Bitcoin Price Prediction: Analyst Signals Potential Rally Beginning May 6th (Chart Included)

Table of Contents

The cryptocurrency market is buzzing with speculation, with several analysts pointing towards a potential Bitcoin price rally starting around May 6th. This article delves into the factors contributing to this prediction, analyzing key on-chain metrics, market sentiment, and expert opinions. We'll also present a relevant chart illustrating the potential price trajectory. Is now the time to buy Bitcoin? Let's explore.

Analyst Predictions and Supporting Factors

Several prominent analysts have voiced their opinions on Bitcoin's potential price movement in early May. Their predictions aren't solely based on gut feeling; they're supported by various technical and fundamental analyses.

-

Analyst A's prediction and rationale: Analyst A, known for their accurate Bitcoin price predictions using technical indicators, suggests a potential price increase based on the Relative Strength Index (RSI) nearing oversold territory and a bullish MACD crossover. They believe this indicates a potential reversal in the short term.

-

Analyst B's prediction and their methodology: Analyst B, focusing on fundamental analysis, points to increasing institutional investment and growing adoption of Bitcoin as catalysts for a price surge. Their methodology involves analyzing macroeconomic factors and Bitcoin's market capitalization.

-

Consensus among analysts regarding the potential rally and its timeframe: While specific price targets vary, a consensus is forming among many analysts that a rally is likely to begin around May 6th, potentially lasting for several weeks. This consensus is strengthened by the confluence of technical and fundamental indicators.

Overall market sentiment also plays a crucial role. Currently, although cautious, sentiment shows signs of shifting from bearish to neutral, further bolstering the potential for a price upswing.

On-Chain Data Suggesting a Potential Upswing

On-chain data provides valuable insights into Bitcoin's underlying network activity and can offer clues about future price movements. Several key metrics point towards a potential upswing:

-

Bitcoin's exchange reserves and their correlation with price movements: A decrease in Bitcoin held on exchanges often suggests reduced selling pressure and potential accumulation by long-term holders, which can be bullish for the price.

-

Network activity and transaction volume: Increased network activity and transaction volume indicate growing adoption and usage, which can positively influence the price.

-

Miner behavior and their selling pressure: If miners aren't selling off their Bitcoin holdings at a high rate, it suggests confidence in the future price and reduces downward pressure.

-

Addresses holding significant amounts of Bitcoin and their recent activity: The behavior of "whales"—addresses holding substantial amounts of Bitcoin—is closely watched. A lack of significant selling among whales can signal confidence in the asset's long-term prospects.

These on-chain indicators, when combined, paint a picture consistent with the analysts' predictions of a potential Bitcoin price rally.

Macroeconomic Factors Influencing Bitcoin Price

Macroeconomic conditions significantly influence Bitcoin's price. Several factors are currently at play:

-

Inflation rates and their effect on Bitcoin's safe-haven appeal: High inflation can increase Bitcoin's appeal as a hedge against inflation, driving demand and price appreciation.

-

Regulatory developments and their impact on investor confidence: Clearer and more favorable regulatory frameworks can boost investor confidence and attract further capital into the Bitcoin market.

-

Overall market sentiment and risk appetite: A positive shift in overall market sentiment, particularly in traditional markets, can spill over into the cryptocurrency market, impacting Bitcoin's price.

-

The performance of traditional markets and their correlation with Bitcoin: Bitcoin's price often shows correlation with traditional markets; strong performance in these markets can positively influence Bitcoin's price.

The interplay of these macroeconomic factors adds another layer of support to the predicted price increase, particularly if global economic uncertainty persists.

