Palantir's Path To A Trillion-Dollar Market Cap: A 2030 Projection

Table of Contents

Can a data analytics company, currently valued significantly lower, realistically reach a trillion-dollar market cap within a decade? This article argues that Palantir Technologies, a leader in big data analytics for government and commercial clients, possesses the potential to achieve this ambitious goal by 2030. Palantir's current market capitalization, while substantial, pales in comparison to the trillion-dollar valuation we believe is within its reach. This projection rests on several key pillars: explosive market expansion, relentless technological innovation, and compelling financial projections.

Palantir's Expanding Market Dominance in Government and Commercial Sectors:

Government Contracts and National Security:

Palantir has established itself as a crucial provider of advanced data analytics solutions to government agencies worldwide. Its expertise in national security and intelligence gathering has secured it lucrative contracts with numerous governments, particularly in the United States. The increasing global demand for sophisticated data analytics to combat terrorism, enhance cybersecurity, and improve national security further fuels this growth. Successful deployments of Palantir's Gotham platform in various intelligence agencies highlight its ability to deliver critical insights from complex datasets. Future growth in this sector hinges on several factors:

- Growth in defense spending: Increased global geopolitical tensions are driving up defense budgets, creating a fertile ground for Palantir's services.

- Increasing adoption of AI/ML in government: The integration of artificial intelligence and machine learning into government operations significantly enhances the value proposition of Palantir's platforms.

- Strategic partnerships with key government agencies: Palantir's collaborations with leading government bodies ensure continued access to critical projects and facilitate ongoing platform development.

Commercial Market Penetration and Growth:

Palantir's Foundry platform is making significant inroads into the commercial sector, revolutionizing data analysis in diverse industries. The healthcare sector benefits from improved patient care and operational efficiency, while finance leverages Palantir's solutions for risk management and fraud detection. The platform's ability to integrate and analyze vast amounts of disparate data provides a significant competitive advantage. Key drivers of Palantir's commercial growth include:

- Successful case studies in commercial applications: Demonstrable successes across various industries build trust and attract new clients.

- Partnerships with major corporations: Collaborations with industry leaders provide access to new markets and technological expertise.

- Expansion into new commercial sectors: Continuous exploration of new markets ensures diversified revenue streams and sustainable growth.

Technological Innovation and Future-Proofing:

Artificial Intelligence (AI) and Machine Learning (ML) Integration:

Palantir is heavily investing in AI and ML technologies, which are fundamental to its future success. These advancements are not merely incremental improvements; they represent a paradigm shift in data analysis capabilities. AI and ML enable Palantir's platforms to extract deeper insights, predict future trends, and automate complex tasks, creating a strong competitive moat. Key aspects of Palantir's AI/ML strategy include:

- Recent AI/ML breakthroughs: Consistent innovation and cutting-edge research drive the development of sophisticated algorithms and analytical tools.

- Strategic acquisitions of AI companies: Acquiring smaller AI companies strengthens Palantir's technological capabilities and expands its talent pool.

- Development of new AI-powered features: Continuous improvements and the addition of new AI features enhance the platform's value and appeal.

Product Development and Platform Expansion:

Palantir's commitment to continuous product development and platform enhancement ensures its long-term competitiveness. The company strategically develops new offerings to address evolving customer needs and capture emerging market opportunities. This proactive approach is critical for maintaining a leadership position in the rapidly evolving data analytics landscape. Important elements of Palantir's product strategy include:

- Upcoming product releases: Introducing new features and products maintains Palantir’s relevance and attractiveness to clients.

- Planned platform integrations: Seamless integration with other critical business systems increases the platform’s value and usability.

- Investment in R&D: Significant investment in research and development ensures Palantir remains at the forefront of technological innovation.

Financial Projections and Valuation:

Revenue Growth and Profitability:

Palantir’s historical revenue growth demonstrates its potential. Forecasting future revenue relies on the continuation of this growth trajectory, bolstered by market expansion and technological innovation. A key aspect of reaching a trillion-dollar valuation is achieving sustainable profitability. This involves efficient operational management, strategic pricing, and a focus on high-margin revenue streams. Key financial metrics supporting the trillion-dollar projection include:

- Projected annual revenue growth: Consistent double-digit revenue growth is crucial for achieving the target valuation.

