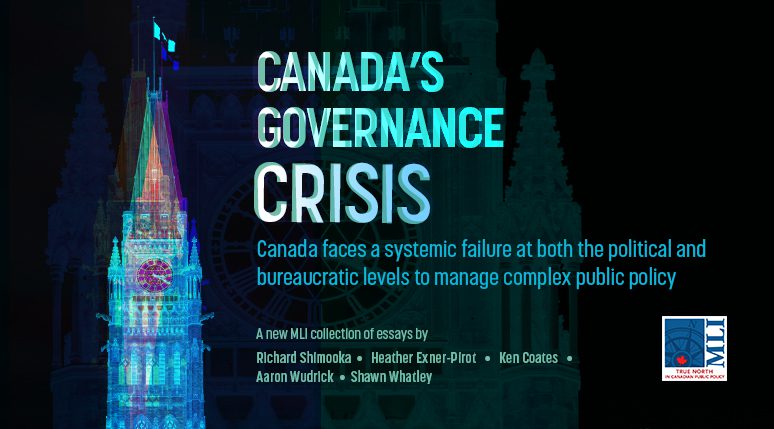

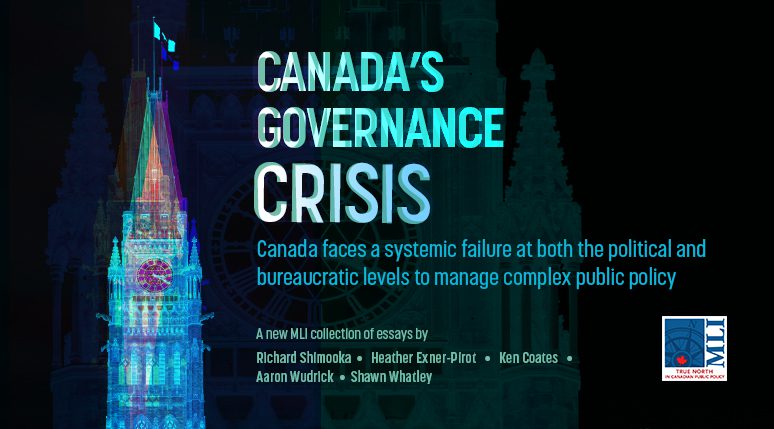

Can A "Bulldog" Banker Fix Canada's Resource Sector? A Look At The Challenges

Table of Contents

The Current State of Canada's Resource Sector

The Canadian resource sector, encompassing mining, oil and gas, forestry, and fisheries, is a significant contributor to the national economy. However, recent years have presented considerable challenges impacting economic growth and investment. The current economic climate, marked by global uncertainty and fluctuating commodity prices, has created a volatile environment for resource companies.

Environmental Concerns and Regulations

The push for sustainable resource management is paramount. Growing environmental concerns, coupled with increasingly stringent ESG (environmental, social, and governance) investing criteria, are forcing companies to adopt eco-friendly practices. This includes:

- Reducing carbon emissions through technological innovation and process optimization.

- Implementing stricter waste management and remediation strategies.

- Adhering to robust environmental impact assessments and obtaining necessary permits.

- Engaging in transparent and accountable reporting of environmental performance.

These regulations, while necessary for long-term sustainability and responsible resource extraction, can also add significant costs and complexity for businesses.

Global Market Volatility

Fluctuating commodity prices are a major source of uncertainty for the Canadian resource sector. Global economic downturns, geopolitical instability, and shifts in global demand all contribute to this volatility. Effective risk management strategies are crucial for navigating this turbulent landscape. This includes:

- Diversification of production and markets.

- Hedging strategies to mitigate price fluctuations.

- Developing robust financial models that account for uncertainty.

Infrastructure Deficiencies

Canada's resource sector suffers from infrastructure deficiencies, particularly in transportation and energy infrastructure. The lack of adequate pipelines and transportation networks increases costs and limits the efficient movement of resources to market. Significant investment is needed in:

- Modernizing existing pipelines and transportation networks.

- Constructing new pipelines and infrastructure to access remote resource deposits.

- Investing in renewable energy infrastructure to support sustainable resource extraction.

Indigenous Relations and Consultation

Respectful consultation and collaboration with Indigenous communities are crucial for responsible resource development. Recognizing and upholding Indigenous rights and title, and ensuring meaningful benefit-sharing agreements, are essential for achieving reconciliation and securing long-term social license to operate. Key aspects include:

- Early and meaningful engagement with Indigenous communities.

- Free, prior, and informed consent (FPIC) processes.

- Benefit-sharing agreements that provide tangible economic and social benefits to Indigenous communities.

