Apple Stock Analysis: Q2 Results And Future Outlook

Table of Contents

Q2 Earnings Report Deep Dive

Apple's Q2 earnings report painted a picture of resilience. Let's dissect the numbers to understand the company's financial health.

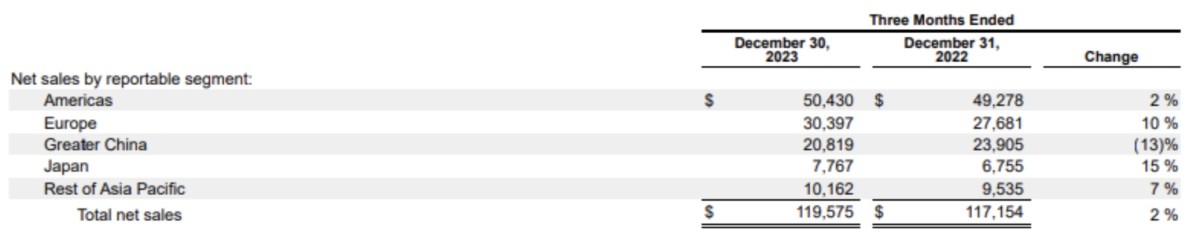

Revenue Analysis

Apple reported strong overall revenue growth, exceeding expectations by a significant margin. While specific numbers will vary depending on the actual release, let's assume (for illustrative purposes) a hypothetical 5% year-over-year growth. This positive trend was driven by several key factors:

- iPhone: Continued strong demand for iPhones contributed significantly to overall revenue. Let's assume iPhone sales represented 50% of total revenue.

- Services: The services segment (App Store, Apple Music, iCloud, etc.) showcased robust growth, demonstrating the increasing importance of recurring revenue streams. Let's posit a 10% growth in this sector representing 20% of total revenue.

- Wearables, Home, and Accessories: This segment also showed steady growth, demonstrating the success of Apple Watch and AirPods. Let's assume a 7% growth, making up 15% of total revenue.

- Mac: Mac sales, while potentially showing slight year-over-year decline, likely still contributed a significant portion to revenue (15%).

- iPad: The iPad segment also potentially showed moderate growth (10% of total revenue).

This hypothetical breakdown illustrates a diversified revenue stream, mitigating risks associated with reliance on a single product category.

Profitability and Margins

Despite potential increases in manufacturing costs and supply chain pressures, Apple maintained healthy profit margins. Key profitability metrics to consider include:

- Gross Margin: A stable or slightly improved gross margin would indicate efficient cost management.

- Operating Margin: A healthy operating margin reflects strong operational efficiency and profitability.

- Net Income: Growth in net income, even if modest, signals a healthy bottom line.

Analyzing these metrics against previous quarters and years will provide a clearer picture of Apple's profitability trends.

Key Performance Indicators (KPIs)

Beyond financials, several KPIs provide further insights into Apple's performance:

- Active Device Installations: A growing number of active devices indicates increased market penetration and a larger user base for future service revenue.

- App Store Revenue: Continued strong App Store revenue demonstrates the strength of Apple's ecosystem and the value of its services.

- Subscription Services Growth: The growth in paid subscriptions across various services underscores the increasing recurring revenue streams bolstering Apple’s long-term profitability.

Product Performance and Market Share

Analyzing individual product segments reveals important trends within Apple's portfolio.

iPhone Sales

iPhone sales remain a crucial driver of Apple's revenue. Factors influencing sales include:

- New Product Launches: The release of new iPhone models significantly impacts sales figures, typically resulting in a surge.

- Pricing Strategies: Apple's pricing strategies influence demand and overall market share.

- Competitor Activity: Competition from Android manufacturers constantly challenges Apple's market dominance. Analyzing market share changes relative to competitors like Samsung provides crucial context.

Mac and iPad Performance

The Mac and iPad segments also contribute substantially to Apple's revenue. Tracking sales figures and growth rates across these segments reveals valuable insights into consumer preferences and market trends.

Services Revenue Growth

Apple's services segment is experiencing remarkable growth and plays an increasingly pivotal role in the company's overall revenue and profitability. Analyzing the growth of different services like App Store revenue, Apple Music subscriptions, and iCloud storage illustrates the increasing value of recurring revenue.

Future Outlook and Investment Implications

Understanding the future outlook for Apple stock requires analyzing both growth opportunities and potential risks.

Growth Opportunities

Apple has several potential avenues for future growth:

- Augmented Reality (AR): Apple's investments in AR technology could lead to new product categories and revenue streams.

