Analyzing The Recent $67 Million Ethereum Liquidation: Market Trends And Forecasts

Table of Contents

H2: Understanding the $67 Million Ethereum Liquidation Event

H3: The Scale and Impact

The $67 million Ethereum liquidation represents a substantial event, particularly considering the volatility already present within the cryptocurrency market. While the exact number of affected traders isn't publicly available due to the decentralized nature of many platforms, the scale suggests a significant number of leveraged positions were liquidated simultaneously. This involved not just ETH itself, but likely a range of ETH-based tokens and DeFi assets, magnifying the overall impact. The sheer monetary loss emphasizes the potential for substantial financial consequences in the volatile crypto space.

H3: Identifying the Trigger

Pinpointing the exact trigger for this specific Ethereum liquidation requires examining several interconnected factors. A likely scenario involves a combination of events:

- Sudden Price Drops: A sharp and unexpected drop in Ethereum's price, perhaps due to a broader market sell-off triggered by macroeconomic factors (discussed below), acted as the primary catalyst.

- Liquidation Cascades: Margin calls, triggered by the initial price drop, caused a cascade effect. As leveraged positions were liquidated, further selling pressure pushed the price down, leading to more margin calls and further liquidations, creating a vicious cycle.

- DeFi-Related Events: While not definitively confirmed in this case, vulnerabilities within certain DeFi protocols or flash loan exploits could have contributed to the downward pressure, exacerbating the liquidation event.

H3: Affected Parties and Their Losses

The $67 million loss was likely spread across various actors. The most significantly affected parties were likely:

- Leveraged Traders: Individuals and entities who used leverage to amplify their trading positions bore the brunt of the losses. High leverage magnifies both profits and losses, leading to significant liquidation risks during price volatility.

- DeFi Lending and Borrowing Platforms: These platforms may have experienced losses due to defaulted loans and liquidations of collateralized assets.

- Liquidity Providers: Users providing liquidity to decentralized exchanges (DEXs) could have also experienced losses depending on their exposure to the affected assets during the price crash.

H2: Market Trends Leading to the Ethereum Liquidation

H3: Volatility in the Cryptocurrency Market

The cryptocurrency market is inherently volatile. Recent price fluctuations demonstrate this, with periods of significant gains followed by sharp corrections. This volatility makes leveraged trading exceptionally risky and contributes significantly to the frequency and magnitude of liquidation events like the $67 million Ethereum liquidation. (Insert chart/graph depicting Ethereum price volatility in the relevant period).

H3: Impact of Macroeconomic Factors

Macroeconomic factors play a significant role in shaping the crypto market's trajectory. Factors such as:

- Inflation: High inflation rates often lead investors to seek alternative assets, potentially impacting demand for cryptocurrencies.

- Interest Rate Hikes: Increased interest rates influence the overall investment climate, often leading to risk-averse behavior and reduced investment in volatile assets like cryptocurrencies.

- Geopolitical Events: Global uncertainties and geopolitical tensions can create market uncertainty and negatively impact investor sentiment, contributing to price drops.

These factors all contribute to market volatility, increasing the likelihood of Ethereum liquidations.

H3: The Role of Leverage and DeFi

The use of leverage in cryptocurrency trading significantly amplifies both potential gains and losses. This is particularly true in the rapidly growing decentralized finance (DeFi) ecosystem. DeFi's inherent complexity and the ease of accessing leveraged positions contribute to the potential for large-scale liquidations during periods of market instability, creating a feedback loop that further exacerbates price drops.

H2: Forecasts and Future Outlook for Ethereum

H3: Short-Term Predictions

In the short term, the market sentiment around Ethereum will likely remain cautious following the $67 million liquidation event. Price fluctuations are expected to continue, influenced by broader market trends and news related to Ethereum's development and adoption. Expect increased scrutiny on leveraged trading and DeFi risk management practices.

H3: Long-Term Ethereum Prospects

Despite the volatility and risks associated with Ethereum, its long-term prospects remain positive. Several factors contribute to this optimism:

- Ethereum 2.0: The ongoing transition to Ethereum 2.0 promises significant improvements in scalability, security, and transaction speeds.

- Business Adoption: Increasing adoption by businesses and enterprises signals growing confidence in Ethereum's technology and potential.

- DeFi Ecosystem: Ethereum's dominant position in the DeFi ecosystem provides a robust foundation for continued growth and innovation.

H3: Risk Mitigation Strategies

To mitigate risks associated with future Ethereum liquidations, investors should consider:

- Careful Risk Management: Employing strategies like diversification, stop-loss orders, and position sizing.

- Understanding Leverage: Fully grasping the implications of leveraged trading before using it.

- Due Diligence: Thoroughly researching any DeFi protocol before interacting with it.

3. Conclusion

The $67 million Ethereum liquidation serves as a stark reminder of the inherent risks associated with cryptocurrency investments, particularly those involving leverage. Macroeconomic factors, market volatility, and the complexities of DeFi all contributed to this event. While short-term price predictions are uncertain, Ethereum's long-term prospects remain positive due to ongoing technological advancements and growing adoption. To stay ahead of the curve and navigate the complexities of the crypto market, continue researching and analyzing potential Ethereum liquidations and other market events. Stay informed and invest wisely, understanding the risks inherent in Ethereum and other crypto assets.

Featured Posts

-

Central Cordoba Un Analisis De Su Situacion Actual En El Gigante De Arroyito

May 08, 2025

Central Cordoba Un Analisis De Su Situacion Actual En El Gigante De Arroyito

May 08, 2025 -

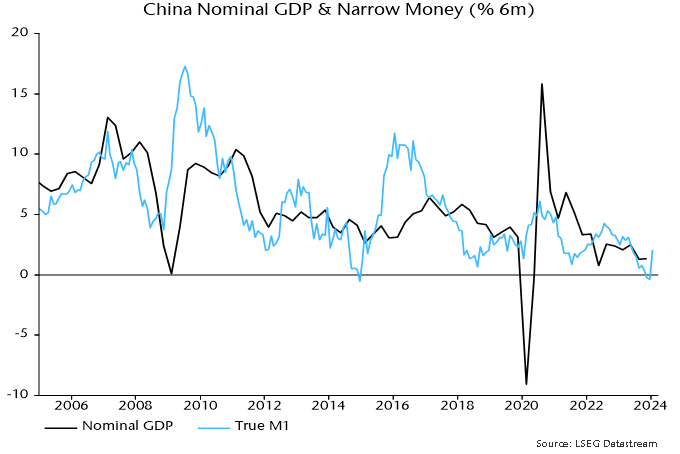

Analysis Chinas Monetary Policy Response To Trade Tensions

May 08, 2025

Analysis Chinas Monetary Policy Response To Trade Tensions

May 08, 2025 -

Scholar Rock Stock Plunge Mondays Market Drop Explained

May 08, 2025

Scholar Rock Stock Plunge Mondays Market Drop Explained

May 08, 2025 -

Inter Milan Stuns Bayern Munich In Champions League First Leg Report

May 08, 2025

Inter Milan Stuns Bayern Munich In Champions League First Leg Report

May 08, 2025 -

Analyzing Xrps 400 Increase Future Potential

May 08, 2025

Analyzing Xrps 400 Increase Future Potential

May 08, 2025