Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

The Trump Administration's Tariffs on Chinese Goods and Their Impact on Apple

The Trump administration's imposition of tariffs on various Chinese goods, beginning in 2018, significantly impacted global supply chains, including Apple's. These tariffs, intended to address trade imbalances and intellectual property concerns, targeted numerous products relevant to Apple's manufacturing and supply chain, such as components for iPhones, iPads, and MacBooks.

- Specific tariffs implemented and their effective dates: Tariffs ranged from 10% to 25% on various goods, implemented in phases throughout 2018 and 2019. The exact dates and product categories affected are complex and can be found in official US Trade Representative documentation.

- The percentage increase in costs for Apple due to tariffs: Estimating the precise percentage increase in Apple's costs due to these tariffs is difficult, as the company doesn't publicly disclose granular cost breakdowns linked to specific tariffs. However, analysts have suggested that the tariffs added several billion dollars to Apple's costs.

- Apple's response to the tariffs: Apple responded by attempting to diversify its manufacturing base, shifting some production from China to other countries like India and Vietnam. They also absorbed some of the increased costs, avoiding significant price increases for consumers.

- Quantifiable data on the impact on Apple's profits during that period: While Apple's overall profits remained strong, the tariffs undoubtedly impacted margins. Precise figures attributing profit decreases solely to tariffs are challenging to isolate from other market factors.

Apple's Supply Chain Vulnerability and Geographic Diversification Strategies

Apple's heavy reliance on Chinese manufacturing for years made it vulnerable to disruptions caused by tariffs and geopolitical events. While China offers cost advantages and a well-established manufacturing ecosystem, this concentration created significant risk.

- Percentage of Apple products manufactured in China: While exact figures remain confidential, estimates suggest a substantial portion of Apple products were manufactured in China before the diversification efforts.

- Apple's efforts to diversify its manufacturing base: Apple has been actively working to diversify its manufacturing base, investing heavily in India and Vietnam. This involves building factories, training local workforces, and establishing supplier networks.

- Challenges and costs associated with relocating manufacturing: Relocating manufacturing is a complex and costly undertaking. It involves significant investments in infrastructure, training, and logistics, while also facing potential challenges related to labor costs and regulatory hurdles.

- Long-term implications of diversification on production costs and efficiency: Diversification aims to mitigate risks associated with over-reliance on a single manufacturing hub. However, it's likely to lead to higher production costs in the short-term, although this may be offset by reduced tariff risks and increased geopolitical stability in the long term.

The Current Trade Landscape and Potential for Future Tariff Escalation

The US-China trade relationship remains complex, with ongoing tensions and the potential for future trade disputes. While the current administration has taken a less confrontational approach than the previous one, the possibility of future tariff escalations, particularly concerning technology, cannot be ruled out.

- Current trade tensions between the US and China: While a trade war hasn't fully erupted again, tensions persist over various issues, including technology dominance, intellectual property rights, and national security concerns.

- Potential for future tariffs or trade restrictions: The potential for future tariffs or trade restrictions targeting technology remains a significant risk for companies like Apple. Geopolitical instability and changing global alliances could further fuel trade conflicts.

- Impact of geopolitical instability on Apple's supply chain: Geopolitical instability, including tensions between the US and China, can disrupt Apple's supply chain, leading to delays, increased costs, and potential shortages of components.

- Risk assessment for future tariff-related disruptions to Apple's business: Apple's continued diversification efforts aim to mitigate this risk, but the company remains vulnerable to unexpected trade disputes and regulatory changes.

Buffett's Continued Investment in Apple: A Vote of Confidence or Calculated Risk?

Warren Buffett's continued significant investment in Apple, despite the tariff risks, signals either unwavering confidence in Apple's long-term prospects or a calculated risk.

- Berkshire Hathaway's current Apple holdings: Berkshire Hathaway remains a major Apple shareholder, holding billions of dollars worth of Apple stock.

- Analysis of Buffett's investment strategy and risk tolerance: Buffett is known for his long-term investment approach and his preference for high-quality businesses.

- Potential reasoning behind continued investment despite tariff risks: Buffett likely believes Apple’s strong brand, innovative products, and diversified revenue streams outweigh the risks posed by potential future tariffs.

- Implications of Buffett's investment for Apple's long-term prospects: Buffett's continued investment reinforces confidence in Apple's future, suggesting that the market largely views the tariff risks as manageable.

Conclusion

The impact of Trump-era tariffs on Apple highlighted the vulnerability of global supply chains and the complexities of international trade. While Apple has taken steps to diversify its manufacturing base, the potential for future trade disputes remains a concern. Buffett's sustained investment suggests confidence in Apple's ability to navigate these challenges. However, the situation remains fluid, emphasizing the need for ongoing vigilance.

Call to Action: Stay informed on the evolving landscape of international trade and its impact on Apple, a pivotal player in the global tech industry. Continue to monitor the implications of potential future tariffs and their effect on "Buffett's Top Tech Stock," and understand the ongoing challenges and opportunities facing Apple in the global marketplace. Understanding the intricacies of Apple and tariffs is crucial for anyone interested in investing in or following this influential tech giant.