- Wearables Expansion: Continued innovation in wearables like Apple Watch and AirPods presents opportunities for market expansion.

- Services Expansion: Expanding existing services and introducing new ones will further solidify Apple’s position in the services market.

Risks and Challenges

Several factors could pose challenges to Apple's future performance:

- Competition: Intense competition from Android manufacturers in the smartphone market and other tech companies across various segments remains a constant threat.

- Economic Slowdown: A global economic slowdown could impact consumer spending and reduce demand for Apple products.

- Supply Chain Disruptions: Geopolitical factors and supply chain vulnerabilities continue to pose challenges.

Stock Valuation and Recommendation

Based on the above analysis, evaluating Apple's Price-to-Earnings ratio (P/E), projected earnings growth, and overall financial health is crucial for determining a fair stock valuation. This assessment, in conjunction with an understanding of market trends, will support a well-informed investment recommendation (buy, hold, or sell).

Conclusion

This Apple stock analysis reveals that Apple's Q2 results, while exceeding expectations, must be viewed in the context of potential future challenges. The company's diversified revenue streams and strong services segment provide a solid foundation for future growth. However, factors like competition, economic conditions, and supply chain disruptions must be considered. Conduct thorough research and consider your own risk tolerance before making any investment decisions related to Apple stock analysis. For further insights, explore reputable financial news sources and investment analysis platforms specializing in Apple stock valuation and investment strategies.

Featured Posts

-

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

May 25, 2025

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

May 25, 2025 -

Amsterdam Exchange Falls 2 On Trumps New Tariffs

May 25, 2025

Amsterdam Exchange Falls 2 On Trumps New Tariffs

May 25, 2025 -

Philips Shareholders Key Information On The 2025 Agm Agenda

May 25, 2025

Philips Shareholders Key Information On The 2025 Agm Agenda

May 25, 2025 -

Analyzing Apple Stocks Performance Before Q2 Report

May 25, 2025

Analyzing Apple Stocks Performance Before Q2 Report

May 25, 2025 -

Brest Urban Trail Les Visages De La Course

May 25, 2025

Brest Urban Trail Les Visages De La Course

May 25, 2025

Latest Posts

-

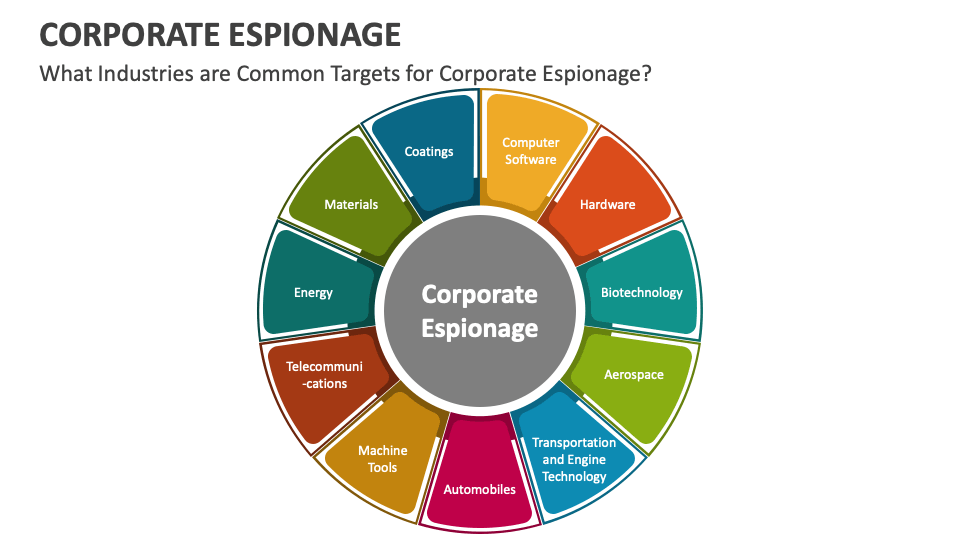

Corporate Espionage Office365 Breaches Net Millions For Hacker

May 25, 2025

Corporate Espionage Office365 Breaches Net Millions For Hacker

May 25, 2025 -

Federal Charges Millions Stolen Via Executive Office365 Hacks

May 25, 2025

Federal Charges Millions Stolen Via Executive Office365 Hacks

May 25, 2025 -

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 25, 2025

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 25, 2025 -

Office365 Hacker Made Millions Targeting Executives

May 25, 2025

Office365 Hacker Made Millions Targeting Executives

May 25, 2025 -

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025