XRP Price Prediction: Analyzing The Potential For $5 And Beyond

Table of Contents

H2: Current Market Conditions and XRP's Position

H3: Analyzing XRP's Current Price and Market Capitalization

Understanding XRP's current standing in the cryptocurrency market is fundamental to any price prediction. As of [Insert Current Date], XRP's price is [Insert Current Price]. This places its market capitalization at approximately [Insert Current Market Cap], making it a [Insert Ranking] cryptocurrency by market capitalization. Analyzing these metrics alongside trading volume is essential.

- Current price: [Insert Current Price]

- Market cap: [Insert Current Market Cap]

- Trading volume (24h): [Insert Current 24h Trading Volume]

- Circulating supply: [Insert Current Circulating Supply]

- Dominance within the crypto market: [Insert Current Market Dominance Percentage]

This XRP price analysis highlights the importance of monitoring these key metrics for potential shifts in market sentiment and subsequent price movements. Significant changes in trading volume, for instance, can often precede price fluctuations. Analyzing XRP market cap against other major cryptocurrencies provides context to its overall performance.

H3: Influence of Bitcoin and the Overall Crypto Market

XRP's price, like most altcoins, is significantly correlated with the price of Bitcoin (BTC). A bullish Bitcoin market generally results in positive sentiment across the broader crypto market, often benefiting XRP's price. Conversely, a bear market in Bitcoin can negatively impact XRP's performance.

- Correlation between Bitcoin and XRP price: [Insert Data or Percentage illustrating correlation, if available. Cite source].

- Impact of bull/bear markets on XRP: Historically, XRP has shown [Insert description of historical performance during bull and bear markets].

- Analysis of altcoin season influence: During periods of "altcoin season," where altcoins outperform Bitcoin, XRP's price can experience significant gains.

H2: Technological Advancements and Ripple's Development

H3: RippleNet Adoption and Growth

The adoption of RippleNet by financial institutions is a key factor influencing XRP's value. RippleNet facilitates faster and cheaper cross-border payments, making it a compelling alternative to traditional banking systems. Increased usage translates to higher demand for XRP, potentially driving its price upward.

- Number of financial institutions using RippleNet: [Insert number, if available. Cite source].

- Transaction volume processed through RippleNet: [Insert data, if available. Cite source].

- Geographical expansion of RippleNet: RippleNet's global reach continues to expand, further enhancing XRP's utility and potential.

H3: Ongoing Development and Upgrades

Continuous development and upgrades to the XRP Ledger are crucial for maintaining its competitiveness and attracting further adoption. Improvements in speed, efficiency, and functionality can enhance XRP's appeal and potentially drive its price higher.

- Upgrades to XRP Ledger speed and efficiency: [Describe specific upgrades and their impact].

- New features or functionalities: [List any new features or planned developments].

- Planned developments and their timelines: [Mention any upcoming developments and their projected timelines]. These XRP technology advancements are crucial for long-term growth.

H2: Regulatory Landscape and Legal Battles

H3: The SEC Lawsuit and its Potential Outcomes

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. The outcome of this legal battle will have profound consequences for XRP's future. A positive ruling could lead to a significant price increase, while a negative outcome could result in substantial losses.

- Different possible outcomes of the lawsuit: [Analyze possible scenarios and their likely impact on the XRP price].

- Impact on XRP trading and liquidity: [Discuss how the lawsuit affects trading volumes and liquidity on various exchanges].

- Analysis of legal arguments from both sides: [Summarize the key arguments presented by both the SEC and Ripple]. The XRP legal battle is a major uncertainty in any price prediction.

H3: Global Regulatory Developments and Their Influence

Regulatory clarity and favorable regulations across different jurisdictions are essential for the widespread adoption of cryptocurrencies, including XRP. Changes in regulatory landscapes worldwide can significantly impact the price and accessibility of XRP.

- Regulatory changes in specific countries: [Discuss specific countries and their approaches to XRP regulation].

- Their influence on crypto adoption: [Analyze how these regulations influence crypto adoption rates].

- Impact on the global XRP market: [Assess the overall impact of global regulatory developments on XRP's price]. XRP regulation is a key factor influencing its future.

3. Conclusion:

Predicting XRP's price with certainty is impossible. However, analyzing current market conditions, technological advancements, and the regulatory landscape provides a framework for informed speculation. Several factors could drive XRP's price towards $5 or beyond: widespread RippleNet adoption, positive resolution of the SEC lawsuit, and continued technological improvements. However, risks remain, including market volatility, further regulatory uncertainty, and the competitive landscape within the cryptocurrency market.

Conduct your own thorough research and consult financial advisors before making any investment decisions. Remember that all cryptocurrency investments carry significant risk. Consider all aspects of an XRP price prediction before investing. Stay informed on the latest XRP price predictions and market analyses for a comprehensive understanding of this evolving digital asset.

