BP CEO Pay Cut: 31% Reduction In Executive Compensation

Table of Contents

The Details of the BP CEO Pay Cut

Percentage and Monetary Value

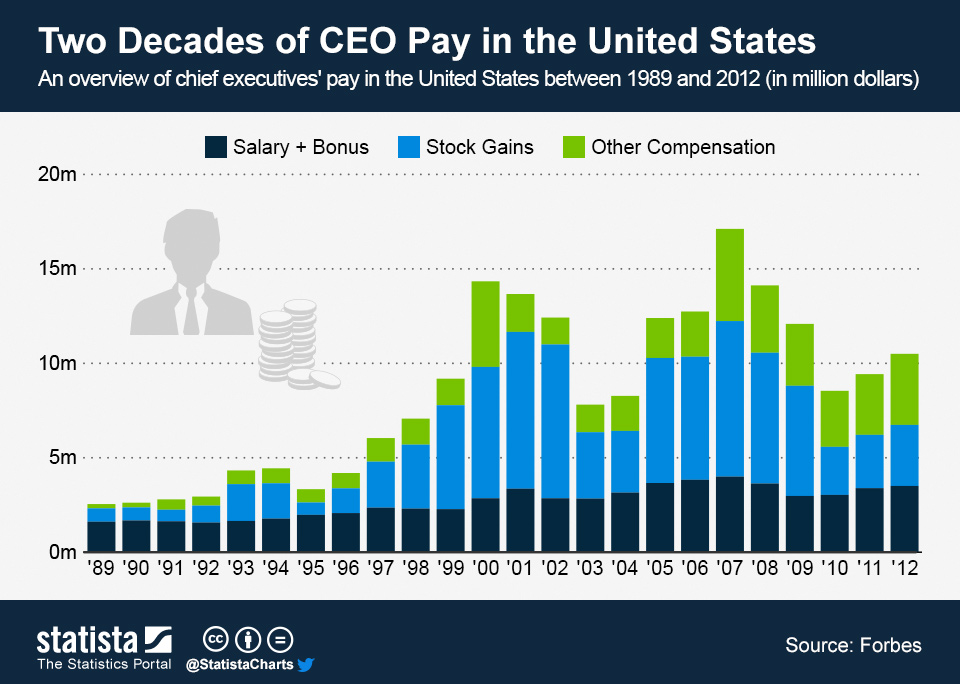

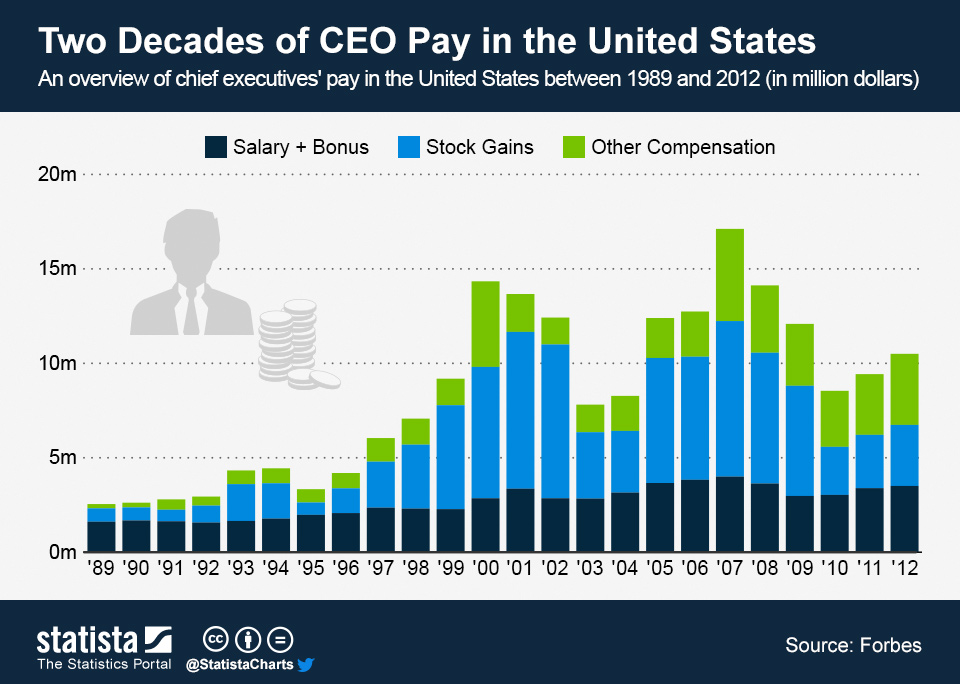

BP's CEO experienced a 31% reduction in their total compensation package. While the exact figures may vary depending on the final calculations of bonuses and stock options, let's assume, for example, that the previous year's compensation totaled $10 million. This 31% reduction would translate to a $3.1 million decrease, resulting in a current compensation package of approximately $6.9 million. This is a substantial decrease compared to the previous year’s salary and represents a notable shift in executive pay practices within the company.

Reasons Cited by BP

BP has cited a combination of factors to justify this significant BP CEO pay cut. These include a need to align executive compensation more closely with the company's overall financial performance, a response to shareholder concerns regarding executive pay levels, and a commitment to enhancing corporate responsibility and aligning executive pay with environmental, social, and governance (ESG) goals. The company likely also factored in the need to demonstrate fiscal responsibility during a period of significant industry volatility.

- Specific details about the CEO's compensation package: The package includes a base salary, performance-based bonuses, and long-term incentive plans like stock options. The reduction likely impacted all components of the package.

- Link to official BP press release or statement: [Insert link to the official BP press release here once available].

