Are High Stock Valuations A Concern? BofA Weighs In

Table of Contents

BofA's Assessment of Current High Stock Valuations

BofA's recent analysis reveals a cautiously optimistic outlook on current high stock valuations. While acknowledging the elevated levels, they don't necessarily predict an imminent market crash. Instead, their assessment suggests a need for careful consideration and strategic portfolio management.

-

Key Metrics: BofA's analysis employed several key metrics, including Price-to-Earnings (P/E) ratios, price-to-sales ratios, and cyclically adjusted price-to-earnings (CAPE) ratios across various sectors. These metrics help assess whether current market prices are justified by underlying company performance and future earnings potential.

-

Highly Valued Sectors: The report highlighted technology, consumer discretionary, and certain segments of the healthcare sector as exhibiting particularly high valuations. These sectors have experienced significant growth in recent years, driving up their stock prices.

-

Specific Companies: While BofA generally avoids naming specific companies in broad market assessments, their analysis likely involved examining major players within the highly valued sectors mentioned above, using those companies' performance as a benchmark to illustrate prevailing high stock valuation trends.

-

Future Market Predictions: BofA's predictions regarding future market trends based on high stock valuations are nuanced. They suggest the potential for volatility and caution investors against overexposure to highly valued assets. They didn't predict a crash but rather a period of potential consolidation or even moderate correction.

Factors Contributing to High Stock Valuations

Several factors have converged to create the current environment of high stock valuations. Understanding these underlying drivers is crucial for assessing the sustainability of these valuations.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and individuals, stimulating economic activity and inflating asset prices, including stocks. This encourages investment in riskier assets like stocks as bonds offer lower yields.

-

Quantitative Easing and Government Stimulus: Government stimulus packages and quantitative easing programs designed to counter economic downturns have injected significant liquidity into the financial system, further boosting asset prices. This influx of cash has increased demand for equities, pushing up their valuations.

-

Strong Corporate Earnings (and Expectations): Robust corporate earnings, especially in certain sectors, have supported higher stock valuations. Positive future earnings expectations also contribute to investors’ willingness to pay higher prices for shares.

-

Increased Investor Confidence (and Speculation): A combination of investor optimism and speculative trading has fueled the rise in stock prices. FOMO (fear of missing out) can lead to further price increases, potentially creating a bubble.

-

Technological Advancements: Rapid technological advancements and the growth of innovative sectors, such as artificial intelligence and biotechnology, have attracted significant investment and driven up valuations in related companies.

Potential Risks Associated with High Stock Valuations

Investing in a market with high valuations carries inherent risks. Understanding these potential downsides is critical for prudent investment decision-making.

-

Market Correction or Crash: High valuations increase the likelihood of a market correction or even a more severe crash. If investor sentiment shifts or underlying economic conditions deteriorate, prices could experience a significant and rapid decline.

-

Significant Losses: If valuations revert to the mean, investors holding highly valued stocks could experience substantial losses. This reversion could be triggered by various factors, including rising interest rates or economic slowdown.

-

Reduced Future Returns: High valuations generally imply lower potential for future returns compared to investments made at lower valuations. The higher the starting price, the lower the potential percentage increase.

-

Impact of Inflation: Rising inflation can erode the purchasing power of returns and impact stock valuations negatively. High inflation may force central banks to increase interest rates, reducing the attractiveness of equities.

-

Geopolitical Instability: Geopolitical events and uncertainties can trigger market volatility and negatively affect stock valuations, regardless of the current valuation levels.

Strategies for Navigating High Stock Valuations

Given the current market environment, adopting a strategic approach to investing is crucial. Here are some strategies for navigating high stock valuations:

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risk. Don't put all your eggs in one basket, especially in highly valued sectors.

-

Sector-Specific Investment: Focus on undervalued sectors or companies within overvalued sectors that demonstrate strong fundamentals and growth potential. Thorough research is essential here.

-

Long-Term Investment Horizon: Adopting a long-term investment strategy can help weather short-term market fluctuations and benefit from the long-term growth potential of the market.

-

Value Investing: Consider value investing strategies to identify undervalued companies with strong fundamentals that are trading below their intrinsic worth.

-

Hedging Strategies: Employ hedging strategies, such as options or inverse ETFs, to protect your portfolio from potential market downturns.

Conclusion

BofA's assessment of high stock valuations highlights a need for cautious optimism. While not predicting an immediate crash, they emphasize the importance of careful portfolio management and diversification. Understanding the factors contributing to these high valuations, along with the associated risks, is crucial for making informed investment decisions. Assessing stock valuations should be a key component of your investment strategy. Don't underestimate the impact of high stock valuations on your portfolio; continue researching and adapting your approach to manage these risks effectively. Stay informed about BofA's ongoing analysis and other market insights to make sound investment choices and effectively manage high stock valuations.

