Bitcoin Chart Analysis: Analyst Sees Signs Of Impending Rally (May 6th Data)

Table of Contents

Main Points:

2.1. Technical Indicators Suggesting a Bitcoin Price Upswing:

Technical analysis plays a crucial role in predicting Bitcoin's price movements. Analyzing key indicators from May 6th reveals a bullish signal, hinting at a potential price upswing.

2.1.1. Relative Strength Index (RSI) Analysis:

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. On May 6th, the Bitcoin RSI showed a notable shift.

- RSI Value: The RSI broke above the oversold level of 30, indicating a potential reversal of the bearish trend. This suggests buying pressure is increasing.

- Interpretation: This upward movement signifies weakening bearish momentum and growing bullish sentiment. A sustained rise above 50 would strengthen this bullish signal.

- Implications: The RSI suggests a short-term price increase is likely, although confirmation from other indicators is necessary for a long-term prediction.

2.1.2. Moving Average Convergence Divergence (MACD) Analysis:

The MACD is another momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend. Its May 6th reading was equally promising.

- MACD Crossover: A bullish crossover was observed, meaning the MACD line crossed above the signal line. This is a classic bullish signal.

- Upward Momentum: This crossover suggests growing upward momentum and a potential increase in buying pressure.

- Correlation with Price: Historically, bullish MACD crossovers have often preceded Bitcoin price increases.

2.1.3. Volume Analysis:

Analyzing trading volume alongside price action provides further context. On May 6th, volume played a crucial role in strengthening the bullish signal.

- Increased Volume: The price increase on May 6th was accompanied by a noticeable increase in trading volume.

- Confirmation of Trend: This higher volume confirms the strength of the upward movement and reduces the likelihood of a false signal.

- Sustained Growth: Sustained high volume alongside price increases would be a powerful confirmation of the ongoing rally.

2.2. On-Chain Metrics Pointing Towards Increased Bitcoin Accumulation:

On-chain data provides valuable insights into the behavior of Bitcoin holders and network activity, offering further evidence for a potential rally.

2.2.1. Exchange Outflows:

A significant indicator of accumulating bullish sentiment is the movement of Bitcoin out of exchanges.

- Significant Outflows: May 6th saw substantial Bitcoin outflows from major exchanges, suggesting large holders are accumulating rather than selling.

- Institutional Buying: This accumulation often reflects institutional investment and long-term holding strategies, contributing to price support.

- Reduced Selling Pressure: Fewer coins on exchanges mean less readily available supply, potentially driving up the price.

2.2.2. Bitcoin Network Activity:

Increased network activity is another positive sign, reflecting growing investor interest and use of the Bitcoin network.

- Hashrate Stability: The Bitcoin hashrate remained stable on May 6th, demonstrating robust network security and computational power.

- Transaction Fees: While not exceptionally high, transaction fees suggest a moderate level of network activity, consistent with increasing demand.

- Overall Network Health: The combination of these factors indicates a healthy and active network, supporting the bullish outlook.

2.3. External Factors Influencing Bitcoin's Potential Rally:

External factors, such as regulatory developments and macroeconomic conditions, can significantly influence Bitcoin's price.

2.3.1. Regulatory Developments:

Regulatory clarity and positive developments can greatly boost investor confidence.

- Positive Regulatory Sentiment: While specific examples are context-dependent and require further research, positive regulatory announcements from key jurisdictions can create a more favorable environment for Bitcoin investment.

- Increased Institutional Adoption: Clearer regulations can pave the way for increased institutional adoption, fueling demand and potentially driving prices higher.

- Reduced Uncertainty: Reducing regulatory uncertainty encourages greater investment and participation in the Bitcoin market.

2.3.2. Macroeconomic Factors:

Global macroeconomic conditions play a significant role in Bitcoin's price.

- Inflation Hedge: Bitcoin is often viewed as a hedge against inflation. Persistent inflation could drive investors towards Bitcoin as a store of value, increasing demand.

- Interest Rate Impact: Interest rate changes influence the attractiveness of traditional investments. Certain interest rate scenarios could favor Bitcoin's appeal as an alternative asset.

- Economic Uncertainty: Periods of economic uncertainty can often push investors towards safe-haven assets like Bitcoin, leading to increased demand and price appreciation.

