BigBear.ai Stock: Risks And Rewards For Investors

Table of Contents

Understanding BigBear.ai's Business Model and Growth Potential

BigBear.ai's core business revolves around providing cutting-edge AI-powered solutions across various sectors. This includes sophisticated AI-driven analytics, robust cybersecurity platforms, and advanced geospatial intelligence tools. Let's delve into the details:

AI-Powered Solutions and Target Markets

BigBear.ai's target markets span the government, defense, and commercial sectors. The company leverages its AI expertise to address critical challenges faced by these industries.

- Government & Defense: This sector represents a substantial market for BigBear.ai's offerings, particularly in areas like intelligence analysis, cybersecurity, and mission support. Market growth projections for this sector are robust, fueled by increasing government investment in AI and national security.

- Commercial Sector: BigBear.ai is expanding its commercial client base, providing AI-driven solutions for data analytics, risk management, and other business-critical applications. The commercial AI market is experiencing exponential growth, presenting significant opportunities for BigBear.ai.

BigBear.ai has secured several key contracts and partnerships that demonstrate its growing market traction and validate its technology. These partnerships provide access to new markets and enhance its competitive standing. However, it's crucial to understand the competitive landscape. BigBear.ai competes with other established players in the AI market, and maintaining a competitive edge requires continuous innovation and strategic partnerships.

Financial Performance and Future Projections

Analyzing BigBear.ai's financial performance is vital for any potential investor. Key financial metrics such as revenue growth, profitability (or lack thereof), and debt levels must be carefully scrutinized.

- Key Financial Metrics: Investors should examine trends in BigBear.ai's revenue, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and net income. Analyzing these metrics over time provides insights into the company's financial health and growth trajectory.

- Future Projections: Reviewing management's guidance and projections for future revenue and earnings offers a glimpse into the company's anticipated performance. However, these projections should be considered with caution, as they are inherently uncertain and subject to market conditions.

- Competitive Benchmarking: Comparing BigBear.ai's financial performance to its competitors in the AI sector provides valuable context and allows for a more informed assessment of its relative strengths and weaknesses.

Assessing the Risks Associated with Investing in BigBear.ai Stock

Investing in BigBear.ai stock involves significant risks. Potential investors must carefully weigh these risks against the potential rewards.

Market Volatility and Sector-Specific Risks

The technology and AI sectors are inherently volatile, prone to significant price swings driven by investor sentiment and market conditions.

- Market Downturns: Technology stocks are often disproportionately affected during market downturns, making BigBear.ai stock susceptible to considerable price fluctuations.

- Regulatory Hurdles: The AI industry faces evolving regulatory landscapes, and changes in regulations could significantly impact BigBear.ai's operations and profitability.

- Technological Disruption: The rapid pace of technological innovation creates a risk of disruption, where newer technologies could render BigBear.ai's offerings obsolete.

Financial Risks and Company-Specific Concerns

BigBear.ai's financial health, including its debt levels, cash flow, and profitability, presents further risks to consider.

- Financial Weaknesses: Investors should carefully examine BigBear.ai's balance sheet for any potential red flags, such as high debt levels or negative cash flow.

- Management Team: Assessing the experience and expertise of the management team is crucial, as their leadership and strategic decisions directly impact the company's success.

- Contract Dependence: BigBear.ai's revenue may be concentrated among a few key contracts. The loss of any significant contract could negatively impact the company's financial performance.

Evaluating the Potential Rewards of Investing in BigBear.ai Stock

Despite the inherent risks, BigBear.ai stock offers significant potential rewards stemming from the growth prospects of the AI market.

Growth Opportunities in the AI Market

The long-term growth potential of the AI market is undeniable. BigBear.ai is well-positioned to capitalize on this growth.

- Increasing AI Adoption: Across various industries, the adoption of AI solutions is accelerating, driving market expansion and creating opportunities for BigBear.ai.

- Market Share Expansion: BigBear.ai has the potential to increase its market share by delivering innovative solutions and expanding its client base.

