Who Will Succeed Warren Buffett? A Look At Potential Canadian Candidates

Table of Contents

Evaluating Key Qualities of a Warren Buffett Successor

Identifying Warren Buffett's successor requires a meticulous assessment of several key qualities. Simply replicating his investment strategies isn't enough; a true successor must embody a similar philosophy and possess exceptional leadership skills.

Investment Philosophy Alignment

Buffett's value investing principles are the cornerstone of his success. Finding someone who shares this long-term, value-focused approach is paramount. Value investing prioritizes identifying undervalued assets and holding them for extended periods, capitalizing on long-term growth.

- Value Investing Strategies: Thorough fundamental analysis, identifying companies with strong balance sheets and sustainable competitive advantages, and a patient, long-term outlook.

- Characteristics of a Value Investor: Disciplined approach, risk aversion (calculated risk-taking), contrarian thinking, and an unwavering commitment to thorough due diligence.

- Canadian Value Investing Firms: Several Canadian investment firms, such as [Insert name of a Canadian value investing firm] and [Insert name of another Canadian value investing firm], demonstrate a commitment to value investing principles, potentially nurturing future successors to Warren Buffett.

Business Acumen and Leadership Skills

Beyond shrewd investment strategies, a successful successor to Warren Buffett needs exceptional business acumen and leadership capabilities. Managing vast portfolios, navigating complex market dynamics, and inspiring teams requires strong decision-making skills, effective communication, and an ethical compass.

- Successful Canadian Leadership Examples: [Insert examples of successful Canadian CEOs known for their leadership skills and ethical conduct]. Their approaches to leadership and strategic decision-making offer valuable insights.

- Essential Leadership Qualities: Strategic vision, decisive decision-making, risk management expertise, team-building capabilities, and a commitment to fostering a positive and productive work environment.

- Ethical Leadership: Buffett's reputation is built on integrity and ethical conduct. Any potential successor must similarly uphold the highest ethical standards in their investment practices and business dealings.

Track Record of Success

Demonstrating readiness to succeed Warren Buffett requires a proven track record of success in investment management or a related field. This isn't just about generating high returns; it's about consistently achieving strong risk-adjusted returns while maintaining portfolio diversification.

- Metrics to Consider: Return on Investment (ROI), Sharpe Ratio (risk-adjusted return), Alpha (excess return compared to the benchmark), and portfolio diversification across various asset classes.

- Successful Canadian Investors: [Insert examples of successful Canadian investors with a demonstrable track record of success, linking to their profiles or relevant articles]. Their achievements showcase the potential for Canadian investment leadership.

Potential Canadian Candidates: A Closer Look

While identifying a direct replacement for Warren Buffett is an ambitious goal, several prominent Canadian investors and CEOs demonstrate the qualities necessary to lead in the investment world. Further research and analysis are crucial to fully assess their suitability.

Candidate Profile 1: Mark Wiseman

Mark Wiseman, a prominent figure in Canadian finance, has held leadership roles at various major firms, showcasing his experience in investment management and business leadership. His investment approach blends value principles with a focus on long-term growth. However, his experience primarily centers around institutional investing, which differs significantly from Buffett's approach.

- Investment Approach: Blend of value and growth investing, with a focus on long-term, sustainable returns.

- Key Achievements: [Insert key achievements and career highlights, linking to reputable sources].

- Strengths: Extensive experience in institutional investing, strong leadership skills.

- Potential Weaknesses: Lesser public profile in comparison to Buffett, limited direct experience in the style of investing practiced by Warren Buffett.

Candidate Profile 2: [Name of another prominent Canadian investor/CEO]

[Similar profile as above, focusing on their unique qualifications and potential. Include links to relevant resources.]

The Canadian Investment Landscape and its Relevance

The Canadian investment landscape presents both strengths and challenges in the search for a Warren Buffett successor. Understanding these aspects is crucial for a comprehensive evaluation.

Strengths of the Canadian Market

Canada boasts a stable and well-regulated economy, creating a favorable environment for long-term investment. The presence of several large, well-managed companies offers ample opportunities for value investors.

