Analyzing The CoreWeave (CRWV) Stock Price Drop On Tuesday

Table of Contents

Market Sentiment and Investor Concerns

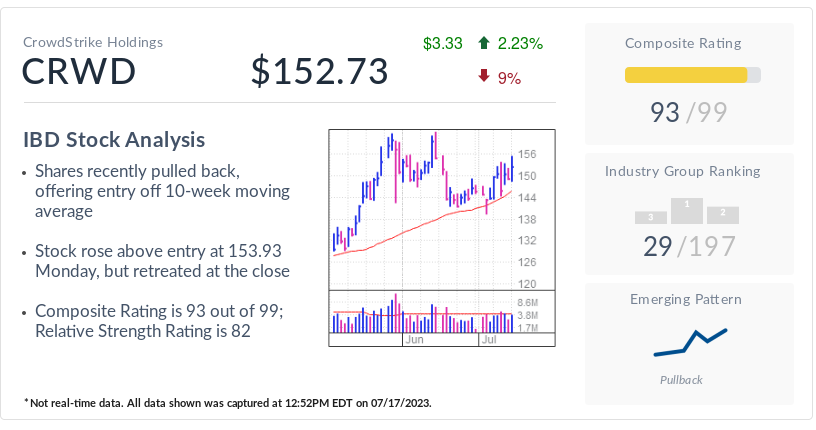

Tuesday's market conditions played a significant role in CRWV's stock price drop. While the broader tech sector experienced a downturn, the magnitude of CRWV's decline suggests specific factors were at play. Let's examine some key contributing elements:

-

Broader Tech Sector Downturn: The overall negative sentiment in the technology sector undoubtedly impacted CRWV. Many tech stocks faced selling pressure due to various macroeconomic factors.

-

Investor Profit-Taking After Recent Gains: CoreWeave had enjoyed substantial growth leading up to Tuesday's drop. This often leads to profit-taking by investors who capitalize on previous gains, contributing to price declines.

-

Impact of General Economic Uncertainty: Growing concerns about inflation, interest rate hikes, and a potential recession create a risk-averse environment, pushing investors toward safer investments and away from riskier growth stocks like CRWV.

-

Trading Volume and Volatility: Analyzing the trading volume and volatility surrounding the CRWV drop provides crucial insights. High trading volume accompanying the decline suggests a significant number of investors were selling their shares, amplifying the price movement.

News and social media sentiment surrounding CRWV before and after the drop also played a role. Negative narratives, even if unfounded, can influence investor behavior and exacerbate price declines. A thorough analysis of these online conversations is essential to understanding the full picture.

Analysis of Recent CoreWeave News and Announcements

To fully understand Tuesday's CRWV stock price drop, examining any recent company-specific news is critical. Were there any announcements or developments that might have spooked investors?

-

Review of Press Releases, Financial Reports, and Investor Calls: A careful review of all publicly available information is crucial. Did any recent statements from CoreWeave hint at potential challenges or missed targets?

-

Potential Negative Impacts from Partnerships or Contracts: Strained relationships with key partners or difficulties securing crucial contracts could significantly impact investor confidence.

-

Regulatory Changes or Legal Developments: Any regulatory hurdles or legal issues facing CoreWeave could lead to investor uncertainty and selling pressure.

-

Analyst Downgrades or Revisions: Changes in analyst ratings and price targets often influence investor sentiment and directly impact stock prices. Any negative revisions preceding the drop should be carefully examined.

Competitive Landscape and Industry Trends

CoreWeave operates in a competitive cloud computing and data center market. Understanding its position relative to competitors and prevailing industry trends is essential to analyzing the stock price movement.

-

Competitive Positioning: How does CRWV compare to major players like AWS, Google Cloud, and Microsoft Azure? Does its niche strategy provide sufficient protection against intense competition?

-

Emerging Trends Affecting the Sector: The rapid advancement of AI is a double-edged sword. While it presents growth opportunities, it also increases competition and demands significant investment.

-

Impact of Increased Competition: The increasing number of players in the cloud computing market intensifies competition, potentially squeezing profit margins and impacting stock valuations.

-

Supply Chain Issues or Resource Constraints: Any difficulties securing necessary hardware or resources could negatively impact CoreWeave's growth trajectory and investor confidence.

The Role of AI in CoreWeave's Performance

CoreWeave's business model is heavily intertwined with AI, making the sector's performance a significant factor influencing its stock price.

-

Reliance on the AI Sector: CRWV's growth is significantly tied to the adoption and advancement of AI technologies. Any negative news concerning AI development or adoption could directly impact CRWV.

-

Negative News Concerning AI: Concerns about AI regulation, slowing investment in the sector, or breakthroughs from competitors could contribute to investor anxieties.

-

Future Growth Tied to AI Advancements: Conversely, positive developments in AI could greatly benefit CoreWeave. Its long-term success hinges on its ability to adapt and thrive within this rapidly evolving landscape.

Conclusion

The CoreWeave (CRWV) stock price drop on Tuesday resulted from a confluence of factors, including broader market sentiment, specific company-related news (or lack thereof), competitive pressures within the cloud computing and AI sectors, and the inherent volatility of growth stocks. Understanding the interplay between these elements is critical for informed investment decisions.

Call to Action: Understanding the reasons behind the CoreWeave (CRWV) stock price decline is crucial for informed investment decisions. Continue monitoring the CRWV stock performance, staying informed about news and industry developments to make sound investment choices. Further research into the CoreWeave (CRWV) business model and its long-term prospects is recommended for investors considering this stock. Consider consulting with a financial advisor before making any investment decisions related to CRWV or other cloud computing stocks. Careful analysis of CRWV's future performance within the AI and cloud computing markets is essential for assessing its investment potential.

Featured Posts

-

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Ket Noi Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Ket Noi Binh Phuoc

May 22, 2025 -

Why Did Core Weave Inc Crwv Stock Fall On Thursday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Fall On Thursday

May 22, 2025 -

Second Reintroduced Colorado Gray Wolf Found Dead In Wyoming

May 22, 2025

Second Reintroduced Colorado Gray Wolf Found Dead In Wyoming

May 22, 2025 -

Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025

Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025 -

Mexico Vs Panama Guia Completa Para Ver La Final De La Liga De Naciones Concacaf

May 22, 2025

Mexico Vs Panama Guia Completa Para Ver La Final De La Liga De Naciones Concacaf

May 22, 2025

Latest Posts

-

Trinidad Concert Restrictions Defence Ministers Proposal For Kartel Show

May 23, 2025

Trinidad Concert Restrictions Defence Ministers Proposal For Kartel Show

May 23, 2025 -

The Impact Of Low Self Esteem Vybz Kartels Experience With Skin Bleaching

May 23, 2025

The Impact Of Low Self Esteem Vybz Kartels Experience With Skin Bleaching

May 23, 2025 -

Vybz Kartel Opens Up The Link Between Self Love And Skin Bleaching

May 23, 2025

Vybz Kartel Opens Up The Link Between Self Love And Skin Bleaching

May 23, 2025 -

Le Programme Maxine Trouver L Assurance Et La Confiance En Soi

May 23, 2025

Le Programme Maxine Trouver L Assurance Et La Confiance En Soi

May 23, 2025 -

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 23, 2025

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 23, 2025