Apple Stock Slumps On $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The core reason for Apple's stock slump is the projected $900 million in tariffs on its products. This figure represents a significant increase in the cost of production and importation, potentially impacting profitability and consumer pricing. Understanding the source and scope of this projection is critical.

-

Source of the Projection: While the exact source may vary depending on the news cycle, this figure often originates from analyst predictions based on proposed tariff rates and Apple's import volume. Reputable financial news sources should be consulted for the most up-to-date information. Official government announcements also play a key role in confirming or altering these projections.

-

Products Affected: The tariffs are likely to impact a wide range of Apple products, including iPhones, iPads, Macs, Apple Watches, and AirPods. Products manufactured primarily in China are expected to bear the brunt of these increased costs due to import tariffs. The exact breakdown will depend on the specifics of the implemented tariffs.

-

Geographic Impact: The primary impact of these tariffs is felt in markets where Apple imports its products, most notably the United States. However, ripple effects could impact other regions depending on Apple’s global supply chains and distribution networks. The implications for global sales are significant and are constantly being assessed.

Impact on Apple's Profitability and Stock Price

The projected tariffs pose a serious threat to Apple's profitability. The increased costs could force Apple to either absorb the losses, impacting its profit margins, or pass the costs on to consumers, potentially reducing demand. This uncertainty directly influences investor confidence, leading to the observed Apple stock slump.

-

Margin Squeeze: A $900 million tariff represents a considerable hit to Apple's bottom line. Depending on the product mix affected, the profit margin on individual items could be significantly reduced. This directly impacts Apple’s overall profitability and return on investment (ROI).

-

Consumer Price Increases: Apple may attempt to offset some or all of the increased costs by raising prices for its products. However, increasing prices could decrease consumer demand, especially in price-sensitive markets. Finding a balance between maintaining profitability and retaining market share is a critical challenge.

-

Investor Sentiment: The uncertainty surrounding the tariffs creates a negative outlook among investors. Fear of reduced profitability and decreased sales leads to selling off Apple stock, thus driving down the stock price. The negative investor sentiment contributes to the overall market volatility.

Broader Implications for the Tech Sector and Global Trade

Apple's situation serves as a stark warning for other tech companies heavily reliant on global supply chains. The escalating trade war underscores the vulnerability of businesses to geopolitical factors and underscores the need for diversification and strategic planning. This Apple stock slump is a symptom of a much larger problem.

-

Impact on other Tech Giants: Companies like Samsung, Google, and other tech firms with significant manufacturing in China or other tariff-affected regions face similar challenges. The impact of these tariffs extends beyond Apple.

-

Geopolitical Uncertainty: The ongoing trade tensions create significant geopolitical uncertainty, making it difficult for businesses to plan long-term strategies. This volatility creates risk and undermines economic stability.

-

Supply Chain Diversification: To mitigate future tariff risks, companies need to diversify their manufacturing and supply chains. This includes exploring manufacturing options in countries less affected by trade disputes. This is a key takeaway for businesses operating in the global market.

Potential Responses and Future Outlook for Apple

Apple will likely explore various strategies to mitigate the impact of these tariffs. These could include renegotiating trade deals, diversifying manufacturing locations, or absorbing some of the costs. The long-term outlook depends heavily on the resolution of the trade disputes and Apple's ability to adapt.

-

Negotiation and Lobbying: Apple will likely engage in intense lobbying efforts to influence trade policy and potentially negotiate exemptions or reduced tariffs. Their influence on policy decisions will play a significant role in their success.

-

Manufacturing Relocation: Shifting some or all of its manufacturing outside of tariff-affected regions is a potential long-term strategy. However, this involves significant logistical and financial challenges.

-

Pricing Strategies: In addition to price increases, Apple could explore other pricing models, such as tiered pricing or bundled services to offset the tariff impact. Their pricing strategies will directly impact consumer perception.

