Dutch Central Bank Investigates ABN Amro Bonus Scheme

Table of Contents

The Trigger for the Investigation

The Dutch Central Bank's investigation into ABN Amro's bonus scheme wasn't launched without cause. While the exact details remain partially undisclosed, reports suggest a combination of factors led to the regulatory scrutiny. Initial triggers appear to include:

- Whistleblower complaints: Allegations of irregularities within the bonus system, potentially involving unfair practices or breaches of internal regulations, may have sparked the investigation.

- Media reports: Press coverage highlighting concerns about the size and allocation of bonuses, potentially raising questions about ethical conduct and compliance.

- Concerns about compliance with regulations: The investigation may stem from the Central Bank's proactive monitoring of financial institutions and concerns about potential non-compliance with existing rules concerning executive compensation and risk management.

While official statements from the Dutch Central Bank are limited, links to relevant news articles will be added as they become available. The ABN Amro scandal, as it's been dubbed in some media, highlights the increasing regulatory scrutiny faced by major financial institutions.

Aspects of the ABN Amro Bonus Scheme Under Scrutiny

The investigation centers on several crucial aspects of ABN Amro's variable compensation structure. Key elements under the microscope include:

- Size of bonuses: The sheer magnitude of bonuses awarded, particularly to senior executives, is likely a focal point. Concerns around excessive payouts relative to overall bank performance and potential financial misconduct are being investigated.

- Criteria for awarding bonuses: The methods used to determine bonus amounts are under intense scrutiny. Questions revolve around whether the criteria accurately reflect individual and team contributions, align with long-term strategic goals, or potentially incentivize excessive risk-taking.

- Transparency of the scheme: The clarity and accessibility of information regarding the bonus scheme are crucial aspects of the investigation. A lack of transparency can foster mistrust and potentially indicate conflicts of interest.

Potential issues include a lack of alignment between bonus payouts and long-term performance-related pay goals, potentially fostering short-term gains at the expense of sustainable growth. Moreover, the investigation aims to assess whether the ABN Amro compensation policy adequately addresses risk management and corporate governance best practices.

Potential Consequences for ABN Amro

The consequences of this Dutch Central Bank investigation for ABN Amro could be severe and far-reaching:

- Financial penalties: Substantial fines could be imposed for breaches of regulations. The amount will likely depend on the severity of any identified misconduct.

- Reputational damage: Negative publicity associated with the investigation can significantly impact ABN Amro's brand image and customer trust. This reputational risk can impact future business prospects.

- Changes to the bonus scheme: The bank may be required to make significant changes to its compensation structure, potentially adopting stricter criteria and increased transparency.

- Management changes: Depending on the findings, senior management could face consequences, including resignations or dismissals.

The impact on investor relations is significant. The ABN Amro stock price is likely to be sensitive to the investigation's outcome, potentially leading to volatility and impacting shareholder value.

Wider Implications for the Dutch Banking Sector

The ABN Amro investigation has significant ramifications beyond the bank itself. It underscores the increasing importance of robust Dutch banking regulation and highlights potential shortcomings in the current framework.

- Potential changes to banking regulations in the Netherlands: The investigation could lead to stricter regulations concerning banking bonuses and executive compensation, mirroring similar trends in other European countries.

- Impact on financial stability: The investigation serves as a reminder of the systemic risks associated with poorly designed incentive structures within the financial sector, impacting overall financial stability.

- Comparison with European banking regulations: The investigation may trigger a comparative analysis of Dutch regulations against those in other European nations, leading to harmonization or reform efforts.

The investigation also raises questions about the effectiveness of existing Basel accords and their application in the Dutch context. The ongoing scrutiny of the ABN Amro bonus scheme could influence future developments in European banking regulation.

Conclusion: The Future of the ABN Amro Bonus Scheme and Banking Regulation

The Dutch Central Bank's investigation into the ABN Amro bonus scheme is ongoing, and the full ramifications remain to be seen. However, the potential consequences for ABN Amro – including financial penalties, reputational damage, and changes to its compensation structure – are significant. Furthermore, the investigation has broader implications for the Dutch banking sector, potentially leading to stricter regulations and reforms to enhance corporate governance and risk management practices. Stay updated on developments in this crucial investigation of the ABN Amro bonus scheme. Follow us for the latest news on this and other important developments in Dutch banking regulation.

