CoreWeave (CRWV) Soars: Analyzing The Reasons For Last Week's Stock Increase

Table of Contents

Strong Earnings Report and Revenue Growth

CoreWeave's recent earnings report was a significant catalyst for the CRWV stock increase. The company exceeded analyst expectations across the board, delivering impressive figures that solidified investor confidence. Key highlights included a substantial percentage increase in revenue, exceeding projected growth rates, and positive earnings per share (EPS). This strong financial performance signaled a healthy trajectory for the company and fueled optimistic projections.

- Exceeded Analyst Expectations: CoreWeave significantly surpassed analysts' consensus estimates for both revenue and earnings, demonstrating strong execution and market demand for its services.

- Significant Revenue Increases from AI and Cloud Computing: A considerable portion of the revenue surge stemmed from the rapidly expanding AI and cloud computing sectors, showcasing CoreWeave's strategic positioning within these high-growth markets. This segment showed particularly strong growth, outpacing overall revenue increases.

- Positive Guidance for Future Quarters: The company provided positive guidance for the coming quarters, reinforcing the belief that this upward trend is sustainable and not a one-off event. This forward-looking outlook further bolstered investor sentiment.

These positive financial results directly impacted investor confidence, driving up demand for CRWV stock and leading to the observed price increase. The "earnings beat" narrative coupled with a positive outlook significantly impacted investor sentiment and fueled the CRWV stock surge.

Increasing Demand for AI and Cloud Computing Infrastructure

The surge in CRWV stock price is also closely linked to the explosive growth of the AI and cloud computing infrastructure markets. CoreWeave is perfectly positioned to capitalize on this burgeoning demand, offering high-performance computing solutions crucial for AI model training and deployment.

- Global Market Size and Projected Growth: The global market for AI and cloud computing is expanding exponentially, with projections indicating continued double-digit growth for the foreseeable future. This massive market opportunity presents a significant tailwind for CoreWeave.

- CoreWeave's Competitive Advantage: CoreWeave's specialized infrastructure and expertise in high-performance computing give it a significant competitive advantage within this rapidly evolving market. Their focus on providing tailored solutions for demanding AI workloads sets them apart.

- Strategic Partnerships and Acquisitions: Strategic partnerships and potential acquisitions further enhance CoreWeave's market position, providing access to new technologies, expanded customer bases, and broader market reach.

The escalating demand for AI infrastructure, coupled with CoreWeave's ability to meet this need effectively, makes it a compelling investment in the high-performance computing space. The company's strong position in this rapidly growing market is a key driver of its recent stock performance.

Strategic Partnerships and Technological Advancements

CoreWeave's recent success isn't solely based on market trends; the company itself has actively contributed to its growth through strategic partnerships and technological advancements. These initiatives have enhanced efficiency, strengthened its competitive edge, and fueled positive investor sentiment.

- Significant Partnership Announcements: New partnerships with major players in the technology sector have expanded CoreWeave's reach and access to key resources, further accelerating its growth trajectory. These collaborations provide synergistic opportunities and enhance their market positioning.

- Technological Innovation and Improved Efficiency: CoreWeave's continuous investment in technological innovation has led to increased efficiency and cost-effectiveness, allowing them to deliver superior services to its clients. These advancements translate to increased profitability and enhance their value proposition.

- Contributions to Increased Efficiency and Market Competitiveness: These technological strides and strategic alliances have directly contributed to increased efficiency and market competitiveness, reinforcing CoreWeave's position as a leader in the high-performance computing space. This translates into better financial results and increased investor appeal.

These strategic moves and technological breakthroughs demonstrate CoreWeave's commitment to innovation and growth, further reinforcing the positive outlook for its stock.

Analyst Upgrades and Positive Market Sentiment

The surge in CRWV stock price was also amplified by positive analyst upgrades and a generally optimistic market sentiment surrounding the company. Several major investment firms upgraded their ratings on CoreWeave stock, citing the company's strong performance and positive future prospects.

