Analysts Recommend Buying The Dip In This Entertainment Stock

Table of Contents

Why Analysts Are Bullish on Netflix

Strong Fundamentals Despite Recent Dip

Despite the recent pullback, Netflix boasts strong financial performance indicators. This makes the current dip an attractive entry point for long-term investors looking to buy the dip in entertainment stocks.

- Consistent Revenue Growth: Netflix has consistently demonstrated year-over-year revenue growth, showcasing its ability to attract and retain subscribers.

- Expanding Market Share: The company continues to expand its global market share, penetrating new territories and solidifying its position as a leading streaming platform.

- Robust Subscriber Base: Netflix's vast and growing subscriber base provides a solid foundation for future revenue streams and profitability. The addition of new content and features continually strengthens this foundation.

- Positive Industry Trends: The continued growth of the streaming industry and the increasing demand for on-demand entertainment content create a favorable environment for Netflix's growth.

Undervalued Asset with High Growth Potential

Many analysts believe Netflix's current stock price doesn't fully reflect its intrinsic value and future growth potential. This presents a unique opportunity for investors looking to buy the dip in this promising entertainment stock.

- Price-to-Earnings (P/E) Ratio: A lower-than-expected P/E ratio suggests that the market may be undervaluing Netflix's earnings potential.

- Future Growth Catalysts: Netflix's planned expansion into new markets, continued investment in original programming, and ongoing technological advancements are expected to drive future growth. New gaming initiatives also contribute significantly to future growth potential.

- Value Investing Opportunity: The combination of strong fundamentals and a relatively low stock price positions Netflix as a compelling value investment.

Positive Analyst Ratings and Price Targets

Several reputable analyst firms have issued buy ratings and positive price targets for Netflix stock, supporting the notion that now is a good time to buy the dip.

- Goldman Sachs: Has issued a "Buy" rating with a price target significantly above the current market price. (Link to Goldman Sachs report, if available)

- Morgan Stanley: Also issued a positive rating, highlighting the strong growth potential. (Link to Morgan Stanley report, if available)

- Consensus View: The overall consensus among analysts remains positive, suggesting a strong belief in Netflix's long-term prospects.

Mitigating the Risks of Buying the Dip

While the opportunity to buy the dip in Netflix is compelling, it's crucial to acknowledge and mitigate potential risks.

Understanding the Reasons Behind the Dip

The recent decline in Netflix's stock price can be attributed to several factors:

- Market Correction: The broader market correction has impacted many stocks, including Netflix.

- Increased Competition: The growing competition in the streaming market presents challenges.

- Subscriber Growth Slowdown: Slower-than-expected subscriber growth in certain regions may have contributed to investor concerns.

Diversification and Risk Management Strategies

To mitigate the risks associated with any investment, diversification is key.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce overall risk.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps to reduce the impact of market volatility.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses if the stock price falls below a certain level.

Long-Term Investment Perspective

Investing in the stock market requires a long-term perspective.

- Long-Term Growth Potential: Netflix's long-term growth potential significantly outweighs short-term market fluctuations.

- Patience and Discipline: Patience and discipline are essential for weathering short-term market volatility and realizing long-term gains.

Netflix: A Closer Look at the Entertainment Giant

Competitive Advantage and Market Positioning

Netflix maintains several key competitive advantages:

- Extensive Content Library: A vast and diverse content library, including original programming and licensed content.

- Global Reach: A global reach and strong international presence.

- Strong Brand Recognition: High brand recognition and consumer loyalty.

Innovative Strategies and Future Roadmap

Netflix continues to innovate:

- Investment in Original Content: Continued investment in high-quality original programming, including movies and series.

- Expansion into New Markets: Expansion into new geographic markets to reach a wider audience.

- Technological Advancements: Technological advancements, such as improved streaming technology and personalized recommendations.

Strong Management Team and Corporate Governance

Netflix benefits from a strong and experienced management team:

- Experienced Leadership: A proven track record of innovation and strong leadership.

- Sound Corporate Governance: Adherence to strong corporate governance principles enhances investor confidence.

Conclusion: Capitalize on the Opportunity: Buying the Dip in This Entertainment Stock

The current dip in Netflix's stock price presents a compelling buying opportunity for long-term investors. The company's strong fundamentals, positive analyst outlook, and significant growth potential outweigh the short-term risks. While market corrections and increased competition pose challenges, a diversified portfolio and strategic risk management techniques can mitigate these risks. Don't miss this opportunity to capitalize on the dip. Conduct your own thorough research and consider adding Netflix to your investment portfolio today. This entertainment stock presents a compelling case for long-term growth, and buying the dip could be a very lucrative strategy.