Featured Posts

-

Peppa Pigs Mummy Welcomes Another Baby Gender Reveal

May 21, 2025

Peppa Pigs Mummy Welcomes Another Baby Gender Reveal

May 21, 2025 -

Turning Trash Into Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 21, 2025

Turning Trash Into Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 21, 2025 -

Understanding The Love Monster Phenomenon

May 21, 2025

Understanding The Love Monster Phenomenon

May 21, 2025 -

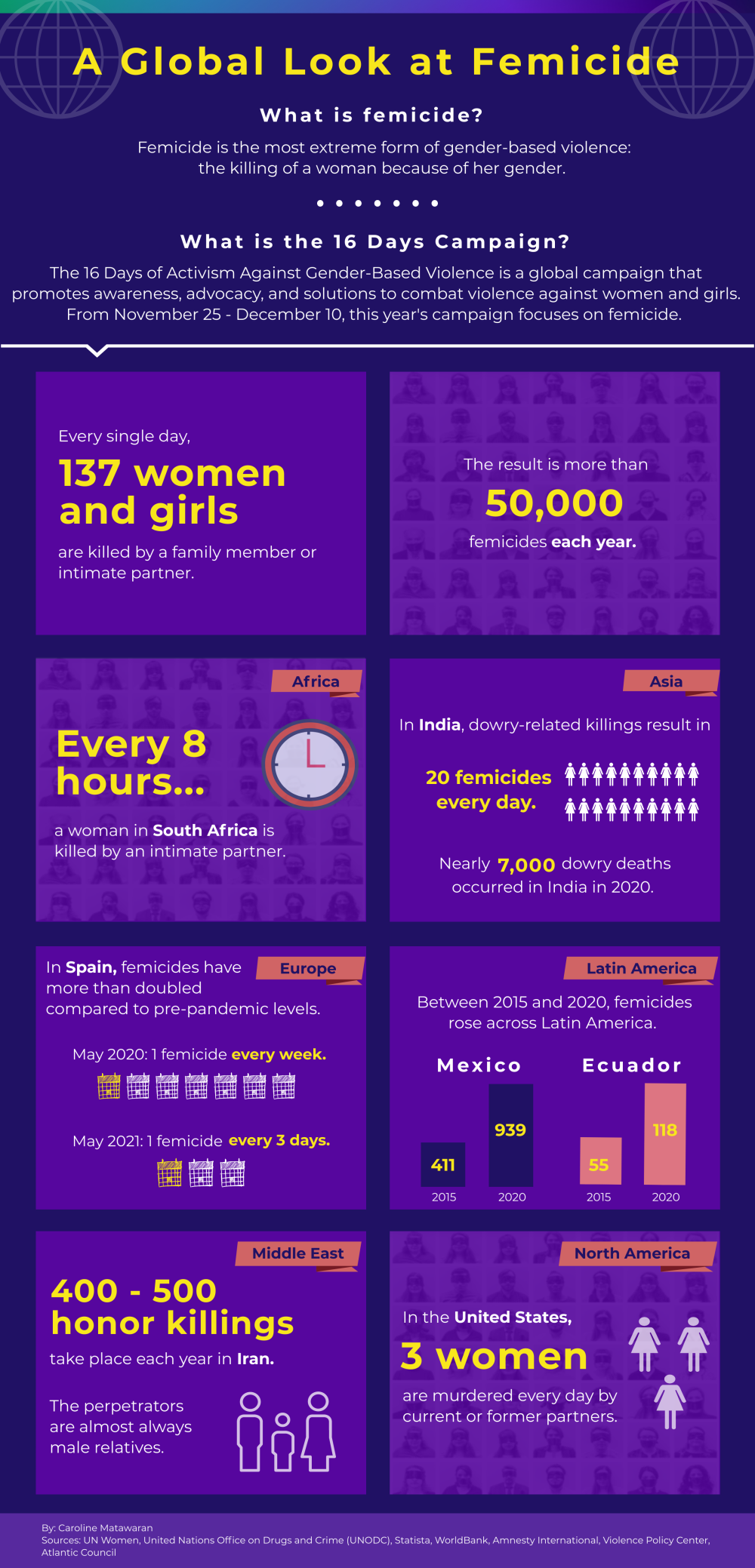

Understanding Femicide A Look At The Statistics And Contributing Factors

May 21, 2025

Understanding Femicide A Look At The Statistics And Contributing Factors

May 21, 2025 -

The Assault On Clean Energy Challenges Despite Rapid Growth

May 21, 2025

The Assault On Clean Energy Challenges Despite Rapid Growth

May 21, 2025

Latest Posts

-

Ramon Rodriguezs Unexpected Will Trent Encounter Three Scorpion Stings During Sleep