- Upgrades from Major Investment Firms: Positive ratings changes from prominent financial institutions signaled a growing confidence in CoreWeave's potential for continued growth. These upgrades often come with increased price targets, further supporting the upward momentum.

- Reasons for Positive Assessments: Analysts highlighted CoreWeave's impressive financial results, robust market position, and strategic initiatives as key reasons for their positive assessments. These factors combined to generate increased investor interest.

- Impact of Positive Media Coverage and Investor Perception: Favorable media coverage and positive investor perception reinforced the narrative of CoreWeave's success, contributing to a self-reinforcing cycle of increased investor interest and higher stock prices.

The combined effect of analyst upgrades and positive media coverage significantly boosted investor confidence, driving further demand for CRWV stock and exacerbating the price increase.

Conclusion

The recent surge in CoreWeave (CRWV) stock price is a result of a confluence of positive factors. Strong financial performance, the explosive growth of the AI and cloud computing market, strategic partnerships, and positive analyst sentiment have all contributed to this impressive rise. These elements collectively paint a promising picture for CoreWeave's future. Understanding these contributing factors is crucial for investors seeking to make informed decisions. To stay updated on the latest developments and potential investment opportunities with CoreWeave (CRWV), continue to follow market analysis and company news related to CRWV stock and the broader AI and cloud computing sectors. Keep monitoring CoreWeave (CRWV) for further insights into this exciting growth story and consider its potential as a strong investment in the rapidly growing AI and cloud computing infrastructure markets.

Featured Posts

-

Love Monster More Than Just A Cute Creature

May 22, 2025

Love Monster More Than Just A Cute Creature

May 22, 2025 -

Risicos Voor Voedingsbedrijven Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 22, 2025

Risicos Voor Voedingsbedrijven Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 22, 2025 -

El Virus Fifa La Real Sociedad Sin Respiro Tras La Avalancha De Partidos

May 22, 2025

El Virus Fifa La Real Sociedad Sin Respiro Tras La Avalancha De Partidos

May 22, 2025 -

Core Weave Inc Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Core Weave Inc Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025 -

Wordle 1352 Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Wordle 1352 Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Latest Posts

