Atkins Signals Overhaul Of SEC Crypto Broker Regulations

Table of Contents

The Current Regulatory Landscape for Crypto Broker-Dealers

SEC's Current Approach to Crypto Regulation

The SEC's current approach to crypto regulation is often criticized for its lack of clarity and consistency. The agency has primarily relied on existing securities laws, applying them to crypto assets deemed to be securities, leading to a complex and often confusing regulatory framework. This approach has resulted in a patchwork of enforcement actions, creating uncertainty for businesses operating in the crypto space.

- Examples of current SEC actions against crypto firms: The SEC has pursued enforcement actions against numerous cryptocurrency exchanges and lending platforms for alleged violations of securities laws, including unregistered offerings and failure to register as broker-dealers. These actions highlight the difficulties companies face in navigating the ambiguous regulatory landscape.

- Lack of clarity and inconsistencies: The SEC's interpretation of which crypto assets qualify as securities remains unclear, leading to inconsistencies in enforcement and making it difficult for firms to comply with the law.

Challenges Faced by Crypto Broker-Dealers Under Current Rules

Navigating the current regulatory landscape presents significant challenges for crypto broker-dealers. The lack of clear guidelines and the high cost of compliance create a significant barrier to entry and hinder innovation.

- High Compliance Costs: The complexity of existing securities laws necessitates substantial investments in legal and compliance resources, disproportionately affecting smaller firms.

- Difficulty in Navigating Ambiguous Rules: The lack of specific regulations tailored to the crypto industry forces firms to interpret and apply existing laws to novel situations, increasing the risk of unintentional violations.

- Limited Legal Precedent: The relatively nascent nature of the crypto industry means there is limited legal precedent to guide firms in navigating regulatory uncertainty.

Atkins' Statements and Their Implications

Key Statements by Atkins Indicating Potential Changes

While specific statements haven't been attributed to an individual named "Atkins" in the context of SEC crypto regulation, we can extrapolate based on public statements by Commissioner Peirce and other SEC officials expressing the need for a more adaptable regulatory framework for digital assets. These statements suggest a potential shift towards a more nuanced approach, acknowledging the unique characteristics of the crypto market.

- Focus on investor protection: Statements emphasizing the importance of protecting investors while fostering innovation in the crypto space indicate a potential shift away from a purely restrictive approach.

- Calls for clearer definitions: Public calls for clearer definitions of what constitutes a security within the crypto space signal a potential overhaul of the current regulatory ambiguity.

Potential Changes to Registration Requirements for Crypto Broker-Dealers

The signals suggest potential changes to registration requirements for crypto broker-dealers, potentially making it easier for firms to comply with securities laws. This might involve:

- Different Regulatory Tiers: A tiered system could differentiate between smaller, less complex firms and larger institutions, applying different regulatory burdens accordingly.

- Streamlined Registration Process: Simplifying the registration process could reduce compliance costs and encourage more firms to enter the market legally.

- Clarification of Which Crypto Assets Fall Under Which Regulations: Clearer guidelines on which crypto assets are considered securities and which are not would significantly reduce uncertainty.

Potential Impact on the Crypto Market

Increased Regulatory Certainty and its Effects

Clearer regulations would likely lead to increased regulatory certainty, positively impacting market stability and investor confidence.

- Increased Institutional Investment: Reduced regulatory uncertainty could attract more institutional investors seeking to participate in the crypto market.

- More Transparency: A clearer regulatory framework would promote greater transparency and accountability within the industry.

- Reduced Risk: Greater clarity would help mitigate the risks associated with investing in crypto assets.

Potential for Innovation and Growth in the Crypto Sector

A more defined regulatory framework could stimulate innovation and growth in the crypto sector.

- DeFi Growth: Clearer rules could facilitate the development and adoption of decentralized finance (DeFi) protocols.

- Stablecoin Development: A more predictable regulatory environment could foster the creation of stable and reliable stablecoins.

- NFT Market Expansion: A more transparent regulatory landscape might unlock the potential of the non-fungible token (NFT) market.

Potential Challenges and Unintended Consequences

While a regulatory overhaul offers significant benefits, potential drawbacks must be considered.

- Over-regulation Stifling Innovation: Excessively strict regulations could stifle innovation and hinder the growth of the crypto industry.

- Creation of Unforeseen Loopholes: Complex regulations might create unintended loopholes that could be exploited by bad actors.

Conclusion: Navigating the Evolving Landscape of SEC Crypto Broker Regulations

The signals suggest a potential overhaul of SEC crypto broker regulations, a significant development with far-reaching implications for the crypto market. Increased regulatory clarity, while potentially challenging to implement, offers the potential for greater stability, increased investor confidence, and accelerated innovation within the sector. However, navigating this evolving landscape requires careful consideration of potential challenges and unintended consequences. Stay informed about developments related to "Atkins Signals Overhaul of SEC Crypto Broker Regulations" by following updates from the SEC and reputable industry news sources. Understanding these changes is crucial for navigating the future of the cryptocurrency industry.

