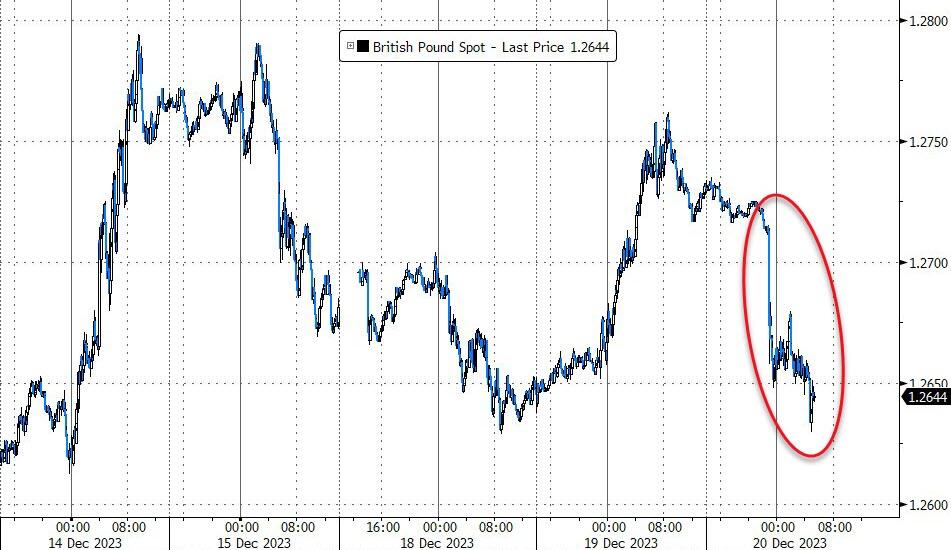

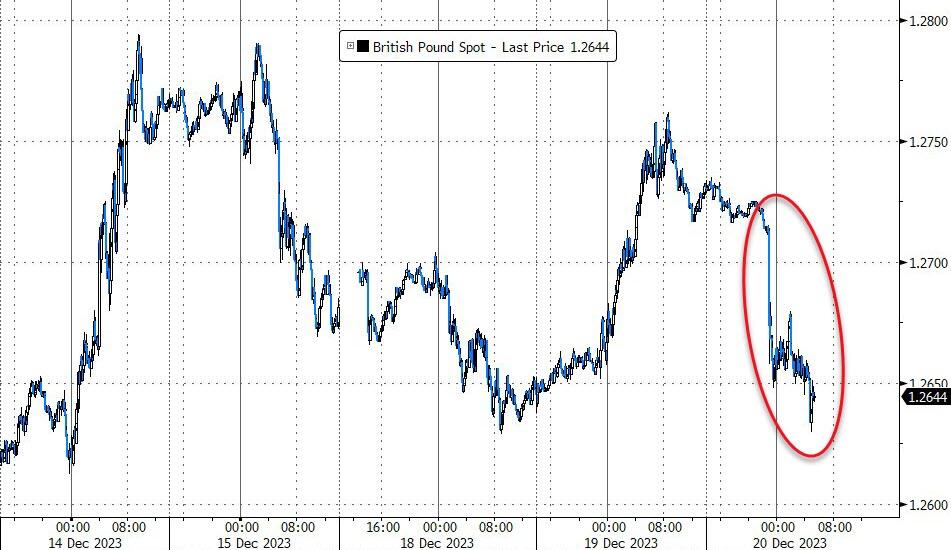

BOE Rate Cut Odds Fall: Pound Gains Momentum Following UK Inflation Report

Table of Contents

UK Inflation Data Surprises Markets

Sticky Inflation Remains a Concern

Despite expectations of a decline, inflation remained stubbornly high in the UK. This suggests the BOE's fight against inflation is far from over and significantly impacts the likelihood of a BOE rate cut.

- CPI figures exceeded analyst predictions, fueling concerns about persistent inflationary pressures. The higher-than-anticipated Consumer Price Index (CPI) reading solidified fears that inflation is more entrenched than previously thought.

- Core inflation, which excludes volatile elements like energy and food, also remained elevated, indicating underlying price pressures within the UK economy. This persistent core inflation is a key factor driving the BOE's monetary policy decisions and reducing the chances of a near-term interest rate cut.

- The data points to a more prolonged period of higher interest rates than previously anticipated. The market consensus now leans toward a longer period of restrictive monetary policy to curb inflation, making a BOE rate cut less probable in the short term.

Impact on BOE Monetary Policy Expectations

The unexpected inflation figures significantly reduce the probability of an imminent rate cut by the Bank of England. The BOE is now more likely to maintain, or even slightly increase, interest rates in the coming months.

