BofA Reassures Investors: High Stock Market Valuations Explained

Table of Contents

BofA's Rationale Behind High Stock Market Valuations

BofA's analysis points to several key fundamentals supporting current stock market valuations, despite the apparent high price tags. Their arguments center around continued economic strength and robust corporate performance.

- Strong Corporate Earnings Growth: Despite inflationary pressures, many companies have demonstrated impressive earnings growth. BofA highlights the resilience of numerous sectors, demonstrating that businesses are adapting and maintaining profitability. This strong earnings performance justifies, in their view, a higher price-to-earnings (P/E) ratio for many stocks.

- Resilient Consumer Spending: Consumer spending remains a significant driver of economic growth, suggesting a healthy underlying economy. While inflation is impacting purchasing power, BofA's analysis suggests that consumer demand remains relatively robust, supporting continued corporate profitability.

- Interest Rate Impact: BofA acknowledges the impact of rising interest rates on valuations. However, their analysis suggests that the current rate increases are largely anticipated and factored into current market pricing. They believe the effect will be gradual and manageable.

- Historical Context: BofA's research compares current valuations to historical data and other relevant market indicators. Their analysis suggests that while valuations are elevated, they are not necessarily unprecedented, especially considering the strong earnings growth and projected economic performance.

Factors Contributing to High Stock Market Valuations

Several broader economic and market forces are contributing to the high stock market valuations observed today.

- Low Interest Rates (Historically): While interest rates are rising, historically low rates over the past decade fueled substantial investment in equities, driving up prices. This prolonged period of low borrowing costs encouraged companies to invest and expand, further boosting stock valuations.

- Technological Innovation: Breakthroughs in technology continue to drive significant growth in specific sectors, particularly in areas like artificial intelligence, cloud computing, and renewable energy. These high-growth sectors command premium valuations due to their potential for substantial future returns.

- Monetary Policy: Quantitative easing and other expansionary monetary policies implemented in response to the global financial crisis and the COVID-19 pandemic significantly increased liquidity in the market, contributing to higher asset prices, including stocks.

- Valuation Metrics: Understanding key valuation metrics like the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and market capitalization is crucial. While some metrics indicate high valuations, others show more moderate levels, providing a complex picture of the overall market.

Assessing Risks Associated with High Stock Market Valuations

While BofA's analysis presents a positive outlook, it's crucial to acknowledge the potential risks associated with high valuations.

- Market Corrections: The possibility of a market correction or even a more significant downturn remains a real risk. High valuations make the market more susceptible to sharp declines if investor sentiment shifts negatively.

- Inflationary Pressures: Persistently high inflation could erode corporate earnings, impacting stock prices. The ability of companies to pass on increased costs to consumers will significantly affect their profitability.

- Interest Rate Hikes: Further interest rate hikes by central banks could dampen economic growth and reduce investor appetite for equities, potentially leading to lower valuations.

- Recession Risk: Concerns about a potential recession remain a significant risk factor. A recession would likely lead to lower corporate earnings and a decline in stock prices. Diversifying one's portfolio is a key strategy to mitigate such risks.

BofA's Investment Recommendations and Strategies

BofA's advice to investors focuses on a balanced approach, considering both the potential for further growth and the risks involved.

- Sector Analysis: BofA emphasizes the importance of sector-specific analysis, identifying opportunities within sectors that are less sensitive to interest rate increases or inflation.

- Risk Tolerance: Investors are encouraged to adjust their investment strategies based on their individual risk tolerance. More risk-averse investors might consider reducing their equity exposure and increasing their allocation to bonds or other fixed-income instruments.

- Long-Term Investment: BofA generally recommends a long-term investment horizon, suggesting that investors should focus on the long-term growth potential of their investments rather than short-term market fluctuations.

- Portfolio Diversification: Diversification across different asset classes and sectors remains a key recommendation for managing risk and mitigating potential losses.

Conclusion

BofA's assessment of high stock market valuations presents a nuanced perspective, acknowledging both the underlying strengths of the economy and the associated risks. While factors like strong corporate earnings and resilient consumer spending support current valuations, the potential impact of inflation, interest rate hikes, and recessionary risks cannot be ignored. Understanding these complexities is crucial for making informed investment decisions. Before making any investment choices based on BofA’s analysis of high stock market valuations, consult with a qualified financial advisor and conduct thorough research. Explore BofA's reports and market analysis for a more comprehensive understanding of the current market environment and potential investment strategies. Careful consideration of stock market valuations and associated risks is essential for successful long-term investing.

