Apple Stock: A Bullish Long-Term Perspective Despite Lower Price Target

Table of Contents

Strong Fundamentals Remain Intact

Despite the recent dip in the Apple price target, the company's core strengths remain remarkably robust. The long-term Apple investment thesis rests on consistent financial performance and a relentless drive for innovation.

Consistent Revenue Growth and Profitability

Apple consistently demonstrates strong revenue growth across its diverse product lines. The iPhone, while still a major revenue driver, is complemented by the increasingly significant contributions of the Mac, Services, and Wearables segments. This diversification mitigates risk and ensures a steady stream of income.

- High Profit Margins: Apple boasts exceptionally high profit margins, leading to substantial cash reserves. This financial strength allows the company to invest heavily in research and development (R&D), fueling future innovation and providing ample resources for shareholder returns through dividends and stock buybacks.

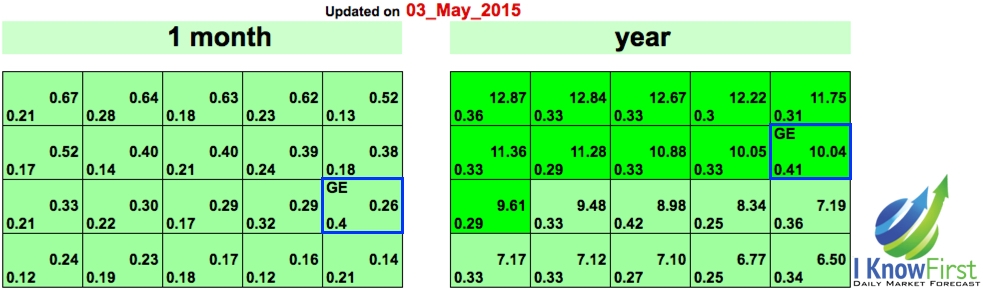

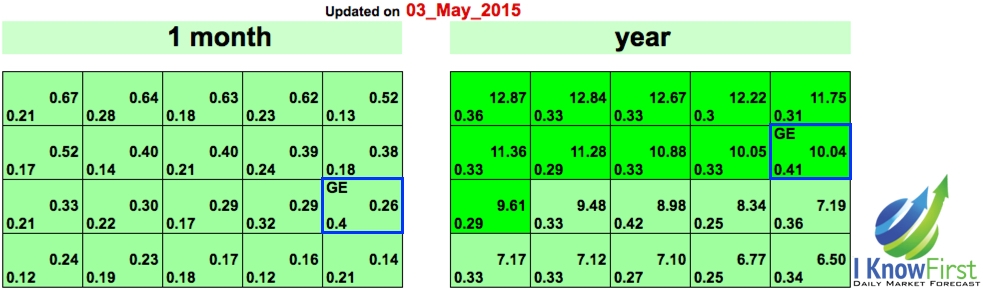

- Analyzing Apple's Financial Reports: Examining Apple's quarterly earnings reports reveals a consistent pattern of growth. For instance, [insert specific data point, e.g., "Q4 2023 showed a [percentage]% increase in revenue compared to the same quarter last year"]. [Include a chart or graph visually representing Apple's revenue growth over the past few years if possible]. This sustained profitability is a cornerstone of the bullish Apple stock outlook.

Innovation Pipeline and Future Product Launches

Apple's continued investment in R&D is a key driver of its long-term growth potential. Upcoming product launches, such as new iPhones, the highly anticipated AR/VR headset, and further advancements in its wearables lineup, promise to fuel future revenue growth.

- Future Technological Advancements: Apple's focus on Artificial Intelligence (AI) and its potential foray into the metaverse represent significant long-term growth opportunities. These advancements will likely integrate seamlessly into the existing Apple ecosystem, reinforcing its position as a technology leader.

- R&D Investment: Apple's significant and consistent R&D spending signals a commitment to innovation, ensuring the company remains at the forefront of technological advancements and maintains its competitive edge.

Resilient Ecosystem and Loyal Customer Base

Apple's success isn't just about individual products; it's about the powerful ecosystem it has cultivated. This ecosystem and its loyal customer base are critical components of a bullish Apple stock forecast.

