BigBear.ai Stock Plunges Following Disappointing Q1 Earnings Report

Table of Contents

Q1 Earnings Miss Expectations

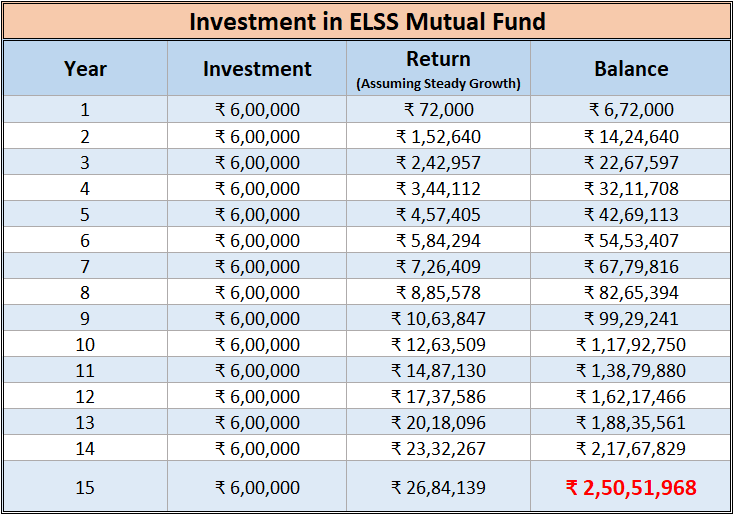

BigBear.ai's Q1 2024 earnings report significantly missed analyst expectations across several key financial metrics. This shortfall triggered the subsequent sell-off in the company's stock price. The disappointing performance underscored challenges faced by the company in navigating the competitive landscape of the AI and government contracting markets.

- Revenue: Revenue came in at $X million (replace X with the actual figure), falling X% short of the consensus analyst estimate of $Y million (replace Y with the actual figure). This significant shortfall indicated weaker-than-anticipated demand for BigBear.ai's products and services.

- Earnings Per Share (EPS): EPS was reported at Y cents (replace Y with the actual figure), significantly lower than the anticipated Z cents (replace Z with the actual figure). This miss reflects the company's struggle to translate revenue into profitability.

- Revised Guidance: The company issued significantly lowered guidance for the full year, further dampening investor sentiment and contributing to the stock price decline. The reduced forecast reflects a more cautious outlook on future performance.

The primary reasons for this underperformance likely stem from a combination of factors, including increased competition, delays in securing lucrative government contracts, and integration challenges following recent acquisitions.

Investor Reaction and Market Sentiment

The market reacted swiftly and negatively to BigBear.ai's disappointing Q1 earnings announcement. The news sparked a sharp sell-off, with trading volume spiking significantly as investors rushed to offload their shares. Market sentiment towards BigBear.ai turned decisively negative, reflecting a loss of confidence in the company's short-term prospects.

- Stock Price Drop: The BigBear.ai stock price experienced a dramatic plunge of X% (replace X with the actual percentage) in the immediate aftermath of the earnings release.

- Increased Trading Volume: Trading volume surged, indicating high levels of investor activity and a significant shift in sentiment.

- Analyst Downgrades: Several analysts downgraded their ratings on BigBear.ai stock, citing concerns about the company's performance and future outlook. Price targets were also significantly reduced.

The overall market response underscores the gravity of the situation and the significant impact of the disappointing Q1 earnings on investor confidence in the AI stock.

Analysis of Underlying Issues

Several underlying factors contributed to BigBear.ai's disappointing Q1 results. Understanding these issues is crucial for assessing the company's long-term prospects and the potential for recovery.

- Increased Competition: The AI market is highly competitive, with numerous established players and emerging startups vying for market share. BigBear.ai's struggle to compete effectively may have contributed to the revenue shortfall.

- Delays in Contract Awards: BigBear.ai's business is heavily reliant on government contracts. Delays in securing these contracts can significantly impact revenue and profitability, as seen in the Q1 results.

- Integration Challenges: Recent mergers and acquisitions can present integration challenges, potentially leading to disruptions in operations and a negative impact on financial performance.

Addressing these underlying issues will be critical for BigBear.ai's future success and regaining investor confidence.

Future Outlook and Implications for Investors

BigBear.ai's revised guidance for the remainder of the year suggests continued challenges ahead. However, the company’s long-term potential in the growing AI and government contracting sectors remains. The outlook, however, is uncertain.

- Revised Guidance: The company has lowered its full-year revenue and earnings expectations, indicating a cautious outlook for the remainder of 2024.

- Potential Risks and Opportunities: BigBear.ai faces risks related to competition, contract delays, and integration difficulties. However, opportunities exist for growth within its core markets.

- Investment Recommendations: Investors should carefully weigh the risks and opportunities before making any investment decisions. A "hold" or "sell" strategy might be prudent in the short term, depending on individual risk tolerance. Further research and monitoring of the company's performance are crucial.

Conclusion: BigBear.ai Stock Plunge: What's Next?

The significant drop in BigBear.ai's stock price following its disappointing Q1 earnings report highlights the challenges facing the company. The revenue shortfall, lower-than-expected EPS, and reduced guidance reflect underlying issues related to competition, contract delays, and integration complexities. Understanding these factors is essential for assessing the company's future prospects. While the short-term outlook appears uncertain, the long-term potential in the AI and government contracting sectors remains. However, investors should proceed with caution and conduct thorough due diligence before making any investment decisions regarding BigBear.ai stock. Stay updated on BigBear.ai’s performance and future earnings reports to make informed investment choices.

Featured Posts

-

Huuhkajien Yllaetyskaeaenne Avauskokoonpanossa Kolme Muutosta

May 20, 2025

Huuhkajien Yllaetyskaeaenne Avauskokoonpanossa Kolme Muutosta

May 20, 2025 -

Efimeries Iatron Stin Patra Savvatokyriako 10 And 11 Maioy

May 20, 2025

Efimeries Iatron Stin Patra Savvatokyriako 10 And 11 Maioy

May 20, 2025 -

Understanding The Drier Weather Forecast For Your Area

May 20, 2025

Understanding The Drier Weather Forecast For Your Area

May 20, 2025 -

Analyzing The D Wave Quantum Qbts Stock Crash Of Monday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Crash Of Monday

May 20, 2025 -

Los Angeles Wildfires And The Gambling Industry A Societal Commentary

May 20, 2025

Los Angeles Wildfires And The Gambling Industry A Societal Commentary

May 20, 2025

Latest Posts

-

Billionaire Boy Inheritance Influence And Impact

May 20, 2025

Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

The Billionaire Boys Guide To Success Or How Not To Be One

May 20, 2025

The Billionaire Boys Guide To Success Or How Not To Be One

May 20, 2025 -

Raising A Billionaire Boy Challenges And Opportunities

May 20, 2025

Raising A Billionaire Boy Challenges And Opportunities

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon

May 20, 2025

Understanding The Billionaire Boy Phenomenon

May 20, 2025 -

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025