Tax Bill's Impact: Stock Market, Bond, And Bitcoin Price Movements

Table of Contents

Stock Market Reactions to Tax Bills

The stock market's response to a new tax bill is rarely straightforward. Changes in tax policy can significantly influence corporate profitability, investor sentiment, and sector-specific performance.

Impact on Corporate Profits

Tax rate changes directly affect corporate profitability. Lower corporate tax rates, for example, typically boost after-tax earnings. This can lead to:

- Increased Stock Buybacks: Companies might use extra cash flow to repurchase their own shares, reducing the number of outstanding shares and potentially increasing earnings per share (EPS), thus driving up stock prices.

- Higher Dividend Payouts: Increased profitability can translate into larger dividend payouts to shareholders, making stocks more attractive to income-focused investors.

- Stimulated Investment and Expansion: Lower taxes can incentivize companies to invest in research and development, expansion projects, and hiring, leading to long-term growth.

Conversely, higher tax rates can squeeze corporate profits, potentially leading to reduced investment and a dampening effect on stock prices.

Investor Sentiment and Market Volatility

The passage of a new tax bill often creates uncertainty. This uncertainty can significantly impact investor sentiment and market volatility.

- Increased Volatility: Before the bill's effects are fully understood, investors might react with caution, leading to increased market swings and volatility.

- Shifting Investor Confidence: Positive tax changes, like lower rates, can boost investor confidence, leading to increased investment and potentially higher stock prices. Negative changes can have the opposite effect.

- Differential Sectoral Impacts: The effects of tax changes aren't uniform across sectors. For example, changes to capital gains taxes will disproportionately affect real estate investment trusts (REITs), while changes to corporate tax rates will largely impact manufacturing and industrial companies.

Sector-Specific Impacts

Different sectors react differently to tax bill changes. It's essential to analyze these sector-specific impacts for informed investment decisions.

- Real Estate: Changes in capital gains taxes significantly influence real estate investments. Lower capital gains taxes can stimulate real estate transactions and increase property values.

- Healthcare: Tax reforms can impact the healthcare sector through changes in deductibility of medical expenses, influencing insurance premiums and healthcare stock performance.

- Technology: The technology sector might benefit from tax incentives related to research and development, leading to increased innovation and potential stock price appreciation.

Bond Market Sensitivity to Tax Bill Changes

The bond market is highly sensitive to changes in interest rates, which are often influenced by government fiscal policy, including tax bills.

Interest Rate Adjustments

Tax bills can indirectly influence interest rates through government borrowing.

- Increased Borrowing: Tax cuts often lead to increased government borrowing to finance the deficit, potentially pushing interest rates higher. This can negatively impact bond prices, as bond yields move inversely to prices.

- Inflation Expectations: Tax cuts can also affect inflation expectations. Higher inflation generally leads to higher interest rates, putting downward pressure on bond prices.

- Yield Curve Shifts: Changes in the yield curve (the relationship between bond yields and their maturities) reflect the market's expectations about future interest rates and economic growth, and can be significantly altered by changes in taxation policy.

Impact on Municipal Bonds

Municipal bonds, often considered tax-advantaged investments, are particularly sensitive to changes in tax laws.

- Demand Fluctuations: Changes in the tax deductibility of municipal bond interest directly impact investor demand.

- Yield Adjustments: Changes in demand directly affect the yields of municipal bonds.

- Tax-Advantaged Status: Any alteration to their tax-advantaged status can have a cascading effect on their attractiveness to investors seeking tax-efficient income.

Investment Strategies for a Changing Bond Market

Adapting your bond portfolio to the new tax landscape is crucial. Consider these strategies:

- Diversification: Diversify across different bond types (government, corporate, municipal) and maturities to mitigate risks.

- Duration Management: Consider adjusting the duration (sensitivity to interest rate changes) of your bond portfolio based on your expectations for future interest rates.

