Analyzing The Damage: How Trump's Tariffs Affected Small Businesses

Table of Contents

Increased Costs and Reduced Profit Margins

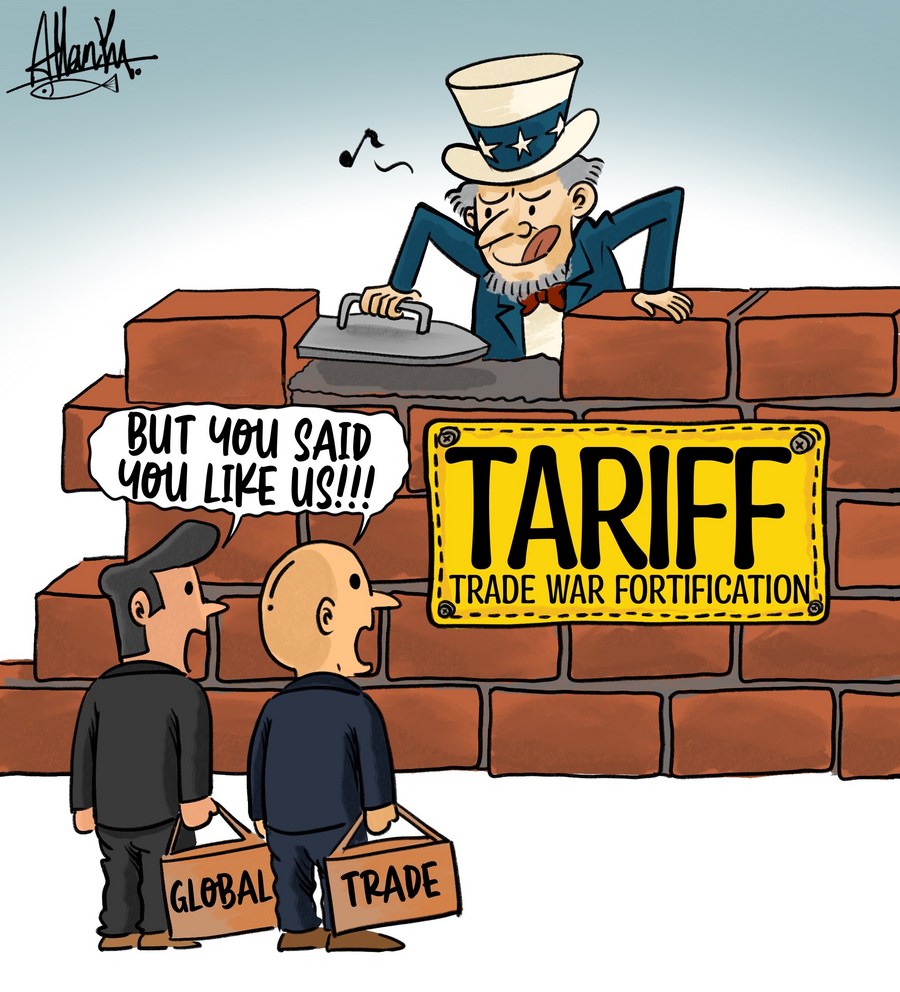

Trump's tariffs directly increased the cost of imported goods, a critical factor for countless small businesses reliant on global supply chains. These increased import costs squeezed profit margins and forced many to make difficult choices.

- Higher prices for raw materials: Many small businesses rely on imported raw materials for production. Tariffs significantly increased the cost of these materials, directly impacting their manufacturing costs. This was particularly true for businesses in industries like manufacturing and textiles.

- Increased manufacturing costs: The increased cost of raw materials wasn't the only factor driving up manufacturing expenses. Tariffs on intermediate goods and components also contributed to higher overall production costs.

- Reduced consumer demand due to higher prices: As the cost of goods increased due to tariffs, consumers responded by reducing their spending. This decreased demand directly impacted small businesses, forcing them to sell less or lower their prices to remain competitive.

- Difficulty competing with larger businesses: Larger businesses, with greater financial resources, were better equipped to absorb the increased costs associated with tariffs. This left many smaller businesses at a significant competitive disadvantage.

The impact was keenly felt across diverse sectors. For example, the furniture industry, heavily reliant on imported wood and components, experienced a substantial increase in production costs, leading to higher prices and reduced sales. Similarly, the retail sector faced challenges as the cost of imported goods rose, squeezing profit margins and hindering growth.