- Stable Economy: Canada's relatively stable political and economic climate provides a secure foundation for long-term investment strategies.

- Strong Regulatory Environment: Robust regulatory frameworks enhance investor protection and promote market confidence.

- Presence of Large, Well-Managed Companies: Several Canadian companies exhibit characteristics that appeal to value investors, offering potential for long-term growth.

Challenges for Canadian Investors

While Canada offers significant advantages, certain limitations need to be considered. The Canadian market is smaller than its US counterpart, potentially limiting the scale of investment opportunities. Furthermore, the Canadian economy's dependence on certain sectors (e.g., natural resources) introduces specific risks.

- Market Size: Compared to the US, the Canadian market is smaller, providing fewer investment options and potentially limiting diversification opportunities.

- Sector Dependence: The Canadian economy's reliance on specific sectors can create vulnerabilities to external factors impacting those industries.

Conclusion: The Future of Canadian Investment Leadership – Finding Warren Buffett's Successor

Finding a successor to Warren Buffett is a monumental task. This article has highlighted the key qualities needed – a deep understanding of value investing principles, exceptional leadership skills, and a proven track record of success. While the Canadian investment landscape presents both opportunities and challenges, several talented individuals demonstrate the potential to build lasting legacies in the world of finance. The journey to identifying Warren Buffett's successor, be it in Canada or elsewhere, continues. We encourage you to share your thoughts on potential candidates and contribute to the discussion using #BuffettSuccessor. Explore more articles on our site to delve deeper into the world of Canadian investment strategies and learn more about succeeding Warren Buffett.

Featured Posts

-

Characters Connections And The Ectomobile A Photographic Look At Arctic Comic Con 2025

May 09, 2025

Characters Connections And The Ectomobile A Photographic Look At Arctic Comic Con 2025

May 09, 2025 -

The Lasting Impact Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 09, 2025

The Lasting Impact Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 09, 2025 -

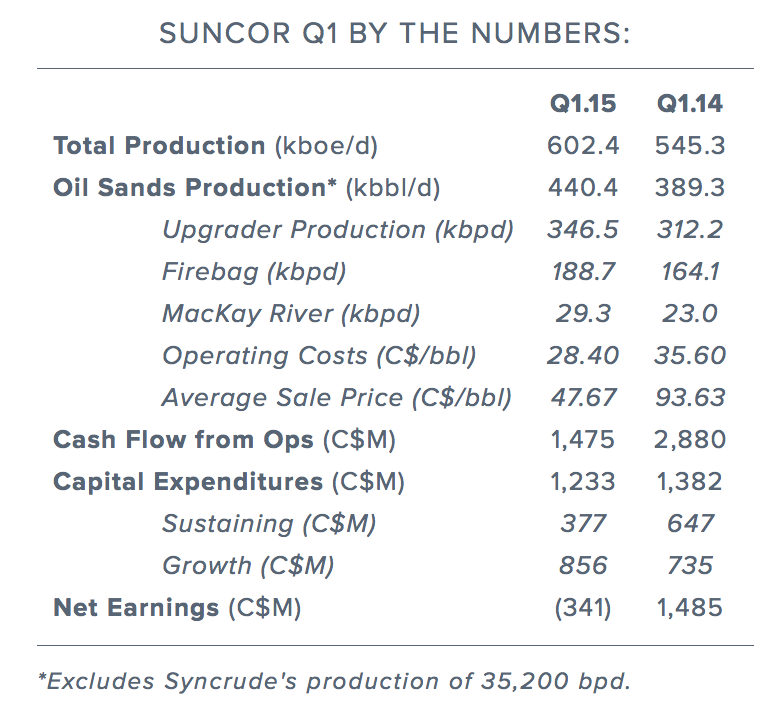

Suncor Hits Record Production Inventory Levels Rise Sales Dip

May 09, 2025

Suncor Hits Record Production Inventory Levels Rise Sales Dip

May 09, 2025 -

Daycare Alternatives Exploring Options For Working Families

May 09, 2025

Daycare Alternatives Exploring Options For Working Families

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025