Featured Posts

-

Exclusive Ai Startup Perplexity Achieves 14 Billion Valuation

May 13, 2025

Exclusive Ai Startup Perplexity Achieves 14 Billion Valuation

May 13, 2025 -

Ncaa Tournament Oregons Deja Blue And The Duke Rematch

May 13, 2025

Ncaa Tournament Oregons Deja Blue And The Duke Rematch

May 13, 2025 -

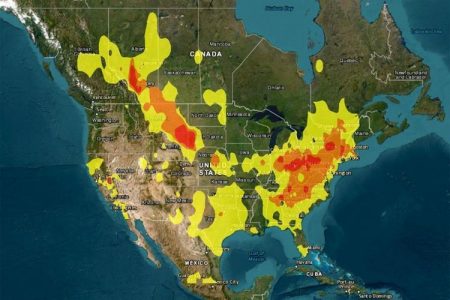

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Impacts

May 13, 2025

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Impacts

May 13, 2025 -

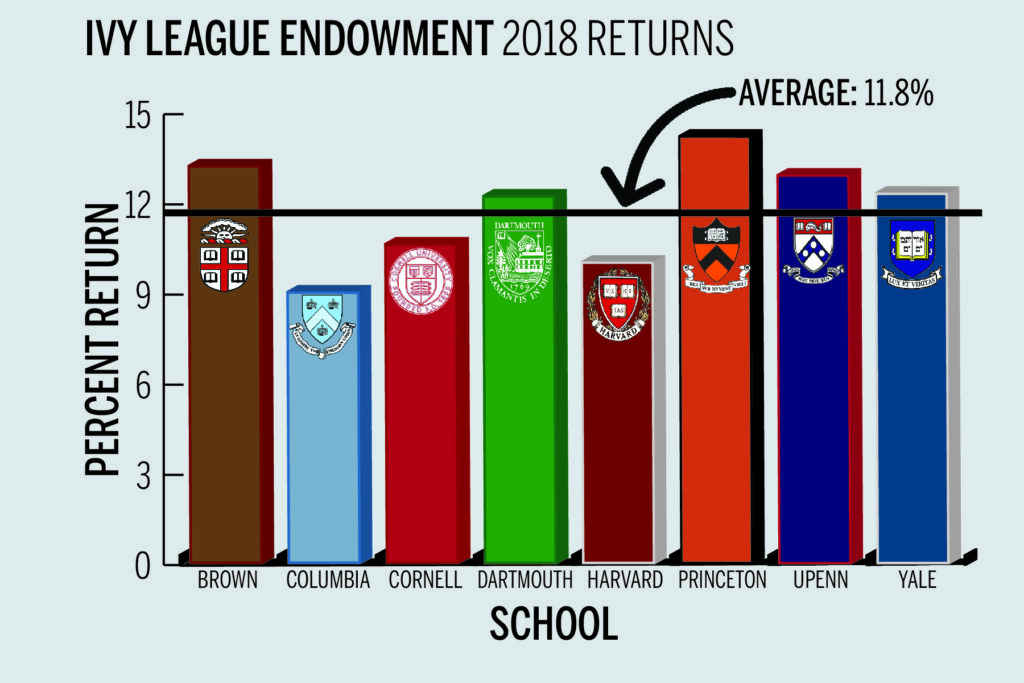

Increased Taxes On Ivy League Endowments The Harvard And Yale Case

May 13, 2025

Increased Taxes On Ivy League Endowments The Harvard And Yale Case

May 13, 2025 -

Kult Statusz Johansson Marvel Szerepenek Joevoje

May 13, 2025

Kult Statusz Johansson Marvel Szerepenek Joevoje

May 13, 2025

Latest Posts

-

Caparros Regresa Al Sevilla Fin De La Etapa De Garcia Pimienta

May 14, 2025

Caparros Regresa Al Sevilla Fin De La Etapa De Garcia Pimienta

May 14, 2025 -

Joaquin Caparros Nuevo Entrenador Del Sevilla Fc Tras El Cese De Garcia Pimienta

May 14, 2025

Joaquin Caparros Nuevo Entrenador Del Sevilla Fc Tras El Cese De Garcia Pimienta

May 14, 2025 -

El Impacto De Joaquin Caparros Un Analisis De Sus Diferentes Etapas En El Sevilla Fc A Traves De Sus Presentaciones

May 14, 2025

El Impacto De Joaquin Caparros Un Analisis De Sus Diferentes Etapas En El Sevilla Fc A Traves De Sus Presentaciones

May 14, 2025 -

Joaquin Caparros Y El Sevilla Fc Evolucion De Sus Presentaciones A Lo Largo De 25 Anos

May 14, 2025

Joaquin Caparros Y El Sevilla Fc Evolucion De Sus Presentaciones A Lo Largo De 25 Anos

May 14, 2025 -

25 Anos Despues Analizando Las Presentaciones De Joaquin Caparros En El Sevilla Fc

May 14, 2025

25 Anos Despues Analizando Las Presentaciones De Joaquin Caparros En El Sevilla Fc

May 14, 2025