Cryptocurrency's Resilience: A Trade War Case Study

Table of Contents

Historical Performance of Cryptocurrencies During Trade Disputes

The 2018 US-China Trade War

The 2018 trade war between the US and China presented a significant test for cryptocurrency markets. While traditional markets experienced considerable volatility, Bitcoin's price movements during this period were complex. Initial escalations often correlated with increased uncertainty, leading to temporary dips in Bitcoin's value. However, it did not experience the same dramatic and sustained downturns as some traditional equities. [Insert chart/graph showing Bitcoin's price during 2018 trade war]. This suggests that some investors viewed crypto as a potential hedge against trade war risks, seeking diversification away from assets directly impacted by trade policies. The lack of a strong, direct correlation between trade war escalation and Bitcoin price fluctuations suggests that other market forces were also at play.

- Increased Volatility: Both traditional and cryptocurrency markets experienced increased volatility during this period.

- Diversification Strategy: Some investors utilized cryptocurrency as part of a broader diversification strategy to mitigate trade war-related risks.

- Decoupling from Traditional Markets: While some correlation existed, cryptocurrency markets showed a degree of decoupling from the traditional markets most heavily impacted by trade tensions.

Other Relevant Trade Disputes

While the US-China trade war is the most prominent recent example, other trade disputes offer valuable insights. For instance, the ongoing trade tensions between the US and the EU have also impacted global markets. While the impact on cryptocurrencies wasn't as dramatic as in the US-China case, it's important to note that cryptocurrency markets are not entirely immune to wider geopolitical uncertainty. Analyzing these various events helps to identify broader patterns in how cryptocurrencies react to international trade conflicts. Further research into the impact of other trade disputes on crypto prices is needed to draw more conclusive observations. [Mention any relevant data points or studies here].

Comparison to Traditional Assets

Comparing cryptocurrency performance to traditional assets like gold, stocks, and bonds during trade wars reveals interesting contrasts. Gold, often considered a safe haven asset, tends to appreciate during times of uncertainty. However, cryptocurrencies, while exhibiting volatility, sometimes displayed less dramatic price swings than some equity markets during the peak of trade war escalations. This difference highlights the unique characteristics of cryptocurrencies and their potential role in a diversified investment portfolio. The relative performance underscores the need for further study to determine the consistent and reliable role crypto can play in a risk-mitigation strategy during geopolitical unrest.

Factors Contributing to Cryptocurrency's Resilience

Decentralization and Lack of Central Control

A key factor contributing to cryptocurrency's resilience is its decentralized nature. Unlike traditional assets, cryptocurrencies are not controlled by any single government or institution. This makes them less susceptible to the direct impact of trade wars and nationalistic policies. Centralized assets, on the other hand, can be significantly affected by government actions and trade restrictions. The decentralized structure of blockchain technology offers a level of protection against geopolitical interference that is absent in many traditional markets.

Global Accessibility and Liquidity

Cryptocurrencies are accessible and tradable globally, bypassing many of the national borders and restrictions that often characterize traditional finance. Crypto exchanges facilitate this global accessibility, enabling investors to buy, sell, and hold crypto regardless of their location or the trade policies affecting their country. This global reach is a significant factor in their relative resilience during periods of trade conflict.

Investor Sentiment and Safe Haven Status

Increasingly, investors view cryptocurrencies as a potential safe haven asset during times of economic and political uncertainty. This perception, while still evolving, contributes to their relative stability compared to other assets during trade wars. Investor behavior shifts during trade disputes, with some seeking refuge in assets perceived as less exposed to geopolitical risk. This shift in sentiment is reflected in the price movements of cryptocurrencies.

Limitations and Considerations

Volatility and Market Maturity

It's crucial to acknowledge the inherent volatility of the cryptocurrency market. This volatility can impact investor confidence, especially during periods of heightened global uncertainty. The relative immaturity of the cryptocurrency market compared to traditional financial markets also presents a risk. This lack of maturity means the market is susceptible to dramatic price swings driven by speculation, hype, and market manipulation.

Regulatory Uncertainty

Regulatory uncertainty and differing government approaches to cryptocurrencies represent significant challenges. The lack of a consistent global regulatory framework affects investor confidence and could impact the price stability of cryptocurrencies during trade conflicts. The evolving regulatory landscape needs to be carefully monitored as it could significantly shape the future role and resilience of cryptocurrencies.

Conclusion: Assessing Cryptocurrency's Resilience and Future Outlook

This analysis highlights cryptocurrency's resilience during periods of trade conflict, demonstrating a notable capacity to withstand some of the shockwaves impacting traditional markets. Key factors contributing to this resilience include the decentralized nature of cryptocurrencies, their global accessibility, and the growing perception of them as a safe haven asset. However, it is essential to acknowledge the limitations, including inherent volatility and regulatory uncertainty. Further research into cryptocurrency resilience and its potential as a hedge against future global economic uncertainties is warranted. Explore resources like [link to relevant research paper/website] to delve deeper into this fascinating and evolving asset class.

