, economic uncertainty, and a shift in buyer demand have combined to create a more balanced market. While the extent and duration of this correction remain to be seen, understanding these current trends is crucial for both buyers and sellers navigating the Toronto housing market. Stay informed about the latest updates and trends by regularly checking for new reports and analyses on the Toronto housing market. Stay tuned for our next market update!

Featured Posts

-

Nzal Marakana Barbwza Byn Alhyat Walmwt Bfqdan Alasnan

May 08, 2025

Nzal Marakana Barbwza Byn Alhyat Walmwt Bfqdan Alasnan

May 08, 2025 -

2 000 Ethereum Price A Realistic Expectation

May 08, 2025

2 000 Ethereum Price A Realistic Expectation

May 08, 2025 -

Alshmrany Rayh Fy Antqal Jysws Lflamnghw Fydyw W Tfasyl

May 08, 2025

Alshmrany Rayh Fy Antqal Jysws Lflamnghw Fydyw W Tfasyl

May 08, 2025 -

Historic Pierce County Home Facing Demolition Park Planned For Site

May 08, 2025

Historic Pierce County Home Facing Demolition Park Planned For Site

May 08, 2025 -

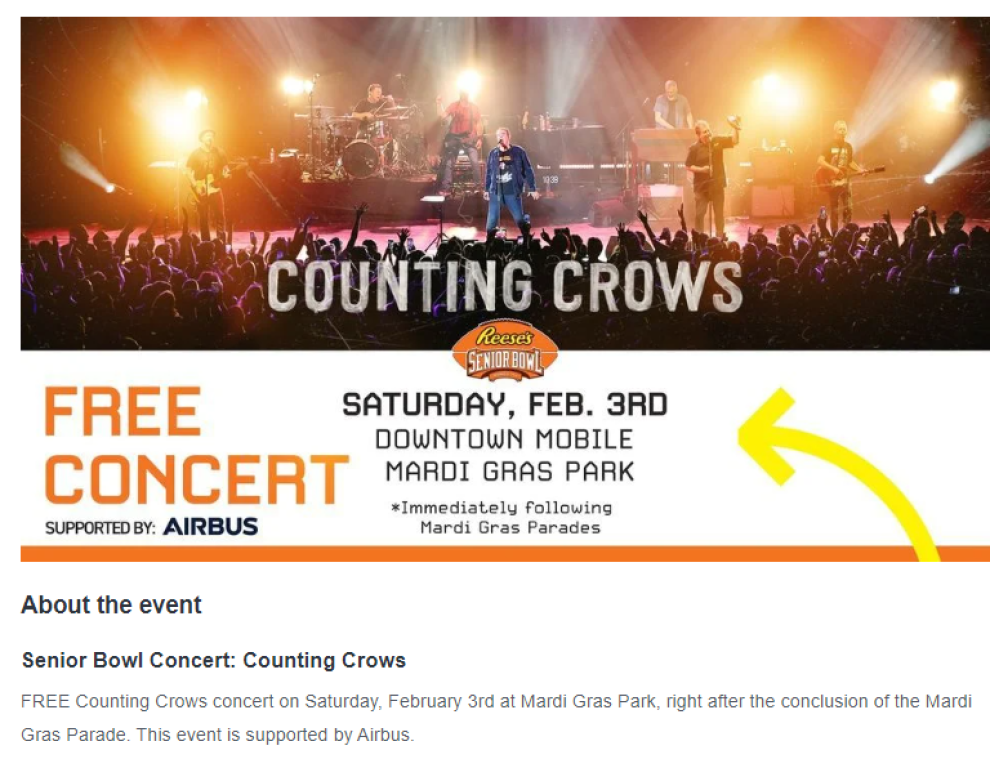

Las Vegas Concert Counting Crows Announce Strip Performance

May 08, 2025

Las Vegas Concert Counting Crows Announce Strip Performance

May 08, 2025