- Risk Assessment: Carefully assess the risk-adjusted returns of different bond categories given the new tax environment.

Bitcoin's Reaction to Tax Bill Uncertainty

The cryptocurrency market, particularly Bitcoin, exhibits unique sensitivities to policy changes and regulatory uncertainty.

Tax Implications for Cryptocurrency

How the tax bill addresses cryptocurrency transactions is paramount.

- Capital Gains Tax: The taxation of capital gains from cryptocurrency transactions can significantly impact investment decisions and market activity.

- Regulatory Scrutiny: Increased regulatory scrutiny could increase market uncertainty and potentially impact Bitcoin's price.

- Tax Compliance: Clearer tax guidelines may increase institutional investment due to increased regulatory clarity.

Bitcoin's Role as a Safe Haven Asset

Bitcoin is sometimes seen as a safe haven asset, particularly during times of economic uncertainty.

- Inflation Hedge: Some investors see Bitcoin as a potential hedge against inflation, particularly if fiat currencies are devalued due to government spending related to tax cuts.

- Market Correlation: The correlation between Bitcoin's price and traditional financial markets varies. It can act as a safe haven during market downturns or exhibit independent price movements based on market sentiment.

- Volatility: Bitcoin's inherent price volatility is influenced by supply, demand, and regulatory developments.

Impact on Bitcoin Mining and Adoption

Tax policy can affect the profitability of Bitcoin mining.

- Energy Costs: Tax impacts on electricity prices can directly influence mining profitability and, consequently, the supply of Bitcoins.

- Regulatory Changes: Tax legislation can indirectly impact regulation, thus influencing the adoption of Bitcoin and other cryptocurrencies.

- Exchange Regulations: Changes in tax regulations concerning cryptocurrency exchanges can lead to a shift in the landscape of crypto trading.

Conclusion

This article has explored the complex and multifaceted impact of the new tax bill on the stock market, bond market, and Bitcoin prices. Understanding these potential effects is crucial for investors seeking to navigate the evolving financial landscape. The implications of the tax bill extend beyond simple rate changes; they encompass investor sentiment, regulatory responses, and the evolving role of cryptocurrencies in the global financial system. Remember that this analysis is for informational purposes only and is not financial advice.

Call to Action: Stay informed about the ongoing effects of the tax bill and adapt your investment strategy accordingly. Regularly review your portfolio and consider consulting with a financial advisor to optimize your investment strategy in light of the evolving tax landscape and the impact on stock market, bond, and Bitcoin price movements. Understanding the tax bill's impact is key to making sound financial decisions.

Featured Posts

-

Ae Xplore England Airpark And Alexandria International Airports Initiative To Promote Local And International Air Travel

May 24, 2025

Ae Xplore England Airpark And Alexandria International Airports Initiative To Promote Local And International Air Travel