Featured Posts

-

Car Dealerships Increase Resistance To Electric Vehicle Regulations

May 09, 2025

Car Dealerships Increase Resistance To Electric Vehicle Regulations

May 09, 2025 -

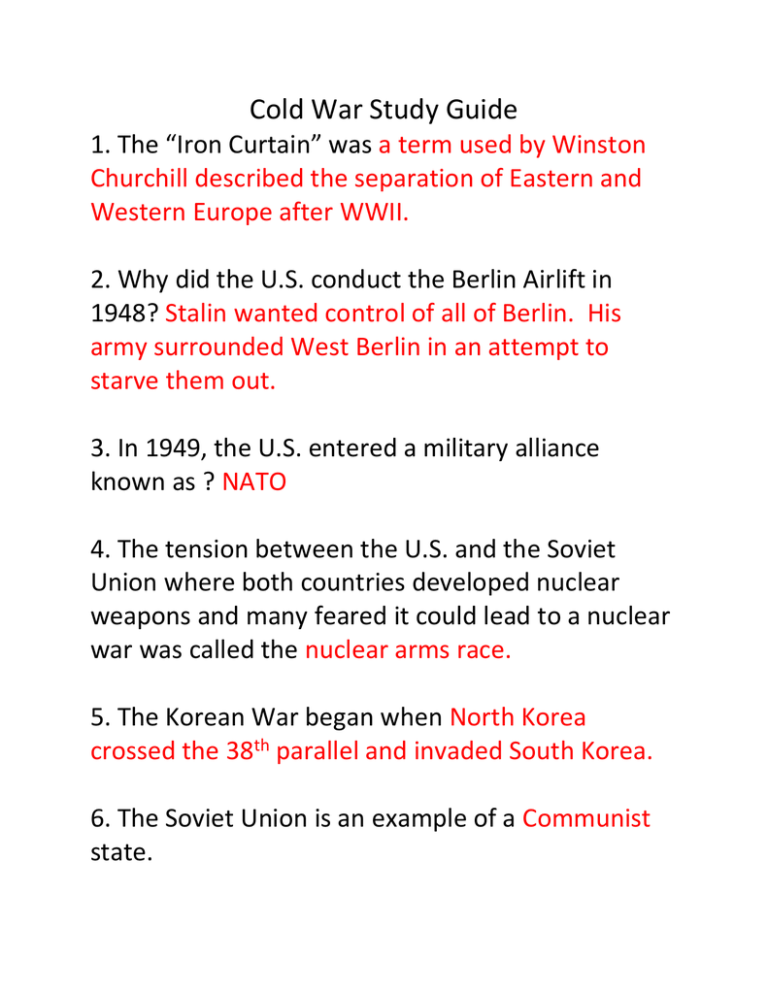

Choppy Trade In Indian Markets Sensex And Nifty 50 End Unchanged

May 09, 2025

Choppy Trade In Indian Markets Sensex And Nifty 50 End Unchanged

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025 -

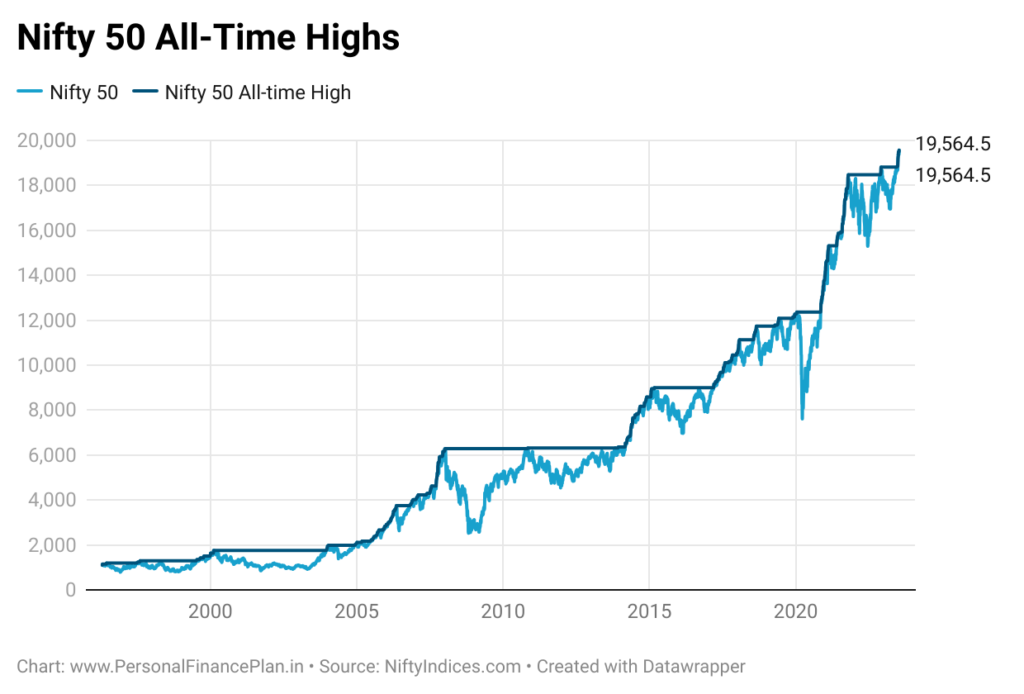

Expensive Childcare Costs From 3 K Babysitter To 3 6 K Daycare

May 09, 2025

Expensive Childcare Costs From 3 K Babysitter To 3 6 K Daycare

May 09, 2025 -

Market Report Sensex And Nifty Gains Ultra Techs Decline

May 09, 2025

Market Report Sensex And Nifty Gains Ultra Techs Decline

May 09, 2025