BigBear.ai Holdings (BBAI) Stock Decline In 2025: Analysis And Predictions

Table of Contents

Macroeconomic Factors Influencing BBAI Stock Performance in 2025

Several macroeconomic headwinds could significantly impact BBAI's stock performance in 2025. These external forces often exert considerable pressure on even the most robust companies.

Interest Rate Hikes and Inflationary Pressures

Rising interest rates represent a considerable challenge for growth-oriented technology companies like BigBear.ai. Higher borrowing costs make it more expensive for BBAI to fund expansion projects, research and development, and acquisitions. This can directly impact its growth trajectory and profitability. Inflation further erodes purchasing power and reduces investor confidence, making them less likely to invest in riskier assets like BBAI stock.

- Increased borrowing costs impacting BBAI's growth plans: Higher interest rates translate to increased debt servicing costs, potentially slowing down expansion initiatives.

- Reduced investor appetite for riskier assets: In a high-interest-rate environment, investors often favor safer, less volatile investments, reducing demand for BBAI stock.

- Potential impact on government contracts and funding: Increased government spending constraints due to inflation might affect the awarding of lucrative contracts to BBAI.

Geopolitical Uncertainty and its Effect on BBAI

Geopolitical instability can significantly disrupt global markets and impact companies like BBAI with international operations. Trade wars, sanctions, and political tensions can lead to supply chain disruptions, impacting the production and delivery of BBAI's products and services. This uncertainty can also erode investor confidence, leading to a decline in stock prices.

- Impact of trade wars or sanctions on BBAI's global operations: International trade restrictions could limit BBAI's access to crucial resources or markets.

- Disruptions to supply chains: Geopolitical instability can cause delays and disruptions in the supply chain, affecting BBAI's ability to deliver its products on time.

- Uncertainty impacting investor confidence: Geopolitical risks increase uncertainty, making investors hesitant to invest in potentially volatile stocks like BBAI.

Company-Specific Factors Contributing to a Potential BBAI Stock Decline

Beyond macroeconomic factors, company-specific issues can contribute to a potential decline in BBAI's stock price. These internal challenges require close monitoring.

Competition and Market Saturation in the AI Sector

The artificial intelligence (AI) market is becoming increasingly competitive. New players are constantly emerging, offering innovative solutions and challenging established companies like BBAI. Maintaining a competitive edge in this rapidly evolving market requires continuous innovation, significant investment in R&D, and the ability to attract and retain top talent.

- Emergence of new players with innovative technologies: The AI sector is characterized by rapid innovation, with new competitors frequently emerging.

- Price wars and pressure on profit margins: Intense competition can lead to price wars, squeezing profit margins and impacting BBAI's profitability.

- Difficulties in attracting and retaining talent: The demand for skilled AI professionals is high, making it challenging for BBAI to attract and retain top talent.

