Bajaj Twins Drag On Indian Indices: Sensex And Nifty 50 Conclude Day Flat

Table of Contents

Bajaj Twins' Performance and Market Impact

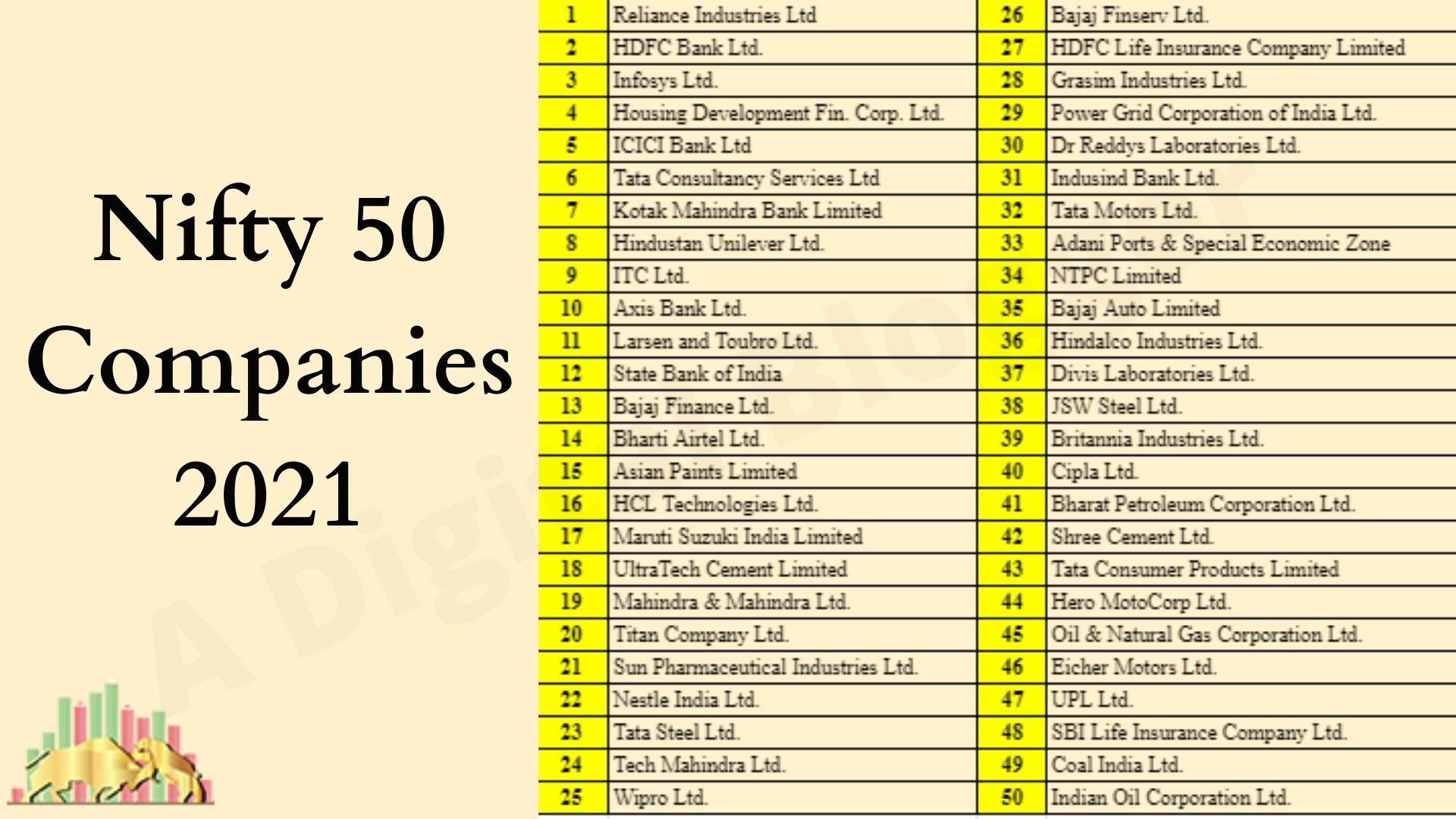

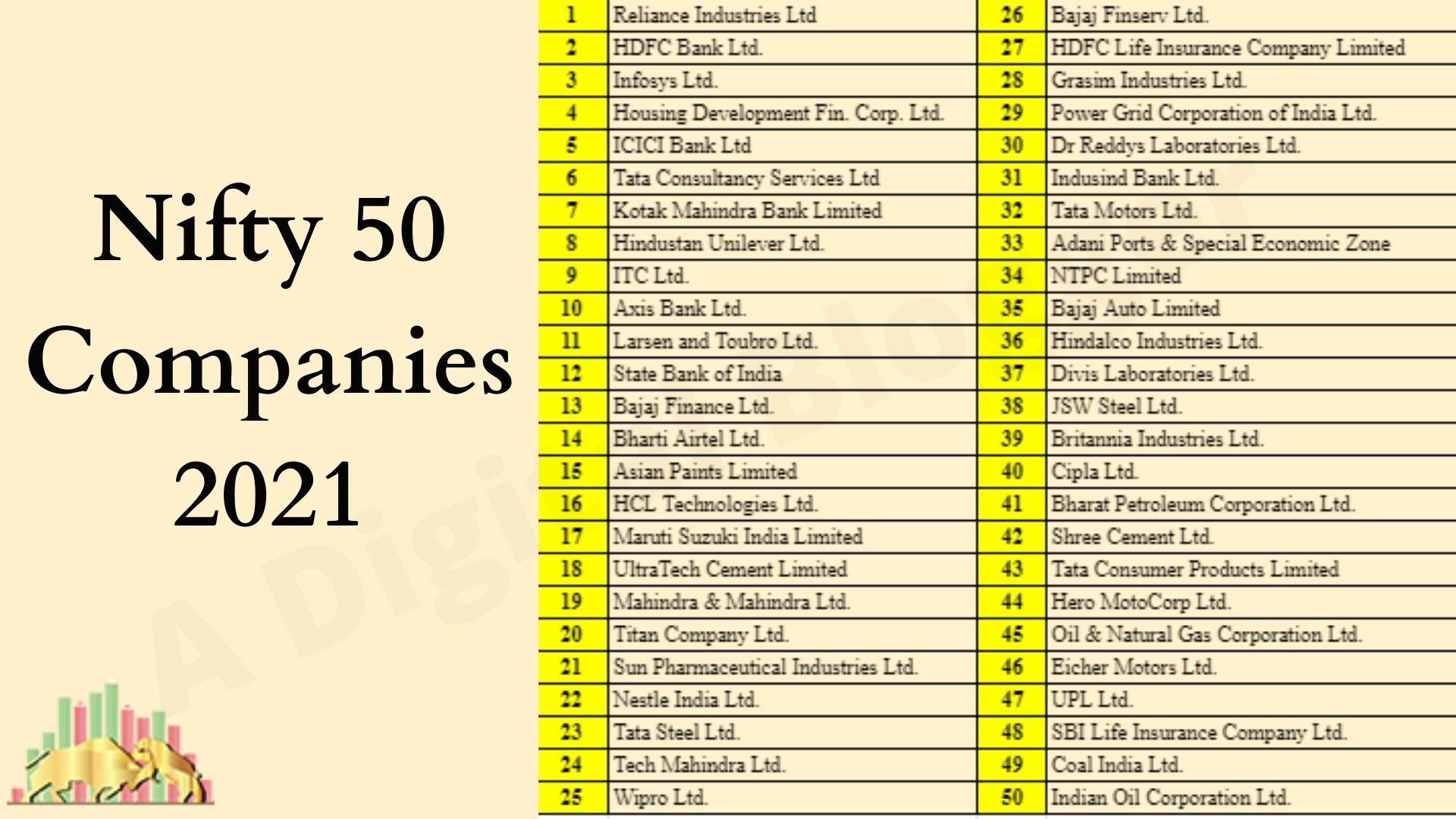

The underperformance of Bajaj Finance and Bajaj Auto shares significantly impacted the Sensex and Nifty 50. Both stocks experienced a notable decline, contributing substantially to the overall flat market close. This stock price decline can be attributed to a confluence of factors, including profit booking by investors after recent gains, potential sectoral headwinds affecting the auto and financial sectors, and broader global market trends impacting investor sentiment. The sheer market capitalization of these companies and their significant index weightage amplified their negative influence on the overall market indices.