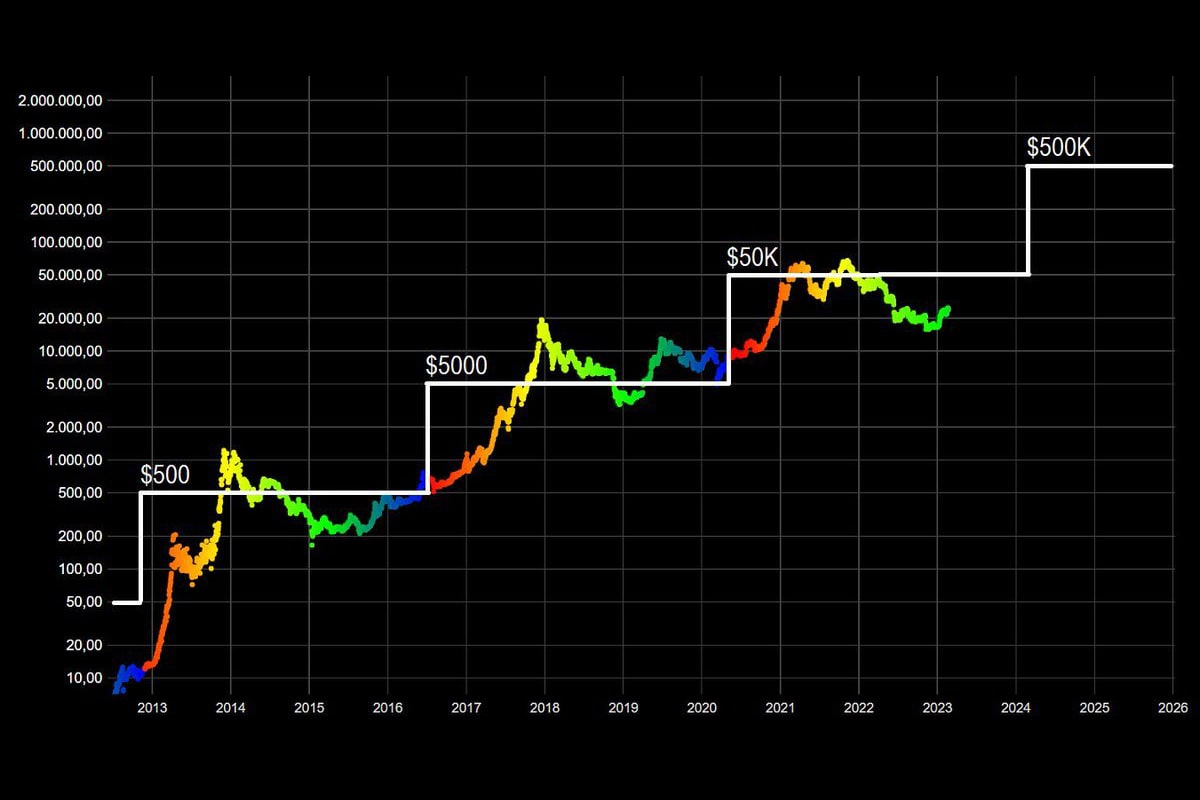

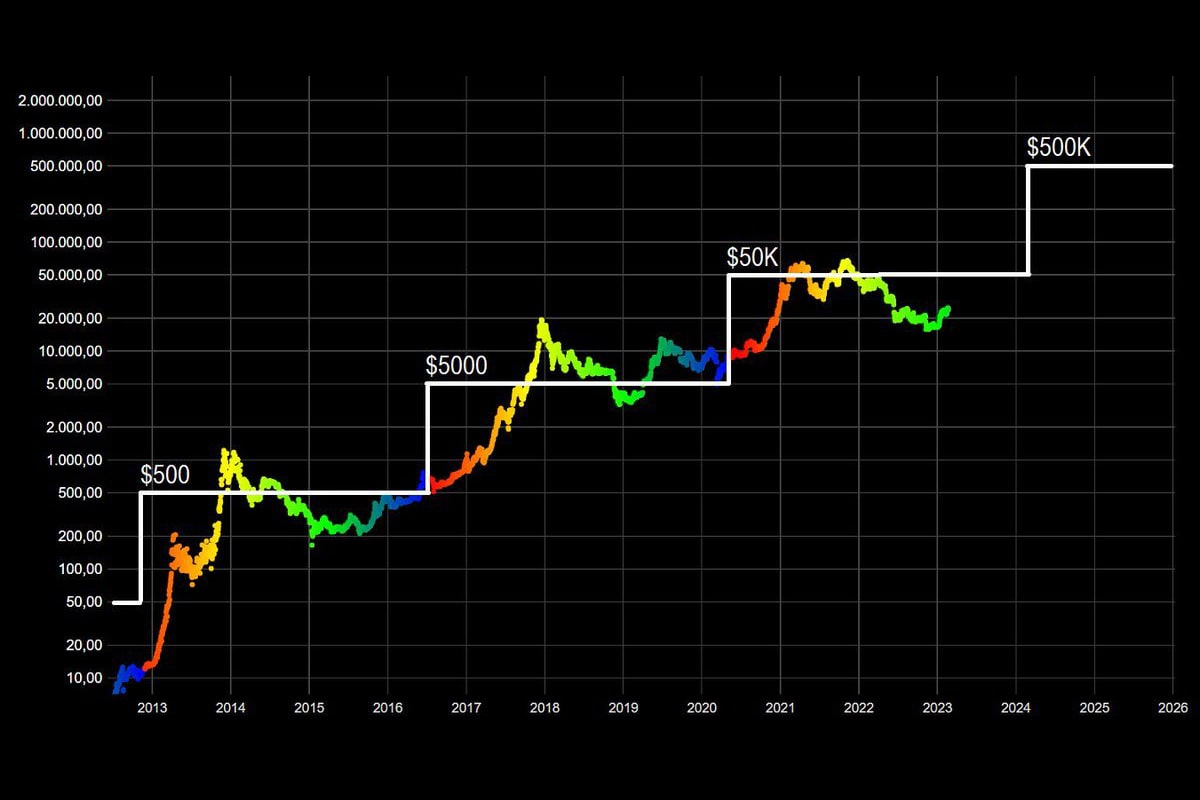

Bitcoin Price Chart Analysis (Include Chart Here)

[Insert Chart Here: A chart showing a potential price trajectory from the current price to a higher projected price around May 6th and beyond. Clearly label axes (Time, Price), significant support and resistance levels, and any relevant indicators used in the analysis.]

This chart illustrates the potential price trajectory based on the confluence of analyst predictions, on-chain data, and macroeconomic factors. Note the projected support levels that could provide a floor for the price during any potential dips, and the resistance levels that could indicate potential selling pressure.

Risk Assessment and Disclaimer

Investing in Bitcoin involves significant risk. The cryptocurrency market is highly volatile, and prices can fluctuate dramatically in short periods. The prediction presented here is not financial advice; it's based on analysis of current market conditions and expert opinions. Past performance is not indicative of future results. Always conduct thorough due diligence and consider your own risk tolerance before investing in Bitcoin or any other cryptocurrency.

Conclusion

