Analysis: UK Inflation, Pound Sterling, And BOE Monetary Policy

Table of Contents

Current State of UK Inflation

The UK is grappling with a significant cost of living crisis, driven largely by stubbornly high inflation. Official statistics, such as the Consumer Price Index (CPI) and the Retail Price Index (RPI), consistently show inflation rates well above the BOE's target of 2%. Several key factors fuel this inflationary pressure.

-

Current CPI and RPI figures: [Insert current CPI and RPI figures from a reputable source like the Office for National Statistics (ONS) and cite the source]. These figures highlight the substantial increase in the cost of living for UK households.

-

Breakdown of contributing factors to inflation: Energy prices have played a dominant role, exacerbated by geopolitical events and supply chain disruptions. Food prices have also risen sharply, impacting household budgets significantly. Wage growth, while increasing, hasn't kept pace with inflation, further contributing to the cost of living crisis. [Include a breakdown of percentage contributions from various sectors if data is available, citing the source].

-

Comparison to inflation rates in other major economies: Compared to other major economies, the UK's inflation rate [Insert comparison with other major economies like the US and Eurozone, citing source]. This comparison provides context for the UK's current economic challenges.

-

Discussion of the impact on consumer spending and business investment: High inflation erodes purchasing power, leading to decreased consumer spending and dampening business investment. This creates a negative feedback loop that can hinder economic growth.

The Impact on Pound Sterling

The relationship between UK inflation and the Pound Sterling's value is inverse. High inflation typically weakens a currency because it reduces its purchasing power relative to other currencies. This makes UK goods and services more expensive for international buyers, decreasing demand for the GBP.

-

Explanation of the correlation between inflation and currency value: Increased inflation leads to a decrease in the value of the currency, making imports more expensive and exports less competitive.

-

GBP performance against major currencies (USD, EUR): The GBP has experienced [Describe recent performance against USD and EUR, citing data from a reliable source, e.g., XE.com or a financial news website]. This performance reflects the interplay of inflation, BOE policy, and global economic factors.

-

Analysis of investor sentiment and its influence on the GBP: Investor confidence plays a significant role. High inflation and uncertainty about the economic outlook can lead to capital flight, further weakening the GBP.

-

Discussion of potential future scenarios for the GBP based on inflation trends: If inflation remains high, the GBP is likely to face further downward pressure. Conversely, a successful reduction in inflation could strengthen the currency.

BOE Monetary Policy Response

The BOE employs various monetary policy tools to combat inflation and stabilize the economy. The most prominent tool is adjusting interest rates. Raising interest rates makes borrowing more expensive, cooling down demand and potentially slowing inflation. Quantitative easing (QE), where the BOE buys government bonds to inject liquidity into the market, has also been used in the past, but less so recently.

-

Summary of recent BOE interest rate decisions: The BOE has recently [Summarize recent interest rate decisions and their rationale, citing official BOE statements].

-

Explanation of the mechanisms by which interest rate changes affect inflation: Higher interest rates increase borrowing costs for consumers and businesses, reducing spending and investment, thus curbing inflationary pressures.

-

Discussion of the potential side effects of BOE policies (e.g., impact on borrowing costs, economic growth): Raising interest rates can negatively impact economic growth by increasing borrowing costs for businesses and households, potentially leading to reduced investment and consumer spending.

-

Analysis of alternative policy options available to the BOE: The BOE might consider other measures, such as targeted fiscal policies or regulatory interventions to address specific inflationary drivers.

Predicting Future Trends

Predicting future trends with certainty is impossible. However, based on current data and the BOE's actions, we can cautiously suggest some possible scenarios. If the BOE successfully manages to bring inflation down to its target, the GBP could strengthen. Conversely, persistent high inflation could lead to further weakening of the Pound and potentially more aggressive interest rate hikes from the BOE. The global economic environment will also significantly impact these trends.

Conclusion

The interplay between UK inflation, the Pound Sterling, and BOE monetary policy is complex and constantly evolving. High inflation poses significant challenges to the UK economy, impacting household budgets, business investment, and the value of the Pound. The BOE's responses, while aiming to control inflation, have potential side effects that need careful consideration. Staying informed about the latest economic data and the BOE's actions is crucial for understanding and navigating this dynamic economic environment. Stay updated on the evolving situation by regularly checking reputable economic news sources and the official BOE website for further analysis on UK inflation, Pound Sterling, and BOE monetary policy.