May 24, 2025 -

Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park The Complete Guide

May 24, 2025

Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park The Complete Guide

May 24, 2025 -

Philips Agm 2025 Agenda And Important Information For Shareholders

May 24, 2025

Philips Agm 2025 Agenda And Important Information For Shareholders

May 24, 2025 -

Sergey Yurskiy Yubiley Genialnogo Aktera I Ego Paradoksalniy Mir

May 24, 2025

Sergey Yurskiy Yubiley Genialnogo Aktera I Ego Paradoksalniy Mir

May 24, 2025 -

Is Apple Vulnerable Examining The Impact Of Tariffs On Buffetts Holdings

May 24, 2025

Is Apple Vulnerable Examining The Impact Of Tariffs On Buffetts Holdings

May 24, 2025

Latest Posts

-

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

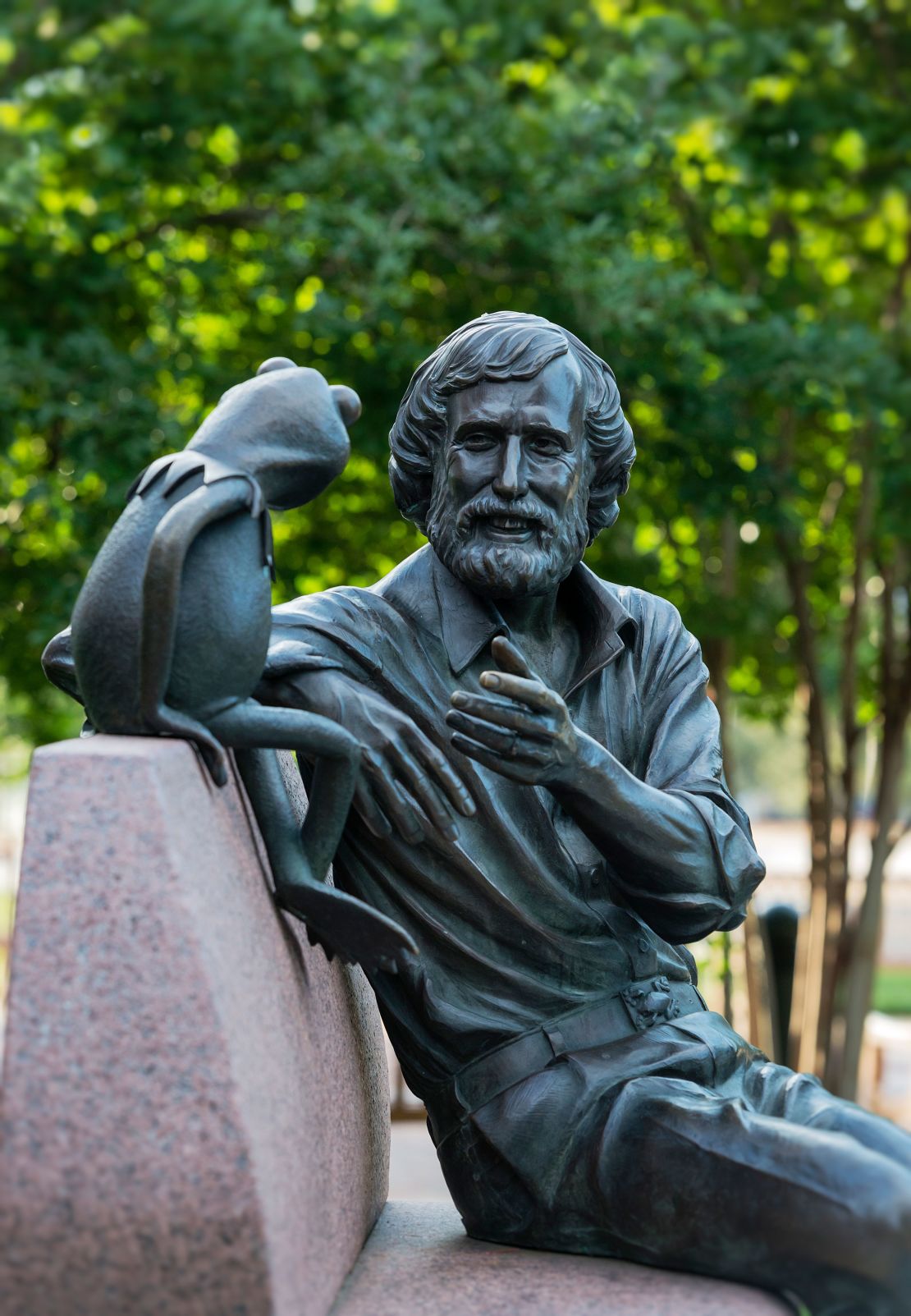

Kermits Commencement Speech Inspiring Maryland Graduates

May 24, 2025

Kermits Commencement Speech Inspiring Maryland Graduates

May 24, 2025 -

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025 -

University Of Maryland Commencement A Celebrated Amphibian To Speak

May 24, 2025

University Of Maryland Commencement A Celebrated Amphibian To Speak

May 24, 2025