Cabinet Invests €750 Million In Green Home Loan Expansion, Accessing EU Climate Funds

Table of Contents

€750 Million Investment: A Detailed Breakdown

This €750 million investment represents a substantial commitment to achieving national climate targets and improving the energy performance of homes. The funding originates from a combination of government budget allocation and EU climate funds, demonstrating a collaborative approach to tackling climate change.

The funds will be allocated through a variety of mechanisms designed to maximize impact and accessibility:

- Grants: Direct financial assistance for specific energy efficiency upgrades, particularly beneficial for low-income homeowners.

- Subsidies: Partial funding for approved renovations, reducing the overall cost for homeowners.

- Low-Interest Loans: Access to affordable financing with favorable repayment terms, making green home improvements more financially viable.

The investment breakdown across key areas includes:

- Insulation: €200 million to improve home insulation, reducing energy consumption and heat loss.

- Renewable Energy Installations: €250 million to support the installation of solar panels, heat pumps, and other renewable energy technologies.

- Window Replacements: €100 million to replace inefficient windows with energy-efficient alternatives, significantly improving thermal performance.

- Other Energy Efficiency Upgrades: €200 million for a range of other improvements, including smart home technology and boiler upgrades.

This investment is projected to facilitate over 100,000 green home renovations, dramatically improving the energy efficiency of the national housing stock and reducing carbon emissions.

Accessing EU Climate Funds: Facilitating Green Transition

This significant investment relies heavily on securing EU climate funds, specifically leveraging programs such as NextGenerationEU and other relevant initiatives designed to support member states in their green transition. Securing these funds is crucial, reducing the overall financial burden on the national budget and ensuring the project’s long-term viability.

Accessing these EU funds involves meeting specific criteria and adhering to a defined application process:

- Environmental Impact Assessments: Detailed assessments of the environmental benefits of proposed renovations are required.

- Reporting Requirements: Regular reporting on project progress and achieved energy savings is mandatory to ensure transparency and accountability.

- Sustainability Criteria: Projects must meet strict sustainability standards to qualify for funding.

The benefits of leveraging EU funding are multifaceted:

- Reduced National Financial Burden: Sharing the cost of the initiative with the EU reduces the strain on the national budget.

- Access to Expert Advice and Support: The EU provides access to technical expertise and guidance throughout the project implementation.

Meeting these conditions ensures that the investment adheres to the highest standards of environmental responsibility and contributes meaningfully to the EU’s broader climate objectives.

Expanding Access to Green Home Loans: Making Sustainability Affordable

The core objective of this initiative is to make sustainable home improvements more accessible to a broader range of homeowners. This will be achieved through:

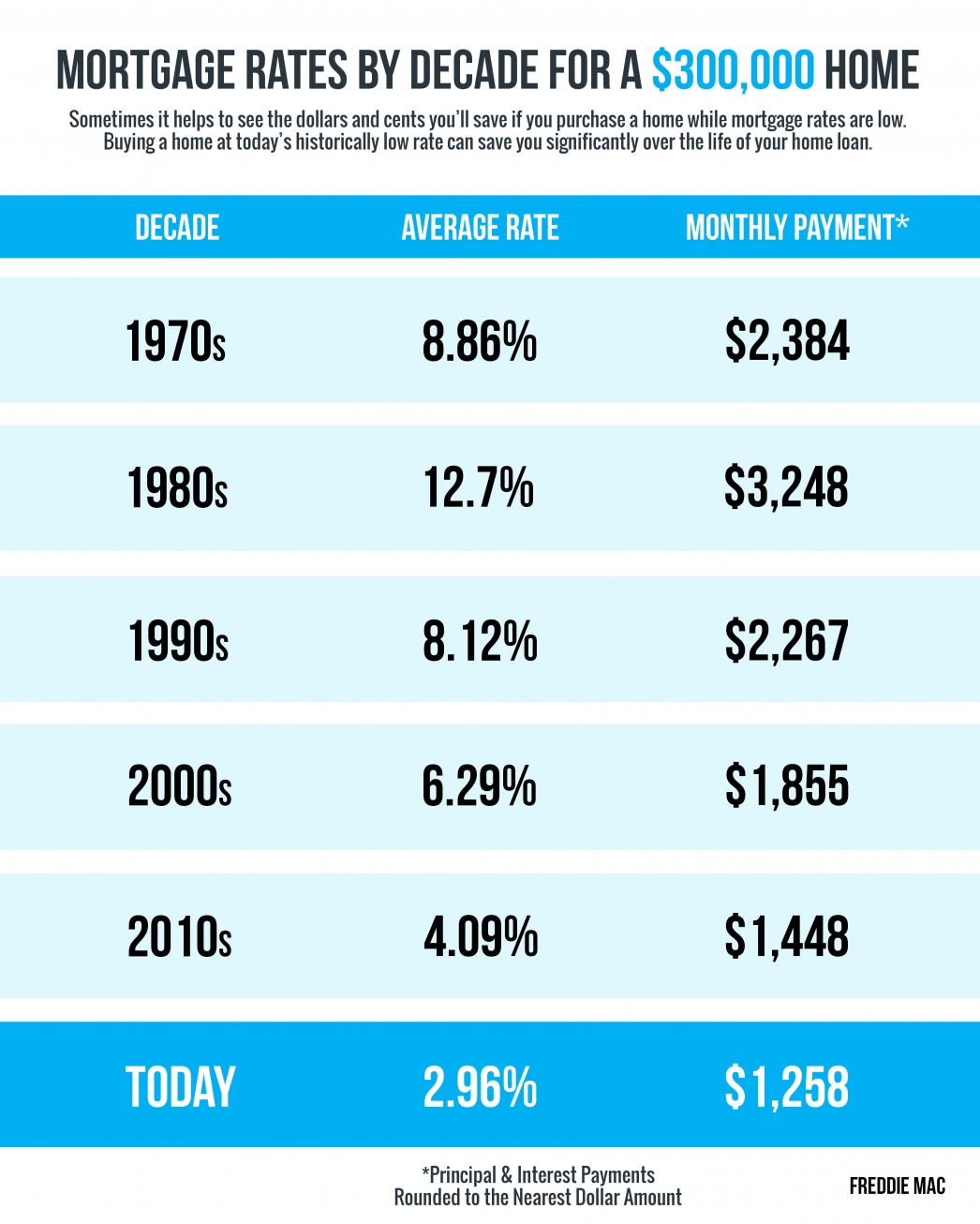

- Lower Interest Rates: Significantly reduced interest rates on green home loans compared to standard mortgages.

- Longer Repayment Periods: Extended repayment schedules to make monthly payments more manageable.

- Increased Loan Amounts: Higher loan limits to cover the cost of more extensive renovations.

The government is actively partnering with financial institutions – banks and lending organizations – to streamline the application process and ensure wide-ranging availability of these green home loans. Furthermore, several support initiatives are in place to assist homeowners:

- Energy Audits: Free or subsidized energy audits to identify areas for improvement and eligible renovations.

- Expert Advice: Access to expert advice on eligible renovations and the application process.

- Simplified Application Procedures: Streamlined procedures designed to make applying for a green home loan straightforward.

Eligible home improvements covered under the scheme include:

- Solar Panel Installation

- Insulation Upgrades (roof, walls, floors)

- Energy-Efficient Window Replacements

- Heat Pump Installation

- Smart Home Technology Integration

Eligibility Criteria and Application Process for Green Home Loans

To be eligible for a green home loan under this initiative, homeowners must meet specific criteria, typically focusing on the property's energy performance and the type of proposed renovations. These criteria may include:

- Property Type: The scheme might cover different property types, including houses, apartments, and terraced houses. Specific details will be available on government websites.

- Energy Performance Rating: Properties may need to meet minimum energy efficiency standards, often determined through an energy performance certificate (EPC).

The application process is designed to be user-friendly:

- Conduct an Energy Audit: Identify potential upgrades and obtain an EPC.

- Select a Participating Lender: Choose a bank or financial institution participating in the green home loan scheme.

- Prepare your Application: Gather necessary documentation, including proof of ownership and EPC.

- Submit your Application: Submit your completed application via the lender's online portal or in person.

- Approval and Disbursement: Once approved, the funds will be disbursed to cover the eligible home improvements.

For detailed information and application forms, please visit [insert link to relevant government website here].

Conclusion

This €750 million investment in green home loans represents a significant step towards achieving national climate goals and enhancing the energy efficiency of the nation's housing stock. By leveraging EU climate funds and making green financing more accessible, the government is actively empowering homeowners to participate in the green transition. This initiative is not only environmentally beneficial but also economically advantageous, stimulating the green economy and creating jobs.

Call to Action: Learn more about the government's green home loan initiative and check your eligibility today! Take advantage of this opportunity to upgrade your home, reduce your carbon footprint, and benefit from government support for green home improvements. Find out how you can access these vital green home loans and contribute to a more sustainable future. Don't miss out on this chance to make your home greener and more energy-efficient – apply for your green home loan now!

Featured Posts

-

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025 -

Pacers Vs Knicks Game 2 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025

Pacers Vs Knicks Game 2 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025 -

Prakiraan Cuaca Terbaru Kalimantan Timur Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025

Prakiraan Cuaca Terbaru Kalimantan Timur Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025 -

Are Torpedo Bats Revolutionizing Marlin Fishing

May 28, 2025

Are Torpedo Bats Revolutionizing Marlin Fishing

May 28, 2025 -

South Korean Presidential Election A Deep Dive Into The Contenders

May 28, 2025

South Korean Presidential Election A Deep Dive Into The Contenders

May 28, 2025

Latest Posts

-

Banksy In Dubai A World News Update On The Exhibition

May 31, 2025

Banksy In Dubai A World News Update On The Exhibition

May 31, 2025 -

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025 -

World News Banksy Artwork Unveiled In Dubai Exhibition

May 31, 2025

World News Banksy Artwork Unveiled In Dubai Exhibition

May 31, 2025 -

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025 -

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025