Featured Posts

-

Escape To The Country Top Destinations For A Relaxing Getaway

May 25, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 25, 2025 -

Gold Prices Rise Amidst Trumps Escalating Trade Dispute With Eu

May 25, 2025

Gold Prices Rise Amidst Trumps Escalating Trade Dispute With Eu

May 25, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 25, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 25, 2025 -

Gregor Robertsons Plan Affordable Housing Without A Market Collapse

May 25, 2025

Gregor Robertsons Plan Affordable Housing Without A Market Collapse

May 25, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Argument

May 25, 2025

Dog Walker Drama Kyle And Teddis Fiery Argument

May 25, 2025

Latest Posts

-

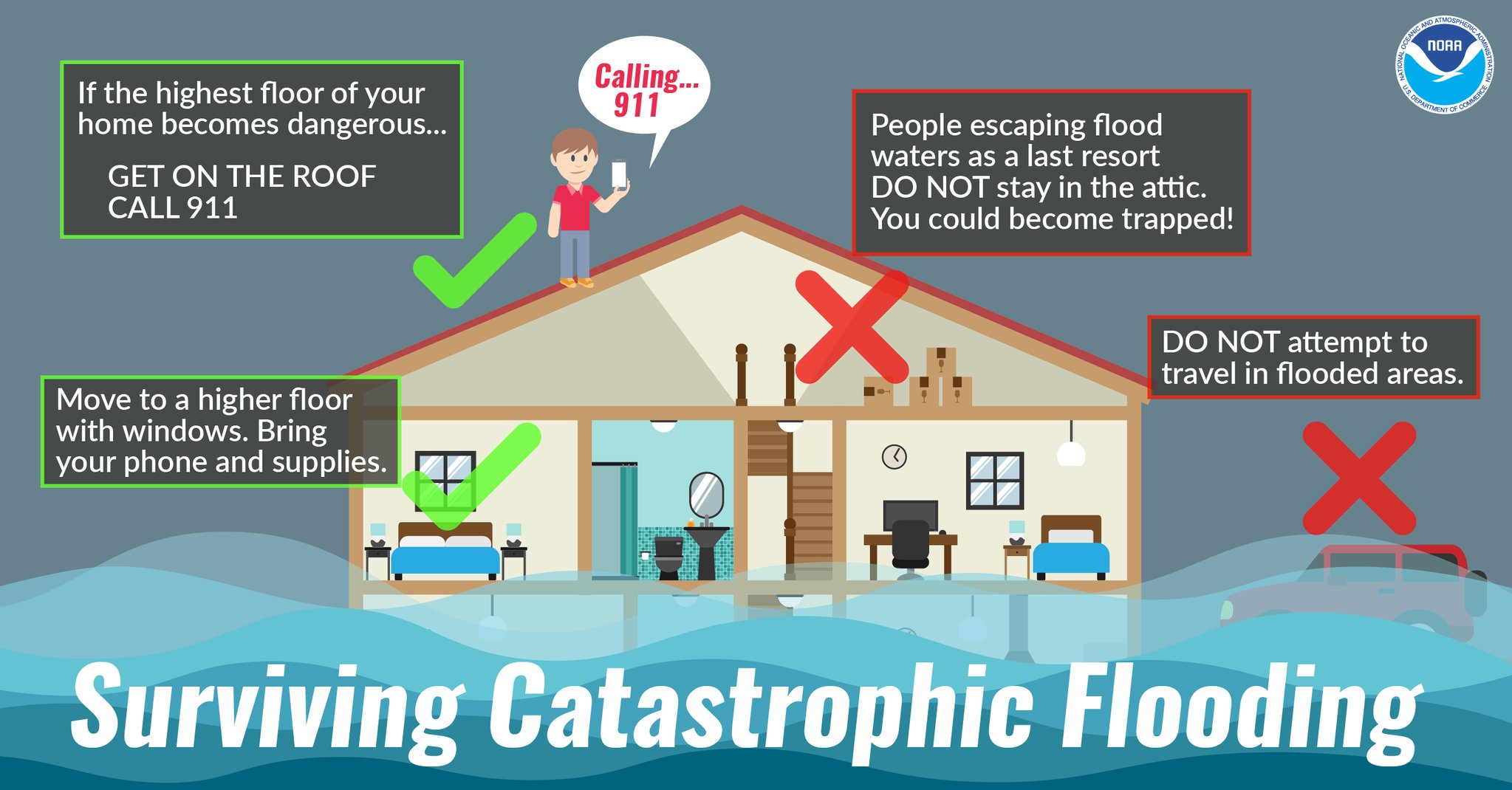

What Is A Flash Flood Emergency Definition Causes And Safety Tips

May 25, 2025

What Is A Flash Flood Emergency Definition Causes And Safety Tips

May 25, 2025 -

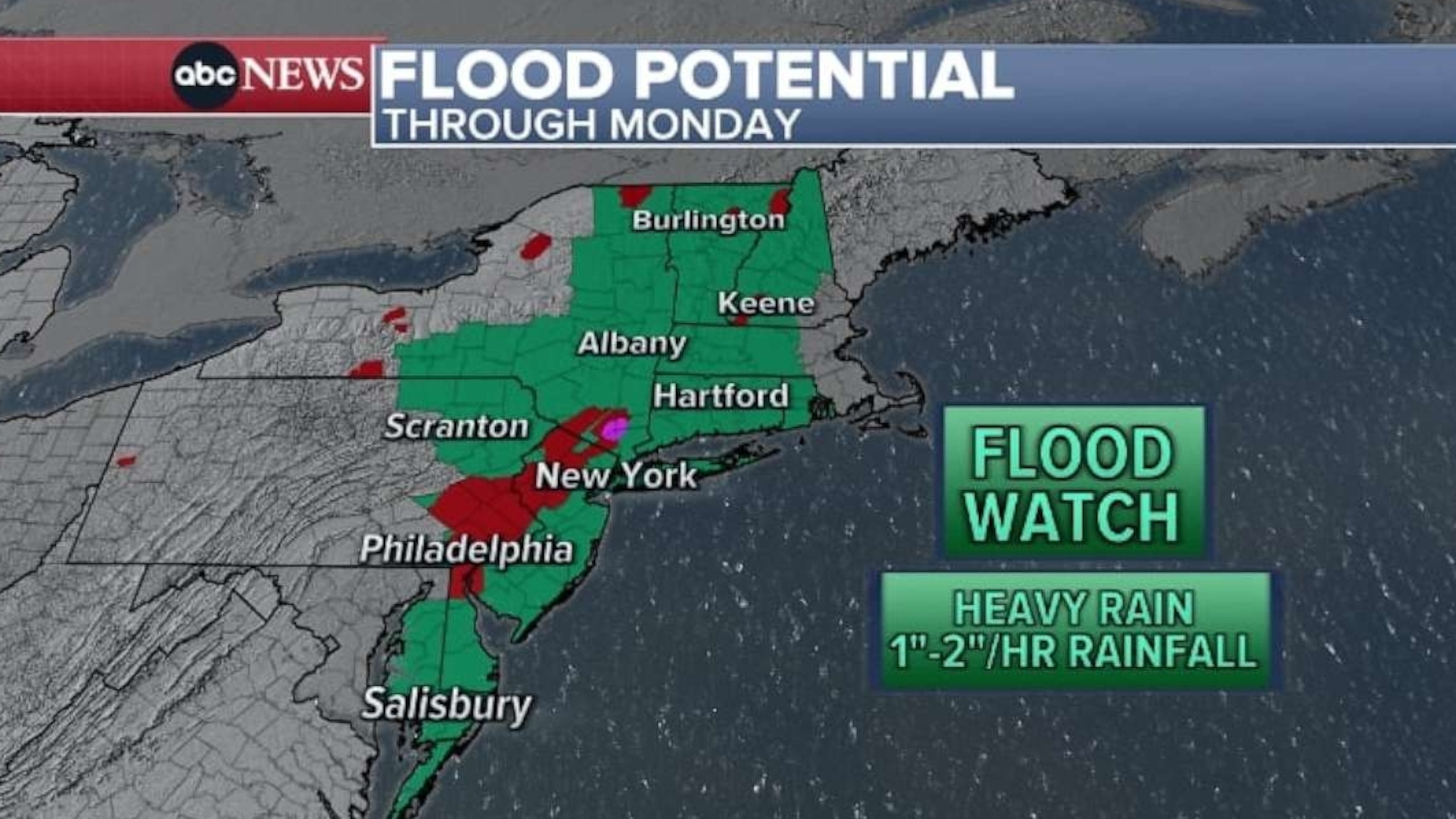

Staying Safe During A Flood Warning Nws Guidance

May 25, 2025

Staying Safe During A Flood Warning Nws Guidance

May 25, 2025 -

Flash Flood Emergency Preparedness A Step By Step Guide

May 25, 2025

Flash Flood Emergency Preparedness A Step By Step Guide

May 25, 2025 -

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025 -

Urgent Flood Warning Immediate Actions To Take Nws

May 25, 2025

Urgent Flood Warning Immediate Actions To Take Nws

May 25, 2025