Cryptocurrency's Resilience: Surviving And Thriving Amidst Trade Wars

Table of Contents

Decentralization as a Protective Shield

Cryptocurrencies possess inherent characteristics that buffer them against the shocks of trade wars. This resilience stems primarily from their decentralized nature and global accessibility.

Reduced Dependence on Geopolitical Factors

Cryptocurrencies operate on decentralized networks, minimizing their vulnerability to single points of failure, including government regulations or trade disputes impacting traditional financial systems. This is a key differentiator from traditional assets.

- Reduced exposure to sanctions and trade barriers: Unlike fiat currencies, crypto transactions are not subject to the same level of geopolitical control. This makes them an attractive option in countries facing sanctions or trade restrictions.

- Transactions are peer-to-peer, bypassing traditional banking systems affected by trade wars: Crypto transactions occur directly between parties, eliminating reliance on intermediary banks that might be impacted by trade disputes or sanctions. This peer-to-peer (P2P) aspect is crucial for maintaining transaction flow even during periods of geopolitical instability.

- Increased transparency through blockchain technology which reduces opportunities for manipulation by single entities: The transparent and immutable nature of the blockchain ledger makes it difficult for any single entity or government to manipulate the system.

Global Accessibility and Liquidity

The crypto market operates 24/7, globally. This constant accessibility ensures liquidity even during periods of heightened geopolitical uncertainty, unlike traditional markets that might experience significant closures or reduced trading hours during crises.

- Investors can easily access and trade cryptocurrencies regardless of geographical location or trade restrictions: The borderless nature of crypto markets allows investors worldwide to participate, regardless of their nationality or location.

- This liquidity provides a hedge against volatility in traditional markets influenced by trade disputes: When traditional markets are experiencing turmoil due to trade wars, crypto markets can offer a haven for investors seeking to preserve capital.

- Diversification opportunities within the crypto market reduce reliance on single national economies: Investing in diverse cryptocurrencies mitigates the risk associated with relying on any single national economy or currency affected by trade wars.

Crypto's Role as a Hedge Against Inflation and Currency Devaluation

Trade wars frequently lead to inflation and currency devaluation in affected countries. This erosion of purchasing power makes investors seek alternative stores of value. Cryptocurrencies, particularly those with limited supply like Bitcoin, offer a potential hedge against these inflationary pressures.

Safe Haven Asset Characteristics

The characteristics of many cryptocurrencies align with those of traditional safe haven assets like gold. Their limited supply and decentralized nature make them attractive during times of economic stress.

- Investors seek alternative stores of value during economic uncertainty: During trade wars, investors often look beyond traditional assets to preserve their wealth. Cryptocurrencies can fill this role.

- Cryptocurrency's deflationary nature contrasts with inflationary pressures caused by trade wars: Unlike fiat currencies, many cryptocurrencies have a fixed or predetermined supply, which can limit inflation.

- Portfolio diversification with crypto assets can minimize the impact of currency fluctuations: Incorporating cryptocurrencies into a diversified portfolio can reduce the overall risk associated with currency devaluation caused by trade wars.

Increased Demand During Economic Uncertainty

As confidence in traditional assets erodes due to trade wars, demand for cryptocurrencies often increases. This is driven by investors seeking refuge in assets perceived as less susceptible to geopolitical events.

- Increased investment in cryptocurrencies as a safe haven asset: This increased interest is evident in rising crypto market capitalization during times of geopolitical instability.

- Greater demand leads to price appreciation, further boosting its appeal: Higher demand can drive up cryptocurrency prices, making them even more attractive to investors.

- This increased demand can lead to market capitalization growth, despite trade war headwinds: The growth in market capitalization demonstrates the sector's resilience even during challenging global economic conditions.

Technological Innovation and Adaptability

The cryptocurrency space is characterized by constant evolution. This adaptability is a key factor in its resilience to external shocks, including those arising from trade wars.

Evolution of Cryptocurrencies

The crypto landscape is constantly evolving, with new technologies and solutions addressing existing challenges.

- Development of new privacy coins mitigating regulatory hurdles: Innovations focus on increasing privacy and potentially circumventing some regulatory hurdles.

- Improved scalability solutions to handle increased transaction volume during times of economic stress: Ongoing development ensures the crypto infrastructure can handle increased transaction volume during periods of high demand.

- Increased focus on regulatory compliance to enhance mainstream adoption: The industry is actively working towards better regulatory compliance to facilitate wider adoption.

Addressing Regulatory Concerns

While regulatory uncertainty remains a challenge, the cryptocurrency sector demonstrates a willingness to adapt and engage with regulators.

- Initiatives towards self-regulation and collaboration with governments: Industry players are actively participating in efforts to establish clear regulatory frameworks.

- Transparency and compliance efforts to overcome regulatory barriers: Increased transparency and compliance initiatives help address regulatory concerns and build trust.

- Increased focus on security and combating illicit activities: The industry is actively working to improve security measures and combat illicit activities to enhance its credibility.