Featured Posts

-

Nintendos Action Ryujinx Emulator Project Shut Down

May 19, 2025

Nintendos Action Ryujinx Emulator Project Shut Down

May 19, 2025 -

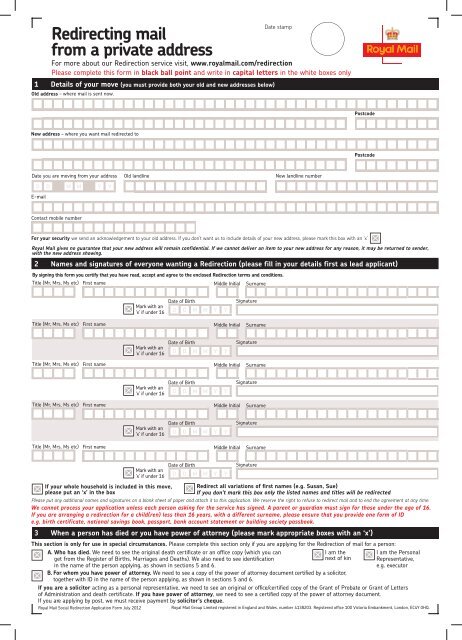

How To Change Your Postal Address With Royal Mail A Simple Guide

May 19, 2025

How To Change Your Postal Address With Royal Mail A Simple Guide

May 19, 2025 -

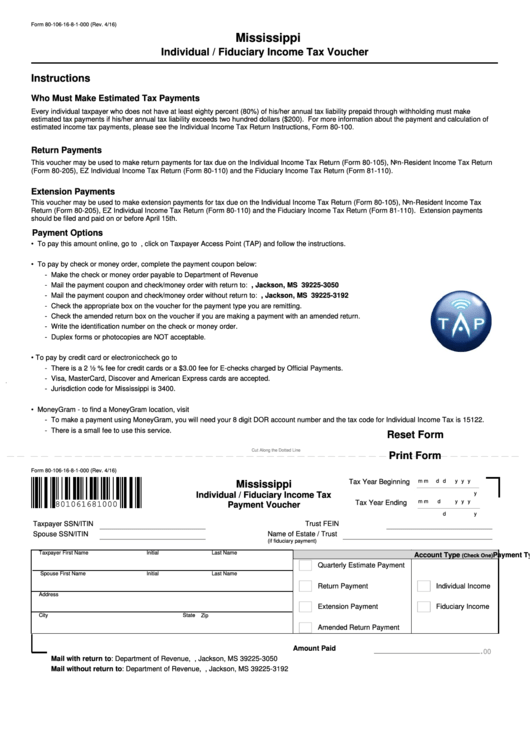

The End Of Mississippi Income Tax What Does It Mean For Hernando

May 19, 2025

The End Of Mississippi Income Tax What Does It Mean For Hernando

May 19, 2025 -

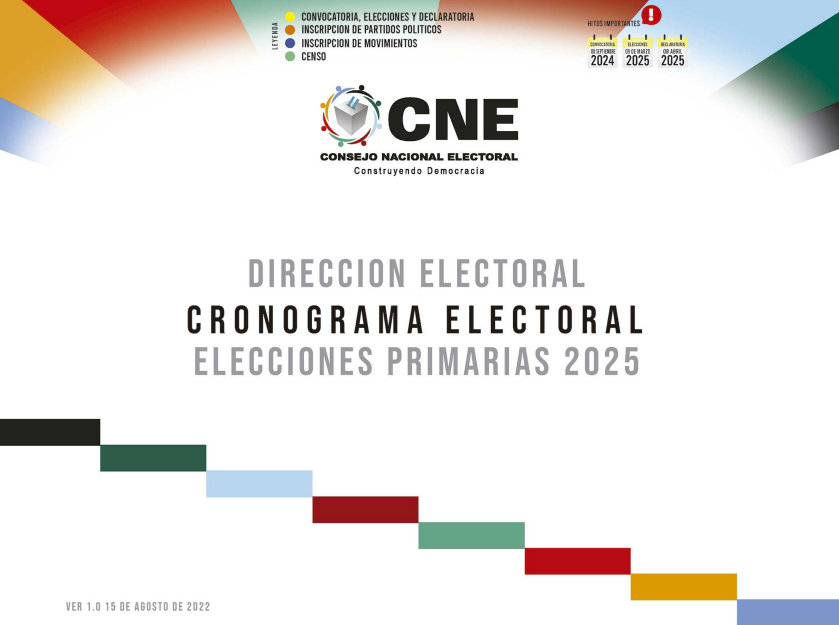

El Cne Y Las Primarias 2025 Analisis De Los 18 Recursos De Nulidad

May 19, 2025

El Cne Y Las Primarias 2025 Analisis De Los 18 Recursos De Nulidad

May 19, 2025 -

Meac Softball Coach Of The Year Norfolk States Angie Nicholson

May 19, 2025

Meac Softball Coach Of The Year Norfolk States Angie Nicholson

May 19, 2025