D-Wave Quantum Inc. (QBTS) Stock's Sharp Increase: A Detailed Look

Table of Contents

Analyzing the Recent QBTS Stock Price Increase

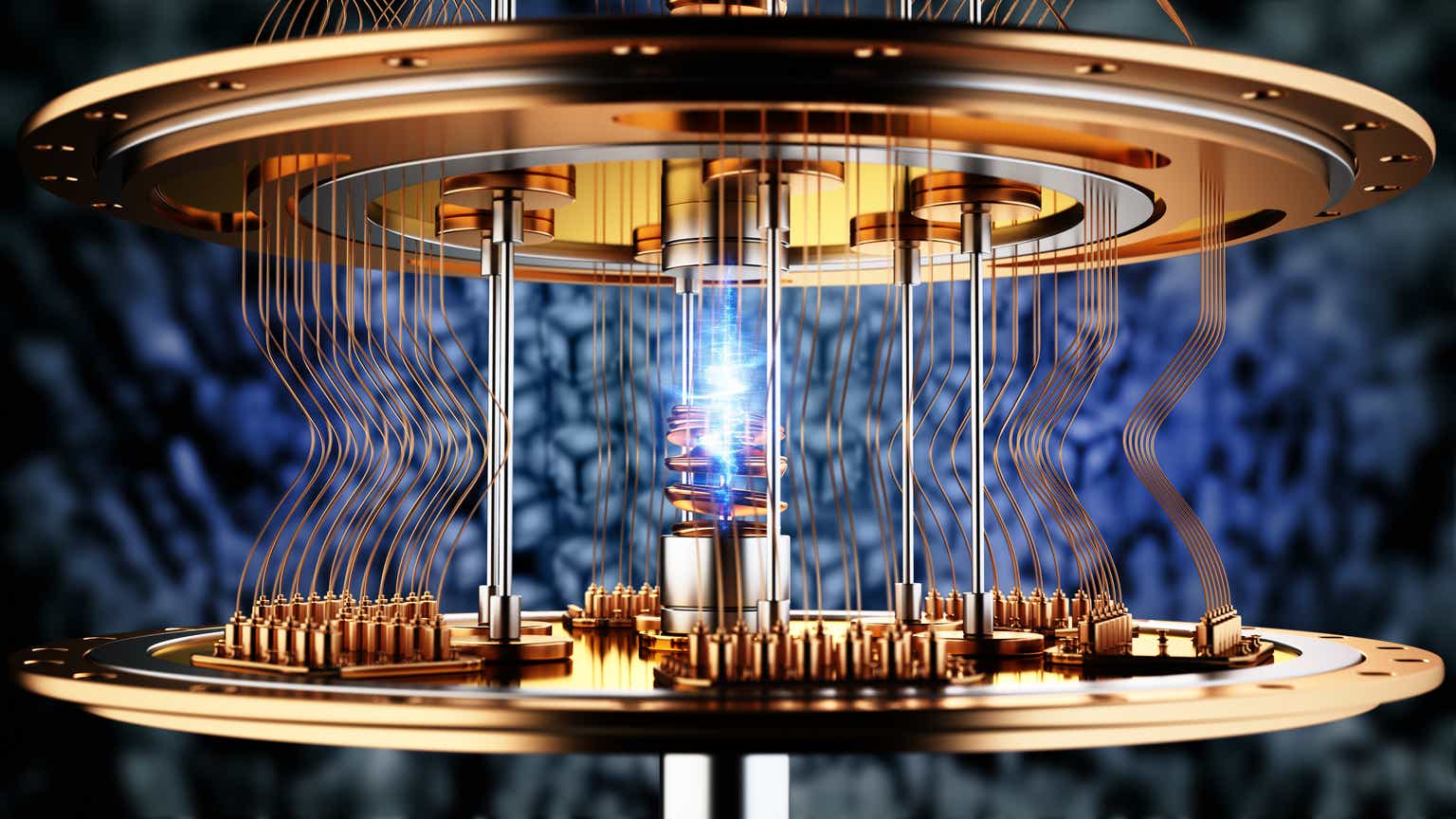

The QBTS stock price has experienced a significant upward trend recently, with a [Insert Percentage]% increase over the past [Insert Timeframe, e.g., month/quarter]. Specifically, notable price jumps occurred on [Insert Dates]. [Insert chart or graph visualizing QBTS stock price movement]. This surge in the QBTS stock price warrants a closer look at the factors contributing to this market activity.

- News and Announcements: Scrutinizing press releases and company announcements from this period is crucial. Any positive news regarding partnerships, technological breakthroughs, or increased customer adoption would likely influence investor sentiment.