May 21, 2025

Ramon Rodriguezs Unexpected Will Trent Encounter Three Scorpion Stings During Sleep

May 21, 2025 -

Will Trent Star Ramon Rodriguez Three Scorpion Stings And A Nap

May 21, 2025

Will Trent Star Ramon Rodriguez Three Scorpion Stings And A Nap

May 21, 2025 -

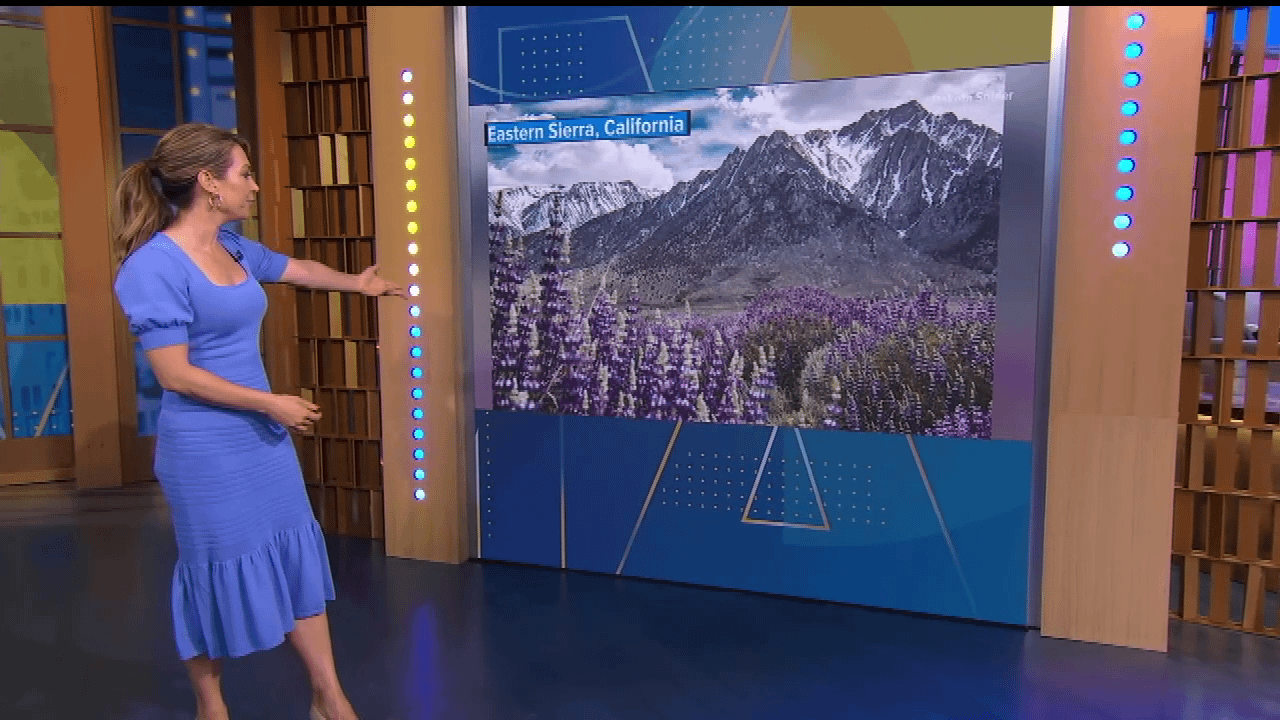

Gmas Ginger Zee At Wlos For Upcoming Asheville Rising Helene Feature

May 21, 2025

Gmas Ginger Zee At Wlos For Upcoming Asheville Rising Helene Feature

May 21, 2025 -

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 21, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 21, 2025 -

Ginger Zee Of Gma Visits Wlos In Advance Of Asheville Rising Helene Special

May 21, 2025

Ginger Zee Of Gma Visits Wlos In Advance Of Asheville Rising Helene Special

May 21, 2025