Analyzing The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. It's calculated by taking the total value of all the assets held within the ETF (like stocks, bonds, etc.), subtracting liabilities, and then dividing by the total number of outstanding shares. For ETFs like the Amundi MSCI World II UCITS ETF Dist, which tracks a specific index (the MSCI World Index), the NAV closely reflects the performance of that underlying index. Understanding the ETF NAV is crucial for assessing its performance and making informed investment decisions. Monitoring the Amundi MSCI World II UCITS ETF Dist NAV is a key aspect of effective investment management.

The Amundi MSCI World II UCITS ETF Dist is a UCITS ETF that provides diversified exposure to global equities, tracking the MSCI World Index. This means it aims to mirror the performance of a large selection of global companies. Because this ETF invests in a broad range of international markets, understanding its NAV is particularly critical for evaluating its performance against your investment goals. Fluctuations in the Amundi MSCI World II UCITS ETF Dist NAV directly reflect the overall performance of the global equity market.

Factors Affecting the Amundi MSCI World II UCITS ETF Dist NAV

Several factors contribute to the daily fluctuations in the Amundi MSCI World II UCITS ETF Dist NAV. Careful consideration of these elements is essential for informed investment analysis.

-

Underlying Asset Performance (MSCI World Index): The primary driver of the ETF's NAV is the performance of the MSCI World Index. Positive movements in the index (due to rising stock prices of the companies it tracks) typically result in a higher NAV, and vice versa. Global market trends, economic news, and individual company performance all play a role.

-

Currency Fluctuations: As a global equity ETF, the Amundi MSCI World II UCITS ETF Dist holds assets denominated in various currencies. Changes in exchange rates between these currencies and the ETF's base currency (likely EUR) will impact the overall NAV. A strengthening Euro, for example, could lead to a lower NAV if a significant portion of the ETF's assets are in weaker currencies.

-

Expenses and Management Fees: The ETF incurs expenses related to management, administration, and trading. These fees are deducted from the assets under management, reducing the NAV over time. It's crucial to be aware of these costs when assessing the overall return of your investment.

-

Dividend Distributions: When the underlying companies within the MSCI World Index pay dividends, the ETF receives these payments. These dividend distributions are usually passed on to ETF investors, resulting in a slight decrease in the NAV immediately after the distribution date.

-

Supply and Demand: While the NAV represents the intrinsic value of the ETF's assets, the market price may differ slightly due to supply and demand dynamics in the market. High trading volume can influence short-term price deviations from the NAV.

How to Find the Amundi MSCI World II UCITS ETF Dist NAV

Accessing real-time and historical NAV data for the Amundi MSCI World II UCITS ETF Dist is straightforward. Several reliable sources provide this information:

-

Official ETF Provider Website (Amundi): The most accurate and up-to-date NAV data is usually found on Amundi's official website. Look for their ETF listings and fund fact sheets.

-

Financial Data Providers: Reputable financial data providers such as Bloomberg, Yahoo Finance, Google Finance, and others offer real-time and historical NAV information for many ETFs, including the Amundi MSCI World II UCITS ETF Dist.

-

Brokerage Platforms: If you hold the Amundi MSCI World II UCITS ETF Dist through a brokerage account, your platform likely provides access to real-time or delayed NAV data for your holdings.

Interpreting the Amundi MSCI World II UCITS ETF Dist NAV

Understanding how to use the NAV effectively is key to informed investment decisions.

-

Comparing NAV to the Market Price: The market price of the ETF may slightly deviate from the NAV due to supply and demand. A small difference is normal, but significant discrepancies might warrant further investigation.

-

Tracking NAV Performance Over Time: Regularly monitoring the NAV's changes over time provides insights into the ETF's performance and its alignment with your investment objectives. Charting the NAV over longer periods helps gauge the long-term trend.

-

Using NAV for Buy/Sell Decisions: While the NAV isn't the sole factor determining buy/sell decisions, monitoring its trend alongside other market indicators can help you make more informed choices. Consider your investment horizon and risk tolerance.

Amundi MSCI World II UCITS ETF Dist NAV vs. Competitors

Comparing the NAV performance of the Amundi MSCI World II UCITS ETF Dist with similar global equity ETFs can help you assess its relative strength. For instance, comparing its performance against ETFs like the iShares Core MSCI World UCITS ETF (USD) or Vanguard FTSE All-World UCITS ETF over various periods (e.g., 1 year, 3 years, 5 years) can reveal insights into its relative performance and expense ratios. This comparison should consider factors beyond just NAV, including expense ratios, tracking error, and dividend yield.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF Dist NAV Data

Understanding the Amundi MSCI World II UCITS ETF Dist NAV and the factors that influence it is crucial for effective investment management. By regularly tracking your Amundi MSCI World II UCITS ETF Dist NAV and comparing it to competitors, you can gain valuable insights into the performance of your investment. Remember to utilize the resources mentioned above to access accurate data and make sound investment choices. Understanding your Amundi MSCI World II UCITS ETF Dist NAV empowers you to monitor your portfolio's progress towards your financial goals. Start tracking your Amundi MSCI World II UCITS ETF Dist NAV today!