Competition and Global Players

Canada faces stiff competition from other resource-rich nations, many of whom have lower production costs or more favorable regulatory environments. This global competition necessitates a focus on innovation, efficiency, and responsible resource management to maintain a competitive edge in international markets. Challenges include:

- Resource nationalism in other countries restricting access to resources or investment opportunities.

- Price wars driven by oversupply in global markets.

- The need for continuous innovation to improve productivity and reduce costs.

The "Bulldog" Banker Approach: Strengths and Weaknesses

A "bulldog" banker is characterized by a decisive, aggressive, and often risk-taking leadership style. This approach could offer several advantages for the Canadian resource sector:

- Securing Investment: A bold, confident leader can attract significant investment by demonstrating a clear vision and unwavering determination.

- Streamlining Regulations: A strong leader might be able to navigate complex regulatory hurdles and advocate for more efficient processes.

- Driving Innovation: A decisive leader can push for technological advancements and the adoption of innovative solutions to improve efficiency and sustainability.

However, this approach also carries potential drawbacks:

- Alienating Stakeholders: An overly aggressive approach could alienate Indigenous communities, environmental groups, or other key stakeholders.

- Overlooking Long-Term Sustainability: A focus on short-term gains might overshadow the importance of long-term environmental and social considerations.

- Increased Risk: A high-risk approach, while potentially lucrative, might lead to significant losses if not properly managed.

Potential Solutions and Strategies

To revitalize the Canadian resource sector, a "bulldog" banker, or any effective leader, needs to employ strategic solutions:

Strategic Partnerships and Alliances

Collaboration between private and public sector partners is essential. Public-private partnerships can leverage the strengths of both sectors, fostering innovation and investment in infrastructure.

Regulatory Reform and Streamlining

Efficient and less burdensome regulations are crucial. Regulatory reform should focus on streamlining processes while maintaining environmental protection and Indigenous rights.

Technological Innovation

Investing in and adopting technological advancements is key to improving efficiency, reducing environmental impact, and enhancing safety. This includes automation, remote sensing, and data analytics.

Investing in Human Capital

A skilled and well-trained workforce is vital. Investing in education and training programs will ensure the Canadian resource sector has the expertise to thrive.

Conclusion: Can a Bulldog Banker Steer Canada's Resource Sector Towards Success?

The Canadian resource sector faces significant challenges: environmental concerns, market volatility, infrastructure gaps, Indigenous relations, and global competition. While a "bulldog" banker's decisive leadership style could offer advantages in securing investment and streamlining regulations, it also carries risks. The optimal approach requires a balance between decisive action and collaborative engagement, ensuring long-term sustainability and respect for all stakeholders. The success of the Canadian resource sector hinges on finding effective leaders who can navigate these complexities with a blend of determination and collaboration. Continued analysis and discussion of the "bulldog banker" approach and its applicability to the nuanced challenges within the Canadian resource industry are essential for charting a path toward sustainable prosperity. Let's continue the conversation about the best strategies for revitalizing this vital sector of the Canadian economy.

Featured Posts

-

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 15, 2025

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 15, 2025 -

Bruins Eist Spoedberaad Npo Over Leeflang Affaire

May 15, 2025

Bruins Eist Spoedberaad Npo Over Leeflang Affaire

May 15, 2025 -

Bruins Onder Druk Gesprek Met Npo Toezichthouder Over Leeflang Essentieel

May 15, 2025

Bruins Onder Druk Gesprek Met Npo Toezichthouder Over Leeflang Essentieel

May 15, 2025 -

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025 -

Giants Vs Padres Game Prediction Will The Padres Win Or Lose By One Run

May 15, 2025

Giants Vs Padres Game Prediction Will The Padres Win Or Lose By One Run

May 15, 2025

Latest Posts

-

Albanese Vs Dutton A Pivotal Election Pitch

May 15, 2025

Albanese Vs Dutton A Pivotal Election Pitch

May 15, 2025 -

Vont Weekend At 96 1 Kissfm April 4 6 2025 Image Gallery

May 15, 2025

Vont Weekend At 96 1 Kissfm April 4 6 2025 Image Gallery

May 15, 2025 -

103 X Vont Weekend April 4th 6th 2025 In Pictures

May 15, 2025

103 X Vont Weekend April 4th 6th 2025 In Pictures

May 15, 2025 -

1 Kissfms Vont Weekend Four Days In Pictures April 4 6 2025

May 15, 2025

1 Kissfms Vont Weekend Four Days In Pictures April 4 6 2025

May 15, 2025 -

My Vont Weekend A Photo Journal April 4 6 2025 103 X

May 15, 2025

My Vont Weekend A Photo Journal April 4 6 2025 103 X

May 15, 2025