- Investor Sentiment and Market Trends: The overall positive sentiment surrounding the quantum computing sector, coupled with broader market trends favoring technology stocks, could have played a significant role. A positive outlook on the future of quantum computing, generally, often boosts individual stocks within the sector.

- Trading Volume: Examining the trading volume during the price surge provides insight into the level of investor participation and conviction. Higher-than-average volume indicates strong buying pressure.

Understanding D-Wave Quantum's Business and Technology

D-Wave Quantum is a leader in the development and deployment of quantum computing systems. Unlike other quantum computing companies focusing on gate-based models, D-Wave uses quantum annealing, a specialized approach particularly effective for solving optimization problems. Their target markets include sectors such as logistics, finance, and materials science, where complex optimization tasks are commonplace.

- Key Partnerships and Collaborations: D-Wave’s collaborations with major companies and research institutions provide credibility and signal market acceptance of their technology. These partnerships demonstrate their technology's real-world applicability.

- Technological Advancements: D-Wave consistently works on improving its quantum annealing technology. Any advancements in qubit count, coherence times, or performance would be reflected in investor confidence and the QBTS stock price.

- Competitive Landscape: Understanding D-Wave's position relative to competitors in the quantum computing market, including both gate-based and annealing approaches, helps to assess the company's long-term prospects.

Assessing the Risk and Potential of Investing in QBTS

Investing in QBTS stock, like any investment in a technology company, especially one operating in a nascent field like quantum computing, carries inherent risk. The quantum computing market is still developing, and the technology's widespread adoption is not guaranteed. While the long-term growth potential is significant, short-term volatility is expected.

- Financial Health: Analyzing D-Wave's financial statements—revenue, profitability, and cash flow—provides a crucial gauge of the company's financial stability and sustainability.

- Analyst Ratings and Price Targets: Understanding the opinions of financial analysts on QBTS stock, including their price targets and ratings, offers valuable insights into the market's expectations.

- Future Breakthroughs and Market Adoption: The potential for future technological breakthroughs and increased market adoption of quantum computing will significantly influence the value of QBTS stock.

Factors Contributing to the QBTS Stock Surge

The recent QBTS stock surge is likely a result of several contributing factors, working in concert. It's not a single event but a confluence of positive indicators.

- Contract Wins and Partnerships: The securing of significant contracts or new strategic partnerships can significantly boost investor confidence and drive up the stock price. Large-scale adoption by major clients validates the technology and its market viability.

- Market Trends and Investor Confidence: The overall positive sentiment in the technology sector, particularly in emerging technologies, generally contributes to increased interest and investment in quantum computing stocks.

- Media Coverage and Public Perception: Positive media coverage and a growing public awareness of quantum computing can increase investor interest and create a buzz around QBTS. Social media sentiment also plays a considerable role in shaping public perception and influencing investment decisions.

Conclusion

The recent increase in D-Wave Quantum (QBTS) stock price reflects a combination of factors, including positive company news, advancements in their quantum annealing technology, and a broader bullish sentiment in the technology sector. However, investing in QBTS involves inherent risks due to the early-stage nature of the quantum computing market. While the long-term potential is substantial, investors should carefully weigh the risks and rewards before making any investment decisions. For those interested in learning more about the exciting world of quantum computing and the potential of D-Wave Quantum (QBTS) stock, further research is recommended. Consider exploring D-Wave's investor relations materials and conducting thorough due diligence before making any investment decisions in QBTS stock or other quantum computing investments.