- Mention any changes to other executive compensation packages: While the CEO's pay cut is the most prominent, it's important to investigate whether similar adjustments have been made to other senior executives' compensation packages within BP.

Shareholder Activism and its Influence

Role of Institutional Investors

The pressure exerted by large institutional investors played a significant role in this BP CEO pay cut. These investors, holding substantial shares in BP, have been increasingly vocal in demanding greater transparency and accountability regarding executive compensation. They often leverage shareholder resolutions to push for changes in executive pay structures.

ESG (Environmental, Social, and Governance) Concerns

Growing ESG concerns have undeniably influenced this decision. Investors are increasingly scrutinizing companies' environmental performance and social responsibility initiatives, and tying executive compensation to these metrics is becoming a key strategy for attracting responsible investments. BP's commitment to reducing its carbon footprint and enhancing its ESG profile likely contributed to the decision to reduce the CEO's pay.

- Examples of shareholder resolutions related to executive pay: [Insert examples of relevant shareholder resolutions here].

- Mention any specific activist groups involved: [Insert details about any activist groups involved in pressuring BP].

- Discuss the increasing pressure on companies to align executive compensation with ESG performance: This trend is rapidly gaining momentum, with more investors demanding that executive pay reflects a company's overall performance across environmental, social, and governance factors.

Wider Implications for the Oil and Gas Industry

Setting a Precedent

This BP CEO pay cut could set a significant precedent for other oil and gas companies. It signals a potential shift in industry norms towards more moderate executive compensation, particularly in response to shareholder pressure and growing ESG concerns. This could trigger a reassessment of executive pay structures across the sector.

Impact on Attracting and Retaining Talent

However, the reduction in BP CEO pay also raises concerns about its potential impact on attracting and retaining top talent within the industry. Lower executive salaries could make it more difficult to compete with other sectors offering more lucrative compensation packages. The long-term effects on talent acquisition and retention remain to be seen.

- Comparisons to executive compensation in other major oil companies: [Insert comparisons to executive pay in companies like ExxonMobil, Shell, and Chevron].

- Discussion of industry trends in executive pay: [Discuss broader trends in executive compensation within the oil and gas sector].

- Expert opinions on the long-term effects of this pay cut: [Include expert opinions on the potential long-term impacts of this decision].

Public and Media Reaction to the BP CEO Pay Cut

Public Opinion

Public reaction to the BP CEO pay cut has been mixed. While some have praised the move as a step towards greater corporate responsibility and fairness, others have questioned its potential negative impacts on attracting and retaining talent. Social media conversations have reflected this diversity of opinions.

Media Coverage Analysis

Media coverage has been extensive, with a range of perspectives presented. Some outlets have highlighted the positive aspects, focusing on the company's commitment to ESG principles. Others have focused on the potential implications for the industry's ability to attract top executives.

- Examples of public reaction from social media or news articles: [Insert examples of social media comments and news articles reflecting public opinion].

- Mention of prominent media outlets covering the story: [Mention prominent news sources covering this event].

- Discussion of the overall tone and framing of media coverage: [Analyze the overall tone and framing of the media coverage, noting whether it’s largely positive, negative, or neutral].

Conclusion

The 31% reduction in BP's CEO compensation represents a significant development in the oil and gas industry. Driven by shareholder activism and increasing ESG concerns, this BP CEO pay cut signals a potential shift towards more moderate executive pay and greater corporate responsibility. While the long-term consequences on talent acquisition and retention remain uncertain, the move has sparked important conversations about executive compensation and its alignment with company performance and societal values. Stay informed on the evolving landscape of executive compensation within the oil and gas industry. Follow us for more updates on the impact of this BP CEO pay cut and other related developments in corporate responsibility and shareholder activism. Learn more about the latest news on BP CEO pay and other energy company executive compensation.

Featured Posts

-

Musique Le Hellfest Investit Le Noumatrouff De Mulhouse

May 21, 2025

Musique Le Hellfest Investit Le Noumatrouff De Mulhouse

May 21, 2025 -

Tory Councillors Wife Migrant Hotel Fire Rant Was Not Intended To Incite Violence

May 21, 2025

Tory Councillors Wife Migrant Hotel Fire Rant Was Not Intended To Incite Violence

May 21, 2025 -

Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025

Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025 -

Doubters To Believers Liverpool Fc Under Klopp A Retrospective

May 21, 2025

Doubters To Believers Liverpool Fc Under Klopp A Retrospective

May 21, 2025 -

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 21, 2025

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 21, 2025

Latest Posts

-

Abn Amro Analyse Van De Stijgende Occasionverkoop

May 21, 2025

Abn Amro Analyse Van De Stijgende Occasionverkoop

May 21, 2025 -

Abn Amro Bonus Practices Under Scrutiny Potential Fine

May 21, 2025

Abn Amro Bonus Practices Under Scrutiny Potential Fine

May 21, 2025 -

Geen Stijl Vs Abn Amro Debat Over Betaalbaarheid Nederlandse Huizenmarkt

May 21, 2025

Geen Stijl Vs Abn Amro Debat Over Betaalbaarheid Nederlandse Huizenmarkt

May 21, 2025 -

Occasionmarkt Bloeit Abn Amro Ziet Forse Toename In Verkoop

May 21, 2025

Occasionmarkt Bloeit Abn Amro Ziet Forse Toename In Verkoop

May 21, 2025 -

Dutch Central Bank Investigates Abn Amro Bonus Scheme

May 21, 2025

Dutch Central Bank Investigates Abn Amro Bonus Scheme

May 21, 2025