Buy-and-Hold Investing: Facing The Challenges Of Long-Term Growth

Table of Contents

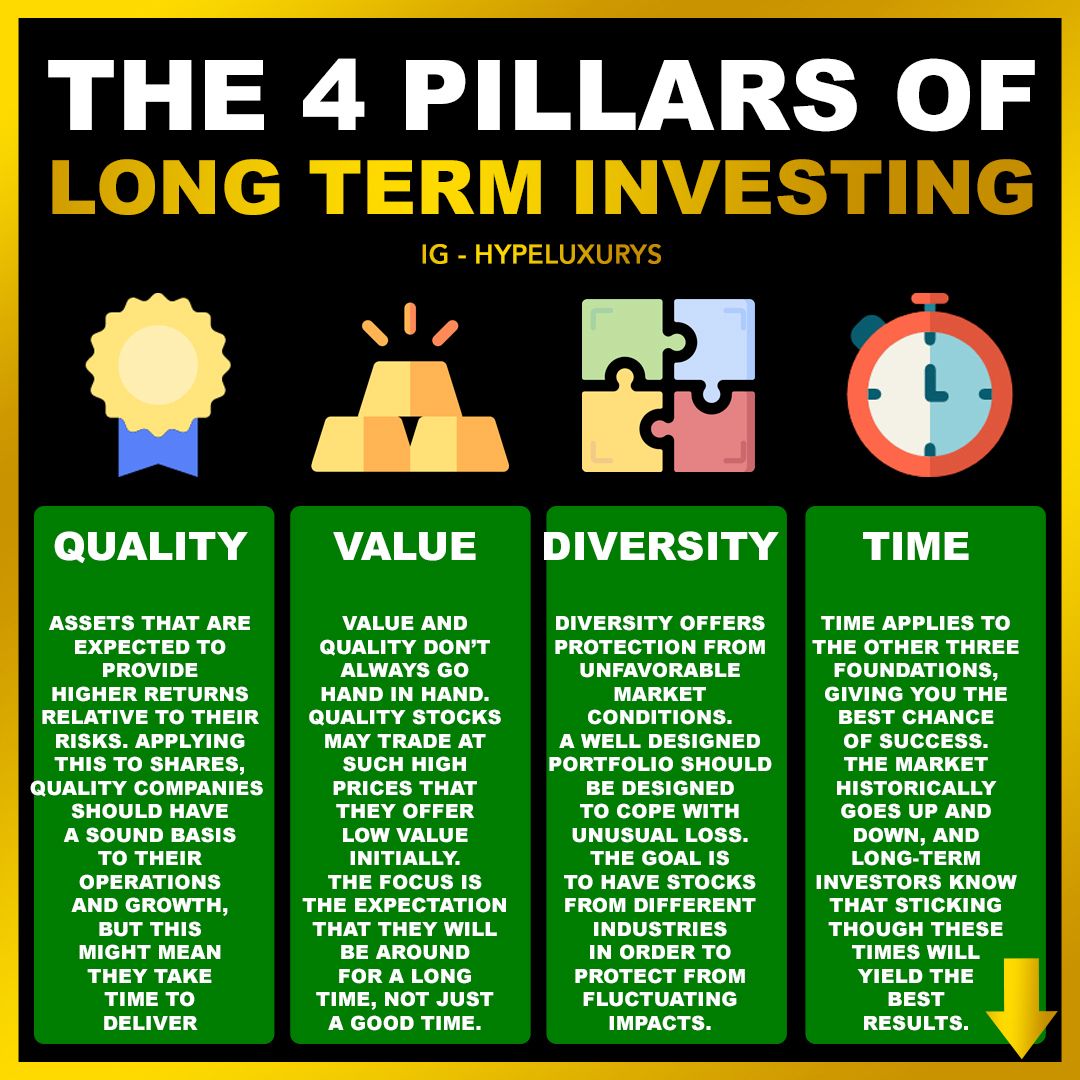

Understanding the Core Principles of Buy-and-Hold Investing

Buy-and-hold is a long-term investment approach focusing on owning assets—stocks, bonds, real estate, and other investments—for extended periods, typically years or even decades, regardless of short-term market fluctuations. The strategy relies on the belief that markets tend to trend upwards over the long run, allowing investors to ride out temporary dips and benefit from the power of compounding.

The benefits of a buy-and-hold strategy are numerous:

- Minimizes transaction costs and taxes: Frequent trading incurs brokerage fees and capital gains taxes. Buy-and-hold significantly reduces these expenses.

