BP Executive Compensation: A 31% Reduction Explained

Table of Contents

The Magnitude of the Reduction and its Impact

BP's announcement of a 31% reduction in executive compensation represents a significant move. This substantial cut translates to millions of pounds saved, marking a considerable departure from previous years' compensation packages. While the exact figures for individual executives (like the BP CEO salary) may vary and require further investigation into official BP financial reports, the overall impact is undeniable. Whether this reduction was a purely voluntary decision or influenced by external pressures like shareholder activism remains a key question.

- Specific Figures: Detailed figures on the pay cuts for the CEO and other top executives are crucial for a complete understanding and should be sourced from official BP press releases and financial filings.

- Competitor Comparison: A comparative analysis of BP executive compensation against competitor companies in the oil and gas industry will provide valuable context and highlight the significance of this reduction.

- Employee Morale: The impact of such a substantial reduction in executive pay on employee morale and perceptions of fairness within the company warrants further consideration.

Underlying Reasons for the Compensation Cut

The 31% cut in BP executive compensation didn't occur in a vacuum. Several interconnected factors likely contributed to this decision. Poor financial performance in the face of volatile oil prices and the global energy transition likely played a significant role. Growing shareholder activism and increasing focus on Environmental, Social, and Governance (ESG) concerns also undoubtedly influenced BP's board in making this decision.

- Financial Performance Analysis: A thorough examination of BP's recent financial reports, including profitability, revenue streams, and operational efficiency, is needed to fully understand the financial pressures leading to this decision.

- Shareholder Activism: Analyzing shareholder resolutions and engagement regarding executive pay provides further insight into the pressures BP faced. Were there specific proposals or campaigns that prompted this change?

- BP's Public Statements: Any official statements released by BP regarding these compensation adjustments should be carefully examined to understand their rationale.

