Closure Of Point72's Pod Focused On Emerging Markets

Table of Contents

Reasons Behind Point72's Decision to Close the Emerging Markets Pod

The closure of Point72's emerging markets pod wasn't a spontaneous decision; rather, it likely stemmed from a confluence of factors. Several contributing reasons can be explored:

-

Underperformance: The most plausible reason is the pod's underperformance relative to its targets and compared to other investment areas within Point72. While specific performance data remains confidential, market whispers suggest a failure to meet internal benchmarks. This could be due to unforeseen challenges specific to emerging markets.

-

Shifting Investment Strategies: Point72, like other large hedge funds, constantly reviews and adjusts its investment strategies. This closure may reflect a broader strategic shift away from emerging markets, perhaps in favor of areas deemed more promising or less volatile. This reallocation of resources is a common practice amongst large investment firms.

-

Economic Headwinds in Emerging Markets: Global economic uncertainties, rising inflation in several emerging markets, geopolitical instability, and currency fluctuations all pose significant challenges to investors. These factors likely played a role in Point72's reassessment of its emerging markets exposure. News articles highlighting the volatility of certain emerging markets during this period support this theory.

-

Internal Restructuring and Resource Allocation: Internal restructuring and a reassessment of resource allocation could have also been key drivers. Point72 might have decided to consolidate its resources in more profitable or less risky areas, leading to the closure of the dedicated emerging markets team.

Impact of the Closure on Employees and Investors

The closure of the emerging markets pod has significant ramifications for both employees and investors:

Impact on Employees:

-

Job Losses: The most immediate impact is job losses for employees within the dedicated pod. The number of affected individuals remains undisclosed, but the event undoubtedly caused significant disruption to their careers.

-

Support from Point72: Point72 is likely providing support services to affected employees during the transition, such as outplacement assistance and severance packages. The extent of this support will influence their long-term prospects.

-

Long-Term Career Prospects: While job losses are significant, the affected individuals' experience and expertise in emerging market investments remain valuable. Their career prospects will depend on their ability to adapt and secure new roles within the financial industry.

Impact on Investors:

-

Portfolio Allocation Adjustments: Point72's investors will likely see adjustments to their portfolio allocations as a result of the pod closure. The firm will need to communicate clearly how this shift impacts overall investment strategy.

-

Investor Expectations: Investor expectations might be impacted, requiring adjustments in risk tolerance and return projections. Transparent communication will be crucial in maintaining investor confidence.

-

Investor Confidence: The decision to close the pod could affect overall investor confidence in Point72's ability to navigate the complexities of emerging market investments. The firm’s response to investor concerns will be vital in mitigating any negative effects.

Point72's Future Strategy in Emerging Markets After the Pod Closure

Following the closure, Point72’s approach to emerging market investments will likely undergo a significant transformation:

-

Increased Reliance on External Partnerships: Point72 might choose to rely more heavily on external partnerships with specialized emerging market funds or investment managers. This would allow them to maintain exposure to these markets without the overhead of an internal dedicated team.

-

Sector-Specific Focus: Rather than a broad approach, Point72 could shift to a more focused investment strategy, targeting specific, high-growth sectors within selected emerging markets with strong growth potential.

-

Cautious and Selective Approach: Expect a more cautious and highly selective approach to emerging market investments. Due diligence and risk assessment will likely become even more stringent.

-

Focus on Other Investment Areas: Resources previously allocated to the emerging markets pod may now be redirected towards other areas deemed to offer higher returns or lower risk.

Comparing Point72's Approach with Other Hedge Funds

Point72's decision to close its emerging markets pod stands in contrast to some hedge funds that continue to aggressively pursue opportunities in this space. However, other large firms might also reassess their strategies based on the recent economic climate and potential risks. A comparative analysis of the approaches of various hedge funds reveals a spectrum of responses to current market conditions, reflecting diverse risk tolerances and investment philosophies.

Conclusion: The Future of Point72's Emerging Market Investments

The closure of Point72's dedicated emerging markets pod marks a significant strategic shift. The decision reflects a combination of underperformance, shifting investment priorities, economic headwinds in emerging markets, and internal resource reallocation. This event has implications for employees, investors, and the broader hedge fund industry. While Point72's future engagement with emerging markets will likely be different, its future strategies will undoubtedly be closely watched. Stay updated on Point72's investment strategy, follow the latest news on emerging market investments, and learn more about Point72's future in emerging markets. The evolving landscape of emerging market investment presents both challenges and opportunities, and Point72's adjustments will serve as a case study for other firms navigating this complex terrain.

Featured Posts

-

Point72s Emerging Markets Fund Shuts Down Trader Departures Confirmed

Apr 26, 2025

Point72s Emerging Markets Fund Shuts Down Trader Departures Confirmed

Apr 26, 2025 -

Price Gouging Allegations Surface In Los Angeles After Recent Fires A Selling Sunset Perspective

Apr 26, 2025

Price Gouging Allegations Surface In Los Angeles After Recent Fires A Selling Sunset Perspective

Apr 26, 2025 -

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 26, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 26, 2025 -

Trump Tariffs Ceo Concerns And Consumer Impact

Apr 26, 2025

Trump Tariffs Ceo Concerns And Consumer Impact

Apr 26, 2025 -

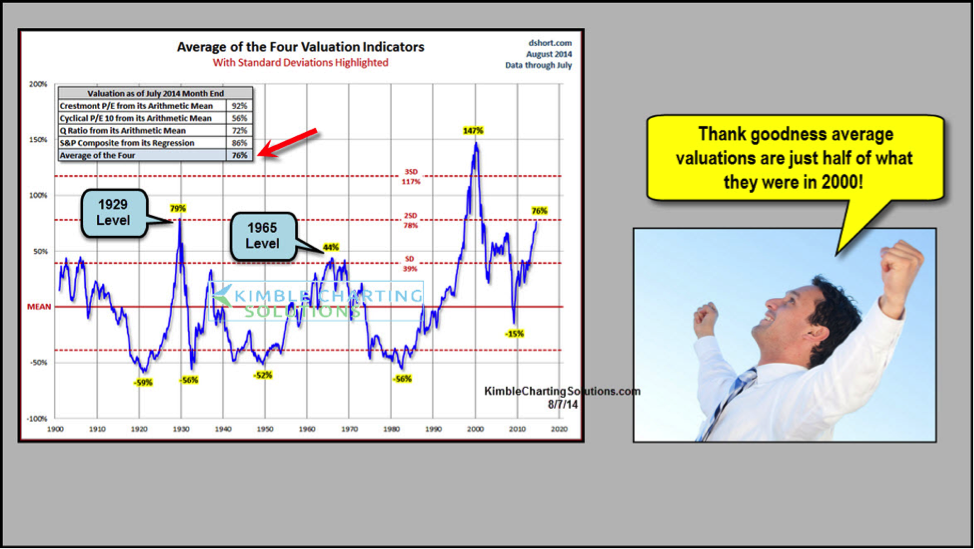

Bof As Take Are High Stock Market Valuations Really A Worry

Apr 26, 2025

Bof As Take Are High Stock Market Valuations Really A Worry

Apr 26, 2025