Cenovus Prioritizes Organic Growth, Dimming Prospects Of MEG Buyout

Table of Contents

Cenovus's Shift Towards Organic Growth

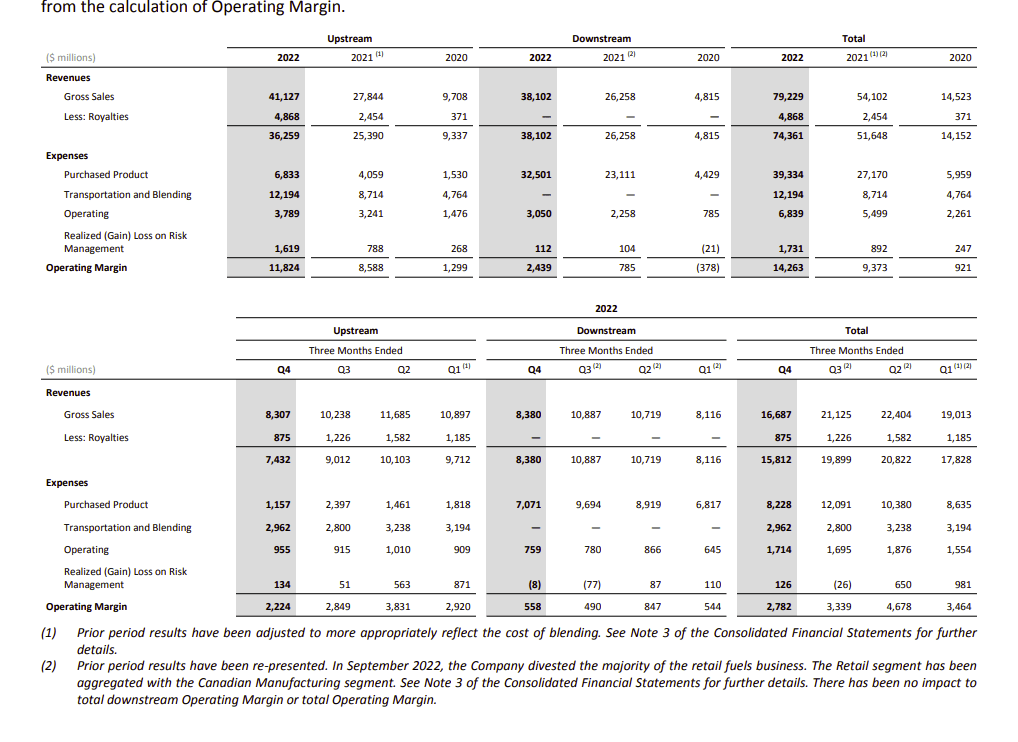

Cenovus's decision reflects a broader strategic realignment, emphasizing sustainable and financially prudent growth strategies. This shift involves several key initiatives:

Focus on Operational Efficiency and Cost Reduction

Cenovus is implementing a comprehensive plan to streamline its operations and enhance efficiency. This includes:

- Streamlining operations: Identifying and eliminating redundancies across its various business units.

- Improving production processes: Implementing technological advancements to optimize extraction and refining processes.

- Leveraging technology for enhanced efficiency: Utilizing data analytics and automation to improve resource allocation and reduce operational costs.

- Reducing capital expenditures in non-core areas: Focusing investment on high-return projects within its core competencies.

These initiatives are designed to boost profitability and strengthen Cenovus's financial position, thereby reducing the need for large-scale acquisitions like the proposed MEG Energy buyout. By focusing on internal improvements, Cenovus aims to achieve sustainable growth without the risks and complexities associated with mergers and acquisitions.

Increased Investment in Existing Assets

Rather than pursuing external acquisitions, Cenovus is increasing its investment in its existing assets. This includes:

- Exploration and development of existing oil sands reserves: Expanding production capacity within its existing operations to maximize returns.

- Upgrades to refining capacity: Modernizing refining infrastructure to improve efficiency and output.