-

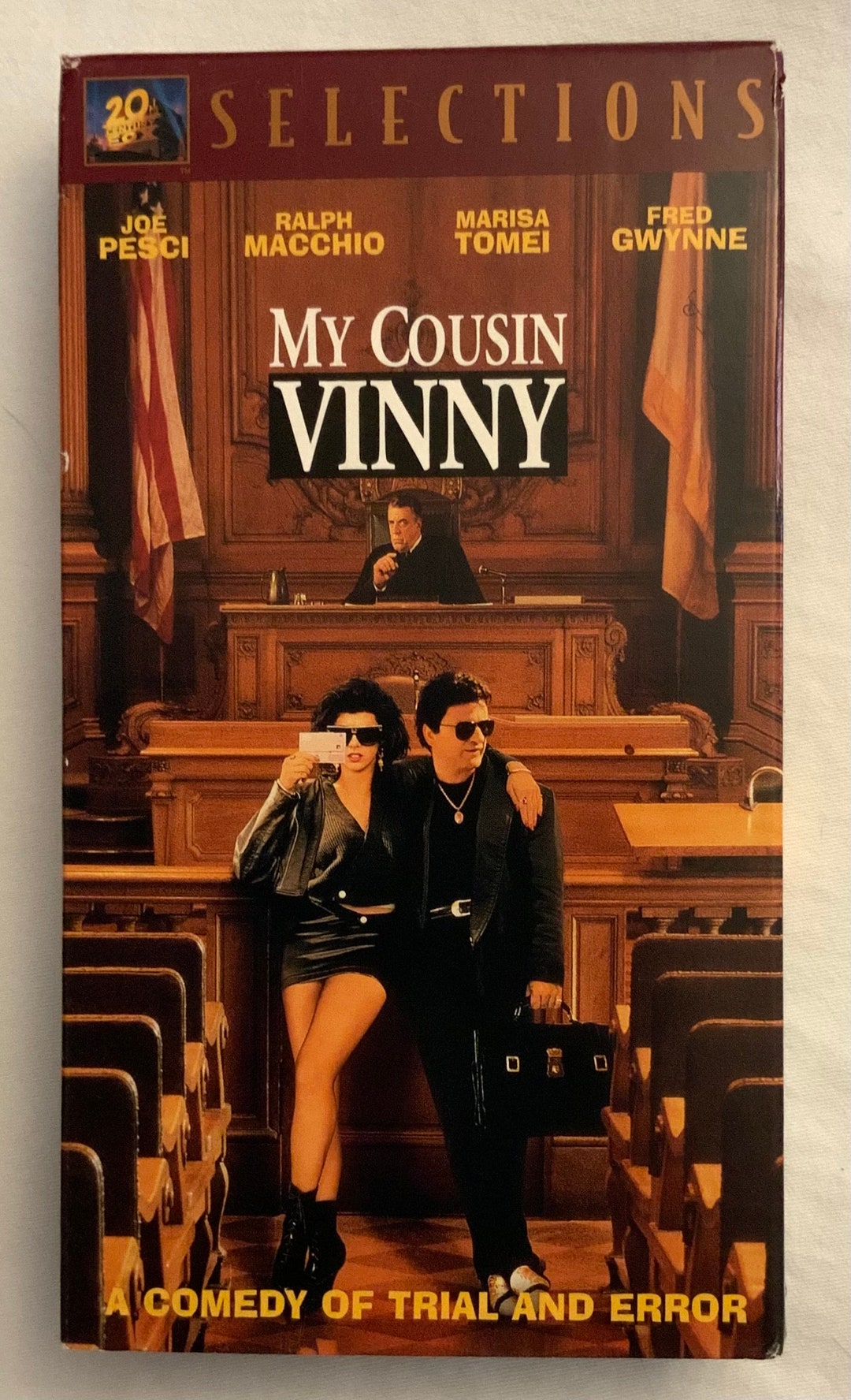

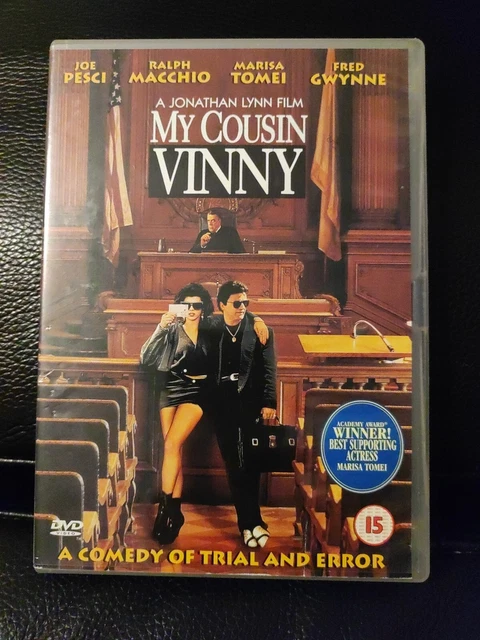

Is A My Cousin Vinny Reboot Happening Ralph Macchio And Joe Pesci Weigh In

May 23, 2025

Is A My Cousin Vinny Reboot Happening Ralph Macchio And Joe Pesci Weigh In

May 23, 2025 -

Trucking News Big Rig Rock Report 3 12 On 99 5 The Fox

May 23, 2025

Trucking News Big Rig Rock Report 3 12 On 99 5 The Fox

May 23, 2025 -

My Cousin Vinny Reboot Update From Ralph Macchio Joe Pescis Possible Return

May 23, 2025

My Cousin Vinny Reboot Update From Ralph Macchio Joe Pescis Possible Return

May 23, 2025 -

Deciphering The Big Rig Rock Report 3 12 97 1 Double Q Results

May 23, 2025

Deciphering The Big Rig Rock Report 3 12 97 1 Double Q Results

May 23, 2025 -

Ralph Macchio On A My Cousin Vinny Reboot Latest News And Joe Pesci Update

May 23, 2025

Ralph Macchio On A My Cousin Vinny Reboot Latest News And Joe Pesci Update

May 23, 2025