Featured Posts

-

D Wave Quantum Qbts A Top Quantum Computing Stock In 2024

May 21, 2025

D Wave Quantum Qbts A Top Quantum Computing Stock In 2024

May 21, 2025 -

Tyler Bate Back On Wwe What To Expect

May 21, 2025

Tyler Bate Back On Wwe What To Expect

May 21, 2025 -

Sandylands U Tv Show Where To Watch Episode Air Dates And Summaries

May 21, 2025

Sandylands U Tv Show Where To Watch Episode Air Dates And Summaries

May 21, 2025 -

Louth Food Entrepreneur Shares Success Secrets With Other Businesses

May 21, 2025

Louth Food Entrepreneur Shares Success Secrets With Other Businesses

May 21, 2025 -

I Istoria Toy Baggeli Giakoymaki Kai I Aksia Toy Anthropoy

May 21, 2025

I Istoria Toy Baggeli Giakoymaki Kai I Aksia Toy Anthropoy

May 21, 2025

Latest Posts

-

Negotiations Sought Switzerland And China On Tariffs

May 22, 2025

Negotiations Sought Switzerland And China On Tariffs

May 22, 2025 -

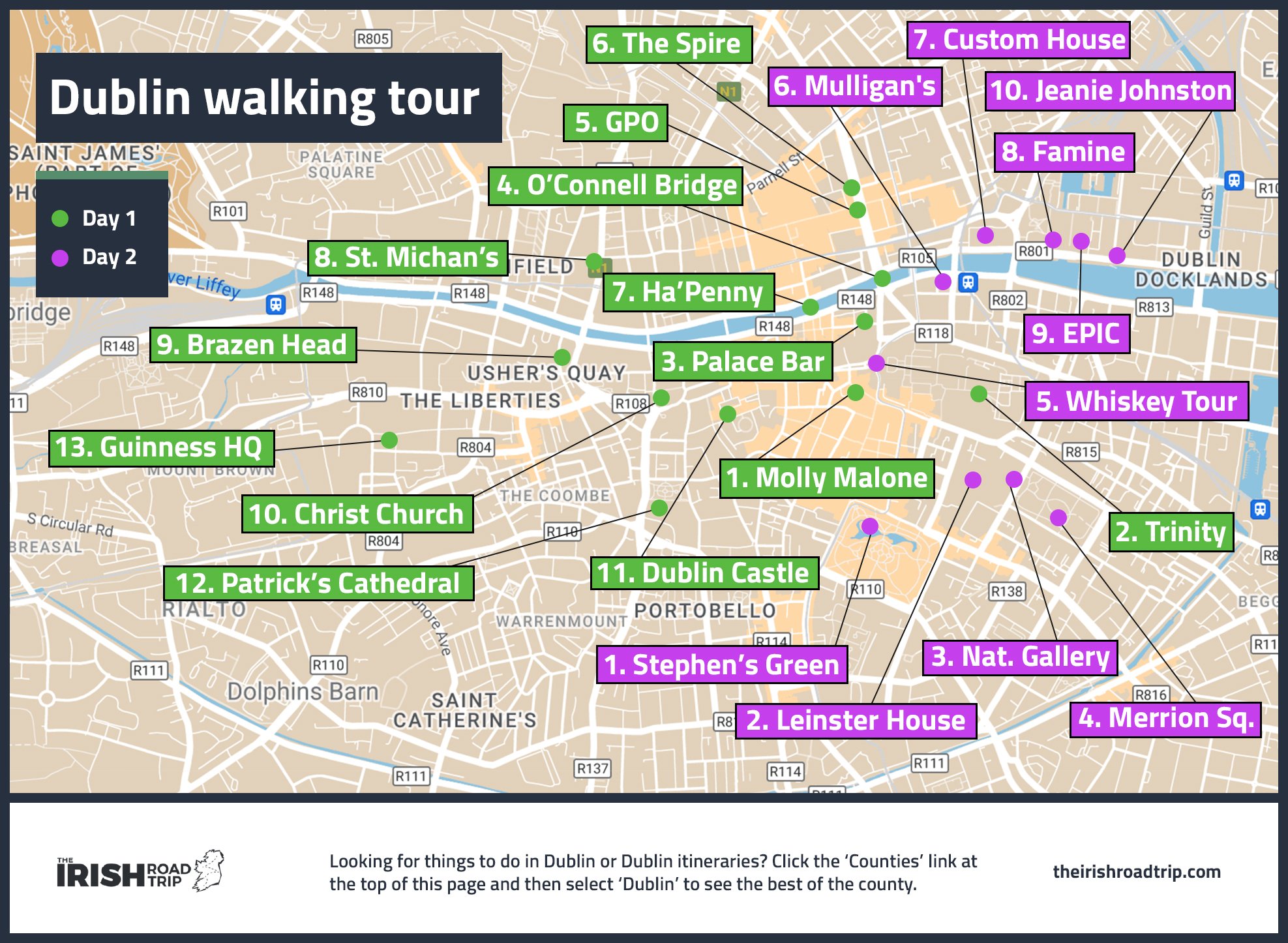

From The Mountains To The Med A Self Guided Walking Tour Of Provence

May 22, 2025

From The Mountains To The Med A Self Guided Walking Tour Of Provence

May 22, 2025 -

Swiss Chinese Call For Dialogue On Trade Tariffs

May 22, 2025

Swiss Chinese Call For Dialogue On Trade Tariffs

May 22, 2025 -

Analysis Switzerlands Rebuke Of Chinas Military Drills

May 22, 2025

Analysis Switzerlands Rebuke Of Chinas Military Drills

May 22, 2025 -

Switzerland And China Urge Dialogue To Resolve Tariff Disputes

May 22, 2025

Switzerland And China Urge Dialogue To Resolve Tariff Disputes

May 22, 2025