- Leverages the power of compounding: Consistent returns, reinvested over time, generate exponential growth. This is the engine of long-term wealth building.

- Reduces emotional decision-making: The buy-and-hold approach minimizes the impact of market volatility on your investment decisions. Fear and greed are significantly less influential.

- Requires thorough due diligence before investment: The upfront research is crucial, as the intention is to hold these assets long-term.

Navigating Market Volatility and Economic Downturns

Long-term investing inherently carries risk. Significant market corrections and economic downturns are inevitable. However, effective strategies can mitigate these risks:

- Diversification: Spreading your investments across different asset classes (stocks, bonds, real estate, commodities) reduces the impact of poor performance in any single asset. This is a fundamental principle of risk management.

- Robust risk assessment: Understanding your risk tolerance is paramount. A well-defined risk tolerance dictates your asset allocation and helps you stay the course during market turbulence.

- Disciplined approach: Emotional responses to market downturns can lead to poor decisions (panic selling). Sticking to your long-term plan despite short-term volatility is crucial for success.

- Macroeconomic awareness: Staying informed about global economic trends, inflation, and interest rates allows you to anticipate potential market impacts and adjust your strategy accordingly. This is key to proactive risk management in buy-and-hold investing.

The Importance of Due Diligence and Asset Selection

Selecting suitable investments is crucial for long-term success. Thorough research and analysis are paramount:

- Fundamental analysis (for stocks): Understanding a company's financial health, management team, competitive landscape, and future growth prospects is vital before investing.

- Credit ratings (for bonds): Assessing the creditworthiness of bond issuers helps determine the risk of default and potential returns.

- Property valuation (for real estate): A thorough assessment of property value, location, and potential appreciation is crucial before committing to a real estate investment.

- Value investing: Identifying undervalued assets offers the potential for significant long-term growth. This strategy aligns well with buy-and-hold, focusing on intrinsic value rather than market sentiment.

Adapting Your Buy-and-Hold Strategy Over Time

While a completely passive approach is sometimes advocated, a truly effective buy-and-hold strategy requires periodic adjustments:

- Regular portfolio reviews: At least annual reviews allow you to assess the performance of your investments, rebalance your portfolio, and adjust your strategy based on changing circumstances.

- Rebalancing: Periodically rebalancing your portfolio back to your target asset allocation helps manage risk and maintain your desired level of diversification.

- Tax optimization: Tax-efficient investing strategies, such as utilizing tax-advantaged accounts (like 401(k)s and IRAs), can significantly impact your long-term returns.

- Estate planning: Incorporating your investments into a comprehensive estate plan ensures a smooth transfer of assets to your beneficiaries.

Conclusion

Buy-and-hold investing, while offering significant long-term growth potential, requires careful planning, discipline, and a realistic understanding of inherent risks. By conducting thorough due diligence, diversifying your investments, and regularly reviewing your portfolio, you can significantly increase your chances of success. Don't let market fluctuations deter you from the rewards of buy-and-hold investing. Begin your journey towards long-term financial security by implementing a sound buy-and-hold investment plan today. Learn more about successful buy-and-hold strategies and start building your wealth. Consider seeking advice from a qualified financial advisor to help you develop a personalized buy-and-hold strategy tailored to your specific financial goals and risk tolerance.

Featured Posts

-

Housing Finance And Fun For Expats The Iam Expat Fair Guide

May 25, 2025

Housing Finance And Fun For Expats The Iam Expat Fair Guide

May 25, 2025 -

New Ae Xplore Campaign Encourages Local And Global Travel From England Airpark And Alexandria International Airport

May 25, 2025

New Ae Xplore Campaign Encourages Local And Global Travel From England Airpark And Alexandria International Airport

