Canadian Businesses Face Rising Uncertainty Amidst Tariffs: StatCan Data

Table of Contents

StatCan Data Reveals Key Impacts of Tariffs on Canadian Businesses

Statistics Canada's recent reports offer a stark assessment of the impact of tariffs on Canadian businesses. The data reveals a significant correlation between tariff increases and decreased business performance across several key sectors. Analyzing this data is crucial for understanding the current economic climate and adapting business strategies accordingly.

-

Key Findings: StatCan data shows a measurable decline in export volumes for several industries, including manufacturing and agriculture, directly attributable to increased tariffs imposed by trading partners. For instance, the manufacturing sector experienced a [insert percentage]% decrease in exports to [insert specific country/region] following the implementation of new tariffs. Similarly, the agricultural sector saw a [insert percentage]% decline in exports of [insert specific product] to [insert specific country/region].

-

Quantifiable Impacts: The impact extends beyond export volumes. Import costs have risen significantly, impacting profitability and squeezing profit margins for businesses reliant on imported goods. This increase in input costs is further exacerbated by supply chain disruptions, leading to a domino effect on pricing strategies and ultimately impacting consumers.

-

Industries Heavily Affected: Sectors heavily reliant on international trade, such as automotive manufacturing, forestry, and food processing, have been disproportionately affected. These industries often rely on imported components or export a significant portion of their output, making them particularly vulnerable to tariff fluctuations.

-

Visual Representation: [Insert graph or chart visually representing StatCan data on tariff impacts. Clearly label axes and include a concise title, such as "Impact of Tariffs on Canadian Export Volumes (2022-2023)"]

Rising Import Costs and Supply Chain Disruptions

The escalating import costs are a major consequence of rising tariffs, directly impacting the bottom line of numerous Canadian businesses. This challenge is further complicated by the disruptions to global supply chains, leading to delays, increased transportation costs, and uncertainty in sourcing raw materials and components.

-

Increased Input Costs: Tariffs increase the cost of imported goods, forcing businesses to absorb these added expenses or pass them on to consumers. This can lead to decreased competitiveness, particularly for businesses operating on tight margins.

-

Supply Chain Disruptions: The complexities of international trade are magnified by tariffs. Businesses must navigate new logistical challenges, potentially requiring them to source materials from alternative, and sometimes less efficient or more costly, suppliers. This uncertainty impacts production schedules and overall business planning.

-

Mitigation Strategies: Many businesses are adopting proactive strategies to mitigate the effects of increased import costs and supply chain disruptions. This includes: diversifying supply chains by sourcing from multiple countries, negotiating better terms with suppliers, investing in more efficient logistics, and exploring opportunities to increase domestic sourcing of materials.

-

Inflationary Pressures: These increased input costs ultimately contribute to inflationary pressures, impacting the overall cost of goods and services for Canadian consumers.

The Impact on Canadian Export Businesses and International Trade

Canadian export businesses face significant headwinds in the global marketplace due to tariffs. These trade barriers reduce market access and increase the cost of Canadian goods and services, impacting competitiveness.

-

Reduced Competitiveness: Tariffs make Canadian exports more expensive compared to competitors in countries not subject to the same trade barriers, potentially leading to a loss of market share.

-

Retaliatory Tariffs: The imposition of tariffs by Canada or other countries can trigger retaliatory measures, further exacerbating the challenges faced by Canadian businesses.

-

Impact on Bilateral Trade Agreements: Tariffs can negatively impact the effectiveness of bilateral trade agreements, undermining the benefits of these partnerships and increasing trade tensions.

-

Maintaining Market Share: Canadian businesses are actively seeking strategies to maintain their market share despite these challenges, including focusing on value-added products, exploring new markets, and enhancing their brand reputation to justify premium pricing.

Government Policies and Support for Affected Businesses

The Canadian government has implemented various programs to support businesses impacted by tariffs. These initiatives aim to mitigate the negative effects and promote economic resilience.

