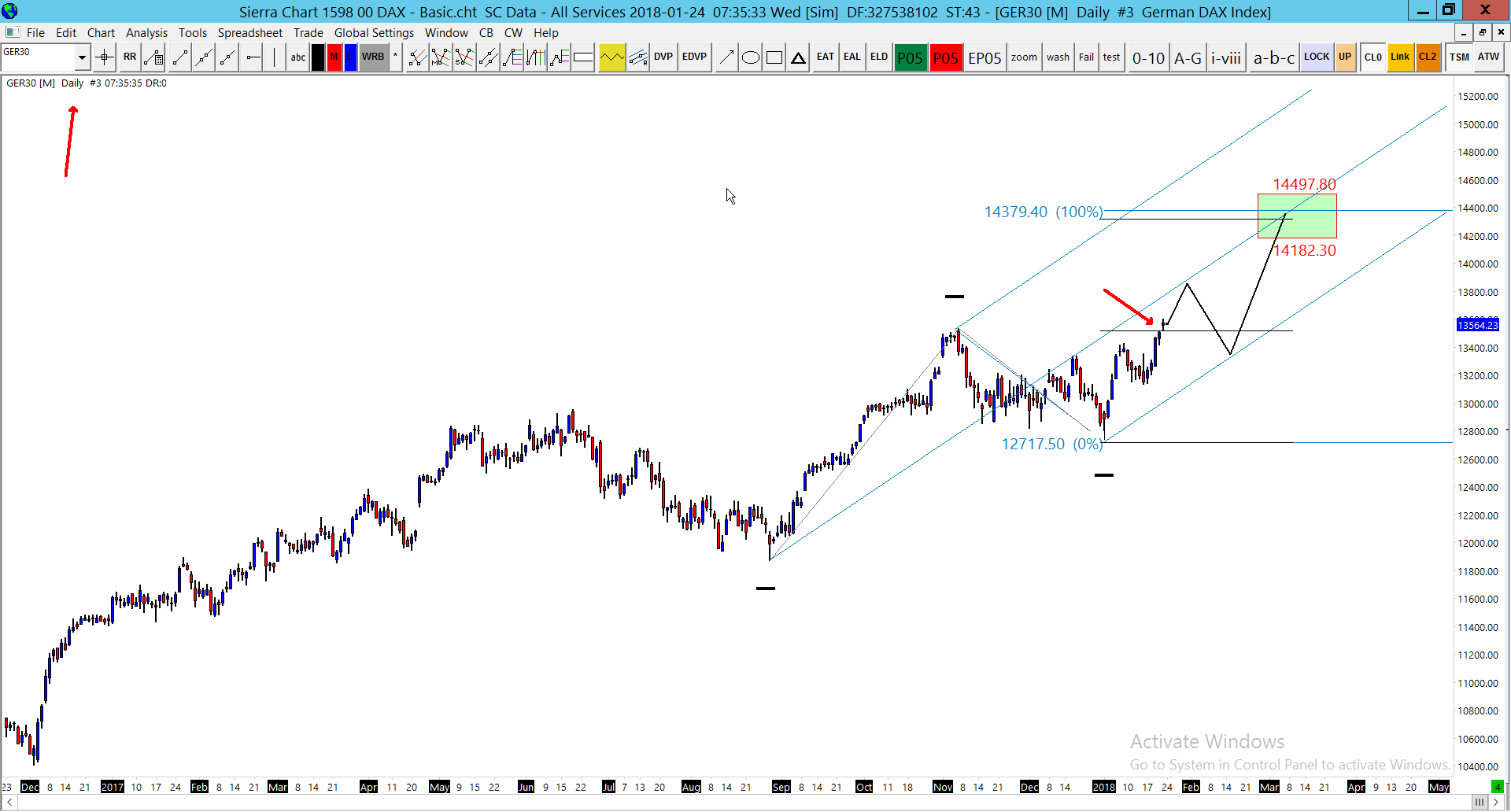

German DAX's Strong Performance: A Look At Wall Street's Influence

Table of Contents

Wall Street's Direct Investment in German Companies

US institutional investors, including powerful mutual funds and hedge funds, are major players in the German stock market. Their direct investment in DAX-listed companies significantly impacts the index's performance. When these investors increase their holdings in German firms, demand for shares rises, pushing up prices and contributing to the German DAX's strong performance. Conversely, a withdrawal of investment can trigger market corrections and price drops, highlighting the direct link between Wall Street's actions and the DAX's daily fluctuations.

- Increased investment: Leads to higher demand and subsequently increased share prices, boosting the DAX. Think of the impact of large-scale buying by firms like BlackRock or Vanguard.

- Withdrawal of investment: Can trigger sell-offs, leading to market corrections and a decline in the DAX. This is particularly pronounced during periods of global economic uncertainty.