May 25, 2025 -

Finding Your Dream Home In The Countryside Budget Friendly Options Under 1m

May 25, 2025

Finding Your Dream Home In The Countryside Budget Friendly Options Under 1m

May 25, 2025 -

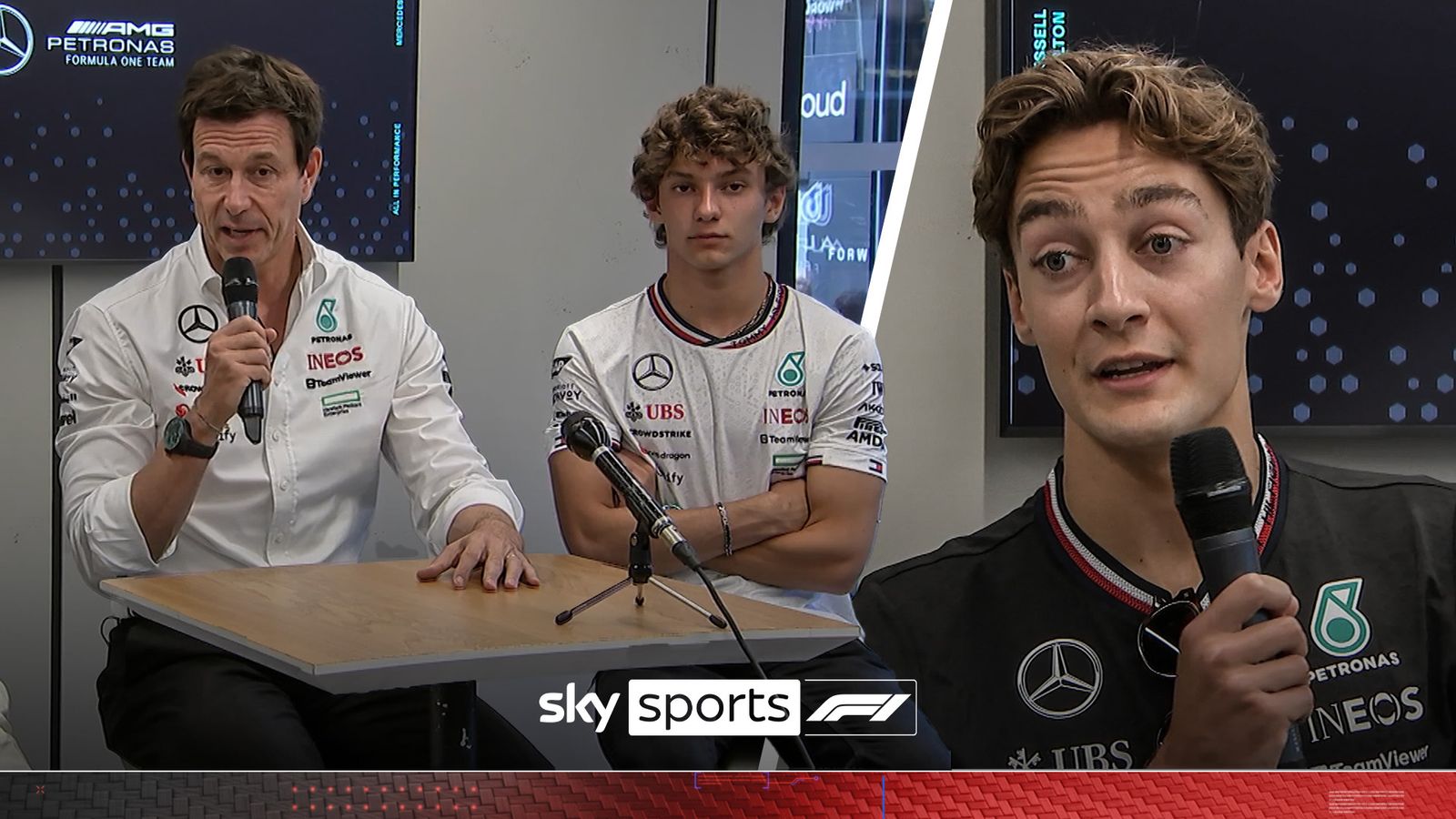

Toto Wolff On George Russell Countering Claims Of Being Underrated

May 25, 2025

Toto Wolff On George Russell Countering Claims Of Being Underrated

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 25, 2025

Latest Posts

-

Sok Gelisme Oenemli Futbol Kuluebuende Sorusturma Basladi 4 Oyuncu Hedefte

May 25, 2025

Sok Gelisme Oenemli Futbol Kuluebuende Sorusturma Basladi 4 Oyuncu Hedefte

May 25, 2025 -

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025 -

Arda Gueler E Uefa Soku Real Madrid De Sorusturma

May 25, 2025

Arda Gueler E Uefa Soku Real Madrid De Sorusturma

May 25, 2025 -

Bueyuek Kuluep Krizi 4 Oenemli Oyuncuyu Ilgilendiren Sorusturma

May 25, 2025

Bueyuek Kuluep Krizi 4 Oenemli Oyuncuyu Ilgilendiren Sorusturma

May 25, 2025 -

Espanyol Uen Atletico Madrid E Direnisi Hakem Hatasi Mi

May 25, 2025

Espanyol Uen Atletico Madrid E Direnisi Hakem Hatasi Mi

May 25, 2025