- Strategic Acquisitions and Partnerships: Acquisitions and strategic alliances could propel BigBear.ai's growth and broaden its market reach.

Potential for Stock Appreciation

The potential for BigBear.ai's stock price to appreciate is directly tied to its growth prospects and market valuation.

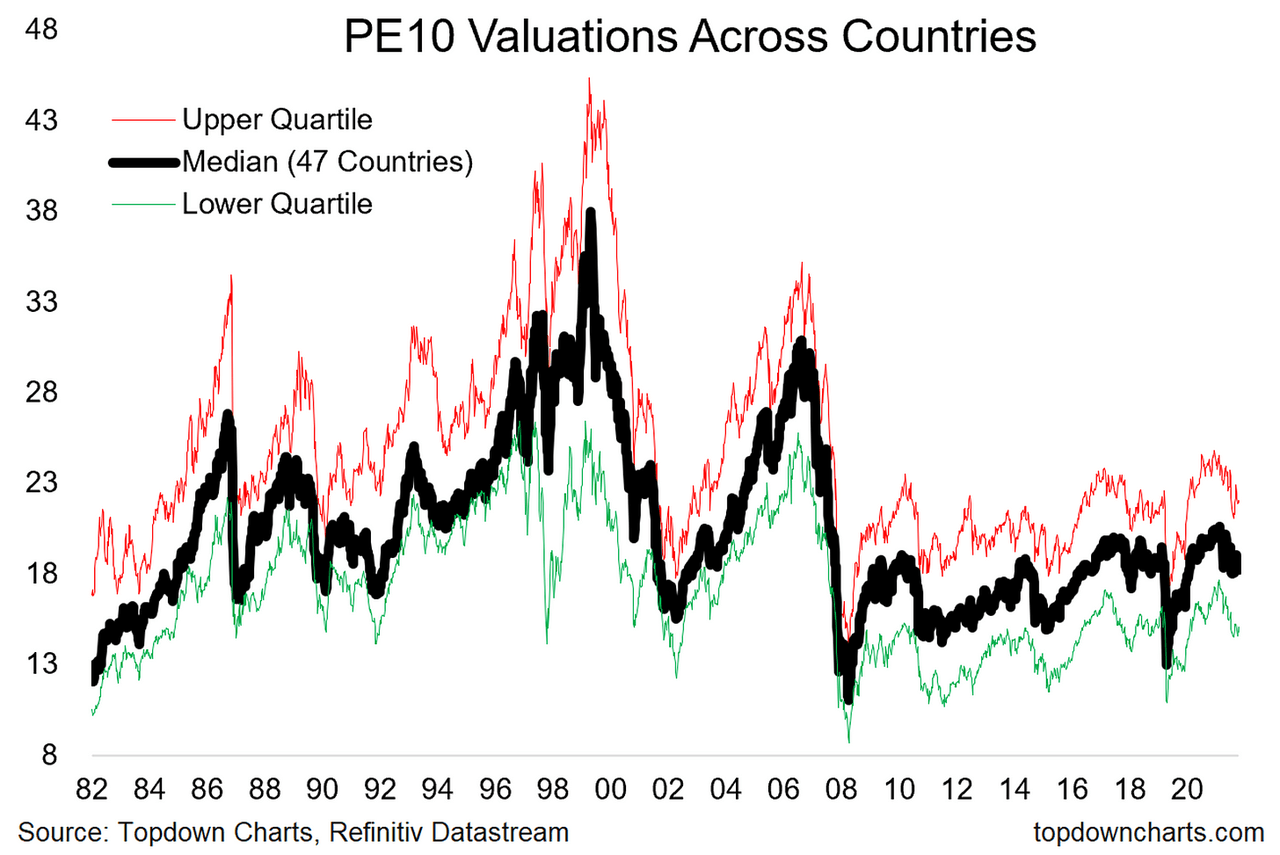

- Valuation Compared to Competitors: Comparing BigBear.ai's valuation multiples (e.g., price-to-earnings ratio) to its competitors provides insights into its relative valuation.