- Impact of US economic policies: US interest rate hikes, for instance, can impact investor sentiment towards German assets, affecting the flow of capital into the DAX. Higher interest rates in the US can make dollar-denominated assets more attractive, potentially diverting investment away from the DAX.

The Ripple Effect of US Market Sentiment on the DAX

Global markets are intrinsically linked. A positive or negative trend on Wall Street often reverberates across the globe, impacting investor sentiment and, consequently, the DAX. This "contagion effect" is driven by investor psychology and herd behavior; a bullish Wall Street market often instills global confidence, while a bearish market can trigger widespread sell-offs, including in the DAX.

- Bullish Wall Street: A rising S&P 500, for example, often fuels optimism, encouraging investors to seek opportunities in other markets, including the DAX.

- Bearish Wall Street: Conversely, a downturn on Wall Street can lead to risk aversion, prompting investors to divest from potentially volatile markets like the DAX.

- S&P 500 as a leading indicator: The performance of the S&P 500 frequently acts as a leading indicator, influencing investor expectations and behavior regarding the DAX.

Specific Sectors & Wall Street's Influence

The influence of Wall Street on the DAX isn't uniform across all sectors. Certain industries are disproportionately affected by US trends. For example, the automotive and technology sectors are particularly sensitive to US consumer demand and the actions of US tech giants.

- US Tech Giants' Influence: The success of US tech companies often impacts the performance of their German counterparts listed on the DAX. Competition and technological advancements in the US directly affect German tech firms.

- US Automotive Market Trends: The performance of German automakers heavily depends on the US automotive market, with shifts in consumer preferences and sales directly impacting their profitability and, consequently, the DAX.

- US Industrial Production: Fluctuations in US industrial production have a ripple effect, affecting the demand for German industrial goods and impacting the performance of related companies on the DAX.

Geopolitical Factors Mediated Through Wall Street

US foreign policy and international events significantly influence the global economic landscape, and Wall Street acts as a key intermediary, shaping the DAX's response. Trade wars, sanctions, and currency fluctuations all play a role, often mediated through the lens of Wall Street's interpretation and reaction.

- US-China Trade War: The US-China trade war, for example, significantly impacted German exporters listed on the DAX, as it disrupted global supply chains and created uncertainty in international trade.

- Impact of US Sanctions: US sanctions on specific countries or entities can impact German businesses involved in global supply chains, leading to potential disruptions and influencing DAX performance.

- US Dollar Fluctuations: The strength of the US dollar against the Euro directly affects the global competitiveness of German multinationals and their profitability, influencing the DAX's performance.

Conclusion: Understanding Wall Street's Impact on the German DAX

Wall Street's influence on the German DAX's strong performance is multifaceted and substantial. It encompasses direct investment, the contagion of market sentiment, sector-specific impacts, and indirect effects through geopolitical factors. Understanding this intricate relationship is crucial for investors seeking to navigate the complexities of the global market. To make informed investment decisions, further research into the interconnectedness of global markets and the continuing influence of Wall Street on the German DAX's strong performance is highly recommended. Consider subscribing to a reputable market analysis service or diligently following key economic indicators to gain a deeper understanding of this dynamic interplay.

