Berkshire Hathaway's Apple Stock: Analyzing The Post-Buffett Era

Table of Contents

Berkshire Hathaway's Apple Investment: A Retrospective

The Buffett Era:

Berkshire Hathaway's journey with Apple stock began gradually, reflecting Buffett's characteristic value investing approach. Unlike his typically large, single-purchase investments, the Apple acquisition was more measured. This phased approach underscores Buffett's meticulous due diligence process.

- Timeline of investments: Initial investments started around 2016, with steadily increasing purchases over subsequent years.

- Initial investment size: While the precise initial investment amount isn't publicly available in a single announcement, the gradual accumulation eventually led to a substantial stake.

- Buffett's public comments on Apple: Buffett frequently praised Apple's strong brand loyalty, exceptional product ecosystem, and robust customer engagement, aligning perfectly with his focus on companies with a durable competitive advantage and strong consumer preference. He described Apple as a "wonderful business" and often compared it to a consumer staple company.

These factors, combined with Apple's strong financial performance and the overall growth trajectory of the tech sector, contributed to the massive return on investment. The use of "value investing" principles guided the decision-making process, resulting in substantial profits for Berkshire Hathaway.

Financial Performance During the Buffett Era:

The Apple investment proved exceptionally lucrative for Berkshire Hathaway under Buffett's leadership. The returns generated were significant, contributing substantially to Berkshire Hathaway's overall portfolio performance.

- Annual returns: While precise figures fluctuate yearly and aren't consistently publicized, reports suggest exceptionally high returns on the initial investment.

- Dividend payouts: Apple's dividend payouts, though not massive compared to the overall capital appreciation, contributed additional income for Berkshire Hathaway.

- Overall portfolio contribution: Apple's contribution to Berkshire Hathaway's overall portfolio value has grown significantly to become one of its largest holdings. This illustrates the magnitude of the success of this investment strategy.

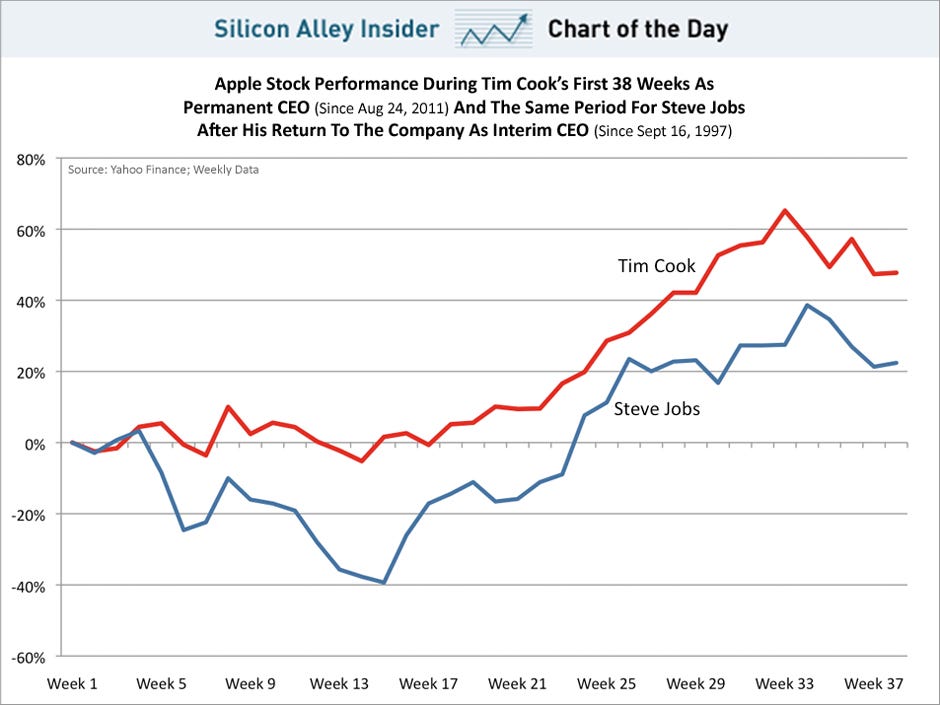

Analyzing charts depicting the growth of Berkshire Hathaway's Apple investment alongside the broader market performance would clearly show the exceptional returns generated during this period. This success is a testament to Buffett’s investment acumen and Apple's exceptional growth. The high ROI achieved showcases the potential of a well-timed long-term investment strategy.

The Post-Buffett Leadership and Apple:

Succession Planning and Investment Strategy:

With Warren Buffett's gradual transition away from day-to-day operations, Greg Abel, the designated successor, will play a pivotal role in shaping the future of Berkshire Hathaway's Apple investment.

- Greg Abel's investment philosophy: While Abel's specific approach to Apple remains to be fully seen, his track record suggests a continuation of a value-driven, long-term investment approach.