- Expansion of downstream operations: Strengthening its presence in the downstream market to secure greater control over its product distribution.

This approach provides higher returns on investment compared to acquisitions, as it leverages existing infrastructure and expertise. Furthermore, it reduces the risk associated with integrating a new company, a major hurdle often encountered in large-scale buyouts.

Sustainable and Responsible Energy Production

Cenovus is also emphasizing sustainable and responsible energy production practices. This involves:

- Emphasis on reducing carbon emissions: Investing in technologies and practices to minimize its environmental footprint.

- Investing in renewable energy technologies: Exploring opportunities in renewable energy sources to diversify its portfolio and reduce reliance on fossil fuels.

- Improved environmental stewardship: Implementing stringent environmental protection measures throughout its operations.

This commitment aligns with growing investor preferences for ESG (Environmental, Social, and Governance) factors, enhancing Cenovus's long-term value and attracting environmentally conscious investors. This strategic shift is viewed favorably by many stakeholders.

Why a MEG Buyout is Less Likely Now

The shift towards organic growth significantly diminishes the probability of a Cenovus MEG buyout. Several factors contribute to this reduced likelihood:

Financial Considerations

The potential acquisition of MEG Energy presents significant financial challenges for Cenovus:

- High acquisition costs: The current market valuation of MEG Energy, combined with potential premiums, makes the acquisition price potentially prohibitive for Cenovus given its current financial priorities.

- Potential debt burden: A large acquisition would significantly increase Cenovus's debt levels, potentially impacting its credit rating and financial flexibility.

- Uncertain market conditions: The volatility of the energy market adds uncertainty to the financial viability of such a large acquisition.

Strategic Alignment

Beyond the financial considerations, there are strategic misalignments between Cenovus and MEG Energy:

- Differing corporate strategies: MEG Energy's operational focus may not be fully compatible with Cenovus's new, more streamlined approach to organic growth.

- Potential integration challenges: Merging two companies of similar size can lead to substantial integration difficulties, impacting operational efficiency and potentially delaying the realization of anticipated synergies.

Regulatory Hurdles

A Cenovus MEG buyout would also face potential regulatory hurdles:

- Antitrust concerns: Regulatory bodies may scrutinize the acquisition for potential anti-competitive effects within the Canadian oil sands industry.

- Regulatory approvals: Securing necessary regulatory approvals can be a lengthy and complex process, adding further uncertainty to the timeline and feasibility of the acquisition.

Implications for Investors and the Energy Market

Cenovus's strategic shift has significant implications for investors and the broader energy market:

Impact on Cenovus Stock

The shift towards organic growth could positively impact Cenovus's stock price in the long term by reducing financial risk and focusing on sustainable, profitable growth. However, short-term market reactions may vary.

Future of MEG Energy

MEG Energy will likely need to explore alternative strategies, potentially including seeking other buyers or forging strategic partnerships to achieve its growth objectives.

Broader Market Trends

Cenovus's decision reflects a broader industry trend towards sustainable and financially prudent growth strategies within the Canadian oil sands sector, emphasizing operational efficiency and responsible resource management. This approach suggests a less aggressive consolidation phase within the sector, at least in the short term.

Conclusion

Cenovus's decision to prioritize organic growth over a potential MEG buyout represents a significant strategic pivot. By focusing on operational efficiency, investing in existing assets, and committing to sustainable practices, Cenovus aims to deliver sustainable shareholder value through a more controlled and less risky approach. While this diminishes the probability of a Cenovus MEG buyout in the near term, it presents a clearer path toward long-term growth and enhanced profitability. This shift highlights a broader trend in the energy sector toward financially prudent and environmentally conscious strategies. To stay updated on the evolving situation and future developments regarding the Cenovus MEG buyout and the Canadian oil sands industry, continue to follow our analysis and insights.