Featured Posts

-

Dazi Stati Uniti Prezzi Moda E Implicazioni

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Implicazioni

May 24, 2025 -

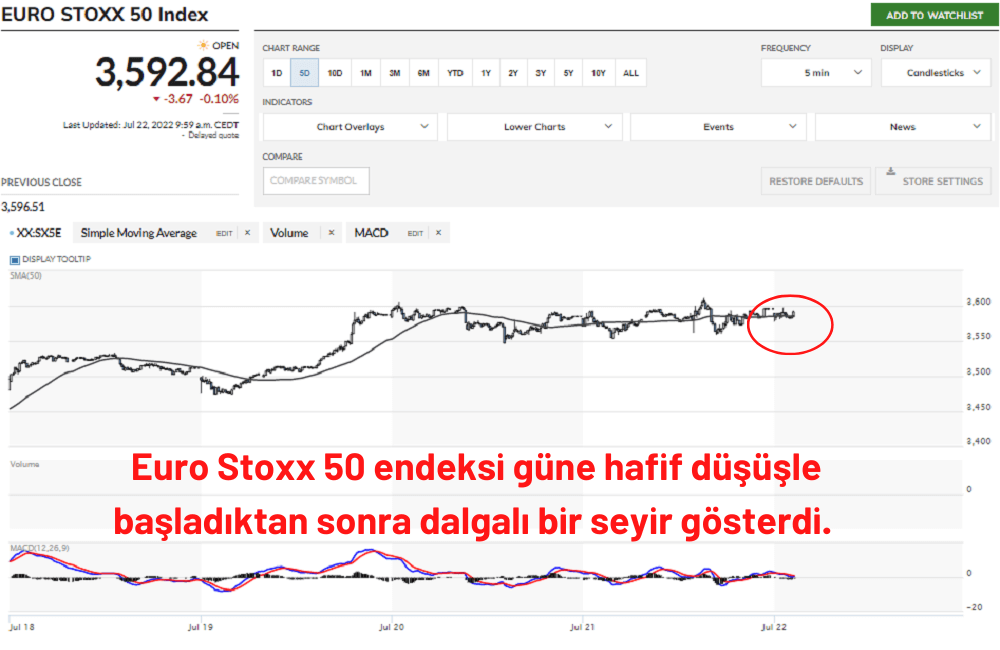

Avrupa Piyasalari Buguenkue Karisik Performans

May 24, 2025

Avrupa Piyasalari Buguenkue Karisik Performans

May 24, 2025 -

Eurovision 2025 Concert Conchita Wurst And Jj In The Village

May 24, 2025

Eurovision 2025 Concert Conchita Wurst And Jj In The Village

May 24, 2025 -

Moje Wrazenia Po Jezdzie Porsche Cayenne Gts Coupe

May 24, 2025

Moje Wrazenia Po Jezdzie Porsche Cayenne Gts Coupe

May 24, 2025 -

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Latest Posts

-

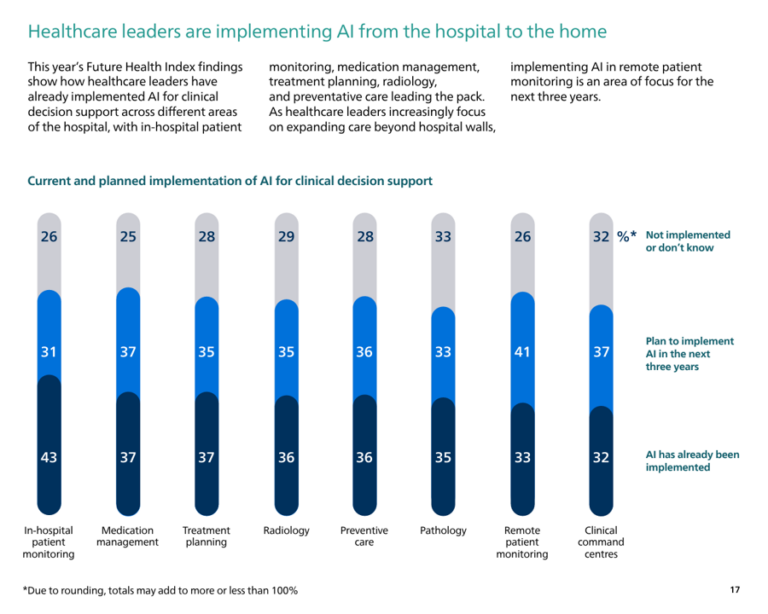

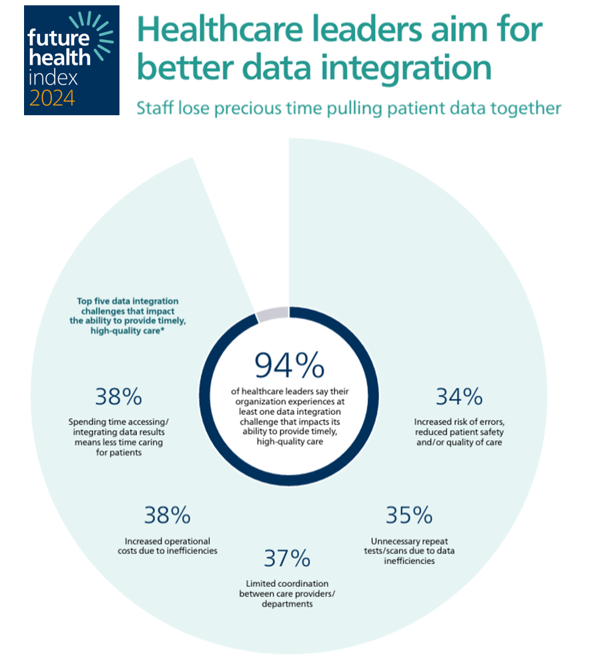

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 24, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 24, 2025 -

Heineken Revenue Update Strong Performance Positive Outlook Remains

May 24, 2025

Heineken Revenue Update Strong Performance Positive Outlook Remains

May 24, 2025 -

Philips Future Health Index 2025 Ais Transformative Impact On Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Impact On Global Healthcare

May 24, 2025 -

Heinekens Revenue Above Forecast Outlook Confirmed Amid Trade Uncertainty

May 24, 2025

Heinekens Revenue Above Forecast Outlook Confirmed Amid Trade Uncertainty

May 24, 2025