Bitcoin Or MicroStrategy Stock: Your Best Investment Strategy For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin's Volatility and Long-Term Growth

Bitcoin's price is notoriously volatile. However, many believe its long-term growth potential is significant. This potential is driven by several factors:

- Historical Bitcoin price fluctuations and potential future scenarios: Bitcoin's price has experienced dramatic swings, from near-zero to record highs. Predicting future price movements is impossible, but analysts often consider factors like adoption rates and macroeconomic conditions. Some predict continued growth based on increasing institutional adoption and the potential for Bitcoin to become a mainstream store of value.

- Impact of institutional adoption and potential for wider acceptance as a payment method: The growing acceptance of Bitcoin by major corporations and institutional investors signals a shift towards wider legitimacy. Increased adoption as a payment method could fuel further price appreciation.

- Bitcoin as a hedge against inflation: Some investors view Bitcoin as a hedge against inflation, believing its limited supply will protect its value during periods of economic uncertainty. This perception can drive demand and support price increases.

Risks Associated with Bitcoin Investment

Despite its potential, Bitcoin investments carry significant risks:

- Possibility of Bitcoin losing value drastically: Bitcoin's price is highly susceptible to market sentiment and regulatory changes. A sudden drop in value is a real possibility.

- Environmental concerns related to Bitcoin mining: The energy consumption associated with Bitcoin mining is a major concern. Increased regulation aimed at reducing its carbon footprint could impact its price and adoption.

- Complexity of securely storing Bitcoin: Securely storing Bitcoin requires technical knowledge and vigilance. Loss of private keys can result in the irreversible loss of funds.

Evaluating MicroStrategy's Bitcoin Strategy for 2025

MicroStrategy's Bitcoin Holdings and Business Model

MicroStrategy, a business intelligence company, has made a significant bet on Bitcoin, accumulating a substantial amount of BTC. This strategy directly ties its financial performance to Bitcoin's price.

- MicroStrategy's financial reports related to Bitcoin: Analyzing MicroStrategy's financial reports reveals the extent of its Bitcoin holdings and their impact on its overall financial position.