Featured Posts

-

Freeway Series Mookie Betts Absence Due To Ongoing Illness

May 08, 2025

Freeway Series Mookie Betts Absence Due To Ongoing Illness

May 08, 2025 -

Andor Season 2 A Guide To Everything You Need To Know Before Watching

May 08, 2025

Andor Season 2 A Guide To Everything You Need To Know Before Watching

May 08, 2025 -

Analysis Of Kyle Kuzmas Comment On Jayson Tatums Viral Instagram

May 08, 2025

Analysis Of Kyle Kuzmas Comment On Jayson Tatums Viral Instagram

May 08, 2025 -

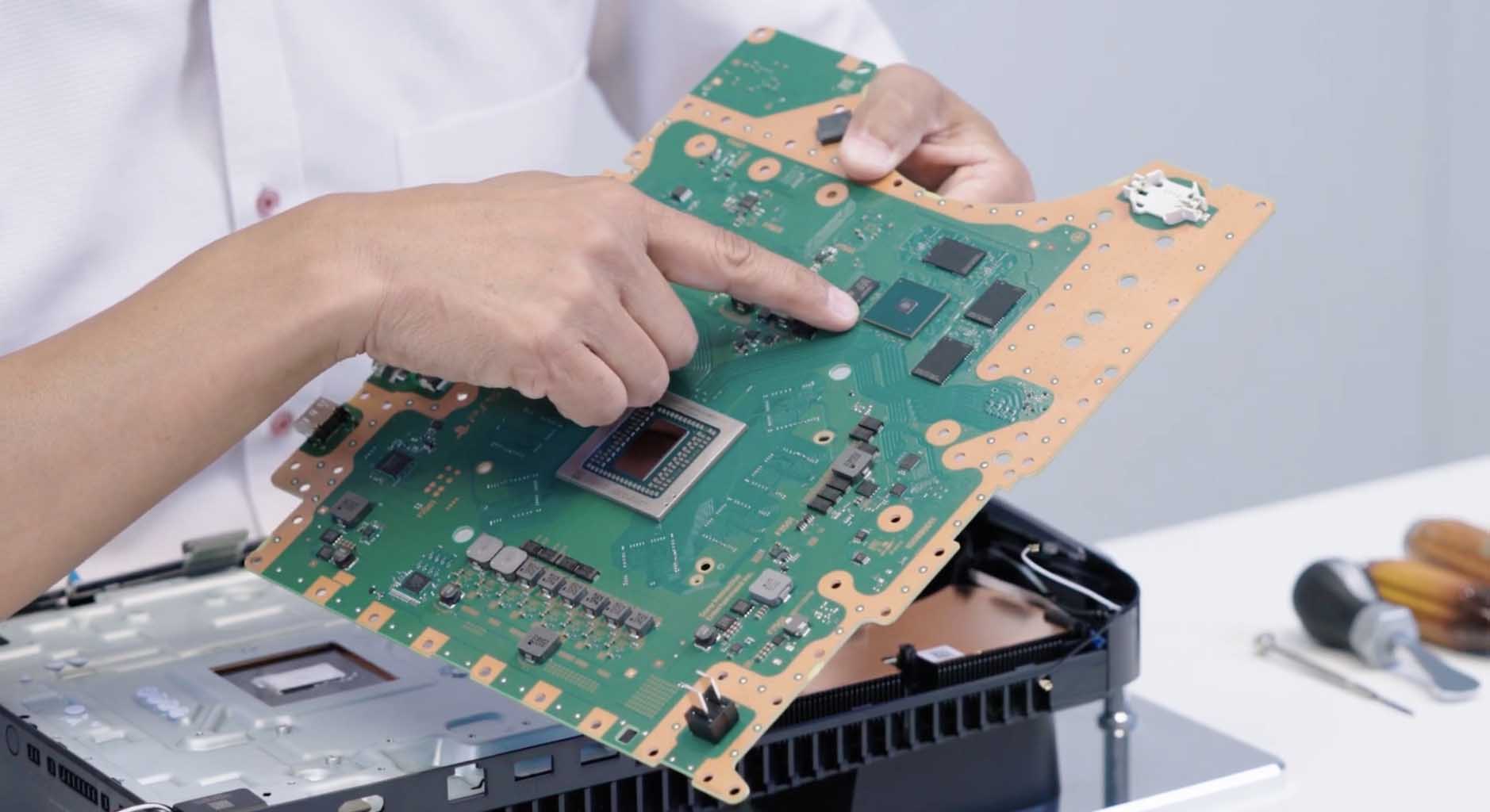

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025 -

Is Krypto The Last Dog Of Krypton Worth Watching A Parents Guide

May 08, 2025

Is Krypto The Last Dog Of Krypton Worth Watching A Parents Guide

May 08, 2025