Featured Posts

-

Trumps Pardon Attorney Ed Martin Targeting Biden Era Cases

May 29, 2025

Trumps Pardon Attorney Ed Martin Targeting Biden Era Cases

May 29, 2025 -

Addressing Chinas Soybean Deficit The Sinograin Auction

May 29, 2025

Addressing Chinas Soybean Deficit The Sinograin Auction

May 29, 2025 -

The Impact Of Covid 19 Vaccines On Long Covid Development

May 29, 2025

The Impact Of Covid 19 Vaccines On Long Covid Development

May 29, 2025 -

Zoellner Family Recognizes Top Paraeducator

May 29, 2025

Zoellner Family Recognizes Top Paraeducator

May 29, 2025 -

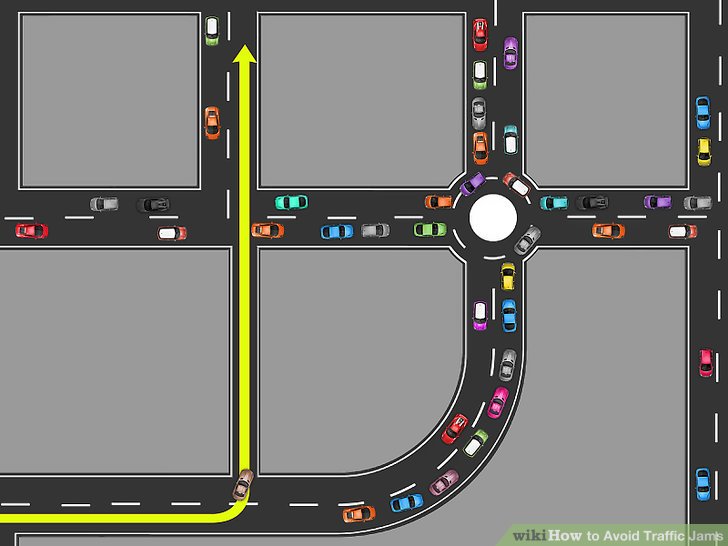

Avoid French Traffic Jams This Weekend Best Routes And Alternatives

May 29, 2025

Avoid French Traffic Jams This Weekend Best Routes And Alternatives

May 29, 2025

Latest Posts

-

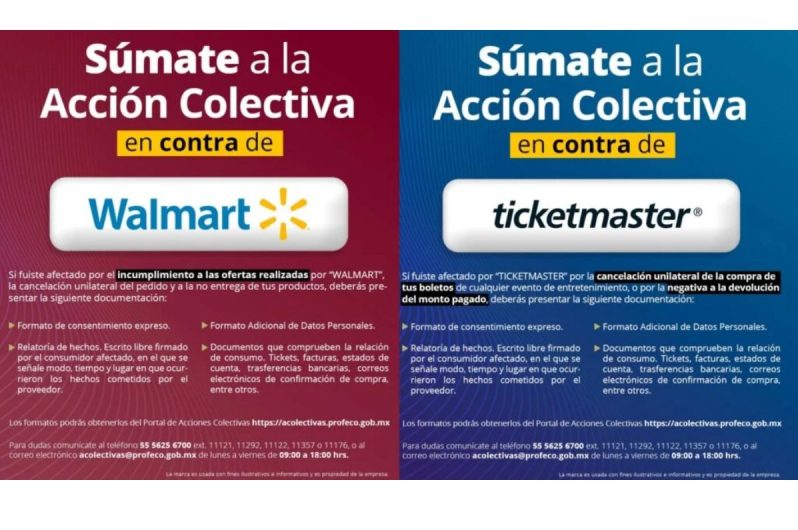

Nuevos Detalles Sobre El Precio De Las Entradas De Ticketmaster

May 30, 2025

Nuevos Detalles Sobre El Precio De Las Entradas De Ticketmaster

May 30, 2025 -

Mas Claridad Sobre Los Precios De Boletos En Ticketmaster

May 30, 2025

Mas Claridad Sobre Los Precios De Boletos En Ticketmaster

May 30, 2025 -

Ticketmaster Aclara Sus Precios De Boletos

May 30, 2025

Ticketmaster Aclara Sus Precios De Boletos

May 30, 2025 -

Ticketmaster Ofrece Mayor Transparencia En El Precio De Sus Entradas

May 30, 2025

Ticketmaster Ofrece Mayor Transparencia En El Precio De Sus Entradas

May 30, 2025 -

Cambios En La Politica De Precios De Ticketmaster Una Explicacion

May 30, 2025

Cambios En La Politica De Precios De Ticketmaster Una Explicacion

May 30, 2025