Supply Chain Disruptions and Delays

Trump's tariffs significantly disrupted global supply chains, creating unforeseen challenges for small businesses. The complexities of navigating new trade barriers and increased scrutiny added significant hurdles.

- Longer lead times for materials and goods: Tariffs led to increased bureaucratic delays and logistical complexities in importing goods, resulting in significantly longer lead times. This unpredictability made it challenging for businesses to plan production and fulfill orders.

- Increased shipping costs and logistical complexities: The added costs associated with navigating tariffs, including increased customs duties and processing fees, led to higher shipping costs and more complicated logistics.

- Uncertainty and difficulty in forecasting inventory needs: The fluctuating nature of tariffs and their impact on supply chains made it incredibly difficult for small businesses to accurately forecast inventory needs. Overstocking risked tying up capital, while understocking risked lost sales.

- Loss of business due to inability to fulfill orders promptly: The delays and disruptions caused by tariffs directly resulted in many small businesses losing sales due to their inability to meet customer demand in a timely manner. This was particularly problematic for businesses operating in sectors with tight deadlines or seasonal demands.

Keywords like global trade, tariff wars, and supply chain management highlight the broader context of these disruptions, impacting businesses beyond their immediate control.

Reduced Consumer Demand and Sales

The increased prices stemming from Trump's tariffs directly led to reduced consumer spending, placing significant strain on small businesses.

- Decreased sales volumes for small businesses: As consumers tightened their belts, the direct impact was a drop in sales for numerous small businesses.

- Pressure to lower profit margins to remain competitive: To maintain sales, many small businesses were forced to reduce their profit margins, further eroding their already-thin financial reserves.

- Increased financial strain and potential business closures: The combined effects of increased costs, reduced demand, and dwindling profit margins led to increased financial strain, forcing some small businesses to close their doors permanently.

- Examples of specific business types impacted: Numerous sectors suffered. Restaurants faced higher prices for imported ingredients, while clothing retailers struggled with increased costs for apparel imports.

The Impact on Specific Industries

The impact of Trump's tariffs was not uniform across all industries. Some sectors, such as farming and manufacturing, were disproportionately affected. For example, "Trump tariffs impact on small farmers" saw many facing significantly higher costs for imported equipment and fertilizer, while simultaneously experiencing reduced export markets. Similarly, the "how Trump's tariffs affected the furniture industry" showed how increased costs on imported wood and components led to job losses and business closures.

Government Assistance and Support (or Lack Thereof)

While some government programs aimed to assist small businesses affected by tariffs, their effectiveness and accessibility were often debated.

- Discussion of specific government programs designed to help businesses: Certain loan programs and tax incentives were introduced to mitigate the impact of tariffs.

- Effectiveness and accessibility of those programs: The reach and efficiency of these programs varied, with many small businesses struggling to navigate the application processes or finding the aid insufficient.

- Anecdotal evidence of businesses receiving or lacking support: Many case studies highlighted both successes and failures in accessing and utilizing government support during this period. The effectiveness of these measures was frequently questioned.

Conclusion

Trump's tariffs led to increased costs for imported goods, significant supply chain disruptions, and reduced consumer demand, creating a perfect storm for many small businesses. The increased costs of raw materials and finished goods, coupled with the difficulty in navigating disrupted supply chains, drastically impacted profit margins and led to decreased sales volumes. While some government assistance programs existed, their effectiveness and accessibility were often questionable. The long-term effects of these tariffs on the American economy and small businesses are still being felt today, highlighting the need for careful consideration of protectionist trade policies. Understanding the full impact of Trump's tariffs on small businesses is crucial for shaping future trade policies. Continue researching the effects of Trump's tariffs and advocate for better support for small businesses.

Featured Posts

-

Early Predictions For Ufc 315 Analyzing The Upcoming Fights

May 12, 2025

Early Predictions For Ufc 315 Analyzing The Upcoming Fights

May 12, 2025 -

Experience The Thrills Houstons Astros Foundation College Classic

May 12, 2025

Experience The Thrills Houstons Astros Foundation College Classic

May 12, 2025 -

Rate Cut Optimism Among Bond Traders Evaporates After Powell Speech

May 12, 2025

Rate Cut Optimism Among Bond Traders Evaporates After Powell Speech

May 12, 2025 -

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Scheitert In Der Cl Quali

May 12, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Scheitert In Der Cl Quali

May 12, 2025 -

Doom Eternal New Dark Ages Location Revealed On Ps 5

May 12, 2025

Doom Eternal New Dark Ages Location Revealed On Ps 5

May 12, 2025