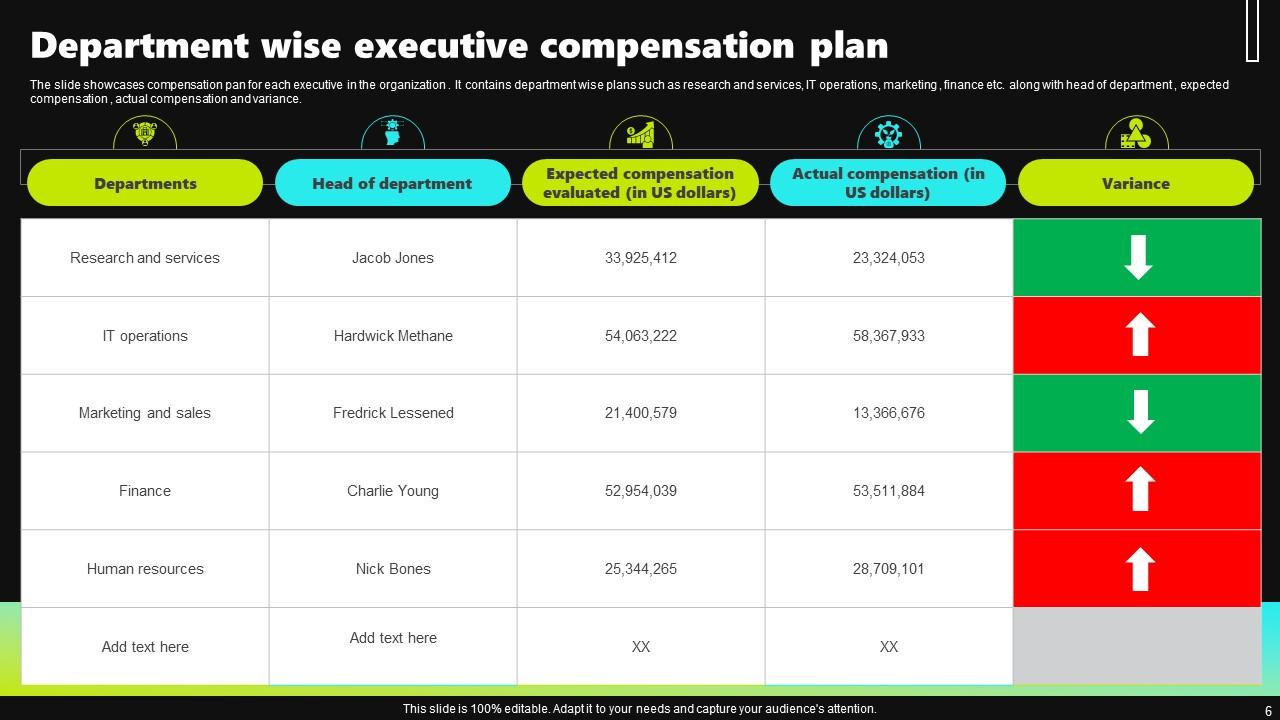

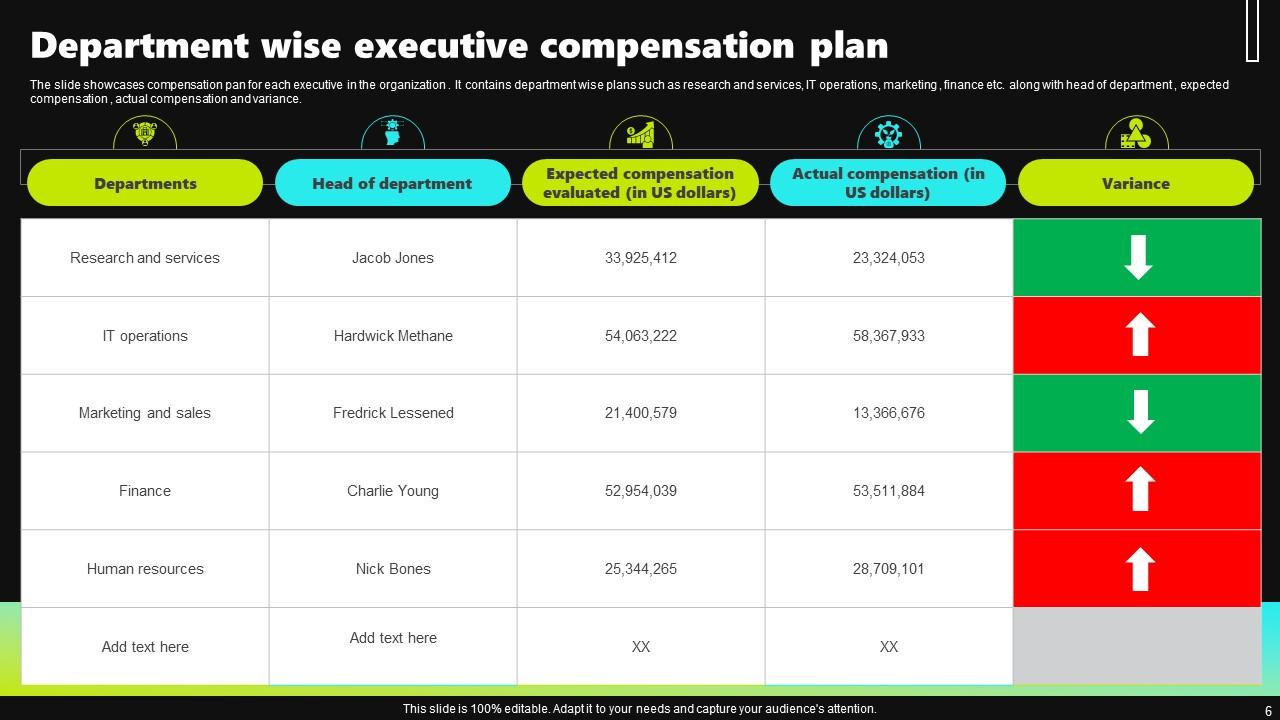

The Structure of BP's Remuneration Package (Before and After)

BP's executive remuneration package, like many large corporations, is multifaceted. It typically includes a base salary, performance-based bonuses, stock options, and long-term incentive plans. The 31% reduction likely affected each component differently. Understanding the pre-reduction and post-reduction structures allows for a complete picture of the change.

- Component Breakdown: A detailed breakdown of the percentage reduction across salary, bonuses, stock options, and long-term incentives is necessary for a complete understanding of the restructuring.

- Performance Metrics: Any changes to the performance metrics linked to bonuses should be explored. Were targets adjusted, or were the bonus structures themselves altered?

- Long-Term Incentives: How did the reduction affect long-term incentives designed to align executive interests with shareholder value over the long term?

Long-Term Implications for BP and its Shareholders

The long-term implications of this significant reduction in BP executive compensation are complex and far-reaching. While it may improve shareholder sentiment in the short-term, it also raises questions about BP's ability to attract and retain top talent. The impact on shareholder returns and investor sentiment needs careful consideration.

- Executive Turnover: Will the reduced compensation package lead to an increase in executive turnover? How will this affect institutional knowledge and operational stability?

- Stock Price Impact: The market's reaction to the announcement, reflected in BP's stock price and market capitalization, provides valuable insight into investor perceptions.

- Alignment with ESG Goals: How does this decision align with BP's publicly stated long-term sustainability goals and its commitment to ESG principles?

Conclusion: Understanding the Future of BP Executive Compensation

The 31% reduction in BP executive compensation is a significant event with complex underlying causes and potentially far-reaching consequences. Poor financial performance, shareholder pressure, and the evolving energy landscape all seem to have played a role. The long-term impact on talent retention, shareholder returns, and BP's strategic direction remains to be seen. To stay informed on this evolving situation and the future of BP executive compensation, continue researching this topic and stay updated on related news and developments. Further reading on BP's annual reports and investor relations materials is recommended.

Featured Posts

-

Service De Navette Gratuit Experimental Entre La Haye Fouassiere Et Haute Goulaine

May 21, 2025

Service De Navette Gratuit Experimental Entre La Haye Fouassiere Et Haute Goulaine

May 21, 2025 -

Abn Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

May 21, 2025

Abn Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

May 21, 2025 -

Abn Amro Heffingen Halveren Voedselexport Naar Verenigde Staten

May 21, 2025

Abn Amro Heffingen Halveren Voedselexport Naar Verenigde Staten

May 21, 2025 -

Explore Provence On Foot A Self Guided Hike From Mountains To Mediterranean

May 21, 2025

Explore Provence On Foot A Self Guided Hike From Mountains To Mediterranean

May 21, 2025 -

Dutch Central Bank To Investigate Abn Amro Bonus Practices

May 21, 2025

Dutch Central Bank To Investigate Abn Amro Bonus Practices

May 21, 2025

Latest Posts

-

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025 -

Trans Australia Run A Race Against Time And Distance

May 21, 2025

Trans Australia Run A Race Against Time And Distance

May 21, 2025 -

Bbc Antiques Roadshow Us Couple Arrested In Uk After Episode Appearance

May 21, 2025

Bbc Antiques Roadshow Us Couple Arrested In Uk After Episode Appearance

May 21, 2025 -

Trans Australia Run Challenging The Existing World Record

May 21, 2025

Trans Australia Run Challenging The Existing World Record

May 21, 2025 -

Trans Australia Run A New Record On The Horizon

May 21, 2025

Trans Australia Run A New Record On The Horizon

May 21, 2025