Conclusion

The projected $900 million tariff on Apple products has undeniably triggered a significant stock slump, highlighting the vulnerability of major corporations to escalating trade tensions. The impact extends beyond Apple's immediate financial performance, raising concerns about the broader tech sector and global trade stability. Understanding the intricacies of this situation is crucial for investors and businesses alike. Stay informed about further developments regarding Apple stock and the ongoing trade disputes to make informed decisions about your investments and business strategies. Keep a close watch on the Apple stock and tariff situation, as the impact on the tech giant and the global economy continues to unfold. Monitor news sources for further updates regarding Apple's response to the projected $900 million tariff and its influence on the Apple stock price.

Featured Posts

-

North Myrtle Beach Water Usage Public Safety Concerns

May 25, 2025

North Myrtle Beach Water Usage Public Safety Concerns

May 25, 2025 -

Uefa Sorusturmasi Arda Gueler Ve Real Madrid In Gelecegi Tehlikede Mi

May 25, 2025

Uefa Sorusturmasi Arda Gueler Ve Real Madrid In Gelecegi Tehlikede Mi

May 25, 2025 -

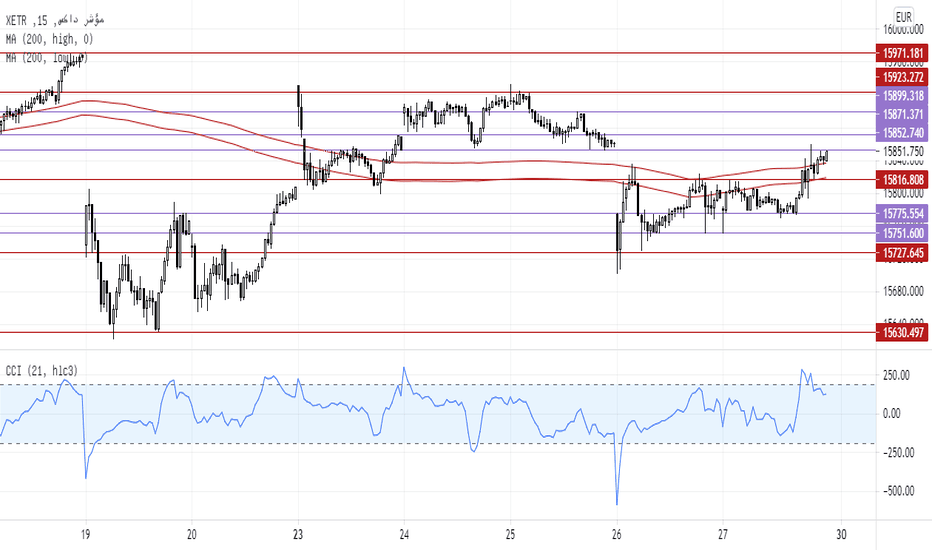

Mwshr Daks Alalmany Yqwd Alanteash Alawrwby

May 25, 2025

Mwshr Daks Alalmany Yqwd Alanteash Alawrwby

May 25, 2025 -

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 25, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local Journalism

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local Journalism

May 25, 2025

Latest Posts

-

Atletico Madrid 3 Mac Sonrasi Zafer

May 25, 2025

Atletico Madrid 3 Mac Sonrasi Zafer

May 25, 2025 -

Atletico Madrid In 3 Maclik Yenilmezlik Serisi

May 25, 2025

Atletico Madrid In 3 Maclik Yenilmezlik Serisi

May 25, 2025 -

Atletico Madrid 3 Maclik Galibiyet Hasreti Bitti

May 25, 2025

Atletico Madrid 3 Maclik Galibiyet Hasreti Bitti

May 25, 2025 -

Atletico Madrid In Geriden Gelme Stratejileri Ve Basarilari

May 25, 2025

Atletico Madrid In Geriden Gelme Stratejileri Ve Basarilari

May 25, 2025 -

Atletico Madrid Zorlu Savaslar Ve Geriden Gelis Zaferleri

May 25, 2025

Atletico Madrid Zorlu Savaslar Ve Geriden Gelis Zaferleri

May 25, 2025