The Power of the Apple Ecosystem

The interconnectedness of Apple devices and services creates a strong lock-in effect for users. Once invested in the Apple ecosystem, customers are less likely to switch to competing platforms. This loyalty translates into consistent sales and recurring revenue streams.

- Subscription Services: Apple's subscription services, including Apple Music, iCloud, Apple TV+, and Apple Arcade, generate substantial recurring revenue and are experiencing significant growth. This predictable revenue stream contributes greatly to the overall financial stability and long-term growth of the company.

- Brand Loyalty: Apple's powerful brand loyalty fosters customer retention and drives repeat purchases, creating a significant competitive advantage and influencing the Apple stock price.

Global Market Reach and Expansion Opportunities

Apple enjoys a significant global market share and continues to identify and tap into regions with high growth potential. This international expansion contributes significantly to the long-term Apple investment appeal.

- Emerging Markets: Emerging markets represent significant growth opportunities for Apple. As these markets develop economically, the demand for Apple products and services is expected to increase substantially.

- Strategic Partnerships: Apple's strategic partnerships and acquisitions further expand its market reach and access to new technologies and customer bases.

Addressing the Lower Price Target Concerns

While the recent reduction in Apple price targets has caused some concern, it's crucial to maintain a long-term perspective on Apple stock investment.

Temporary Market Corrections are Normal

Temporary dips in stock prices are a normal occurrence in the stock market. The reduction in Apple's price target should be viewed within the context of broader market trends and not necessarily as an indicator of the company's inherent value.

- Long-Term Perspective: Long-term investors should not be unduly influenced by short-term market fluctuations. Focusing on the long-term growth potential of Apple is crucial for making informed investment decisions.

- Market Volatility: Market corrections are natural parts of the investment cycle. They create opportunities for discerning investors to acquire high-quality assets at potentially attractive prices.

Potential for Future Price Appreciation

The long-term growth prospects of Apple significantly outweigh current market uncertainty. Several factors point towards future price appreciation.

- Catalysts for Growth: Future product releases, improved global economic conditions, and continued innovation in key areas will serve as significant catalysts for future price appreciation.

- Strong Fundamentals: The strong fundamentals discussed previously provide a robust foundation for a bullish outlook on Apple stock.

Conclusion

While a lower price target might cause temporary concern, Apple stock's strong fundamentals, innovative pipeline, and resilient ecosystem paint a positive picture for long-term investors. The temporary market corrections should not overshadow the company's potential for significant future growth. The long-term Apple investment narrative remains compelling.

Call to Action: Consider adding Apple stock to your long-term investment portfolio. Don't let short-term market fluctuations deter you from taking advantage of the potential of this strong tech giant. Research Apple stock further and make informed decisions based on your risk tolerance and long-term financial goals. Learn more about investing in Apple stock today!

Featured Posts

-

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025 -

Annie Kilners Engagement Ring A Public Display After Walker Reunion

May 25, 2025

Annie Kilners Engagement Ring A Public Display After Walker Reunion

May 25, 2025 -

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Alalmany Thlyl Shaml

May 25, 2025

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Alalmany Thlyl Shaml

May 25, 2025 -

Rio Tinto Responds To Andrew Forrests Pilbara Concerns

May 25, 2025

Rio Tinto Responds To Andrew Forrests Pilbara Concerns

May 25, 2025 -

Carmen Joy Crookes Latest Musical Offering

May 25, 2025

Carmen Joy Crookes Latest Musical Offering

May 25, 2025

Latest Posts

-

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

Us Tariff Fallout Strategies For Increased Canada Mexico Trade

May 25, 2025

Us Tariff Fallout Strategies For Increased Canada Mexico Trade

May 25, 2025 -

Gold Investment Soars Impact Of Trumps Latest Trade Actions

May 25, 2025

Gold Investment Soars Impact Of Trumps Latest Trade Actions

May 25, 2025 -

Competition Heats Up Alternative Delivery Services And Canada Posts Challenges

May 25, 2025

Competition Heats Up Alternative Delivery Services And Canada Posts Challenges

May 25, 2025 -

Global Trade Tensions G7 Fails To Address Tariff Concerns

May 25, 2025

Global Trade Tensions G7 Fails To Address Tariff Concerns

May 25, 2025