Featured Posts

-

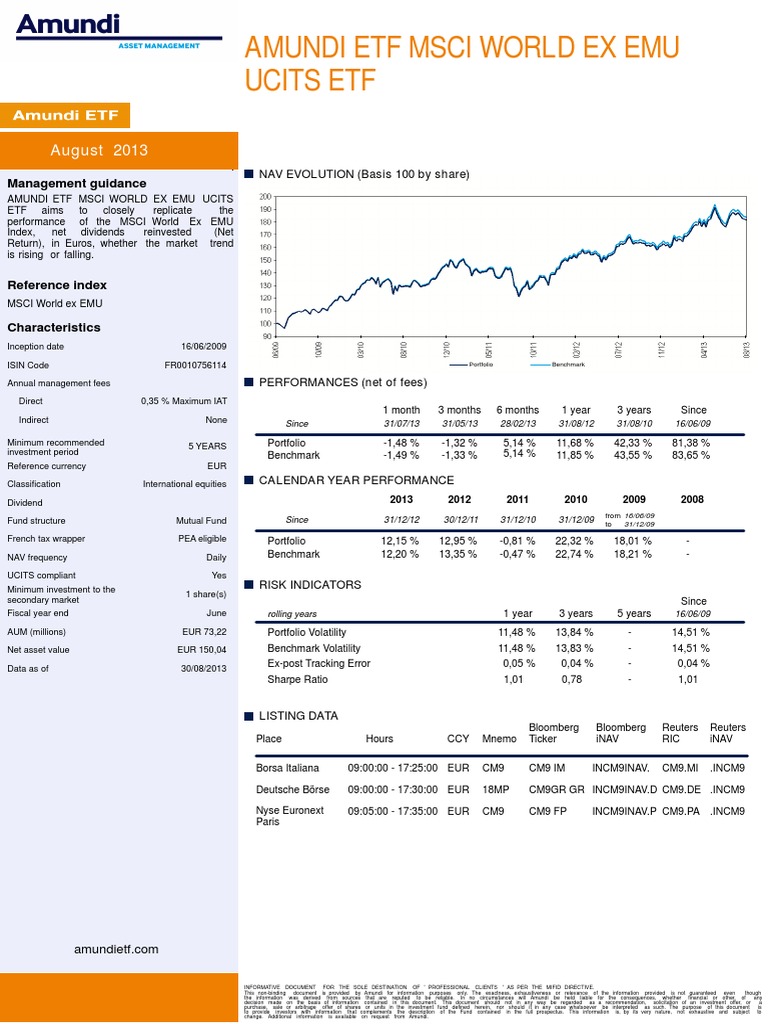

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist An Investors Guide

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist An Investors Guide

May 25, 2025 -

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

Kerings Q1 Performance A 6 Share Price Slump

May 25, 2025

Kerings Q1 Performance A 6 Share Price Slump

May 25, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 25, 2025 -

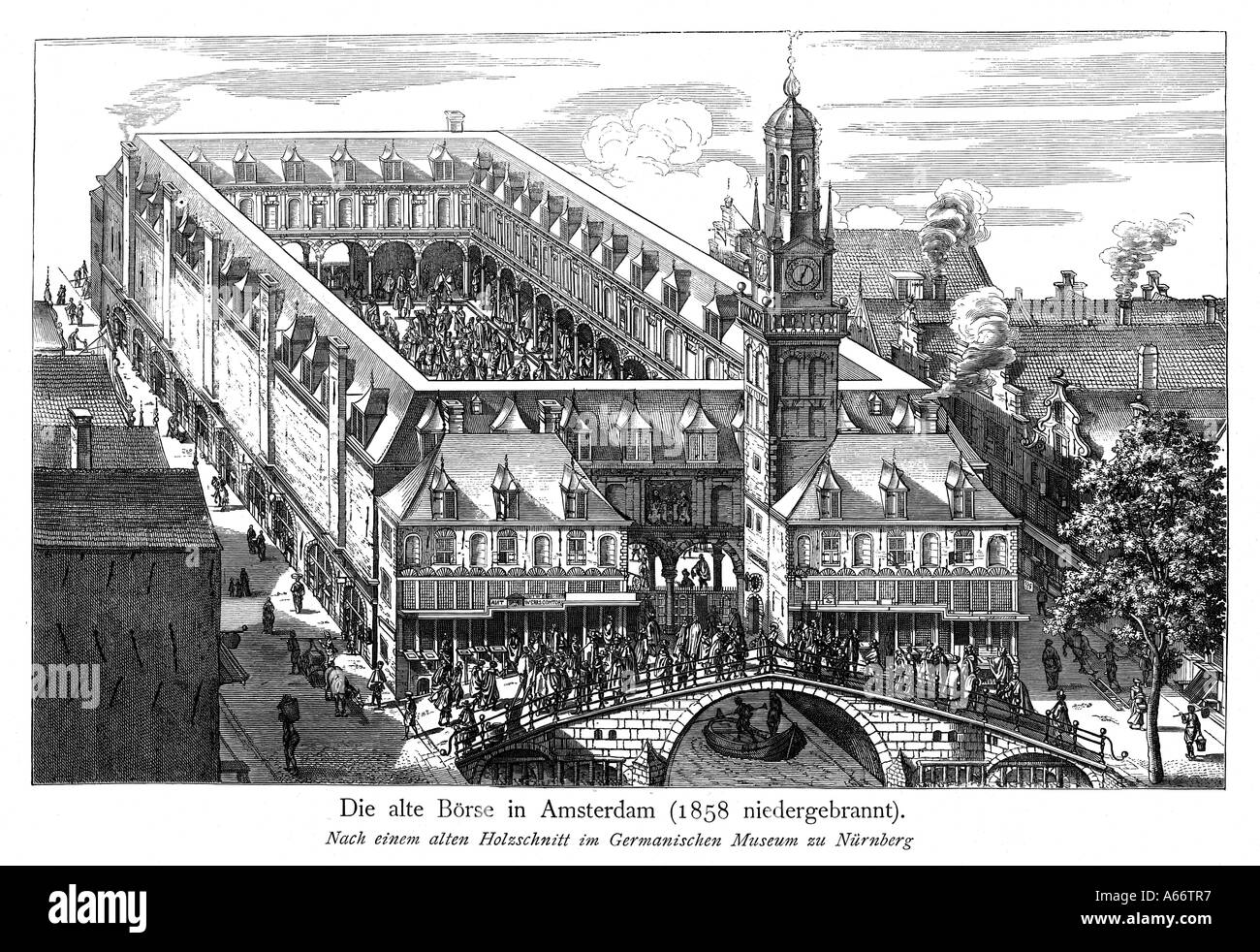

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 25, 2025

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 25, 2025

Latest Posts

-

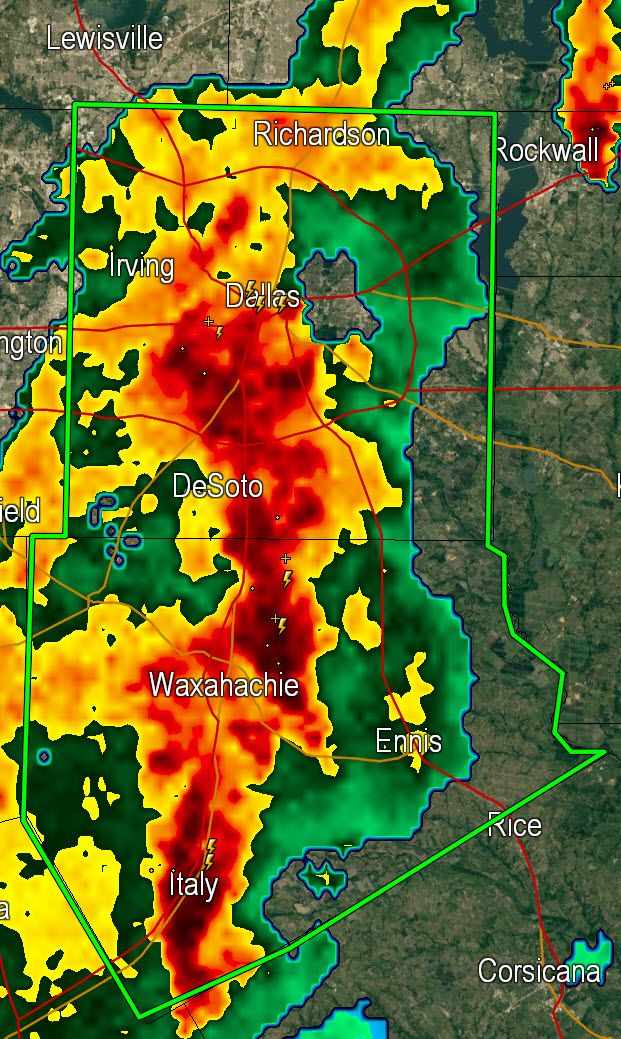

Severe Weather Alert Flash Flood Warning Issued For Parts Of Texas

May 25, 2025

Severe Weather Alert Flash Flood Warning Issued For Parts Of Texas

May 25, 2025 -

Flash Flood Warning Texas North Central Texas Under Downpour Alert

May 25, 2025

Flash Flood Warning Texas North Central Texas Under Downpour Alert

May 25, 2025 -

Miami Valley Flood Risk Current Severe Storm Situation And Advisories

May 25, 2025

Miami Valley Flood Risk Current Severe Storm Situation And Advisories

May 25, 2025 -

Bradford And Wyoming Counties Flash Flood Warning In Effect Until Tuesday

May 25, 2025

Bradford And Wyoming Counties Flash Flood Warning In Effect Until Tuesday

May 25, 2025 -

Urgent Flash Flood Warning Issued For Bradford And Wyoming Counties

May 25, 2025

Urgent Flash Flood Warning Issued For Bradford And Wyoming Counties

May 25, 2025