- Catalysts for Appreciation: Positive events such as securing major new contracts, successful product launches, or strategic partnerships can act as catalysts for stock price appreciation.

- Return on Investment: Based on BigBear.ai's growth projections and valuation, investors can estimate potential return on investment scenarios, though this remains highly speculative.

Conclusion

Investing in BigBear.ai stock is a high-risk, high-reward endeavor. While the company operates in a rapidly expanding market with considerable long-term potential, investors must carefully weigh the associated financial risks and market uncertainties before investing. Thorough due diligence, including a comprehensive review of BigBear.ai's financial statements, competitive landscape, and future projections, is absolutely crucial.

Call to Action: Before making any investment decision regarding BigBear.ai stock or any other AI stock, conduct extensive research and consider consulting with a qualified financial advisor. Understanding the risks and rewards of BigBear.ai investment is critical for making informed investment choices.

Featured Posts

-

Preparing For Drier Weather A Practical Guide

May 21, 2025

Preparing For Drier Weather A Practical Guide

May 21, 2025 -

Is Canada Post Insolvent Report Advocates For The Phase Out Of Residential Mail Delivery

May 21, 2025

Is Canada Post Insolvent Report Advocates For The Phase Out Of Residential Mail Delivery

May 21, 2025 -

Mission Patrimoine 2025 Deux Sites Bretons Restaures A Plouzane Et Clisson

May 21, 2025

Mission Patrimoine 2025 Deux Sites Bretons Restaures A Plouzane Et Clisson

May 21, 2025 -

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 21, 2025

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 21, 2025 -

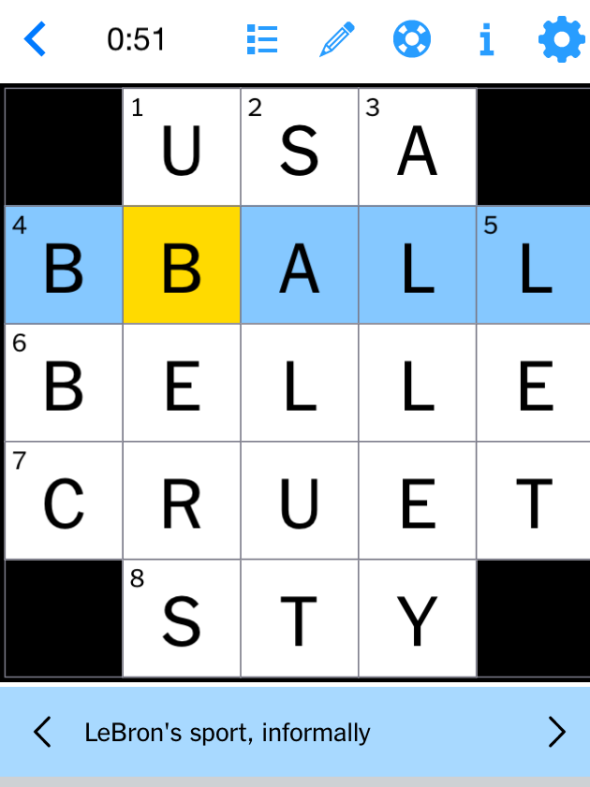

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025

Latest Posts

-

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025 -

Trinidad And Tobago Restricts Dancehall Stars Entry Support From Kartel

May 22, 2025

Trinidad And Tobago Restricts Dancehall Stars Entry Support From Kartel

May 22, 2025 -

Rum Culture And Kartel Insights From Stabroek News

May 22, 2025

Rum Culture And Kartel Insights From Stabroek News

May 22, 2025 -

The Impact Of Kartel On The Rum Industry A Stabroek News Analysis

May 22, 2025

The Impact Of Kartel On The Rum Industry A Stabroek News Analysis

May 22, 2025 -

Understanding Kartels Influence On Guyanese Rum Culture

May 22, 2025

Understanding Kartels Influence On Guyanese Rum Culture

May 22, 2025