Bitcoin Price Rebound: Long-Term Outlook And Predictions

Table of Contents

Factors Contributing to the Bitcoin Price Rebound

Several converging factors are contributing to the recent Bitcoin price rebound. Understanding these elements is vital for predicting its future performance.

Institutional Investment

Increased adoption by institutional investors is a significant driver of Bitcoin's price appreciation. Large-scale investment firms and corporations are increasingly viewing Bitcoin as a viable asset class, leading to substantial demand.

- Examples of institutional adoption: Grayscale Investments, a leading digital currency asset manager, holds a substantial amount of Bitcoin. MicroStrategy, a publicly traded business intelligence company, has made significant Bitcoin purchases, holding it as a treasury asset. Other notable institutional investors include BlackRock, Fidelity, and several significant pension funds.

- Impact of regulatory clarity on institutional participation: As regulatory clarity emerges in various jurisdictions, more institutional investors feel comfortable allocating capital to Bitcoin. The potential approval of a Bitcoin ETF in the United States could further accelerate institutional adoption.

- Potential for further institutional inflows: The ongoing shift towards digital assets and the limited supply of Bitcoin suggest that further institutional inflows are highly probable, potentially driving prices higher.

Keywords: Institutional Bitcoin adoption, Bitcoin ETF, corporate Bitcoin treasury

Macroeconomic Factors

Global macroeconomic conditions are also influencing Bitcoin's price. Uncertainty in traditional markets and rising inflation are pushing investors towards alternative assets.

- Correlation between inflation and Bitcoin price: Bitcoin is often seen as a hedge against inflation, as its limited supply makes it resistant to the devaluation of fiat currencies. Periods of high inflation tend to increase demand for Bitcoin.

- Bitcoin as a hedge against inflation: Many investors see Bitcoin as a store of value, protecting their portfolios from inflation's erosive effects. This perception drives demand during periods of economic uncertainty.

- Impact of interest rate hikes on Bitcoin price: While interest rate hikes can initially negatively impact Bitcoin's price, the long-term effect depends on several factors, including the overall economic impact of these policies.

Keywords: Bitcoin inflation hedge, macroeconomic impact on Bitcoin, Bitcoin as a safe haven

Technological Advancements

Continuous technological advancements are improving Bitcoin's functionality, scalability, and overall appeal. These innovations address past limitations and attract new users and investors.

- Lightning Network adoption: The Lightning Network is a layer-2 scaling solution that significantly increases Bitcoin's transaction speed and reduces fees. Its growing adoption enhances Bitcoin's usability for everyday transactions.

- Taproot upgrade: The Taproot upgrade improved Bitcoin's privacy and efficiency, making it more attractive to developers and users. This enhances the underlying technology.

- DeFi applications built on Bitcoin: The development of decentralized finance (DeFi) applications built on Bitcoin expands its use cases beyond simple payments, attracting a broader range of users.

- Environmental improvements in Bitcoin mining: The transition towards more sustainable energy sources for Bitcoin mining is also addressing environmental concerns, making it a more socially acceptable investment.

Keywords: Bitcoin scalability, Lightning Network, Bitcoin upgrades, environmental sustainability Bitcoin

Long-Term Outlook for Bitcoin

Predicting Bitcoin's future price with certainty is impossible; however, by analyzing various factors, we can formulate a long-term outlook.

Price Predictions

While providing specific numerical price predictions is speculative and irresponsible, analyzing historical trends, adoption rates, and market sentiment can help understand potential price ranges.

- Discussion of various price prediction models: Fundamental analysis considers factors like adoption rates, technological advancements, and regulatory developments. Technical analysis focuses on chart patterns and historical price movements to predict future trends.

- Limitations of price predictions: Price predictions are inherently uncertain and influenced by numerous unpredictable events. They should be treated as potential scenarios rather than guaranteed outcomes.

- Factors influencing long-term price growth: Continued adoption by institutions and individuals, increasing regulatory clarity, and further technological advancements are key drivers of long-term price growth.

Keywords: Bitcoin price prediction, Bitcoin future price, Bitcoin market analysis, Bitcoin long-term investment

Regulatory Landscape

Government regulations and policies significantly impact Bitcoin's future trajectory. The regulatory environment varies widely across different countries.

- Impact of regulatory frameworks in different countries: Some countries have embraced a more favorable regulatory approach towards cryptocurrencies, while others remain cautious or even hostile. This variation impacts market dynamics.

- Potential for increased regulatory clarity: Increased regulatory clarity in major markets could boost investor confidence and further fuel Bitcoin's price growth.

- Effects of potential bans or restrictions: Bans or severe restrictions on Bitcoin in major economies would likely negatively impact its price and adoption.

Keywords: Bitcoin regulation, Bitcoin legal framework, cryptocurrency regulation, government Bitcoin policy

Risks and Challenges Facing Bitcoin

Despite the positive outlook, Bitcoin faces significant risks and challenges. Understanding these is crucial for making informed investment decisions.

Volatility

Bitcoin's price is highly volatile, posing considerable risks to investors. Significant price swings can occur in short periods.

- Discussion of factors contributing to volatility: Market sentiment, regulatory uncertainty, security breaches, and macroeconomic events all contribute to Bitcoin's volatility.

- Strategies for managing risk: Investors can mitigate risks through diversification, dollar-cost averaging (investing a fixed amount regularly), and careful risk assessment.

Keywords: Bitcoin volatility, Bitcoin risk management, Bitcoin investment risks

Security Concerns

Security breaches and hacks remain a persistent threat to the Bitcoin ecosystem.

- Discussion of prominent hacks: While Bitcoin's underlying technology is secure, exchanges and individual wallets are vulnerable to hacking.