- Forecasted profit margins: Improving profit margins significantly contributes to overall valuation.

- Key financial metrics: Analyzing metrics like EBITDA, free cash flow, and return on invested capital provides a comprehensive picture of financial health.

Market Valuation and Comparison to Competitors:

Comparing Palantir's valuation to similar companies in the big data analytics market reveals its significant growth potential. While competitors exist, Palantir's unique combination of government expertise and advanced commercial platforms sets it apart. A discounted cash flow (DCF) analysis, considering future revenue growth and profitability, can justify the potential for a dramatic increase in valuation. However, achieving this valuation is not without risk. Potential challenges include competition, technological disruptions, and macroeconomic factors.

- Peer company comparisons: Benchmarking against competitors helps assess Palantir's relative valuation.

- Discounted cash flow analysis: A DCF model projects future cash flows and discounts them to present value to estimate valuation.

- Sensitivity analysis of valuation assumptions: Analyzing the impact of different assumptions on the valuation provides a more robust assessment.

Conclusion:

Palantir's path to a trillion-dollar market cap by 2030 is ambitious but achievable. The confluence of expanding market dominance in both government and commercial sectors, continuous technological innovation driven by AI and ML, and compelling financial projections all contribute to this potential. The company's strong position in national security, coupled with its increasingly successful penetration of the commercial market, positions it for sustained, exponential growth.

Key Takeaways: Palantir's significant investments in AI and ML, coupled with its expanding market reach and robust financial projections, strongly support the possibility of a trillion-dollar market cap by 2030.

Call to Action: Explore Palantir's potential for a trillion-dollar market cap further. Conduct your own research to understand the opportunities and challenges that lie ahead for this innovative data analytics company. Investing in Palantir’s journey to a trillion-dollar valuation may prove a rewarding endeavor for those who believe in its vision.

Featured Posts

-

Tomas Hertls Double Hat Trick Performance Propels Golden Knights

May 09, 2025

Tomas Hertls Double Hat Trick Performance Propels Golden Knights

May 09, 2025 -

Wynne Evans Dropped From Go Compare Advert Following Strictly Controversy

May 09, 2025

Wynne Evans Dropped From Go Compare Advert Following Strictly Controversy

May 09, 2025 -

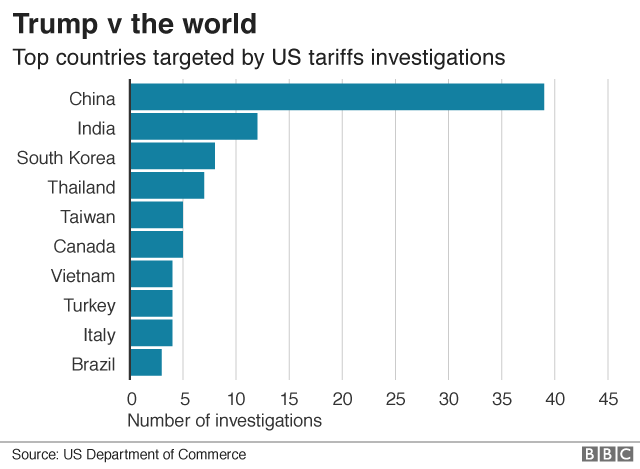

Bilateral Trade Agreement India And Us To Hold Key Discussions

May 09, 2025

Bilateral Trade Agreement India And Us To Hold Key Discussions

May 09, 2025 -

Who Is Kimbal Musk Exploring The Life And Career Of Elons Brother

May 09, 2025

Who Is Kimbal Musk Exploring The Life And Career Of Elons Brother

May 09, 2025 -

The Economic Fallout Of Tariffs Assessing The Losses Of Trumps Billionaire Network

May 09, 2025

The Economic Fallout Of Tariffs Assessing The Losses Of Trumps Billionaire Network

May 09, 2025