Apple Stock Dips Below Key Levels Before Q2 Earnings

Table of Contents

Analyzing the Pre-Earnings Dip in Apple Stock

Technical Analysis of the Stock Price Decline

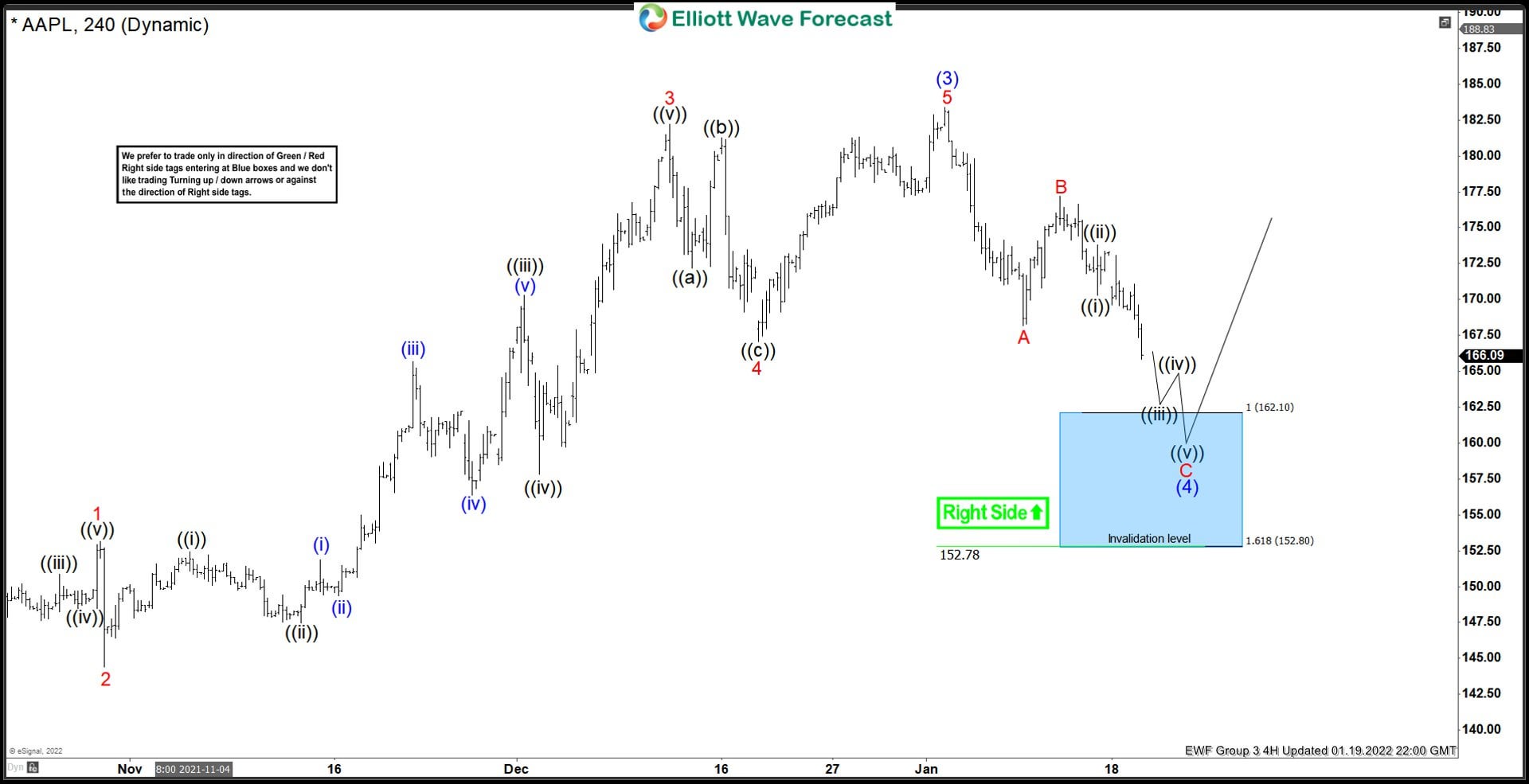

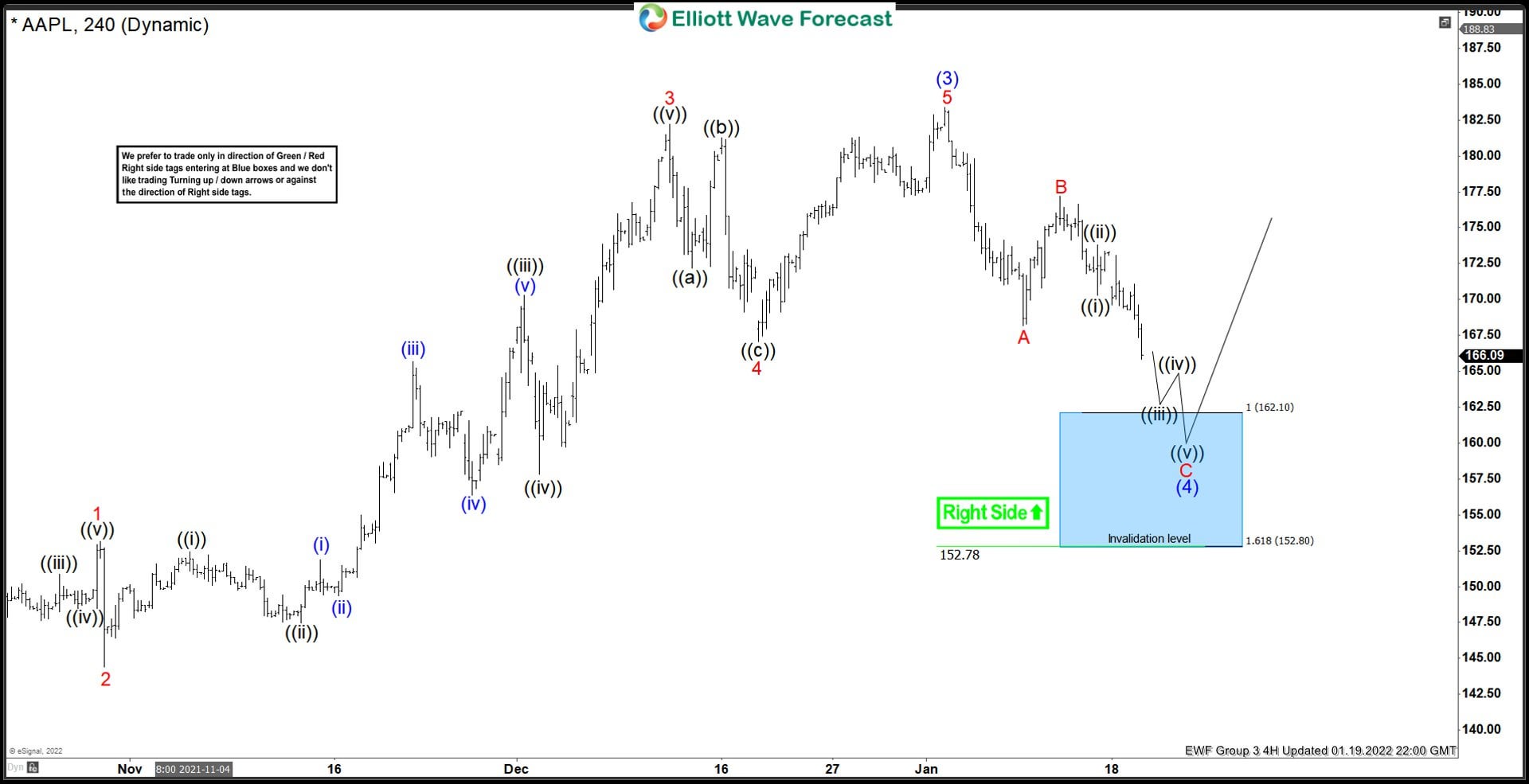

The recent decline in Apple stock can be analyzed through several technical lenses. The Apple stock chart shows a clear breach of several key support levels, indicating a significant shift in market sentiment.

- Price Points: The stock fell below the $160 support level, a key psychological barrier, triggering further sell-offs.

- Chart Patterns: The appearance of bearish candlestick patterns, combined with decreasing trading volume, further reinforced the negative momentum.

- Technical Indicators: Several technical indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), flashed sell signals, suggesting oversold conditions but also potential further downside. Analyzing the Apple stock chart using these technical indicators provides a clearer picture of the situation.

Market Sentiment and Investor Concerns

The dip in Apple stock isn't solely attributable to technical factors. Broader market anxieties are also at play.

- Investor Sentiment: Concerns about inflation, rising interest rates, and a potential economic slowdown have negatively impacted investor sentiment across the tech sector, impacting Apple stock forecast.

- Market Volatility: Increased market volatility makes investors more risk-averse, leading to profit-taking and a sell-off in even strong performers like Apple.

- Economic Uncertainty: Global economic uncertainty, fueled by geopolitical tensions and supply chain disruptions, contributes to the negative outlook.

Factors Contributing to the Apple Stock Decline

Impact of Recent Product Launches and Sales

While Apple remains a dominant player, the performance of its recent product launches might have played a role in the stock's decline.