- Potential diversification strategies: While retaining a significant Apple stake is likely, we might see Berkshire Hathaway exploring diversification opportunities to balance the portfolio’s risk profile, thus minimizing the impact of any downturn in Apple's performance.

- Risk tolerance: Whether Abel maintains Buffett's level of risk tolerance regarding Apple remains a critical factor in determining future investment decisions.

The post-Buffett era will be crucial for evaluating the sustainability of Berkshire Hathaway’s approach to investing in technology companies. This will depend greatly on Abel's alignment with or departure from Buffett's investment philosophy.

Market Volatility and Apple's Future:

The future of Berkshire Hathaway's Apple investment is intrinsically linked to market volatility and Apple's future performance.

- Impact of economic downturns: Economic recessions could impact consumer spending, potentially affecting Apple's sales and, subsequently, Berkshire Hathaway's holdings.

- Competition in the tech sector: Intense competition from other tech giants poses a risk to Apple's continued market dominance, impacting its long-term growth prospects.

- Long-term growth projections for Apple: Apple's ability to innovate and expand into new markets will be crucial for maintaining its value and appeal to investors like Berkshire Hathaway.

Analyzing these factors is vital for predicting potential future scenarios and understanding how they could impact Berkshire Hathaway’s investment.

Analyzing Future Scenarios for Berkshire Hathaway's Apple Stock

Scenario 1: Maintaining the Current Position:

Berkshire Hathaway might choose to retain its substantial Apple holding, banking on Apple's continued growth and market dominance.

- Financial implications: This strategy would maintain a substantial source of revenue and potential capital appreciation for Berkshire Hathaway.

- Potential risks and rewards: While potentially rewarding, this approach exposes Berkshire Hathaway to the risks associated with the tech sector's inherent volatility and competition.

Scenario 2: Partial or Full Divestment:

A partial or complete divestment from Apple could be considered, driven by various factors.

- Reasons for divestment: Factors such as changing market conditions, diversification needs, or identifying more attractive investment opportunities could prompt this decision.

- Market impact: A significant divestment would undoubtedly cause market fluctuations, impacting both Apple's stock price and potentially Berkshire Hathaway's overall portfolio value.

- Alternative investment opportunities: Berkshire Hathaway might reallocate its funds to other promising sectors or companies deemed more attractive based on their assessment of the changing economic landscape.

Scenario 3: Strategic Increase in Holding:

Berkshire Hathaway might strategically increase its Apple stock holding, capitalizing on favorable market conditions or anticipating further growth.

- Rationale behind increasing holdings: This move could reflect a strong belief in Apple's continued success and a desire to capitalize on potential undervaluation.

- Market conditions favoring this move: Certain economic conditions, such as periods of market correction or favorable industry trends, might incentivize this strategy.

- Potential risks and benefits: While offering the potential for significant returns, this strategy also magnifies the risks associated with concentrating a large portion of the portfolio in a single stock.

Conclusion: The Future of Berkshire Hathaway's Apple Stock

The future of Berkshire Hathaway's Apple stock in the post-Buffett era remains uncertain but presents several compelling scenarios. Maintaining the current position, partial or full divestment, or strategically increasing holdings each represent viable paths, each with its own set of risks and rewards. The ultimate decision will likely hinge on the evolving market conditions, Apple's continued performance, and the new leadership's investment philosophy. Closely monitoring the situation is crucial for investors interested in Berkshire Hathaway and Apple. To stay abreast of the evolving investment landscape and make informed decisions, continue researching "Berkshire Hathaway's Apple Stock" and consult reputable financial news sources and analyst reports.

Featured Posts

-

Brest Urban Trail Les Visages De La Course

May 25, 2025

Brest Urban Trail Les Visages De La Course

May 25, 2025 -

Is A Us Band Secretly Playing Glastonbury Social Media Clues Suggest Yes

May 25, 2025

Is A Us Band Secretly Playing Glastonbury Social Media Clues Suggest Yes

May 25, 2025 -

Apple Stock Performance Exceeding Q2 Expectations

May 25, 2025

Apple Stock Performance Exceeding Q2 Expectations

May 25, 2025 -

Apple Stock Sell Off Tim Cooks Tariff Warning

May 25, 2025

Apple Stock Sell Off Tim Cooks Tariff Warning

May 25, 2025 -

The Ultimate Escape To The Country Properties And Lifestyle Choices

May 25, 2025

The Ultimate Escape To The Country Properties And Lifestyle Choices

May 25, 2025

Latest Posts

-

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025 -

The Problem With Thames Waters Executive Bonuses

May 25, 2025

The Problem With Thames Waters Executive Bonuses

May 25, 2025 -

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025 -

Thames Water Executive Compensation A Public Outcry

May 25, 2025

Thames Water Executive Compensation A Public Outcry

May 25, 2025 -

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025