- Importance of secure storage practices: Utilizing hardware wallets and practicing cold storage (offline storage) are essential for protecting Bitcoin holdings.

- Measures taken to improve security: The Bitcoin community constantly works to enhance security protocols and address vulnerabilities.

Keywords: Bitcoin security, Bitcoin wallet security, Bitcoin hacking, cryptocurrency security

Conclusion

The recent Bitcoin price rebound offers a glimpse into its potential for long-term growth. While significant challenges and risks remain, factors like increasing institutional adoption, technological advancements, and potential regulatory clarity contribute to a cautiously optimistic outlook. However, it's crucial to conduct thorough research and understand the inherent volatility before investing in Bitcoin. Stay informed on the latest developments in the Bitcoin market to make informed decisions about your Bitcoin investment strategy. By carefully considering the factors discussed, you can develop a sound Bitcoin investment strategy and navigate the market effectively.

Featured Posts

-

Bristol Airport Stalking Arrest Polish Womans Mc Cann Connection

May 09, 2025

Bristol Airport Stalking Arrest Polish Womans Mc Cann Connection

May 09, 2025 -

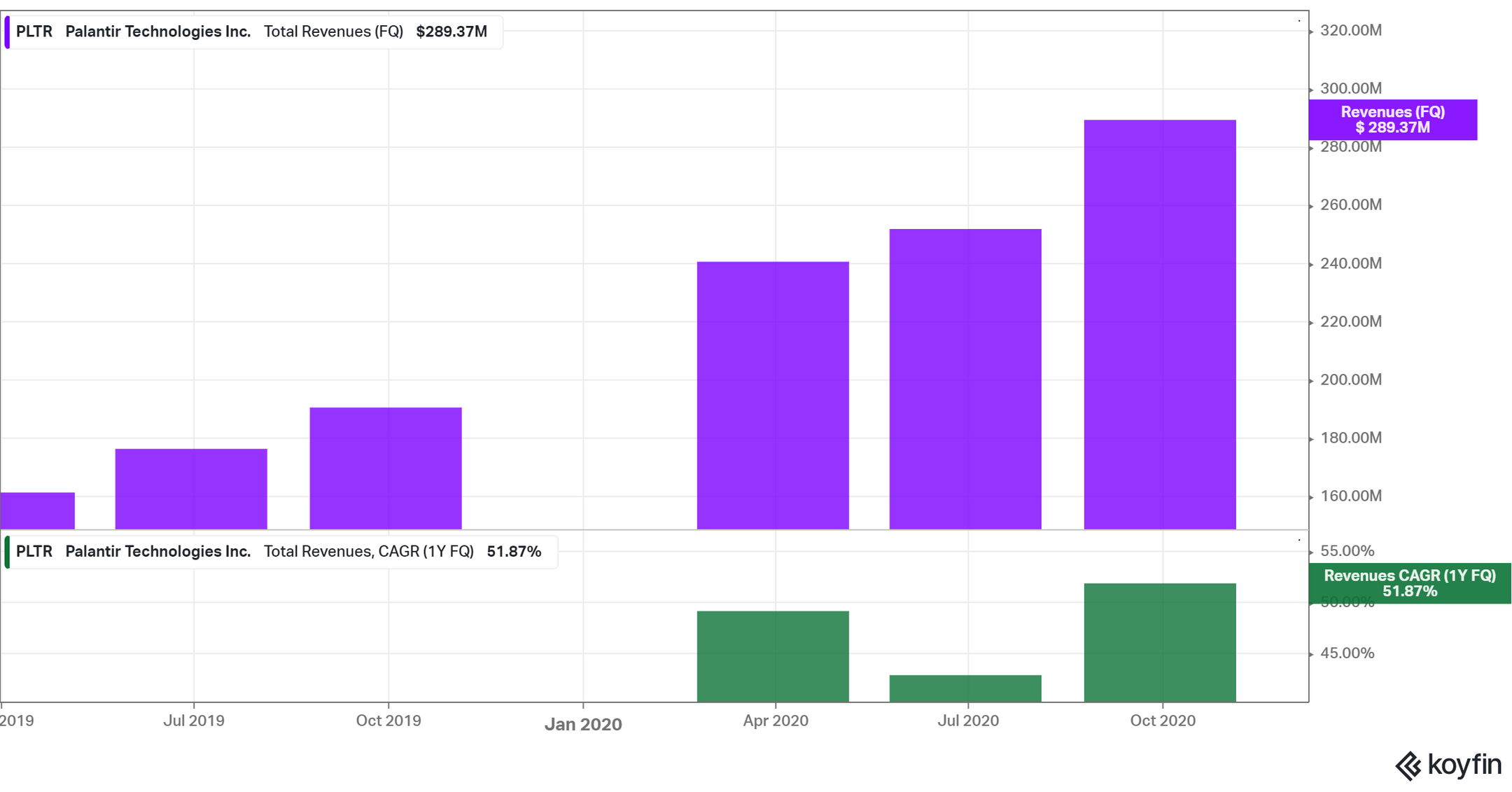

Analyzing Palantir Stock Before The May 5th Earnings Announcement

May 09, 2025

Analyzing Palantir Stock Before The May 5th Earnings Announcement

May 09, 2025 -

Dijon Et Gustave Eiffel Une Relation Mere Fils Revelee

May 09, 2025

Dijon Et Gustave Eiffel Une Relation Mere Fils Revelee

May 09, 2025 -

Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025

Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025 -

Pam Bondis Laughter Amidst James Comers Epstein Files Discussion

May 09, 2025

Pam Bondis Laughter Amidst James Comers Epstein Files Discussion

May 09, 2025