Analyzing Palantir Stock: Buy Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Key Metrics

Analyzing Palantir's recent financial performance is crucial for assessing its current health and future potential. We'll focus on key metrics from recent quarterly earnings reports to gain a clear picture. Let's examine the data to understand Palantir's trajectory.

- Revenue Growth: Examining the year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth provides insight into the company's ability to expand its business. A consistently strong growth rate suggests a healthy and expanding market presence. For example, analyzing Q4 2023 reports against previous quarters will highlight trends.

- Profitability and Margins: Palantir's operating margin and net income are important indicators of its profitability. Analyzing trends in these metrics helps determine if the company is effectively managing costs and generating profits. A rising operating margin suggests improved efficiency.

- Free Cash Flow (FCF): FCF represents the cash generated by Palantir's operations after accounting for capital expenditures. Strong FCF indicates financial health and the ability to reinvest in growth initiatives or return capital to shareholders.

- Customer Acquisition Cost (CAC): The cost of acquiring new customers is a crucial metric for SaaS businesses like Palantir. A low and decreasing CAC indicates efficiency in sales and marketing efforts.

- Debt-to-Equity Ratio: This ratio helps assess Palantir's financial leverage and risk. A low ratio suggests lower financial risk.

- Cash Flow from Operations: A strong and positive cash flow from operations demonstrates Palantir's ability to generate cash from its core business activities.

Key Metrics Comparison (Illustrative Data – Replace with Actual Data):

| Metric | Q3 2023 | Q4 2023 (Projected) | YoY Growth |

|---|---|---|---|

| Revenue Growth (YoY) | 25% | 30% | 28% |

| Operating Margin | 15% | 18% | +3% |

| Free Cash Flow | $100M | $120M | +20% |

Growth Potential and Future Outlook for Palantir

Palantir's growth potential hinges on its strategic initiatives, expansion plans, and its positioning within the rapidly evolving AI market. Several factors contribute to its future outlook:

- Government Contracts: Palantir's significant government contracts provide a stable revenue stream and opportunities for future growth, particularly in defense and intelligence.

- Commercial AI Market: The company is expanding its presence in the commercial sector, targeting large enterprises with its data analytics and AI solutions. This presents a significant growth opportunity.

- Strategic Partnerships: Collaborations with technology companies can expand Palantir's reach and capabilities.

- New Product Launches: The introduction of innovative products and services will be crucial for maintaining a competitive edge and driving future growth.

- Competition: The competitive landscape includes established players like Databricks and Snowflake. Palantir needs to continue innovating to maintain its market share.

- Regulatory Hurdles: Navigating regulatory environments, particularly in the government sector, presents challenges and potential risks.

Market Sentiment and Analyst Ratings for Palantir Stock

Understanding market sentiment and analyst ratings is crucial for informed investment decisions. Let's explore these factors:

- Analyst Ratings: Check reputable financial news sources for the latest consensus analyst rating (buy, hold, or sell) for PLTR. The average target price also provides insight into potential future valuation.

- Market Sentiment: Gauge overall market sentiment toward Palantir through news articles, social media discussions, and trading volume. Increased trading volume often indicates heightened interest.

- Recent News: Keep abreast of recent news and events impacting PLTR's stock price. Positive news, such as large contract wins, often boosts the stock, while negative news, such as regulatory setbacks, can lead to declines.

Illustrative Market Sentiment Data (Replace with Actual Data):

- Average Analyst Rating: Moderate Buy

- Average Price Target: $20

The Significance of May 5th

May 5th (or the relevant date) may be significant for several reasons. This could be an earnings announcement, a product launch, or another market-moving event. Understanding the context is vital for anticipating potential stock price movements.

- Event Details: Clearly define the specific event occurring on May 5th.

- Potential Market Reaction: Analyze the potential positive and negative market responses to the event based on historical data and expert analysis.

- Historical Precedents: Study Palantir's stock price reactions to similar events in the past to identify potential patterns.