Conclusion: Bitcoin Price Predictions and Future Outlook based on May 6th Data

The Bitcoin chart analysis of May 6th data reveals a compelling case for a potential rally. Technical indicators such as the RSI and MACD displayed bullish signals, supported by increased trading volume. On-chain metrics, including significant exchange outflows, indicated growing accumulation by long-term holders. Positive regulatory sentiment and macroeconomic factors further enhance this positive outlook. The combined signals strongly suggest an increase in the likelihood of an impending Bitcoin price increase.

Stay tuned for further Bitcoin chart analysis updates and continue monitoring key indicators to capitalize on this potential Bitcoin rally. Don't miss out on the opportunity to understand the intricacies of Bitcoin chart analysis and improve your trading strategies.

Featured Posts

-

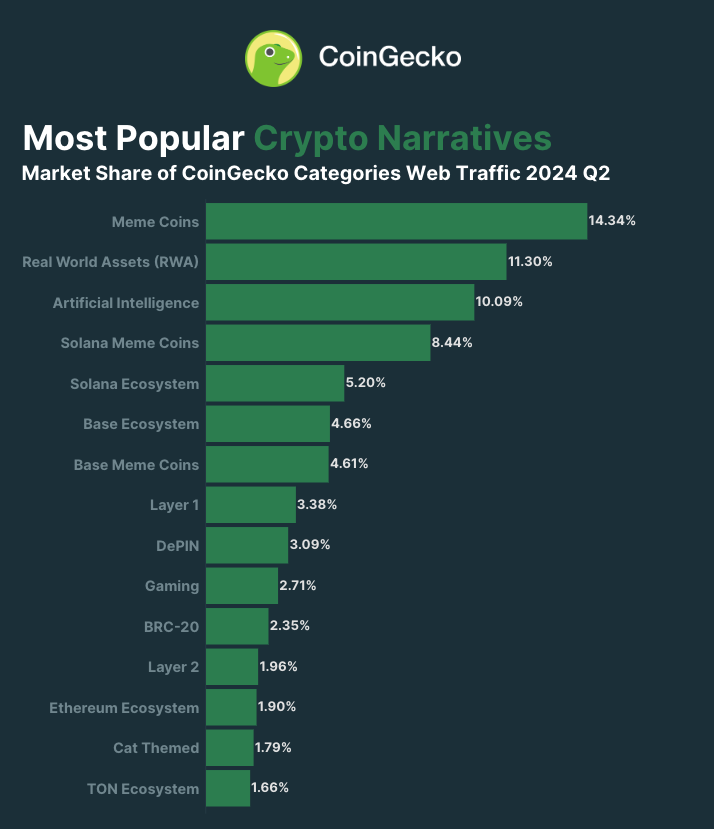

Unforgettable Crypto Narratives A Definitive List

May 08, 2025

Unforgettable Crypto Narratives A Definitive List

May 08, 2025 -

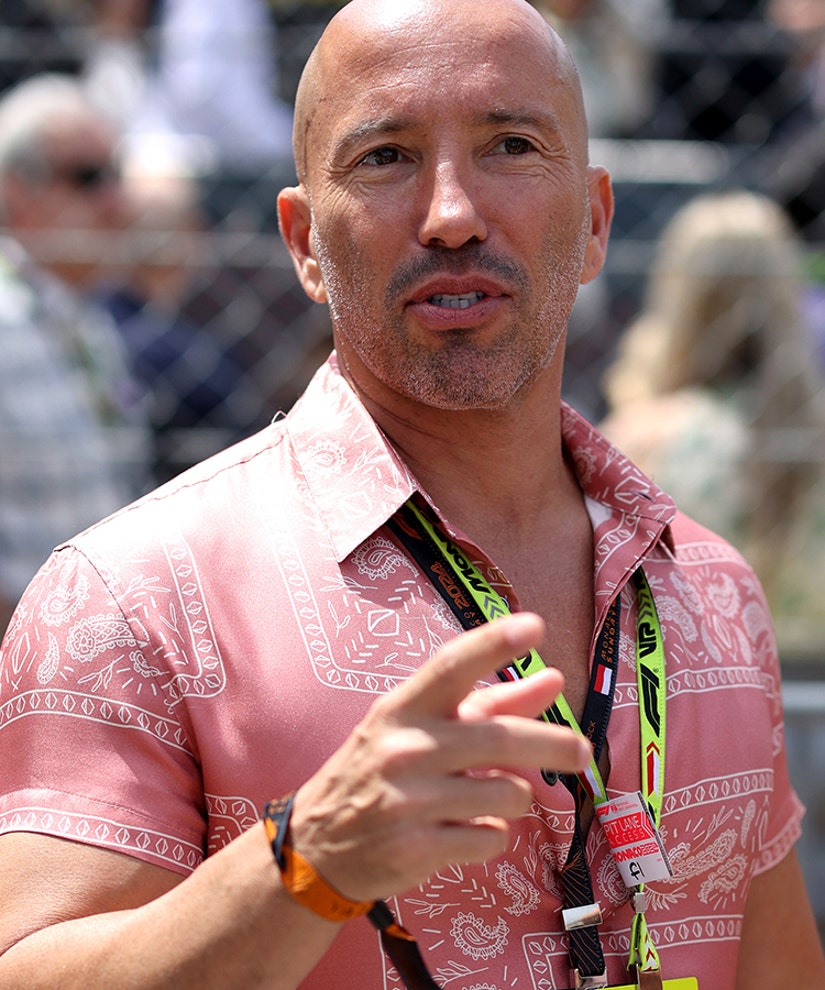

La Fires Fuel Landlord Price Gouging A Selling Sunset Star Speaks Out

May 08, 2025

La Fires Fuel Landlord Price Gouging A Selling Sunset Star Speaks Out

May 08, 2025 -

Tnt Announcers Epic Burn Jayson Tatum Featured In Lakers Celtics Abc Promo

May 08, 2025

Tnt Announcers Epic Burn Jayson Tatum Featured In Lakers Celtics Abc Promo

May 08, 2025 -

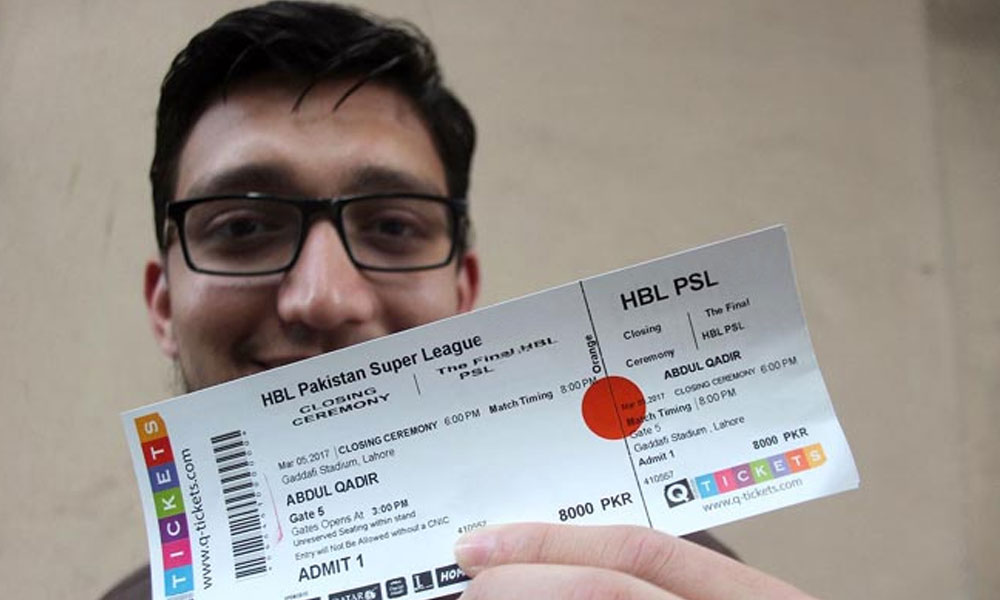

Get Your Psl 10 Tickets Sale Starts Today

May 08, 2025

Get Your Psl 10 Tickets Sale Starts Today

May 08, 2025 -

The Taiwan Dollars Surge Implications For Economic Restructuring

May 08, 2025

The Taiwan Dollars Surge Implications For Economic Restructuring

May 08, 2025