This article examined several factors contributing to the prediction of a potential Bitcoin price rally beginning around May 6th. Analysts' predictions, on-chain data, and macroeconomic factors all point towards a possible upswing, though the cryptocurrency market remains inherently volatile. The provided chart offers a visual representation of this potential price movement.

Call to Action: While investing in Bitcoin carries inherent risk, understanding the potential market movements, as highlighted in this Bitcoin price prediction, can inform your investment strategy. Continue researching Bitcoin price predictions and stay updated on the latest market trends before making any investment decisions. Remember to conduct thorough due diligence before investing in any cryptocurrency.

Featured Posts

-

Analysis Berkshire Hathaways Long Term Strategy In The Japanese Trading Sector

May 08, 2025

Analysis Berkshire Hathaways Long Term Strategy In The Japanese Trading Sector

May 08, 2025 -

Is The Dwp Holding Your Universal Credit Hardship Payment Refund

May 08, 2025

Is The Dwp Holding Your Universal Credit Hardship Payment Refund

May 08, 2025 -

Angels Farm System Receives Scathing Review From Mlb Insiders

May 08, 2025

Angels Farm System Receives Scathing Review From Mlb Insiders

May 08, 2025 -

Andor Final Season Cast Provides Behind The Scenes Look At Rogue One Connections

May 08, 2025

Andor Final Season Cast Provides Behind The Scenes Look At Rogue One Connections

May 08, 2025 -

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025