Bitcoin's Potential: A Growth Investor Forecasts A 1,500% Increase

Table of Contents

The Bull Case for Bitcoin: Why a 1,500% Increase is Possible

The potential for a 1500% Bitcoin return isn't just wishful thinking; several strong arguments support this bullish prediction.

Increasing Institutional Adoption

Large financial institutions are increasingly embracing Bitcoin, signaling a shift towards mainstream acceptance. This institutional adoption is a key driver for future Bitcoin growth.

- Examples: MicroStrategy's significant Bitcoin holdings, Tesla's acceptance of Bitcoin as payment, and the growing interest from other major corporations show a clear trend.

- Impact: Institutional buying helps stabilize prices, reducing volatility and fostering long-term growth. Large-scale investments inject significant capital into the market, boosting demand.

- Regulatory Clarity (or Lack Thereof): While regulatory uncertainty remains a factor, increasing clarity in some jurisdictions could unlock even greater institutional investment. Greater regulatory clarity reduces risk for institutional investors.

Scarcity and Deflationary Nature

Bitcoin's inherent scarcity is a cornerstone of its value proposition. Only 21 million Bitcoin will ever exist.

- Comparison to Gold: Unlike fiat currencies that can be printed infinitely, Bitcoin's limited supply makes it comparable to precious metals like gold, a store of value with inherent scarcity.

- Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, creates further scarcity and historically has been followed by price appreciation.

- Deflationary Currency: Bitcoin's deflationary nature is attractive to investors seeking protection against inflation. As demand increases and supply remains fixed, the value tends to appreciate.

Growing Global Adoption and Use Cases

Bitcoin's adoption is expanding beyond speculation, with growing use cases as a store of value, payment method, and within the burgeoning DeFi (Decentralized Finance) space.

- Examples: El Salvador's adoption of Bitcoin as legal tender showcases the potential for nationwide acceptance.

- Merchant Adoption: An increasing number of businesses are accepting Bitcoin as payment, widening its practical application.

- Bitcoin-Based Financial Services: The rise of Bitcoin-based lending, borrowing, and other financial services further enhances its utility and potential for growth.

Addressing the Risks and Challenges

While the potential for significant gains is undeniable, investing in Bitcoin involves substantial risks.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile, subject to significant swings based on market sentiment and news events.

- Historical Fluctuations: Reviewing Bitcoin's historical price charts reveals periods of dramatic increases and equally sharp decreases.

- Risk Management: Diversification and careful risk management strategies are crucial for mitigating losses. Don't invest more than you can afford to lose.

- Market Sentiment: News events, regulatory changes, and overall market sentiment heavily influence Bitcoin's price.

Regulatory Uncertainty and Government Intervention

Governments worldwide are grappling with how to regulate cryptocurrencies, and this regulatory uncertainty creates risk.

- Regulatory Actions: Various countries have implemented different regulatory frameworks, some more favorable to Bitcoin than others.

- Future Regulations: The evolving regulatory landscape could significantly impact Bitcoin's price. Increased regulation might stifle growth, while favorable regulations could boost it.

- Staying Informed: Staying abreast of regulatory developments is essential for informed investment decisions.

Security Risks and Scams

The cryptocurrency space unfortunately attracts scams and security breaches.

- Reputable Exchanges and Wallets: Using reputable exchanges and wallets is crucial to minimize the risk of theft or fraud.

- Security Best Practices: Employing strong passwords, two-factor authentication, and other security measures is paramount.

- Holding Large Amounts: Holding large amounts of Bitcoin in a single location increases vulnerability to hacking and theft.

The Investor's Perspective and Methodology

(This section would ideally include details on the specific investor's analysis, methodology, and reasoning behind the 1500% prediction. Quotes from the investor would add significant credibility.) For example, the investor might base their prediction on quantitative analysis of adoption rates, network effects, and macroeconomic factors.

Conclusion

The potential for a significant Bitcoin price increase is supported by increasing institutional adoption, the inherent scarcity of Bitcoin, and its expanding global usage. However, the inherent volatility, regulatory uncertainty, and security risks must be carefully considered. This analysis suggests that Bitcoin’s potential is substantial, although the path won't be without its challenges.

Explore the potential of Bitcoin for yourself through thorough research and understanding of the associated risks. Consider adding Bitcoin to your portfolio as part of a diversified investment strategy, but only after carefully assessing your risk tolerance and conducting your own due diligence. Bitcoin, with its disruptive technology and potential for long-term growth, remains a fascinating asset in the evolving world of finance.

Featured Posts

-

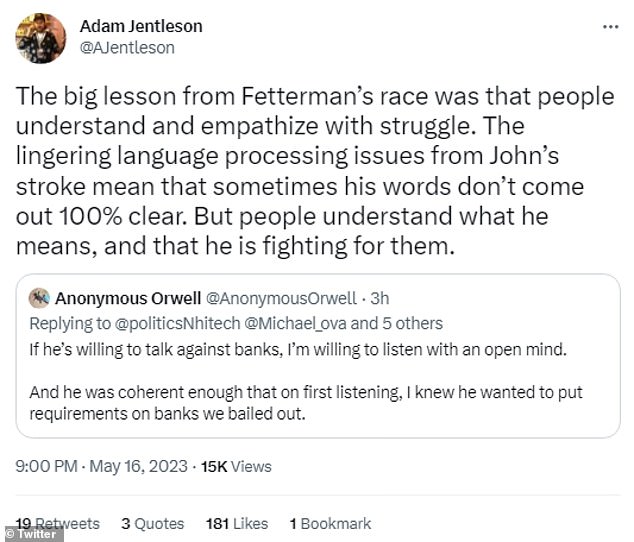

John Fettermans Response To Ny Magazines Health Concerns

May 08, 2025

John Fettermans Response To Ny Magazines Health Concerns

May 08, 2025 -

Gjranwalh Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Jan Bhq

May 08, 2025

Gjranwalh Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Jan Bhq

May 08, 2025 -

Unlock Uber One Free Deliveries And Savings In Kenya

May 08, 2025

Unlock Uber One Free Deliveries And Savings In Kenya

May 08, 2025 -

Ella Mai And Jayson Tatums Baby Confirmation In New Commercial

May 08, 2025

Ella Mai And Jayson Tatums Baby Confirmation In New Commercial

May 08, 2025 -

Lahwr Ke Askwlwn Ka Py Ays Ayl Ke Baeth Awqat Kar Tbdyl

May 08, 2025

Lahwr Ke Askwlwn Ka Py Ays Ayl Ke Baeth Awqat Kar Tbdyl

May 08, 2025