Featured Posts

-

Melanie Griffith And Dakota Johnsons Siblings At Materialist Red Carpet Event

May 09, 2025

Melanie Griffith And Dakota Johnsons Siblings At Materialist Red Carpet Event

May 09, 2025 -

Kjoreforhold I Sor Norge Oppdatert Informasjon Om Vintervaer

May 09, 2025

Kjoreforhold I Sor Norge Oppdatert Informasjon Om Vintervaer

May 09, 2025 -

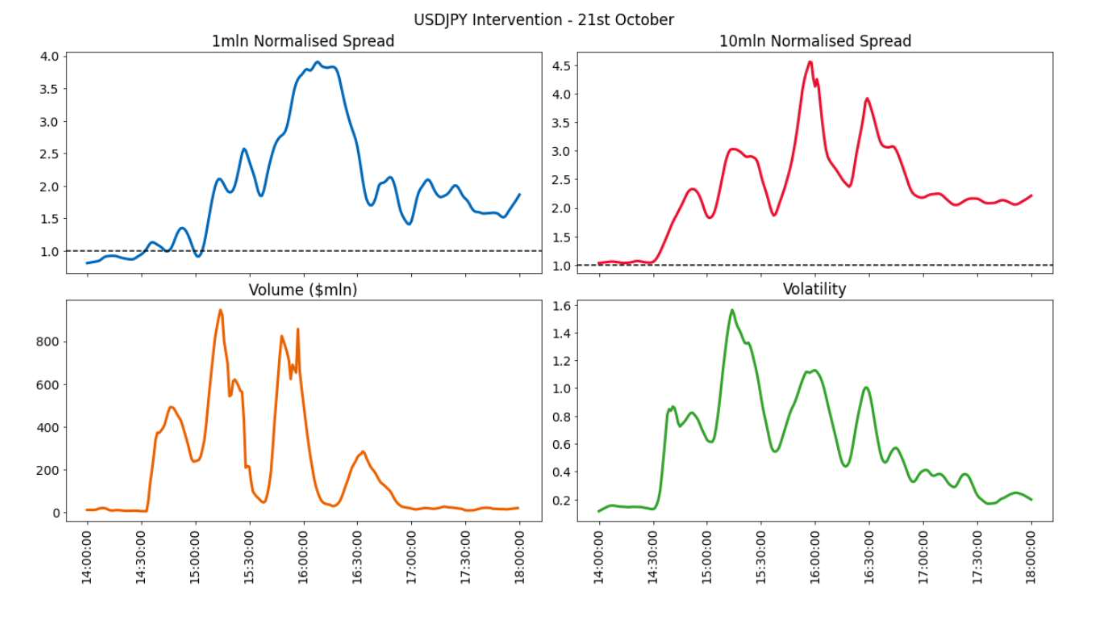

Madeleine Mc Cann Case 23 Year Old Womans Dna Test Results Revealed

May 09, 2025

Madeleine Mc Cann Case 23 Year Old Womans Dna Test Results Revealed

May 09, 2025 -

The 10 Best Film Noir Movies From Beginning To End

May 09, 2025

The 10 Best Film Noir Movies From Beginning To End

May 09, 2025 -

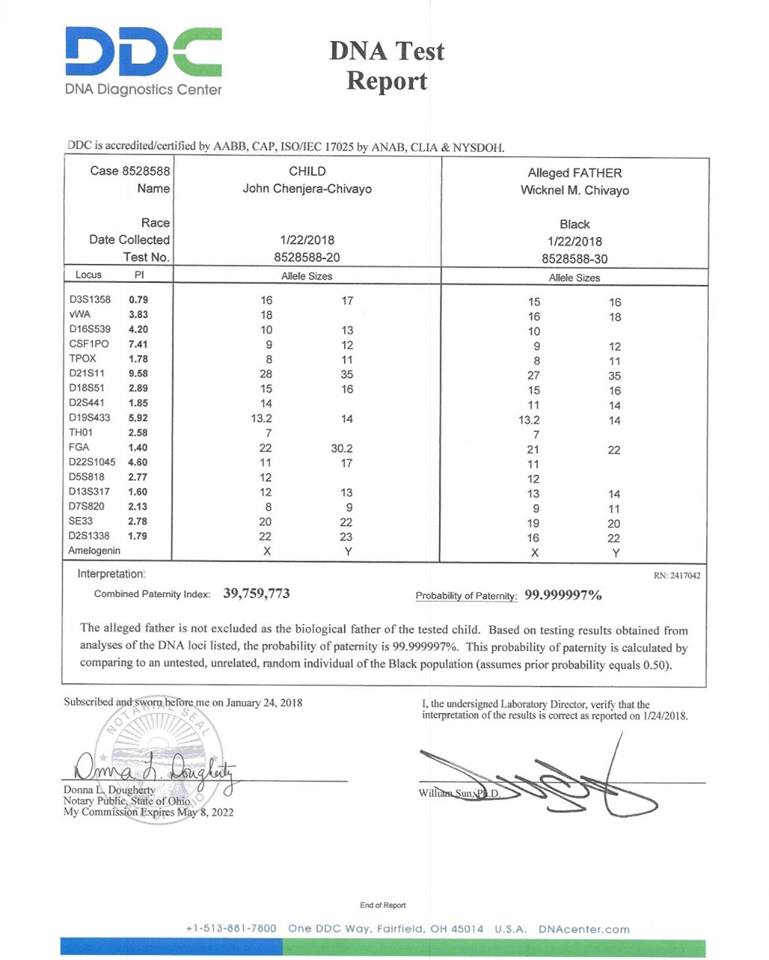

Infineon Ifx Lower Sales Projections Due To Tariff Uncertainty

May 09, 2025

Infineon Ifx Lower Sales Projections Due To Tariff Uncertainty

May 09, 2025