Conclusion

Cryptocurrencies are exhibiting surprising resilience in the face of escalating trade wars. Their decentralized nature, global accessibility, and potential as a hedge against inflation contribute to their growing appeal during times of economic uncertainty. While regulatory challenges remain, the ongoing innovation and adaptability within the cryptocurrency space suggest a promising future. Investing in cryptocurrencies, however, carries inherent risks. It’s crucial to conduct thorough research and understand the potential volatility before engaging with the cryptocurrency market. Learn more about how to navigate the complexities of cryptocurrency and build a robust investment strategy amidst trade wars and global economic uncertainty. Explore the world of cryptocurrency and discover its potential as a safe haven asset.

Featured Posts

-

Ligue 1 El Psg Se Impone Al Lyon En Casa

May 08, 2025

Ligue 1 El Psg Se Impone Al Lyon En Casa

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five

May 08, 2025

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five

May 08, 2025 -

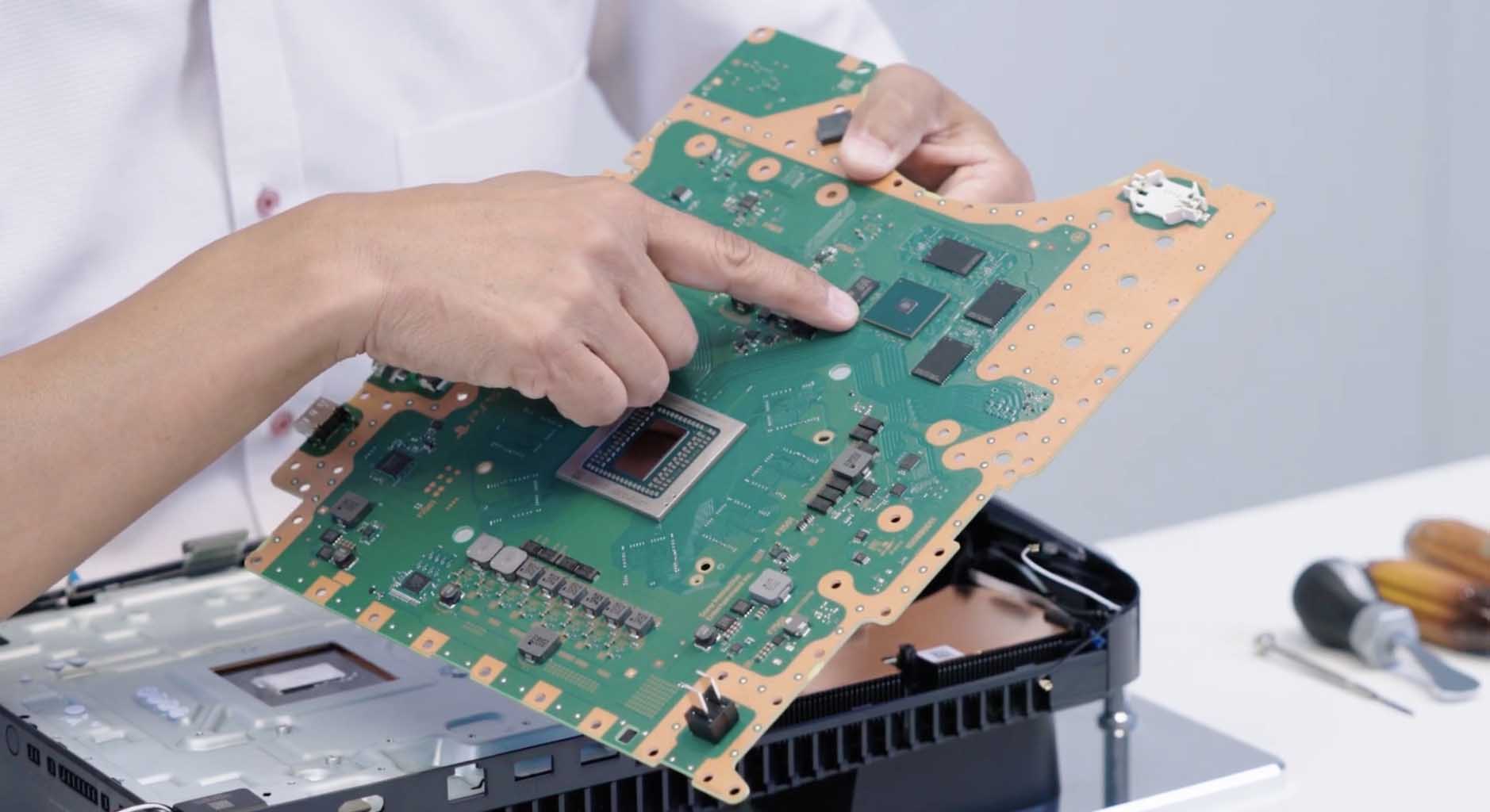

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025 -

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025