Featured Posts

-

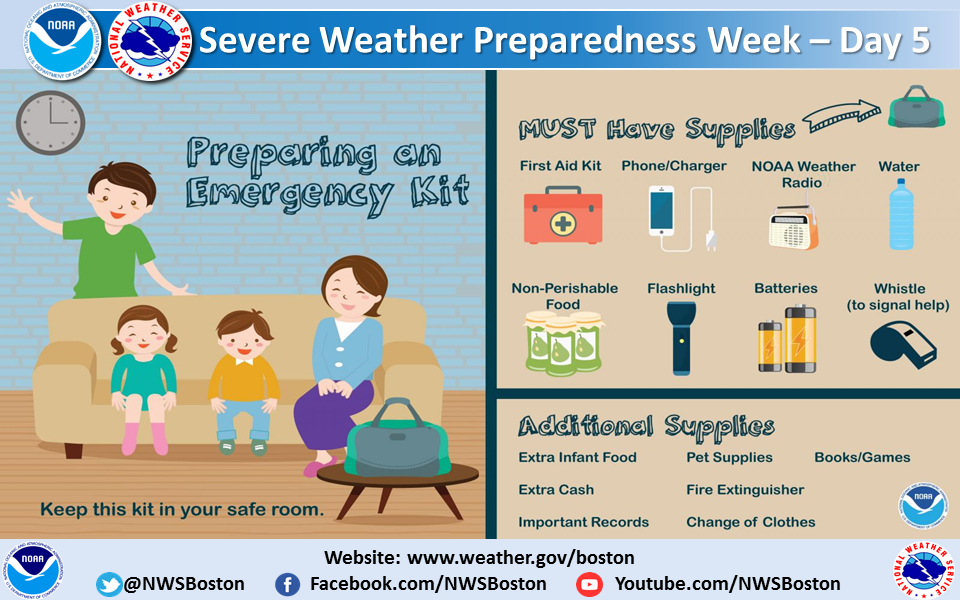

Understanding Flood Risks Your Guide To Flood Safety Severe Weather Awareness Week

May 25, 2025

Understanding Flood Risks Your Guide To Flood Safety Severe Weather Awareness Week

May 25, 2025 -

Eurovision Village 2025 Conchita Wurst And Jj Live On Stage

May 25, 2025

Eurovision Village 2025 Conchita Wurst And Jj Live On Stage

May 25, 2025 -

Demna Gvasalia Reshaping Guccis Brand Identity

May 25, 2025

Demna Gvasalia Reshaping Guccis Brand Identity

May 25, 2025 -

Investing In Apple Considering Wedbushs Revised Price Target And Long Term View

May 25, 2025

Investing In Apple Considering Wedbushs Revised Price Target And Long Term View

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025

Latest Posts

-

Naomi Kempbell Pokazala Detey Novye Foto I Slukhi O Romane S Millionerom

May 25, 2025

Naomi Kempbell Pokazala Detey Novye Foto I Slukhi O Romane S Millionerom

May 25, 2025 -

Doch I Syn Naomi Kempbell Eksklyuzivnye Foto I Podrobnosti O Seme

May 25, 2025

Doch I Syn Naomi Kempbell Eksklyuzivnye Foto I Podrobnosti O Seme

May 25, 2025 -

Naomi Kampel Fotografies Apo Tis Eksotikes Tis Diakopes Stis Maldives

May 25, 2025

Naomi Kampel Fotografies Apo Tis Eksotikes Tis Diakopes Stis Maldives

May 25, 2025 -

Naomi Kempbell 55 Let Luchshie Snimki Za Vsyu Kareru

May 25, 2025

Naomi Kempbell 55 Let Luchshie Snimki Za Vsyu Kareru

May 25, 2025 -

54xroni Naomi Kampel Apolamvanei Tis Diakopes Tis Stis Maldives Me Tin Oikogeneia Tis

May 25, 2025

54xroni Naomi Kampel Apolamvanei Tis Diakopes Tis Stis Maldives Me Tin Oikogeneia Tis

May 25, 2025