Analyzing The Bitcoin Market: Predicting Future Price Based On Trump's Actions

Table of Contents

Trump's Past Economic Policies and Their Effect on Bitcoin

Trump's presidency significantly shaped the global economic landscape, inevitably impacting the cryptocurrency market, including Bitcoin. Understanding this historical context is crucial for any Bitcoin price prediction incorporating political factors.

-

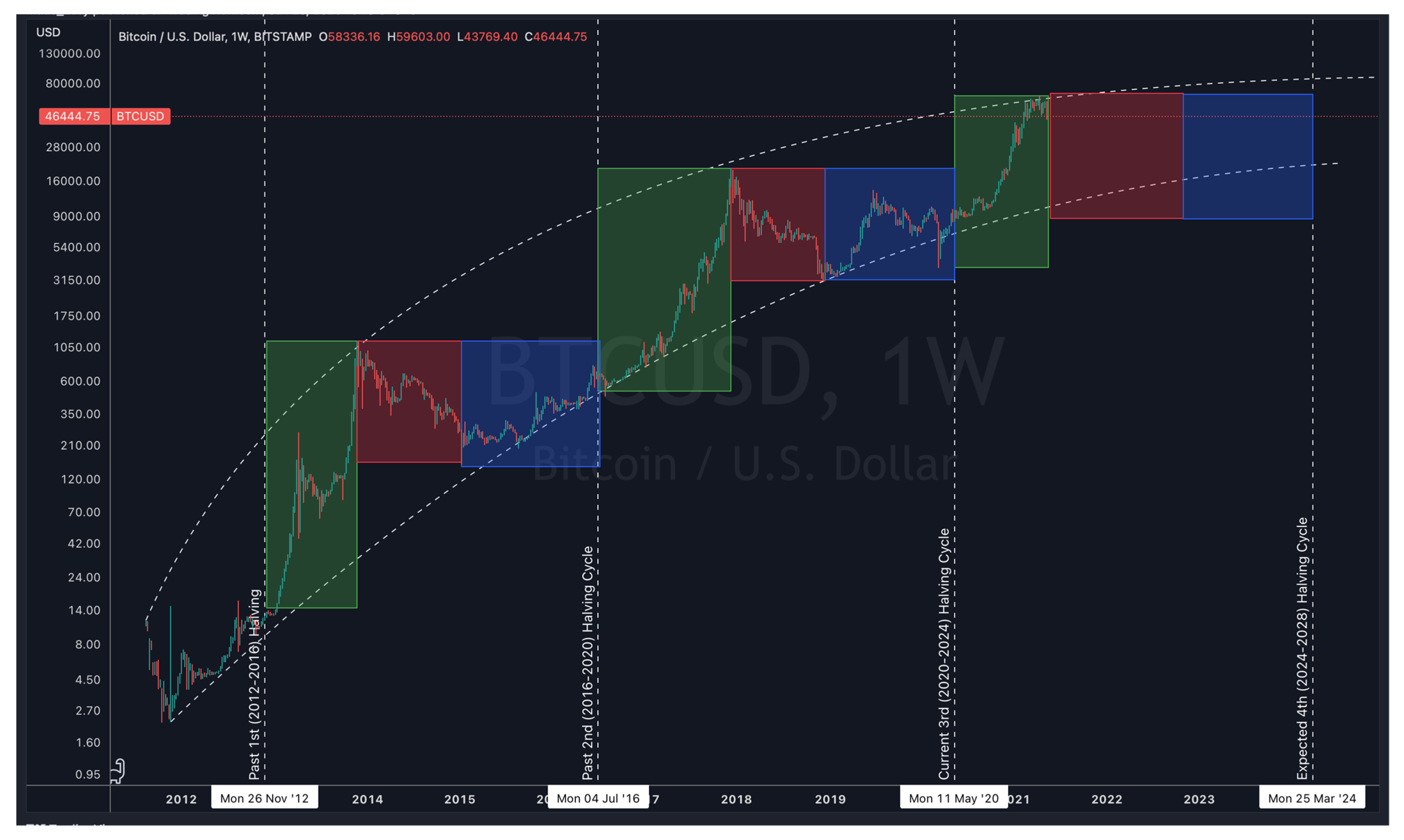

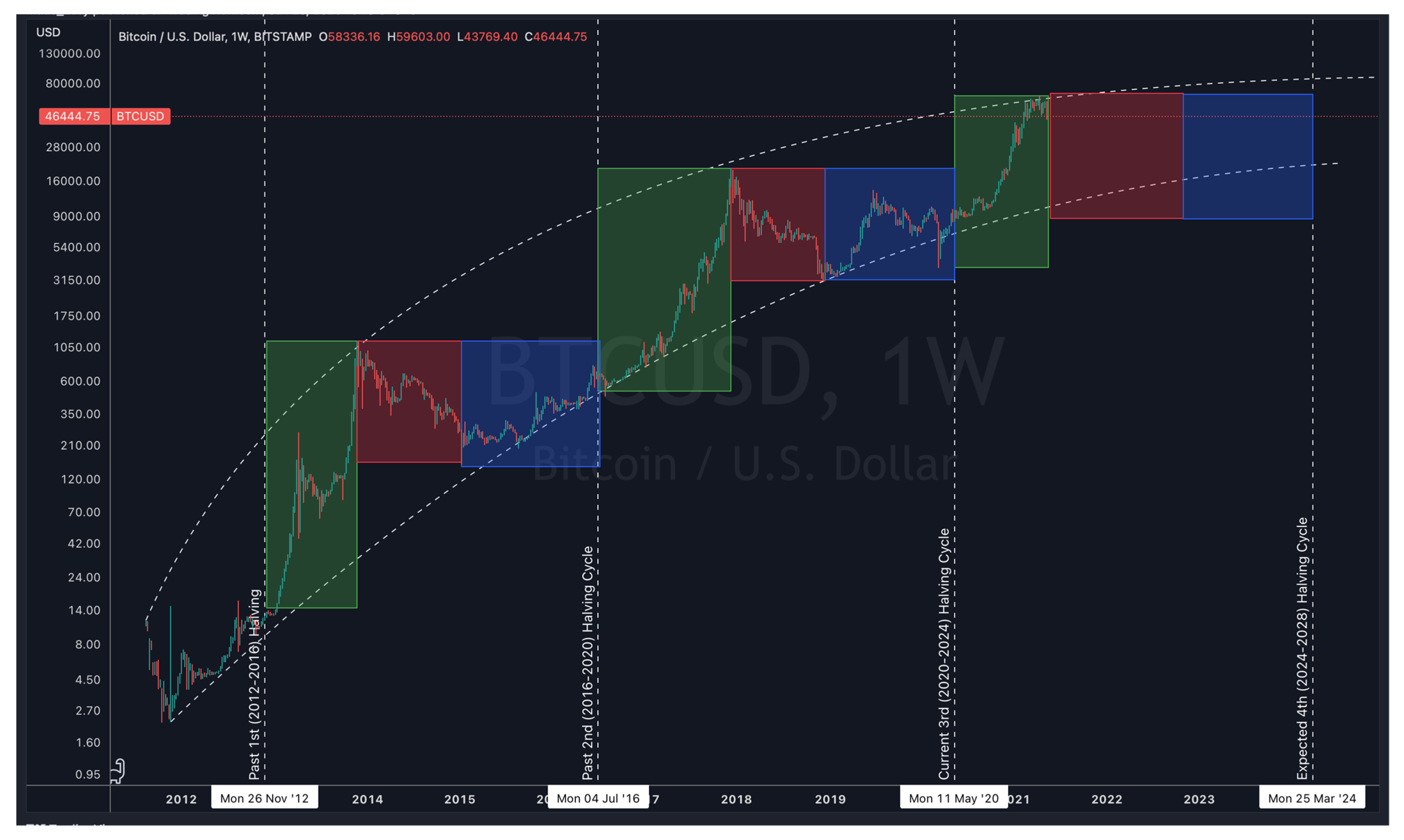

Trump's 2017 Tax Cuts and Bitcoin: The 2017 tax cuts, while intended to stimulate the US economy, also inadvertently influenced the Bitcoin market. The resulting influx of capital into the market, combined with increased investor optimism, contributed to a surge in Bitcoin's price. Charts from this period clearly show a positive correlation, although other factors were certainly at play.

-

Trade Wars and Bitcoin as a Safe Haven: Trump's trade wars with China and other nations introduced significant global economic uncertainty. In times of such uncertainty, Bitcoin, often perceived as a decentralized and inflation-hedging asset, can experience increased demand. This effect is complex and depends on investor sentiment, but evidence suggests Bitcoin can act as a safe-haven asset during periods of geopolitical instability.

-

Regulatory Uncertainty Under Trump: The regulatory environment surrounding cryptocurrencies during the Trump administration remained somewhat ambiguous. While there wasn't a clear, unified policy, the lack of consistent regulation created both opportunities and challenges for Bitcoin investors. This uncertainty, while not directly causing price drops, undeniably contributed to Bitcoin's volatility.