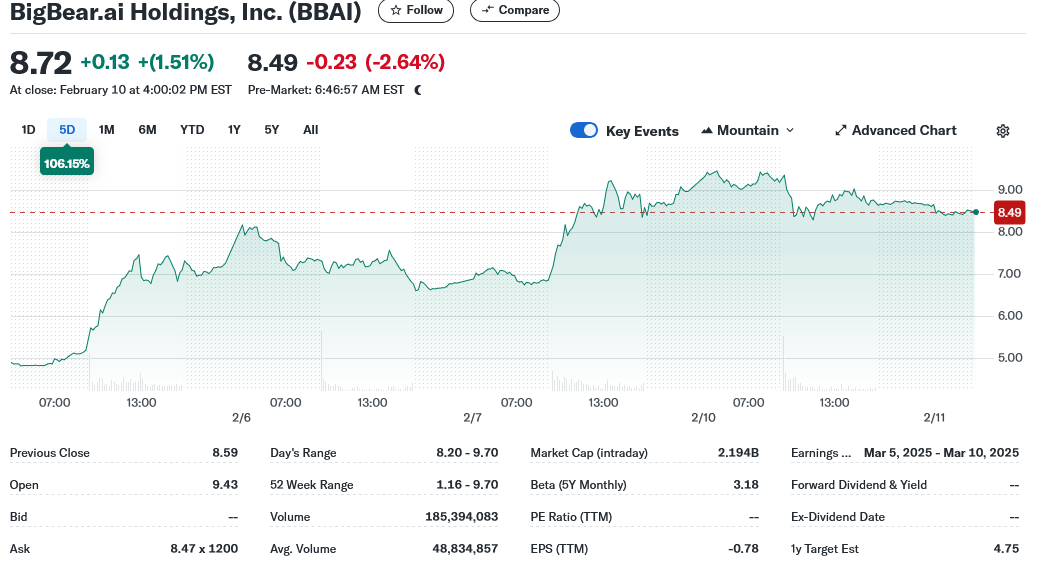

BBAI's Financial Performance and Projections for 2025

Analyzing BBAI's financial statements, including revenue, profitability, and debt levels, is crucial in predicting its future stock performance. Any challenges related to cash flow, profitability, or debt management could negatively impact investor sentiment. Forecasts based on current trends and market analysis provide insights into potential future financial performance.

- Analysis of revenue growth and projections: Examining historical revenue trends and predicting future growth is essential.

- Assessment of profitability and margins: Profitability and margin analysis helps understand BBAI's ability to generate profits.

- Examination of debt levels and financial stability: High debt levels can increase financial risk and negatively impact stock performance.

Predicting the Trajectory of BBAI Stock in 2025: Potential Scenarios

Predicting the future is inherently complex, but by analyzing various factors, we can outline potential scenarios for BBAI stock in 2025.

Bullish Scenario: Factors that could lead to positive stock performance

A bullish scenario for BBAI could involve successful product launches, strategic partnerships, exceeding market expectations in terms of revenue growth, or successful navigation of macroeconomic headwinds. This could lead to a significant increase in stock price.

Bearish Scenario: Factors that could lead to further decline

Conversely, a bearish scenario might involve contract failures, increased competition leading to market share loss, financial difficulties, or a failure to adapt to changing market dynamics. This would likely result in a further decrease in stock price.

Neutral Scenario: A balanced view of potential outcomes

A neutral scenario would involve BBAI maintaining its current market position without significant gains or losses. This scenario assumes a balance between positive and negative factors influencing its performance.

Conclusion: Investing Wisely in BigBear.ai Holdings (BBAI) Stock

The future performance of BigBear.ai Holdings (BBAI) stock in 2025 will depend on a complex interplay of macroeconomic factors, company-specific challenges, and unforeseen events. While a bullish scenario is possible, the potential for a decline exists due to competitive pressures, financial performance, and broader economic headwinds. Before making any investment decisions related to the BigBear.ai Holdings (BBAI) stock decline or growth, thorough research and a comprehensive risk assessment are crucial. Stay informed about market trends and company developments to make informed investment choices. Conduct further research on BigBear.ai Holdings (BBAI) stock and other relevant AI companies before investing.

Featured Posts

-

Abc News Show Future In Jeopardy Following Mass Layoffs

May 21, 2025

Abc News Show Future In Jeopardy Following Mass Layoffs

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025 -

Wwe Segment Fallout Inside The Negative Reaction To Tony Hinchcliffes Appearance

May 21, 2025

Wwe Segment Fallout Inside The Negative Reaction To Tony Hinchcliffes Appearance

May 21, 2025 -

Discover The Best Outdoor Restaurants In Manhattan

May 21, 2025

Discover The Best Outdoor Restaurants In Manhattan

May 21, 2025 -

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 21, 2025

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 21, 2025

Latest Posts

-

Significant Drop In Bp Chief Executives Pay Down 31

May 22, 2025

Significant Drop In Bp Chief Executives Pay Down 31

May 22, 2025 -

Bps Chief Executive Sees 31 Pay Reduction

May 22, 2025

Bps Chief Executive Sees 31 Pay Reduction

May 22, 2025 -

The Saskatchewan Political Panel And The Curious Case Of Costco

May 22, 2025

The Saskatchewan Political Panel And The Curious Case Of Costco

May 22, 2025 -

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025 -

Saskatchewans Costco Campaign A Political Panel Perspective

May 22, 2025

Saskatchewans Costco Campaign A Political Panel Perspective

May 22, 2025