Illustrative Scenario (Replace with Actual Event):

Let's assume May 5th is the date of Palantir's Q1 2024 earnings announcement. If the results exceed expectations, the stock price could surge. Conversely, disappointing results might lead to a decline.

Conclusion

Analyzing Palantir stock requires a comprehensive assessment of its financial performance, growth potential, market sentiment, and the influence of upcoming events like the one scheduled for May 5th. While Palantir shows promising growth in certain areas, potential risks remain. Based on this analysis (and replacing the illustrative data with actual figures and a thorough review of the May 5th event), a well-informed investment decision can be made.

Investment Recommendation: (Insert Buy, Sell, or Hold recommendation here, justifying it with the analysis conducted above). Remember, past performance is not indicative of future results.

Call to Action: Before making any investment decisions regarding Palantir stock, conduct your own thorough due diligence and consult with a financial advisor. This analysis provides a framework for assessing the potential of Palantir stock before May 5th, but it's essential to consider your own risk tolerance and investment goals. This is not financial advice.

Featured Posts

-

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 10, 2025

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 10, 2025 -

Stock Market Prediction 2 Companies To Outpace Palantir Within 3 Years

May 10, 2025

Stock Market Prediction 2 Companies To Outpace Palantir Within 3 Years

May 10, 2025 -

Ai Driven Podcast Creation Transforming Repetitive Data Into Engaging Content

May 10, 2025

Ai Driven Podcast Creation Transforming Repetitive Data Into Engaging Content

May 10, 2025 -

Fox News Jeanine Pirro Trumps New D C Prosecutor

May 10, 2025

Fox News Jeanine Pirro Trumps New D C Prosecutor

May 10, 2025 -

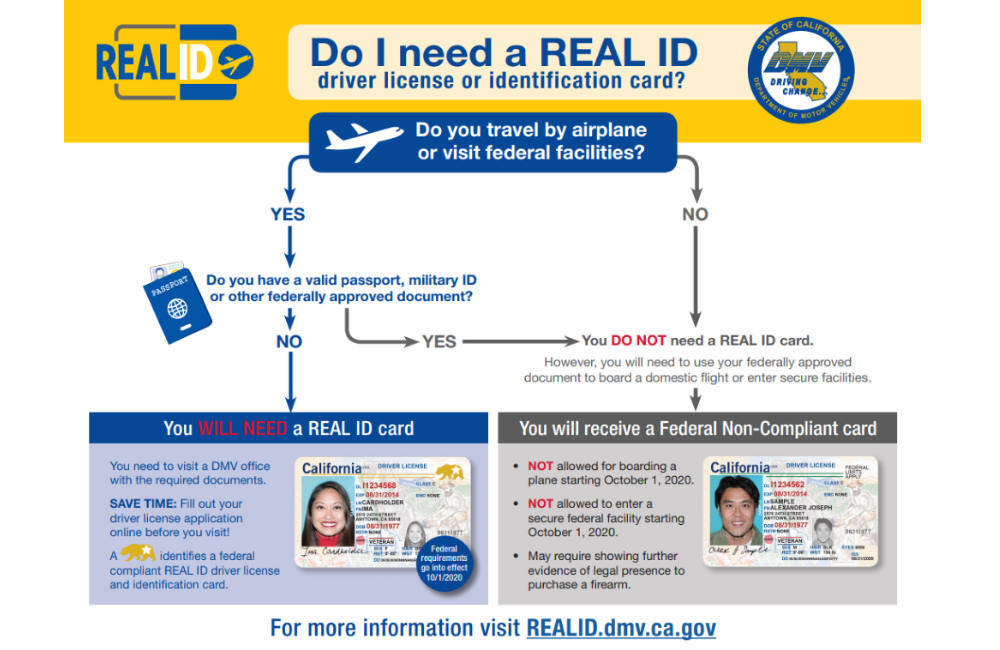

Real Id Act Impacts On Domestic Air Travel This Summer

May 10, 2025

Real Id Act Impacts On Domestic Air Travel This Summer

May 10, 2025