-

Government Initiatives: These may include financial aid, tax credits, and export promotion programs designed to assist businesses in navigating these challenges. [Insert specific examples of government programs and initiatives here, including links to relevant websites]

-

Effectiveness of Policies: The effectiveness of these programs varies depending on the specific industry and the nature of the challenges faced by individual businesses. Further analysis is needed to assess the long-term impact of these support measures.

-

Future Government Actions: Continued monitoring of the situation and adaptation of government policies are crucial to effectively address the ongoing challenges faced by Canadian businesses in the face of tariff-related uncertainty.

Conclusion

The StatCan data clearly demonstrates the significant uncertainty Canadian businesses face due to rising tariffs. Increased import costs, supply chain disruptions, and reduced competitiveness in global markets are creating substantial challenges. Businesses are responding with strategic adaptations, including diversifying supply chains and seeking alternative sourcing options. Understanding the impact of tariffs on Canadian businesses is crucial. Stay updated on the latest StatCan data and explore available government resources to help your business navigate this period of uncertainty. Proactive planning and adaptation are key to mitigating the risks associated with fluctuating tariff policies and maintaining profitability in this dynamic economic landscape.

Featured Posts

-

Analyzing The Pokemon Tcg Pocket New Crown Zenith Card Set

May 29, 2025

Analyzing The Pokemon Tcg Pocket New Crown Zenith Card Set

May 29, 2025 -

Regi Holmik Ertekes Leletek A Bukszak Felfedezese

May 29, 2025

Regi Holmik Ertekes Leletek A Bukszak Felfedezese

May 29, 2025 -

Mstqbl Jwnathan Tah Me Brshlwnt Alqrar Alrsmy Alsadm

May 29, 2025

Mstqbl Jwnathan Tah Me Brshlwnt Alqrar Alrsmy Alsadm

May 29, 2025 -

The Emerging Bond Crisis A Deep Dive For Investors

May 29, 2025

The Emerging Bond Crisis A Deep Dive For Investors

May 29, 2025 -

E4 000 Voor Oranje In Liverpool Waanzinnige Prijzen Voor Wk Tickets

May 29, 2025

E4 000 Voor Oranje In Liverpool Waanzinnige Prijzen Voor Wk Tickets

May 29, 2025

Latest Posts

-

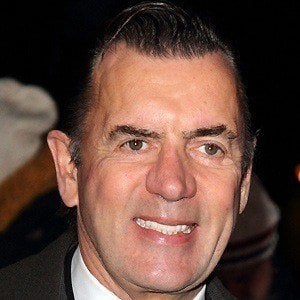

Moroccan Childrens Charity Receives Support From Duncan Bannatyne

May 31, 2025

Moroccan Childrens Charity Receives Support From Duncan Bannatyne

May 31, 2025 -

Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025

Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025 -

New Padel Courts Coming To Chafford Hundred Health Club A Dragons Den Success Story

May 31, 2025

New Padel Courts Coming To Chafford Hundred Health Club A Dragons Den Success Story

May 31, 2025 -

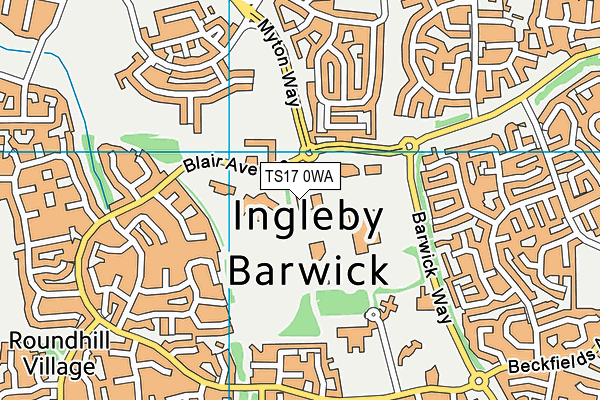

Ingleby Barwick Bannatyne Padel Court Project Progress

May 31, 2025

Ingleby Barwick Bannatyne Padel Court Project Progress

May 31, 2025 -

Life Changing Impact Duncan Bannatynes Support For A Moroccan Childrens Charity

May 31, 2025

Life Changing Impact Duncan Bannatynes Support For A Moroccan Childrens Charity

May 31, 2025