- iPhone Sales: While iPhone 14 sales figures remain strong, they might not have met overly optimistic initial projections impacting Apple product launch success.

- Market Share Analysis: Increased competition in the smartphone and other tech sectors could be impacting Apple's market share.

- Consumer Demand: Shifting consumer demand, potentially influenced by economic headwinds, could be affecting overall sales figures.

Geopolitical and Economic Headwinds

Global factors are significantly impacting Apple's performance and subsequent stock price.

- Global Economy: Slowing global economic growth and recessionary fears impact consumer spending and Apple's sales forecast.

- Geopolitical Risks: The ongoing war in Ukraine and other geopolitical uncertainties disrupt supply chains and create economic instability.

- Supply Chain: Ongoing supply chain disruptions, particularly in China, continue to present challenges for Apple's production and delivery timelines. The inflation impact also affects consumer spending and material costs.

Expectations for Apple's Q2 Earnings Report

Analyst Predictions and Consensus Estimates

Analysts' predictions for Apple's Q2 earnings vary, but there's a general consensus regarding key metrics.

- Earnings per Share (EPS): Estimates for EPS range from [insert range of EPS estimates from reputable sources], reflecting a degree of uncertainty about the Q2 earnings.

- Revenue Growth: Analysts anticipate a slowdown in revenue growth compared to previous quarters, mirroring the broader tech sector slowdown. Tracking revenue growth is key to understanding Apple Q2 earnings.

- Key Metrics to Watch: Beyond EPS and revenue, investors will keenly watch iPhone sales figures, services revenue growth, and guidance for the remainder of the year.

Potential Catalysts for Stock Price Movement

Apple's Q2 earnings report could trigger significant stock price movement depending on the outcomes.

- New Product Announcements: Any announcements of new products or services could influence investor sentiment and boost the stock price prediction.

- Revised Guidance: A positive or negative revision to Apple's guidance for future quarters will significantly impact the market reaction.

- Unexpected Market Events: Unexpected geopolitical or economic events could further affect the Apple stock outlook.

Conclusion: Apple Stock: Navigating the Pre-Earnings Dip and Beyond

The pre-earnings dip in Apple stock highlights the interplay of technical factors, investor sentiment, and broader economic conditions. Analyzing Apple stock requires considering both fundamental and technical indicators. The upcoming Q2 earnings report will be critical in determining the direction of Apple stock in the coming months. Understanding the potential catalysts for stock price movement, as discussed, is crucial for investors. Stay tuned for our comprehensive analysis of Apple's Q2 earnings report and continue following our coverage for insights into the future of Apple stock performance and Apple stock investment strategies.

Featured Posts

-

Planning Your Memorial Day Trip Best Flight Dates For 2025

May 24, 2025

Planning Your Memorial Day Trip Best Flight Dates For 2025

May 24, 2025 -

Tax Bills Impact Stock Market Bond And Bitcoin Price Movements

May 24, 2025

Tax Bills Impact Stock Market Bond And Bitcoin Price Movements

May 24, 2025 -

Can You Still Negotiate After A Best And Final Job Offer

May 24, 2025

Can You Still Negotiate After A Best And Final Job Offer

May 24, 2025 -

Changes To Italian Citizenship Law Great Grandparent Claims Explained

May 24, 2025

Changes To Italian Citizenship Law Great Grandparent Claims Explained

May 24, 2025 -

Previsioni Borsa Europa Cauta Impatto Decisioni Fed Su Piazza Affari

May 24, 2025

Previsioni Borsa Europa Cauta Impatto Decisioni Fed Su Piazza Affari

May 24, 2025

Latest Posts

-

Dylan Dreyer Shares Shocking Update With Today Show Co Hosts

May 24, 2025

Dylan Dreyer Shares Shocking Update With Today Show Co Hosts

May 24, 2025 -

Dylan Dreyer And Brian Fichera New Social Media Post Generates Buzz

May 24, 2025

Dylan Dreyer And Brian Fichera New Social Media Post Generates Buzz

May 24, 2025 -

Horoscopo Del 11 Al 17 De Marzo De 2025 Analisis Para Cada Signo

May 24, 2025

Horoscopo Del 11 Al 17 De Marzo De 2025 Analisis Para Cada Signo

May 24, 2025 -

Did A Mishap Strain Dylan Dreyers Relationships On The Today Show

May 24, 2025

Did A Mishap Strain Dylan Dreyers Relationships On The Today Show

May 24, 2025 -

Hospital Update Dylan Dreyers Son Recovering From Surgery

May 24, 2025

Hospital Update Dylan Dreyers Son Recovering From Surgery

May 24, 2025