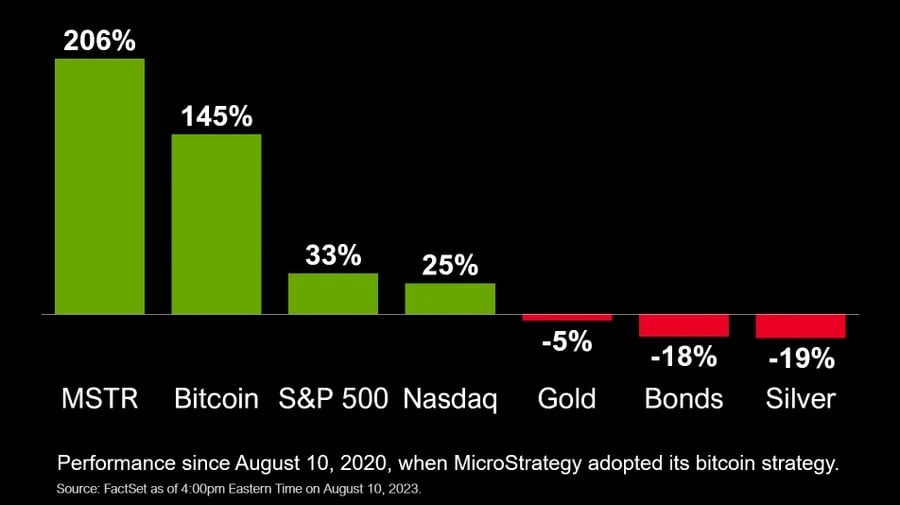

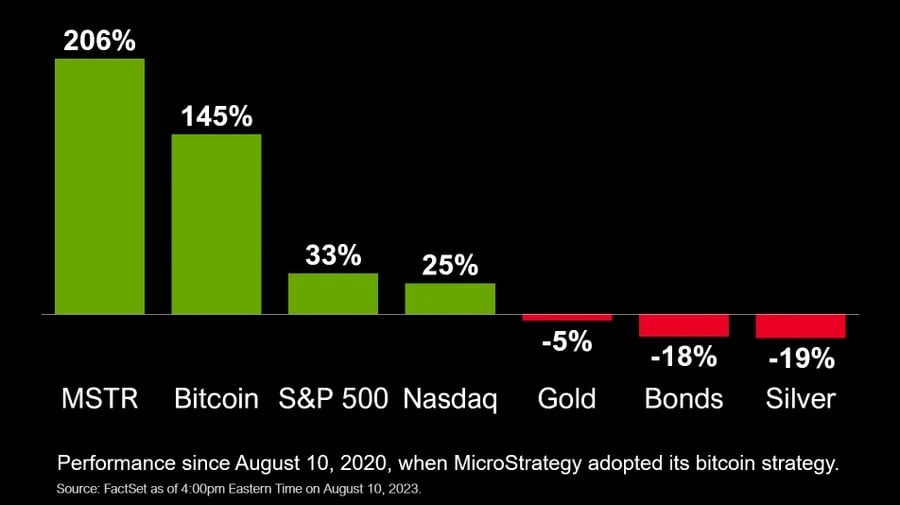

- Correlation between MicroStrategy's stock price and Bitcoin's price: A strong positive correlation exists between MicroStrategy's stock price and the price of Bitcoin. When Bitcoin rises, so does MicroStrategy's stock, and vice versa.

- Potential benefits and risks of investing in a company so heavily reliant on Bitcoin: Investing in MicroStrategy offers exposure to Bitcoin through a more traditional stock market investment. However, it also exposes investors to the volatility of Bitcoin and the specific risks associated with MicroStrategy's business model.

The Risks of Investing in MicroStrategy Stock

Investing in MicroStrategy involves risks beyond Bitcoin's price volatility:

- MicroStrategy's overall financial health and debt levels: Investors should assess MicroStrategy's overall financial health, including its debt levels and profitability outside its Bitcoin holdings.

- Impact of potential Bitcoin price drops on MicroStrategy's stock price: A significant drop in Bitcoin's price could severely impact MicroStrategy's stock price.

- Risks associated with investing in a single company versus diversifying your portfolio: Concentrating investments in a single company, especially one so heavily reliant on a volatile asset, increases risk.

Bitcoin vs. MicroStrategy: A Comparative Analysis for 2025

Risk Tolerance and Investment Goals

Choosing between Bitcoin and MicroStrategy requires careful consideration of your risk tolerance and investment goals.

- Risk/reward profiles: Bitcoin offers higher potential returns but significantly higher risk. MicroStrategy presents a potentially lower risk (relative to pure Bitcoin) but also lower potential rewards.

Investment Risk Level Reward Potential Bitcoin Very High Very High MicroStrategy High Moderate to High - Suitability for different investor profiles: Long-term investors with a high-risk tolerance might find Bitcoin appealing. More risk-averse investors might prefer the relatively lower risk associated with MicroStrategy.

Diversification and Portfolio Management

Diversification is crucial in any investment strategy.

- Allocating funds to either Bitcoin or MicroStrategy within a diversified portfolio: Including either Bitcoin or MicroStrategy (or both, with careful consideration) in a well-diversified portfolio can help manage risk.

Conclusion

The decision to invest in Bitcoin or MicroStrategy stock for 2025 is a complex one, depending heavily on your individual risk tolerance, investment timeframe, and overall portfolio strategy. While Bitcoin offers potentially high rewards but significant volatility, MicroStrategy provides a more established company structure but with substantial reliance on Bitcoin's price performance. Carefully weigh the risks and rewards of each before making a decision. Thorough research and perhaps consultation with a financial advisor are crucial steps before investing in either Bitcoin or MicroStrategy stock to build your optimal investment strategy for 2025. Remember to always diversify your portfolio and invest responsibly.

Featured Posts

-

Once Rejected Now A European Football Icon His Inspiring Journey

May 09, 2025

Once Rejected Now A European Football Icon His Inspiring Journey

May 09, 2025 -

Who Will Succeed Warren Buffett A Look At Potential Canadian Candidates

May 09, 2025

Who Will Succeed Warren Buffett A Look At Potential Canadian Candidates

May 09, 2025 -

Trumps Britain Trade Deal What To Expect

May 09, 2025

Trumps Britain Trade Deal What To Expect

May 09, 2025 -

Stiven King Novaya Ataka Na Trampa I Maska

May 09, 2025

Stiven King Novaya Ataka Na Trampa I Maska

May 09, 2025 -

The Colapinto Doohan Imola F1 Driver Swap Separating Fact From Fiction

May 09, 2025

The Colapinto Doohan Imola F1 Driver Swap Separating Fact From Fiction

May 09, 2025