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025 -

Making The Transition Your Successful Escape To The Country

May 24, 2025

Making The Transition Your Successful Escape To The Country

May 24, 2025 -

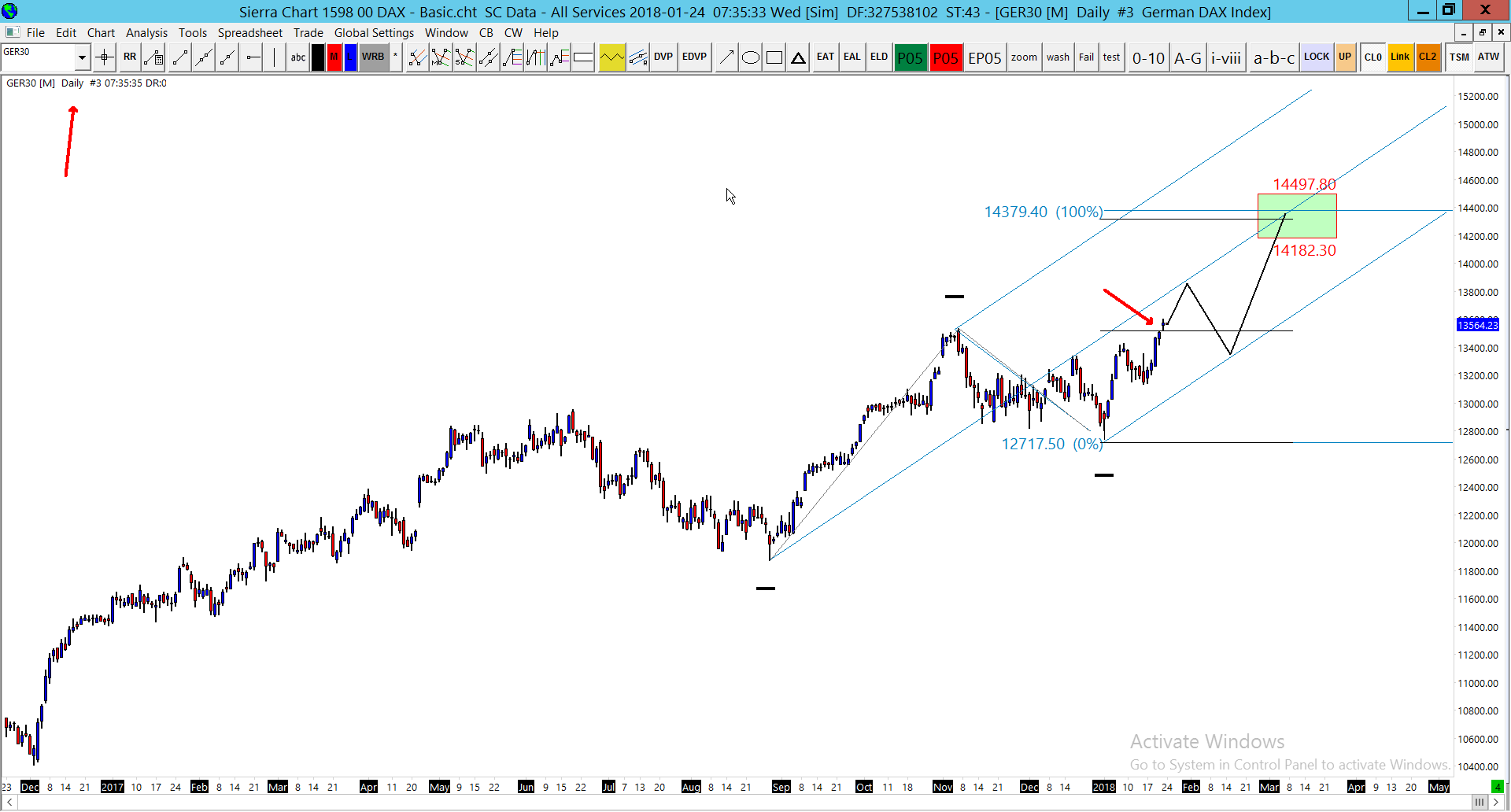

German Daxs Strong Performance A Look At Wall Streets Influence

May 24, 2025

German Daxs Strong Performance A Look At Wall Streets Influence

May 24, 2025

Latest Posts

-

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025 -

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 24, 2025 -

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025