- Market expectations for a rate cut have been significantly revised downwards, reflected in the pricing of interest rate futures contracts. Traders are adjusting their positions based on the new inflation data, pricing in a lower probability of a BOE rate cut.

- Analysts are now forecasting a prolonged period of higher interest rates to combat inflation. Many economic experts predict that interest rates will remain elevated for an extended period to successfully quell inflation.

- The BOE's next meeting will be crucial in determining the future direction of monetary policy. The upcoming Monetary Policy Committee (MPC) meeting will be closely watched by markets worldwide, as it will provide further insight into the BOE's response to the latest inflation figures.

Pound Sterling Gains Momentum

Strengthening GBP Against Major Currencies

The reduced likelihood of a BOE rate cut has boosted investor confidence in the Pound, leading to its appreciation against the US dollar, Euro, and other major currencies. A stronger Pound is a direct consequence of the reduced expectations of a BOE rate cut.

- GBP/USD exchange rate shows a noticeable increase following the inflation report. The Pound has strengthened against the US dollar, reflecting the shift in market sentiment.

- GBP/EUR also experienced gains, reflecting improved market sentiment towards the UK economy. The Pound’s appreciation is not limited to the US dollar; it has also strengthened against other major currencies like the Euro.

- This strengthens the purchasing power of the Pound for UK businesses and consumers. A stronger Pound makes imports cheaper and could, in the long run, help to alleviate cost-of-living pressures.

Implications for UK Economy

The stronger Pound could impact UK exports, making them more expensive for international buyers and potentially impacting economic growth. Conversely, it reduces the cost of imports, potentially easing inflationary pressures in the long term. The implications for the UK economy are complex and multifaceted.

- Export-oriented sectors could experience reduced demand due to the stronger Pound. UK businesses selling goods and services overseas might face reduced competitiveness as their products become more expensive for foreign buyers.

- Lower import costs could help to alleviate inflationary pressures. Cheaper imports can help to moderate price increases for consumers and businesses.

- The overall impact on the UK economy remains complex and will depend on several factors. The net effect of the stronger Pound will depend on various elements, including the elasticity of demand for UK exports and the magnitude of import price reductions.

Conclusion

The unexpectedly high UK inflation figures have significantly altered the outlook for BOE interest rates, decreasing the odds of a rate cut. This has led to a surge in the Pound Sterling, causing it to appreciate against key global currencies. While a stronger Pound offers certain benefits, it also presents challenges for UK exporters. The situation remains dynamic, and investors should closely monitor future economic data and BOE announcements for further insights into the direction of monetary policy and the Pound Sterling’s trajectory. Stay informed on all things BOE Rate Cut related, including analyses of future UK Inflation reports and their impact on Pound Sterling exchange rates, for the latest updates.

Featured Posts

-

The Leaving Neverland Fallout Examining Kieran Culkins Involvement

May 23, 2025

The Leaving Neverland Fallout Examining Kieran Culkins Involvement

May 23, 2025 -

Pivdenniy Mist Detali Pro Remont Pidryadnikiv Ta Finansuvannya

May 23, 2025

Pivdenniy Mist Detali Pro Remont Pidryadnikiv Ta Finansuvannya

May 23, 2025 -

Lluvias Moderadas La Prediccion Meteorologica Del Dia

May 23, 2025

Lluvias Moderadas La Prediccion Meteorologica Del Dia

May 23, 2025 -

Karate Kid Legend Of The Karate Kid Early Reviews Praise Chan And Macchios Performances

May 23, 2025

Karate Kid Legend Of The Karate Kid Early Reviews Praise Chan And Macchios Performances

May 23, 2025 -

European Midday Briefing Stock Market Dip On Pmi Data

May 23, 2025

European Midday Briefing Stock Market Dip On Pmi Data

May 23, 2025

Latest Posts

-

Top Deals On Memorial Day 2025 Shopping Editors Selections

May 23, 2025

Top Deals On Memorial Day 2025 Shopping Editors Selections

May 23, 2025 -

Expert Curated Memorial Day Sales And Deals For 2025

May 23, 2025

Expert Curated Memorial Day Sales And Deals For 2025

May 23, 2025 -

Memorial Day 2025 Find The Best Sales And Deals Here

May 23, 2025

Memorial Day 2025 Find The Best Sales And Deals Here

May 23, 2025 -

Forbes Top Picks Memorial Day Appliance Sales 2025

May 23, 2025

Forbes Top Picks Memorial Day Appliance Sales 2025

May 23, 2025 -

The Last Rodeo Neal Mc Donoughs Unexpected Challenge

May 23, 2025

The Last Rodeo Neal Mc Donoughs Unexpected Challenge

May 23, 2025