(Insert chart/graph visualizing Bitcoin's price performance during Trump's presidency here)

Potential Future Actions and Their Predicted Impact on Bitcoin

Predicting the future is inherently speculative, but analyzing potential scenarios based on Trump's past behavior can inform our Bitcoin price prediction.

-

Trump's Return and Market Reaction: A potential return to office by Trump could significantly affect financial markets. His past pronouncements on Bitcoin, though infrequent, have historically generated volatility. A potential return could lead to increased market uncertainty, influencing Bitcoin's price, either positively or negatively depending on his stated policies and investor interpretations.

-

Policy Proposals and Bitcoin's Future: Different policy proposals under a future Trump administration could have varied impacts. For example, further deregulation of the cryptocurrency space could boost investor confidence, potentially driving up the Bitcoin price. Conversely, increased focus on traditional financial systems might dampen enthusiasm. Infrastructure spending, while generally positive for the economy, could also indirectly affect Bitcoin depending on the funding mechanisms and investor sentiment.

-

Monetary Policy and Bitcoin's Value: Changes in US monetary policy under a Trump administration could significantly impact Bitcoin. A return to expansionary monetary policy might lead to inflation fears, potentially increasing the attractiveness of Bitcoin as a store of value. Conversely, tighter monetary policy could have the opposite effect.

-

Social Media and Short-Term Volatility: Trump's use of social media is well-documented. Even a single tweet mentioning Bitcoin could trigger significant short-term price fluctuations, highlighting the sensitivity of the market to his pronouncements.

Analyzing Other Influencing Factors Beyond Trump

While Trump's actions are a significant variable, attributing Bitcoin's price movements solely to him would be an oversimplification. A comprehensive Bitcoin price prediction necessitates considering various interconnected factors.

-

Technological Advancements: Technological upgrades within the Bitcoin network, such as improvements in scalability or security, can greatly influence its price. These factors are independent of any political figure's actions.

-

Global Regulatory Changes: Regulatory developments in countries outside the US play a substantial role. Positive regulatory frameworks in major economies can boost investor confidence and drive up Bitcoin's value.

-

Institutional Adoption: Increased adoption of Bitcoin by institutional investors, such as large corporations or hedge funds, exerts significant upward pressure on its price. This is a trend largely independent of short-term political shifts.

-

Macroeconomic Factors: Broader macroeconomic trends, like inflation rates, interest rates, and global economic growth, all have an impact on Bitcoin's price. These are fundamental drivers unrelated to any single political figure.

The Importance of Diversification in a Volatile Market

The cryptocurrency market, including Bitcoin, is inherently volatile. Reliance on any single factor, such as Trump’s actions, for Bitcoin price prediction is unwise.

-

Risk Management: Investing in Bitcoin entails significant risk. Unexpected political events, technological disruptions, or market corrections can all lead to substantial price swings.

-

Portfolio Diversification: To mitigate this risk, diversification is paramount. Spreading your investments across different asset classes, including but not limited to Bitcoin, is a crucial risk management strategy.

-

Professional Advice: Before making any significant investment decisions, particularly in volatile markets, it's crucial to consult with a qualified financial advisor.

Conclusion

Predicting the future price of Bitcoin is a complex endeavor, a delicate dance of multiple interacting variables. While Donald Trump's actions and policies have demonstrably impacted the Bitcoin market in the past, it's crucial to consider a broader range of factors. Understanding past correlations and anticipating potential future scenarios offers valuable insight, but should never be the sole basis for investment decisions.

Call to Action: Stay informed about the evolving political and economic landscape to improve your understanding of how these factors might affect your Bitcoin price prediction strategies. Continue your research on analyzing the Bitcoin market and consider diversifying your portfolio to manage the inherent risks associated with cryptocurrency investments.

Featured Posts

-

Counting Crows 2025 Tour Setlist Predictions

May 08, 2025

Counting Crows 2025 Tour Setlist Predictions

May 08, 2025 -

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025 -

Star Wars Andor Behind The Scenes Insights From Creator Tony Gilroy

May 08, 2025

Star Wars Andor Behind The Scenes Insights From Creator Tony Gilroy

May 08, 2025 -

Wall Street Ten Kripto Paraya Artan Ilgi Yatirim Stratejileri Ve Riskler

May 08, 2025

Wall Street Ten Kripto Paraya Artan Ilgi Yatirim Stratejileri Ve Riskler

May 08, 2025 -

Tatums All Star Game Takeaways His Thoughts On Steph Curry

May 08, 2025

Tatums All Star Game Takeaways His Thoughts On Steph Curry

May 08, 2025