- Bajaj Finance: Experienced a 2.5% drop, closing at ₹[Insert Closing Price]. News reports suggested concerns over potential slowing growth in the NBFC sector may have contributed to the decline.

- Bajaj Auto: Saw a 1.8% decrease, closing at ₹[Insert Closing Price]. This could be partially attributed to profit-booking after a period of strong performance and some concerns about the overall two-wheeler market.

- The combined impact of these declines dragged the Sensex down by approximately [Insert Point Value] points and the Nifty 50 by approximately [Insert Point Value] points. The closing values for the Sensex and Nifty 50 were [Insert Closing Values for both].

Other Contributing Factors to the Flat Market Close

While the Bajaj twins played a dominant role, other factors also contributed to the subdued market performance. Global market trends showed mixed signals, with some major international markets experiencing slight declines. Rupee volatility against the US dollar added to the uncertainty, potentially impacting investor confidence. Further analysis of FII/DII activity revealed a net [Insert Net Figure - positive or negative] investment, indicating [Interpretation of the FII/DII activity - net buying or selling pressure]. Crude oil prices remained relatively stable, minimizing their impact on the market. Finally, certain sectors like [Mention Specific Sectors and their Performance] showed weakness, further contributing to the flat market close.

- Global Market Trends: A slight downturn in some key international markets like the US and Europe, coupled with concerns about inflation and interest rates, may have influenced Indian investor sentiment.

- FII/DII Investment: [Insert Detailed breakdown of FII/DII investment figures, showing their contribution]. This indicates [Interpretation based on the figures].

- Sectoral Performance: The IT sector underperformed due to [Reason], while the [sector] sector also faced headwinds due to [Reason].

Analyst Predictions and Future Outlook for Bajaj Twins and Indian Indices

Market analysts offer mixed predictions regarding the future performance of the Bajaj twins and the broader Indian stock market. Some analysts believe the recent decline in Bajaj Finance and Bajaj Auto stocks presents a buying opportunity for long-term investors, pointing to the companies' strong fundamentals and future growth potential. However, others remain cautious, citing potential macroeconomic headwinds and sector-specific challenges. Regarding the Sensex and Nifty 50, the short-term outlook is considered uncertain, with the market expected to consolidate in the near term. The long-term outlook remains positive, fueled by India's strong economic growth fundamentals.

- Analyst Quotes: "[Quote from an analyst on Bajaj Finance's prospects]," and "[Quote from an analyst on Bajaj Auto's prospects]".

- Short-term Predictions: Analysts predict a range-bound market for the Sensex and Nifty 50 in the coming weeks, with potential volatility depending on global events and domestic economic data.

- Long-term Predictions: The long-term outlook remains positive, with continued economic growth expected to drive market performance. Potential catalysts include [mention specific potential catalysts].

Conclusion: Bajaj Twins Impact and Next Steps

The flat close of the Sensex and Nifty 50 today was significantly influenced by the negative performance of the Bajaj twins, Bajaj Finance and Bajaj Auto. While profit-booking, sectoral headwinds, and global market trends contributed to their decline, other factors like FII/DII activity and sectoral performances also played a role in the overall market sentiment. While the short-term outlook remains uncertain, the long-term prospects for the Indian market remain positive. To stay informed about the ongoing impact of the Bajaj twins and navigate the Indian stock market effectively, continue following market updates, and conduct thorough research on Bajaj Finance stock and Bajaj Auto stock, tailoring your investment strategy accordingly. Understanding these dynamics is crucial for successful investment in the Indian market analysis.

Featured Posts

-

Dijon Faire Don De Ses Cheveux

May 09, 2025

Dijon Faire Don De Ses Cheveux

May 09, 2025 -

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 09, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 09, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Iste Gercekler

May 09, 2025

Bitcoin Madenciliginin Azalan Karliligi Iste Gercekler

May 09, 2025 -

Elizabeth City Vehicle Break Ins Police Seek Suspect Information

May 09, 2025

Elizabeth City Vehicle Break Ins Police Seek Suspect Information

May 09, 2025 -

Nhl Game Prediction Oilers Vs Sharks Betting Analysis And Odds

May 09, 2025

Nhl Game Prediction Oilers Vs Sharks Betting Analysis And Odds

May 09, 2025